Friday, August 20th, 2021

Highlights

The new isolved version, 7.15, will be available when you log in on Friday, August 20th, 2021. It includes a tax compliance update for employers in New Mexico, certified payroll report updates, and improvements for employee and benefit administration.

Employee Administration

- Managerial Assignments now includes organization supervisors and managers so you can review your full reporting structure in one place

Benefit Administration

- The Benefit Evaluation Utility is now easier to use. It includes a new tool to identify employees who are missing required information for benefits processing and carrier integration

Reporting

- All certified payroll reports have been updated to display the current expiration date

Tax

- For clients with work locations in New Mexico, the New Mexico Workers’ Compensation Assessment Fee collection has been updated for enhanced compliance

Employee Administration

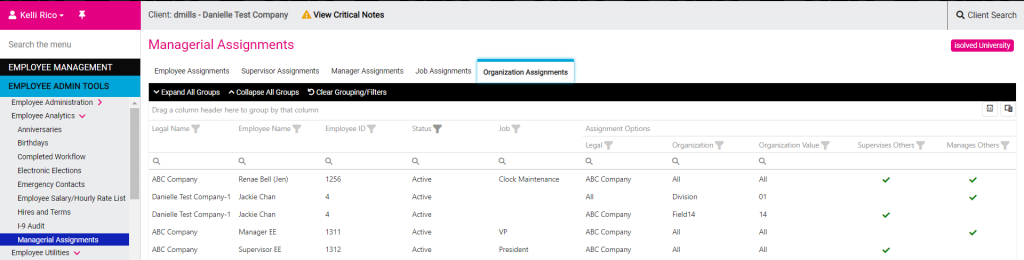

Organization managers and supervisors have been added to the Managerial Assignments dashboard

Quickly view all supervisor and manager assignments in one place

A new Organization Assignments tab has been added to the Managerial Assignments dashboard so you can see all of your reporting relationships in one place. In isolved, you can assign managers and supervisors to jobs or organization levels. If you assign managers and supervisors based on jobs, the Employee Assignments, Supervisor Assignments, Manager Assignments, and Job Assignments tabs introduced in the previous isolved version 7.14 release will show your reporting relationships. If you assign them based on organization levels like department or location, the new Organization Assignments tab will show your reporting structure. If an organization manager or supervisor is terminated, a warning will be displayed until a new leader is assigned.

Like other employee analytics dashboards, the new Organization Assignments tab lets you sort, filter, and export your view to Excel by clicking the Export All Data button to capture the current information.

This dashboard is intended to help analyze current assignments. To add or change organization managers and supervisors, you should continue to use the existing Organization Supervisor/Manager screen in Employee Maintenance.

Benefit Administration

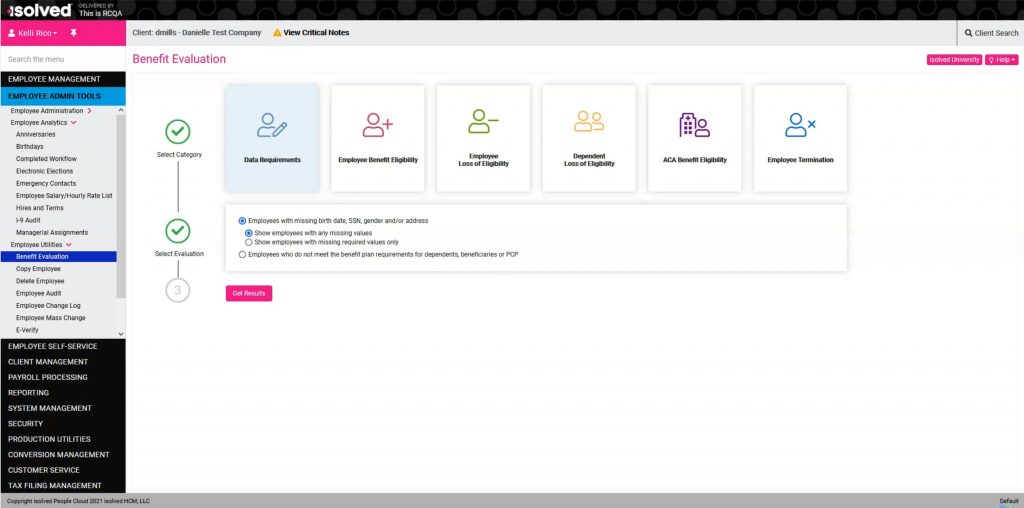

Identify benefit issues more easily in the revamped Benefit Evaluation Utility

The Benefit Evaluation Utility is streamlined and easier to use

The Benefit Evaluation Utility has a new look! Each evaluation category is now a tile on the updated screen. You can still run all the same utilities to review benefit eligibility and plan requirements, but the new options use radio buttons for easier selection.

The new Data Requirements Evaluation finds employees who are missing critical information

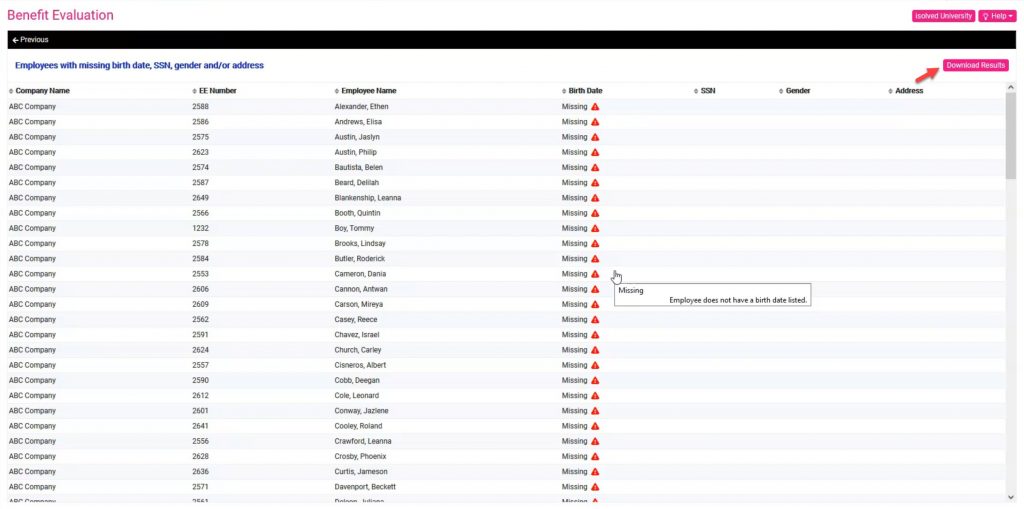

Having complete employee profiles is critical for accurate benefit processing. Many benefit insurance companies require employee birthdates, Social Security Numbers, genders, and addresses to complete enrollment. The Data Requirements evaluation identifies employees who are missing these important data elements. These evaluation options are available:

- Employees with missing birth date, SSN, gender and/or address locates employees who are missing critical employee profile information. Two options are available:

- Show employees with any missing values will search for employees who are missing their birthdate, Social Security Number, gender, or resident address

- Show employees with missing required values only will search for missing information based on the employee profile, dependent, and beneficiary requirements you specified during implementation. You can choose to require the following information:

| Type | Fields you can require: |

| Employee | – Birthdate – Gender – Resident Address – Social Security Number is always required |

| Dependent | – Birthdate – Gender – Social Security Number |

| Beneficiary | – Birthdate – Social Security Number |

Contact your Payroll Specialist if you would like to change your required information.

- Employees who do not meet the benefit plan requirements for dependents, beneficiaries, or PCP reviews your benefit plan requirements and locates benefit records missing covered dependents, beneficiaries, or primary care physician (PCP) elections.

Once you click Get Results, employees are listed who meet the criteria. Columns indicate which data element is missing and you can hover over the red triangle icon for more information.

Click the Download Results button to export the results to Excel.

Reporting

Compliance update for Certified Payroll Reports

Federal and state certified payroll reports have updated with the current expiration date

All certified payroll reports have been evaluated for compliance with the current formats and the Expiration Date has been updated to reflect the latest version. The following federal reports have been updated:

- Biweekly Certified Payroll Report

- Certified Payroll Register

- Certified Payroll Report

- Certified Payroll Report with Deductions

- Certified Payroll with Alt Rates

Tax

Improved compliance for New Mexico employers

Employers will be automatically charged for the NM Workers’ Compensation Assessment Fee if the employee portion cannot be deducted

Employers with work locations in New Mexico are required to pay $4.30 per employee per calendar quarter for the New Mexico Workers’ Compensation Assessment Fee. The employer normally contributes $2.30 per employee per quarter, and the remaining $2.00 is deducted from the employee on the last working day of the quarter. However, if the employee does not get paid in the last payroll of the quarter, their portion cannot be deducted. The employer is still responsible for remitting $4.30 for each employee by the last day of the month following the end of the quarter. Since Insperity collects and remits the New Mexico Workers’ Compensation Assessment Fees on your behalf, if the employee portion cannot be deducted, it will automatically revert to an employer fee and be collected in the last payroll of the quarter to ensure compliance.

Contact with your Payroll Specialist if you have any questions about these new features.

isolved University

For more information, review these updated articles in isolved University:

- Benefit Evaluation Utility – https://learning.myisolved.com/library/articles/998

Download the release notes

Download the release notes: isolved Product Release v7.15