Friday, January 14th, 2022

Highlights

isolved version 8.00 updates minimum wage rates and withholding tax forms to comply with 2022 requirements. The new Certifications dashboard makes it easy to spot employees who need to provide updated documentation. Employees can now receive and sign state wage notices electronically in ESS, beginning with the New York forms in version 8.00. This release includes some new options for legal form addresses and a new overtime calculation for semimonthly and monthly pay frequencies.

Employee Self-Service (ESS)

- The Electronic Consent agreement has been updated to reflect current system requirements for using ESS

- You can now provide pay rates notices to New York employees through ESS

HR

- The new Certifications dashboard lets you quickly identify employees with expired certifications and easily see who still needs to provide needed documentation by certificate type.

- In Performance Reviews, you can now assign the Supervisor as the reviewer even if the same person is assigned as the employee’s supervisor and manager

- The new Client Notices screen allows you to define New York state pay rate notices for hourly employees

Payroll & Tax

- All state and local minimum wages have been updated for 2022. These rates are automatically referenced if you use the minimum wage makeup features for tipped and piece rate employees.

- isolved now tracks separate legal, mailing, and physical company addresses to support different form and notice requirements

- When previewing an employee’s check in Individual Time Entry, you will now see their current federal and state filing statuses

- A new pay rate calculation is available for semimonthly and monthly pay frequencies to determine the employee’s weighted average rate for overtime

Employee Self-Service (ESS)

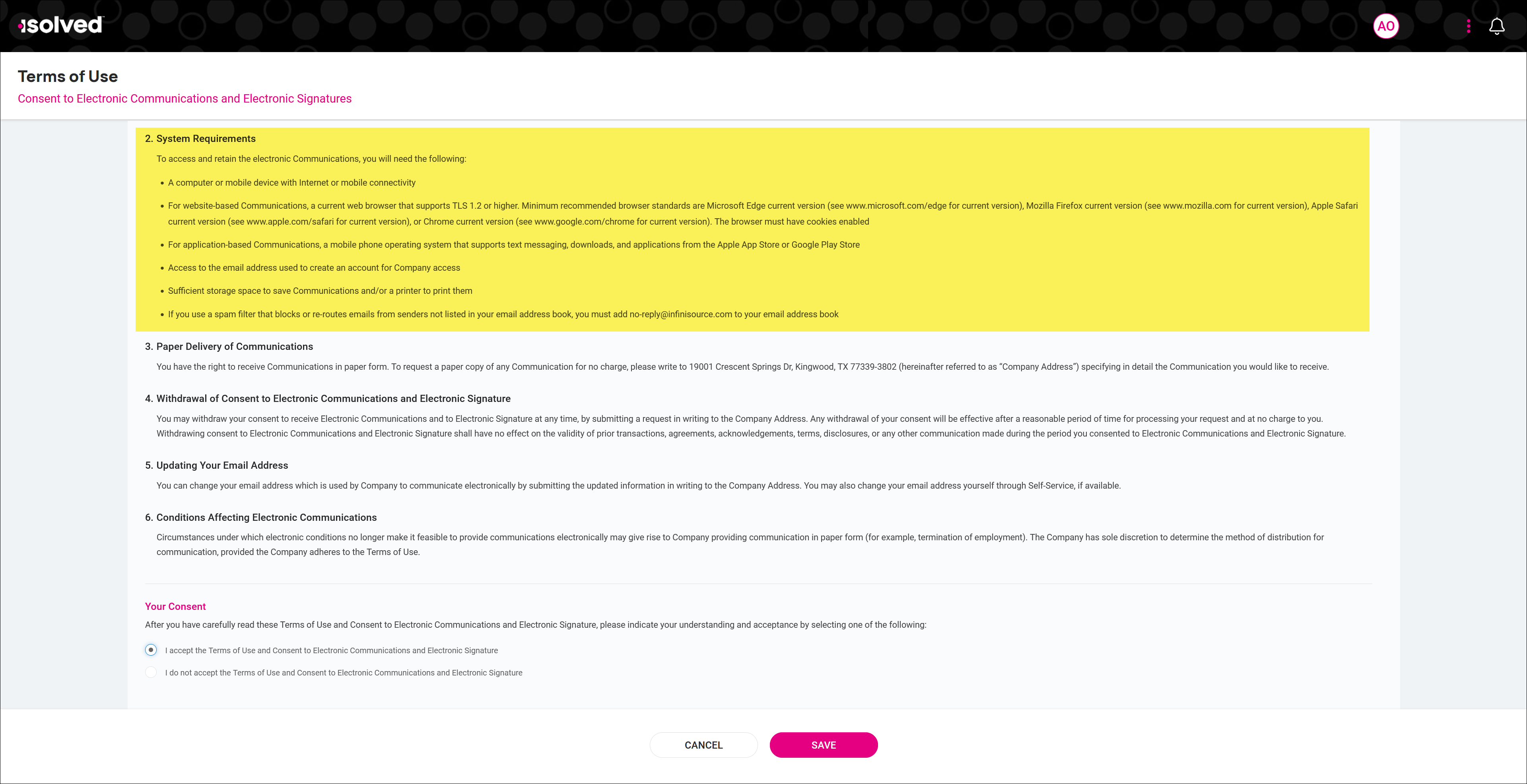

System requirements have been updated in the Electronic Consent Agreement

Employees can now review the current hardware requirements when they log into ESS for the first time

The System Requirements section of the isolved Consent to Electronic Communications and Electronic Signatures has been updated to accurately reflect the current browser requirements. isolved ended support for older TLS versions in September 2021 with the version 7.16 release, so now the system requirements accurately reflect the need to use a browser that is compliant with TLS 1.2 or later. The updated section now reads:

If employees have already consented, they do not need to complete the updated agreement again. This change will impact new ESS registrants moving forward.

Provide NY LS 54 and LS 56 Pay Rate Notices through ESS

Employees can review and electronically sign New York state wage notices when they are hired or when they receive a rate change

Many states require employees to agree to their rate of pay when they are hired or when that rate changes. Employers must provide state-specific forms and save the signed copies with their employee paperwork. With isolved version 8.00.0, employees will now be able to sign these forms electronically in Employee Self-Service (ESS). isolved will eventually support wage notices for all states that require them, but the 8.00 release includes support for these forms:

- LS 54 – New York State Labor Law Notice for Hourly Rate Employees

- LS 56 – New York State Labor Law Notice for Employees Paid a Weekly Rate or a Salary for a Fixed Number of Hours (40 or Fewer in a Week)

Configuration is required to enable these notices. Contact your Payroll Specialist for assistance.

HR

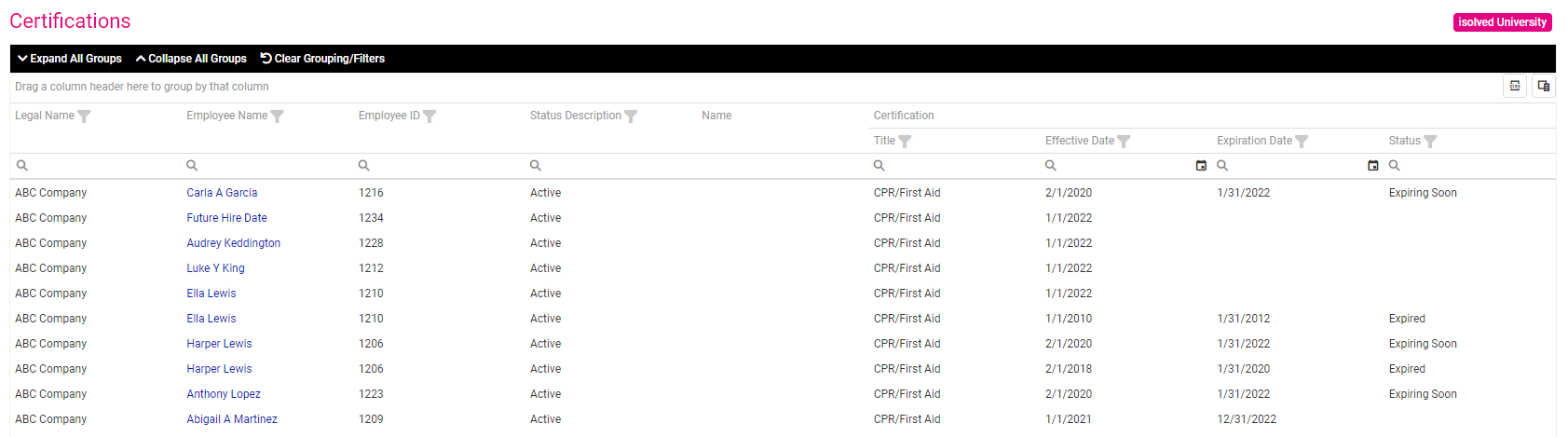

New Certifications dashboard provides a quick overview of employee certification statuses

Quickly identify expired certifications with the new analytics dashboard

The new Certifications dashboard allows you to quickly evaluate employee certifications by type so you can easily determine who needs to provide updated credentials to continue working in specialized roles. This dashboard is available on the Employee Admin Tools menu under Employee Analytics.

Access to the Certifications dashboard has been automatically granted to client administrators with the Manage Employee Human Resources role.

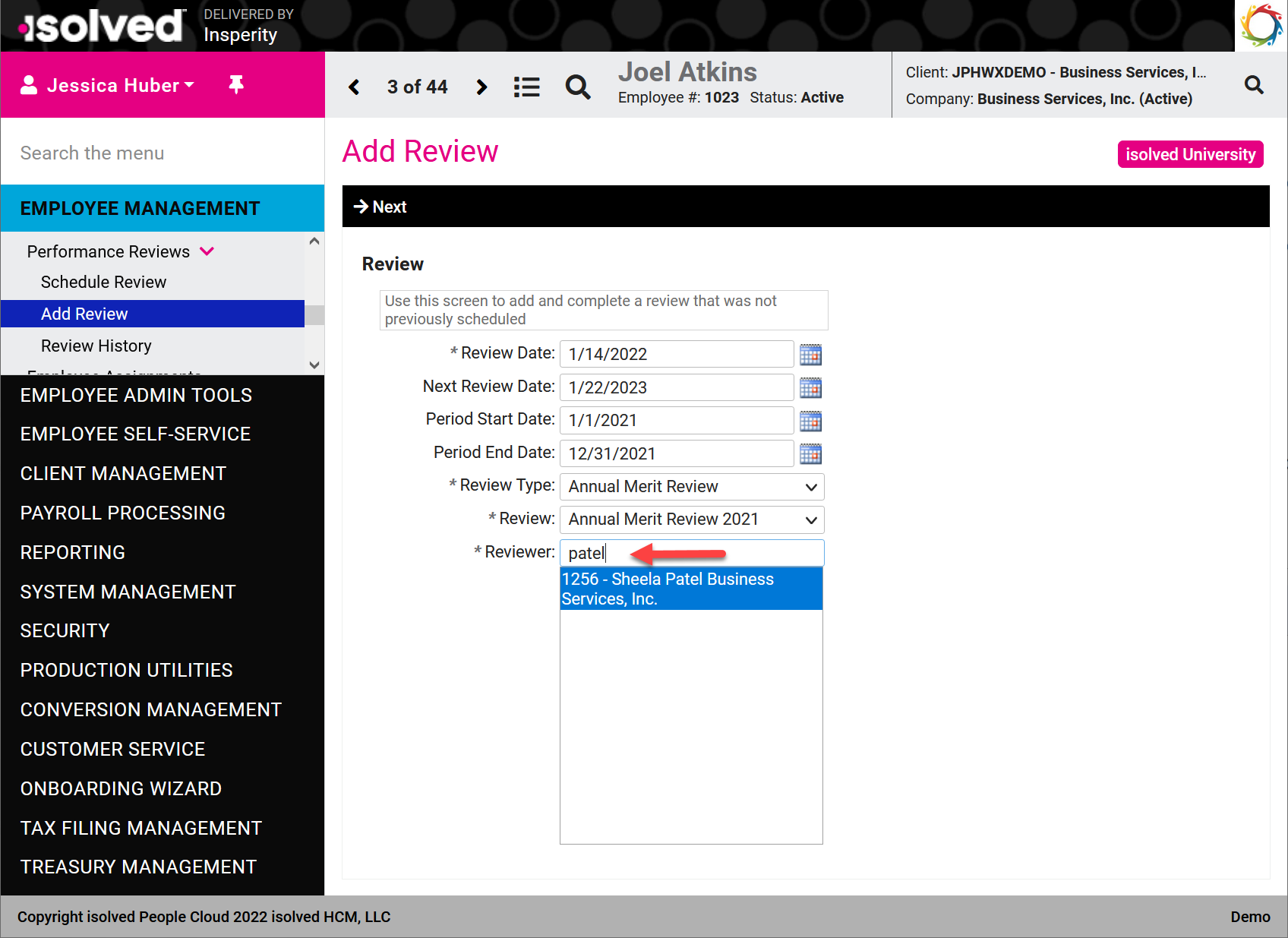

Performance Reviewer fixed for employees with the same Supervisor and Manager

A bug that impacted the ability to assign reviewers if the employee had the same Supervisor and Manager has been fixed

Some clients assign the same person as the employee’s manager and supervisor. Prior to this release, there was an issue assigning the supervisor as a performance reviewer in this scenario. That has been fixed, so now you can assign those supervisors.

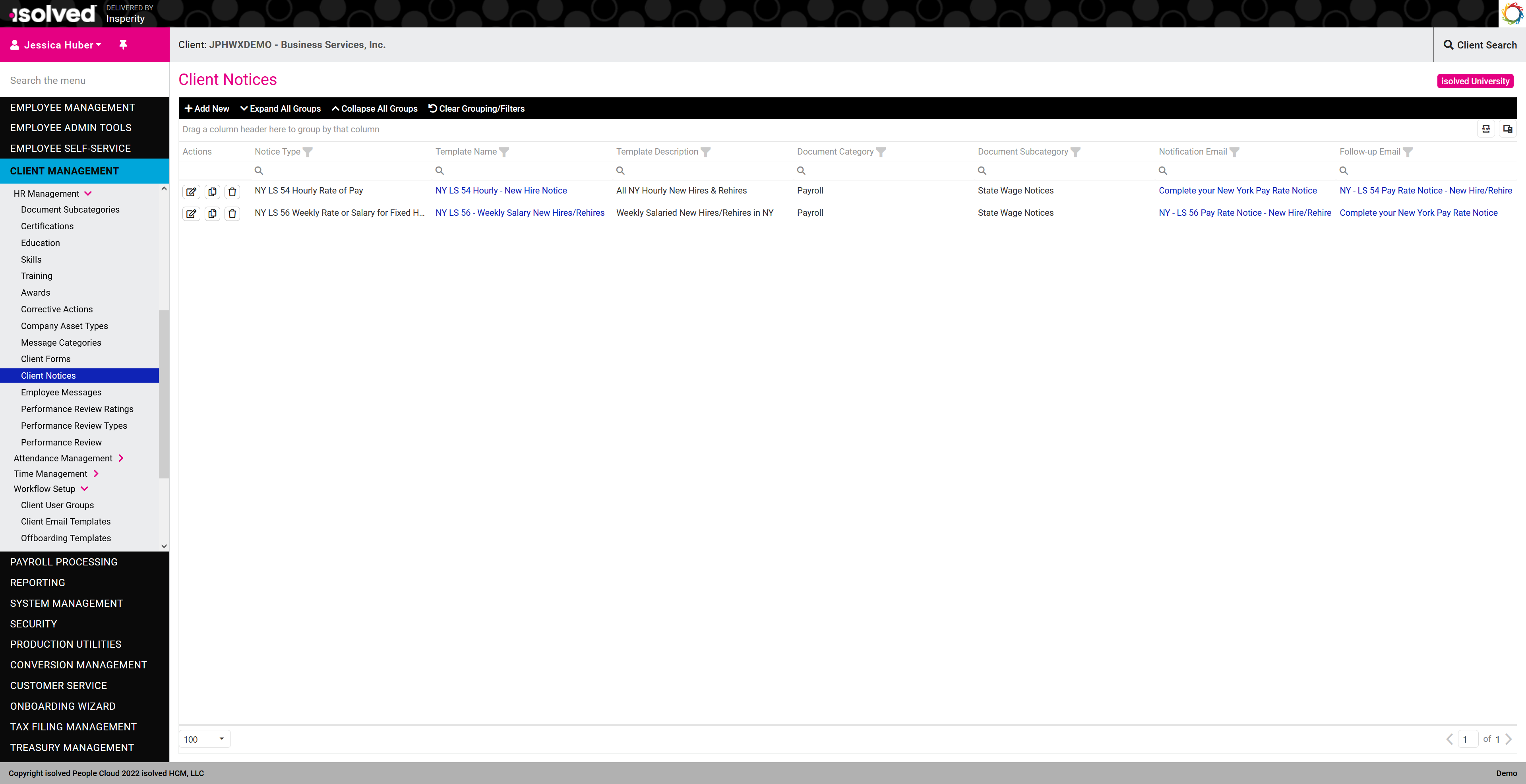

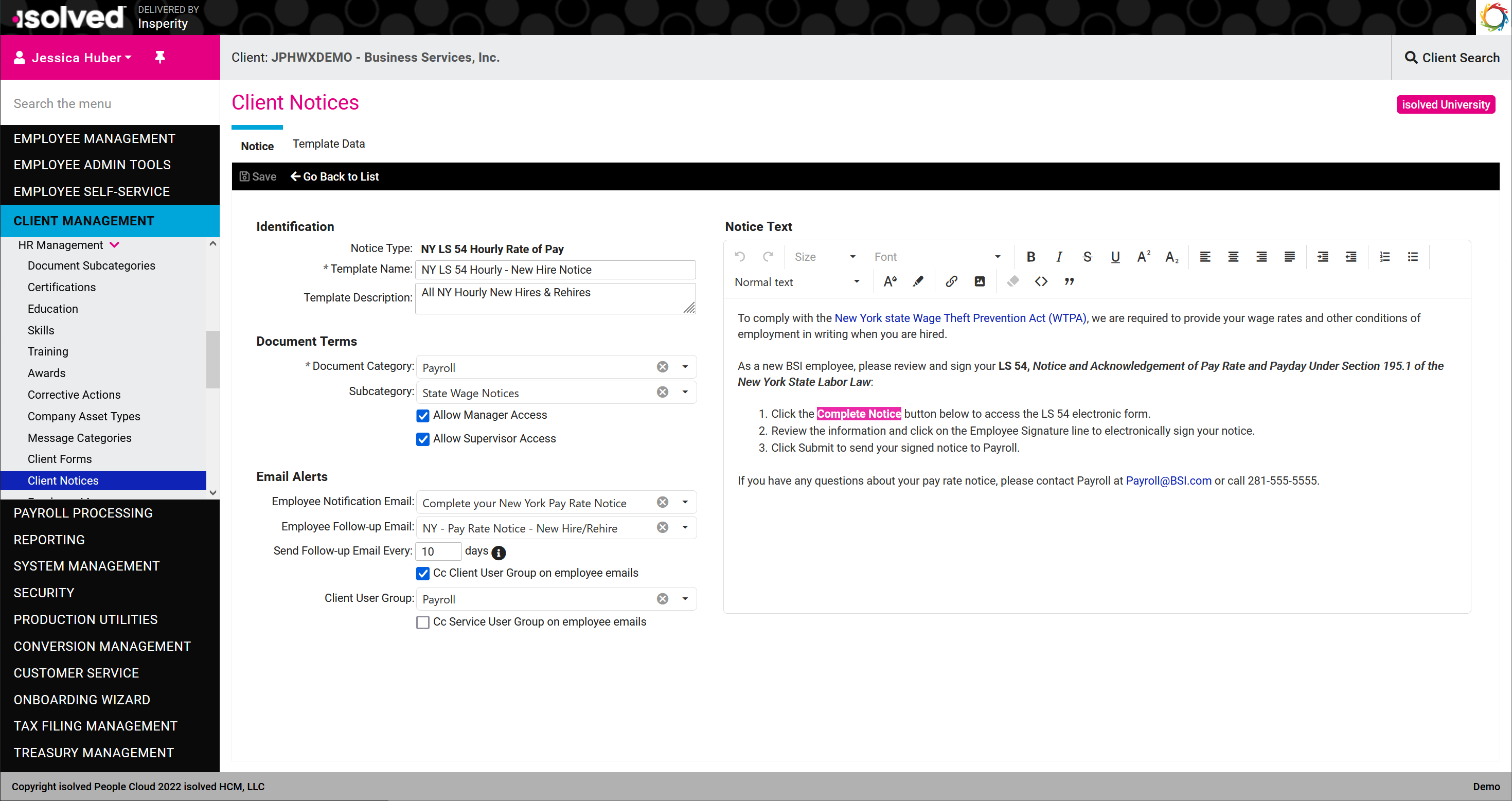

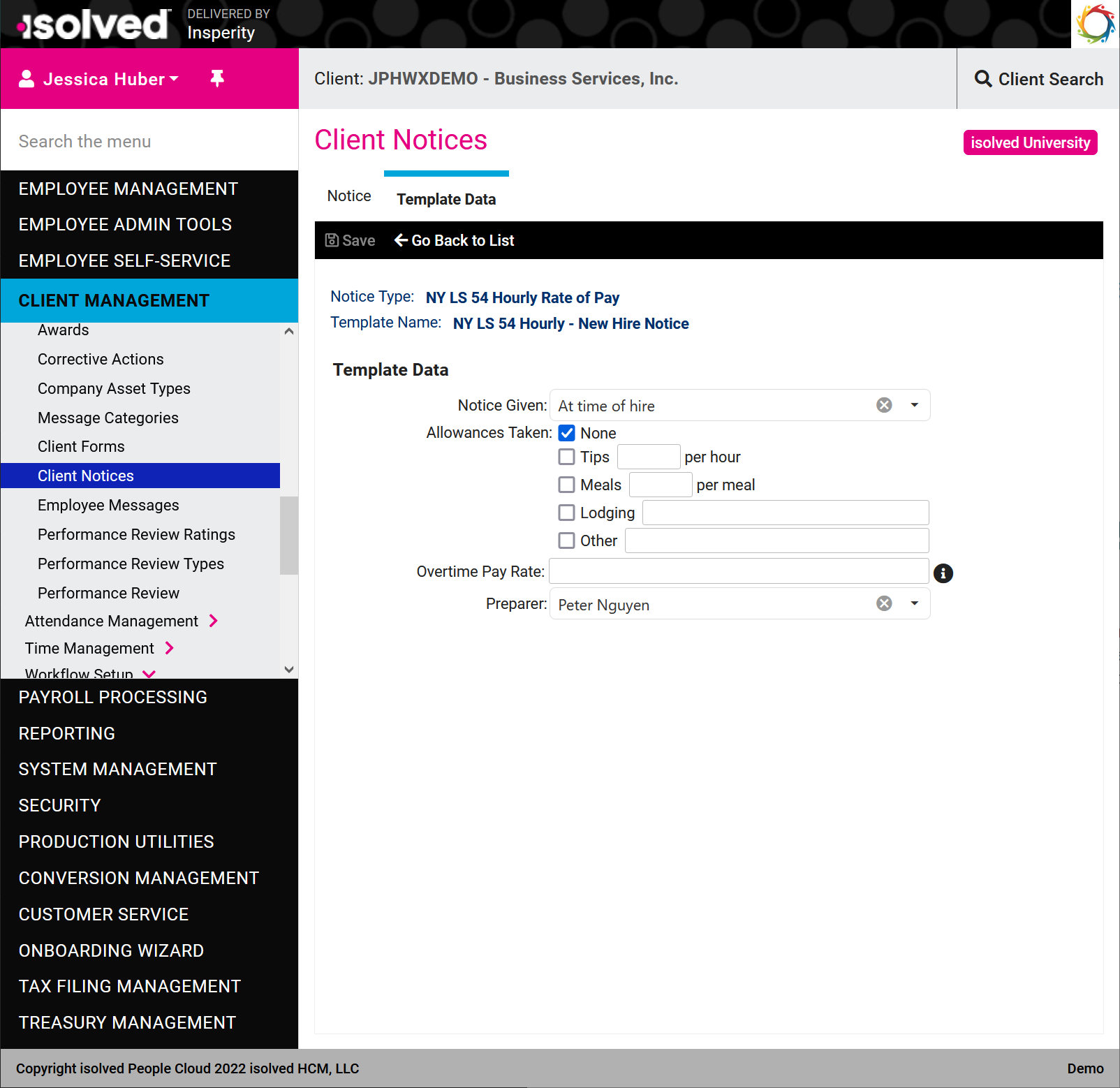

Configure Wage Notices to include New York LS 54 and LS 56 notices in ESS

The new Wage Notices screen allows you to configure multiple wage notice templates

Employers need to efficiently deliver required employment wage notices to employees. In order to implement that functionality, you can now create templates on the new Client Notices screen for the required state forms.

You can define the wage notices required for your employees and the template data that will be automatically populated on the specified form. isolved will eventually support wage notices for all states that require them, but the 8.00 release includes support for these forms:

- LS 54 – New York State Labor Law Notice for Hourly Rate Employees

- LS 56 – New York State Labor Law Notice for Employees Paid a Weekly Rate or a Salary for a Fixed Number of Hours (40 or Fewer in a Week)

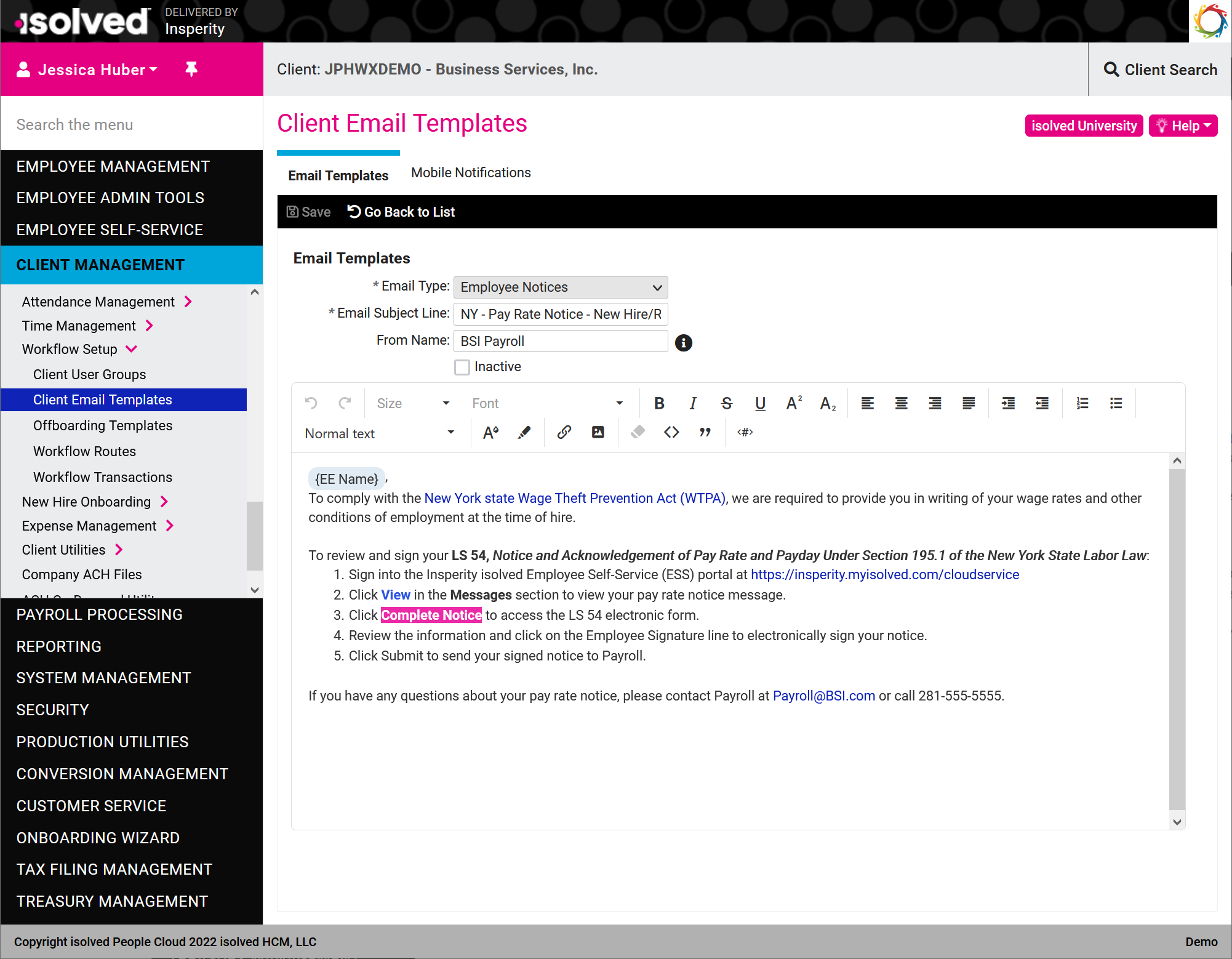

A new Employee Notices email type is available in Client Email Templates so you can configure notification emails to let employees know when they need to acknowledge new pay rate notices. You can also configure reminder emails if they have not signed their notices after a specified number of days.

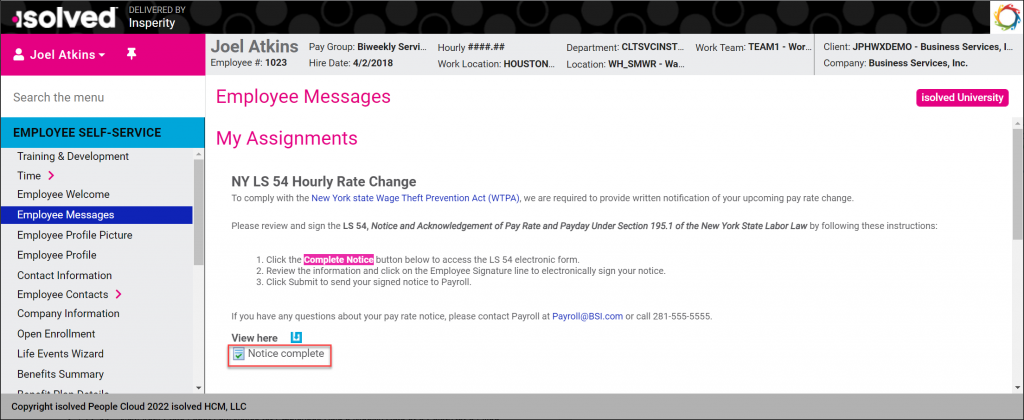

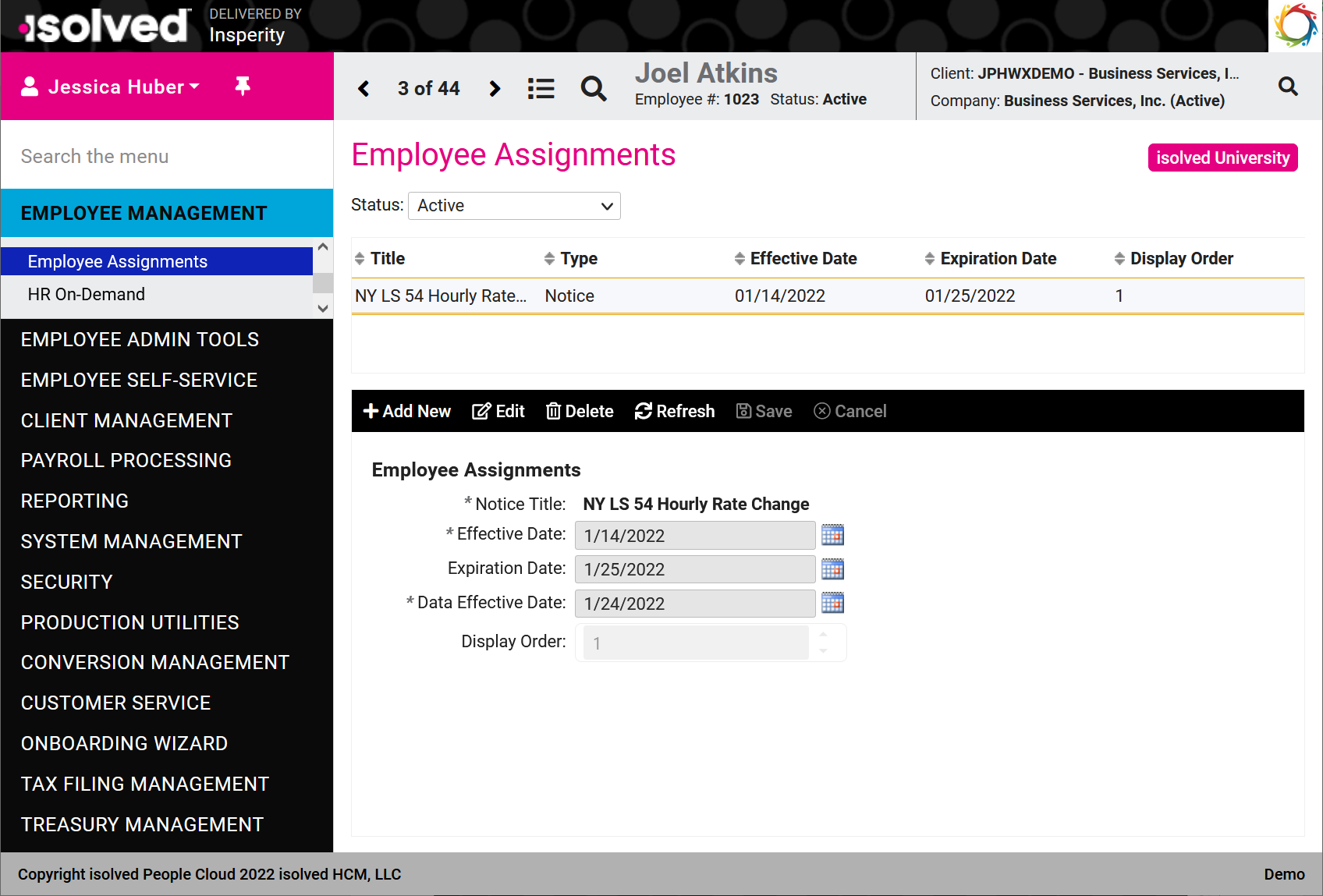

Once you’ve created client notice templates, assign them to employees as employee messages. A new Employee Notification option is available to assign wage notifications.

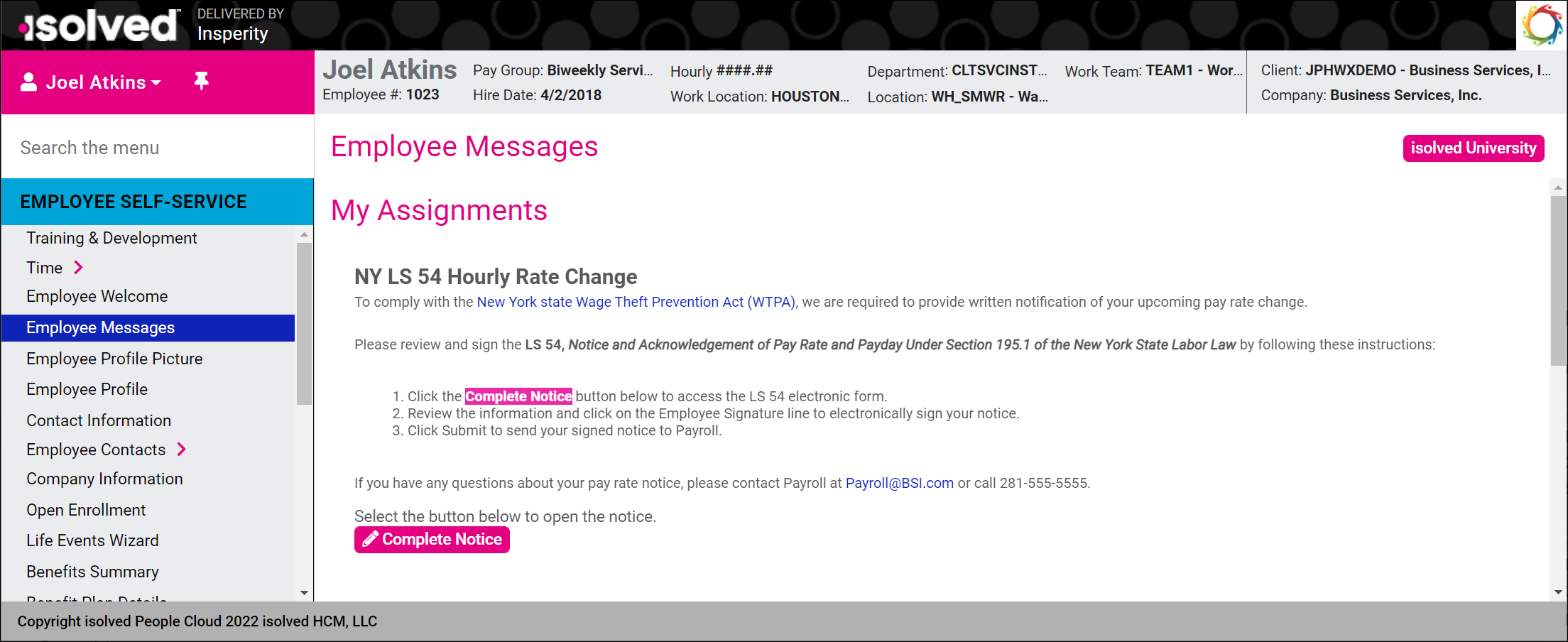

Employees will see the message you defined in the Client Notice template and can click Complete Notice to review the form. Once completed, the message will update to include a link to the completed document.

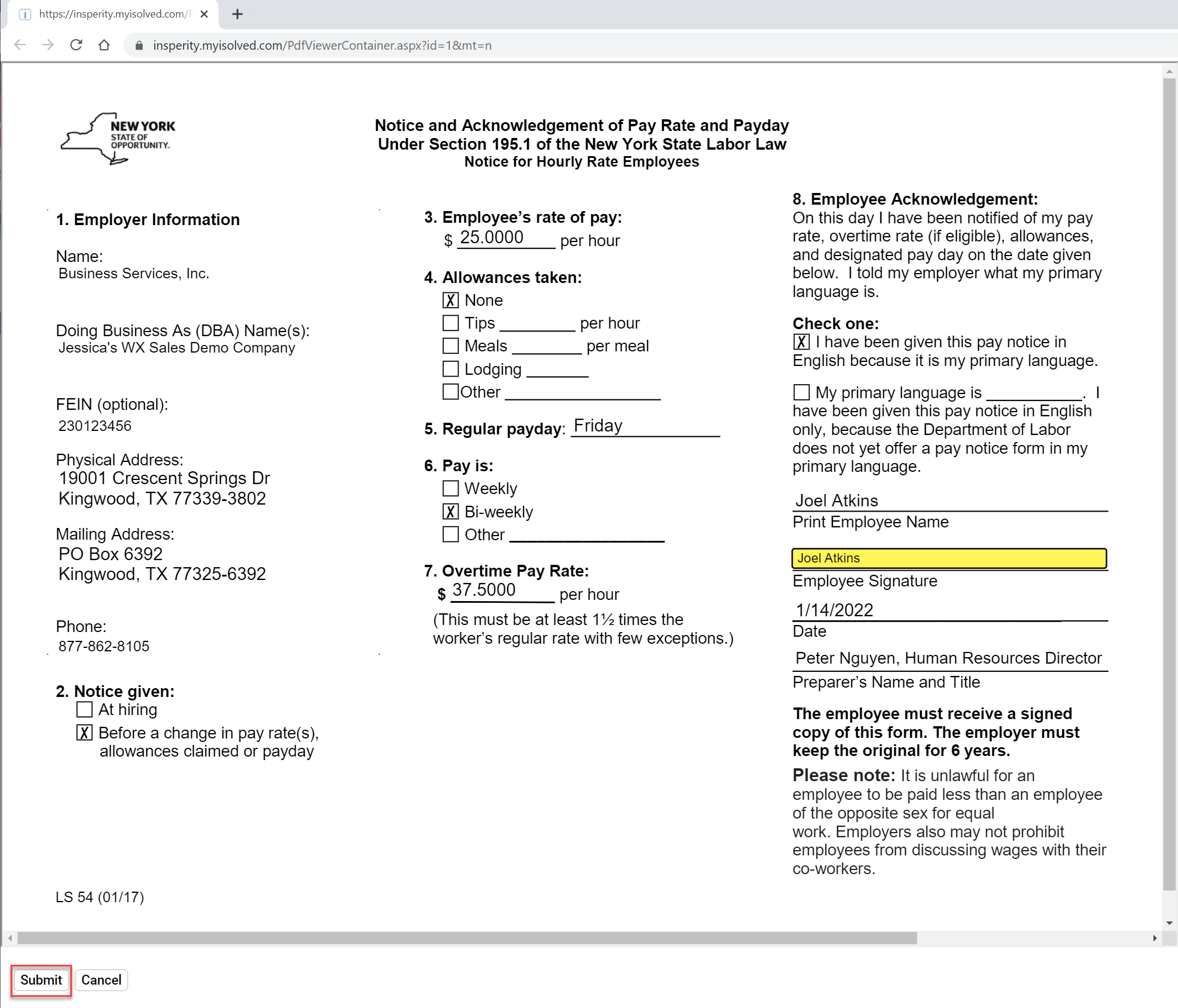

The state form will open automatically in a new tab for the employee to electronically sign and Submit.

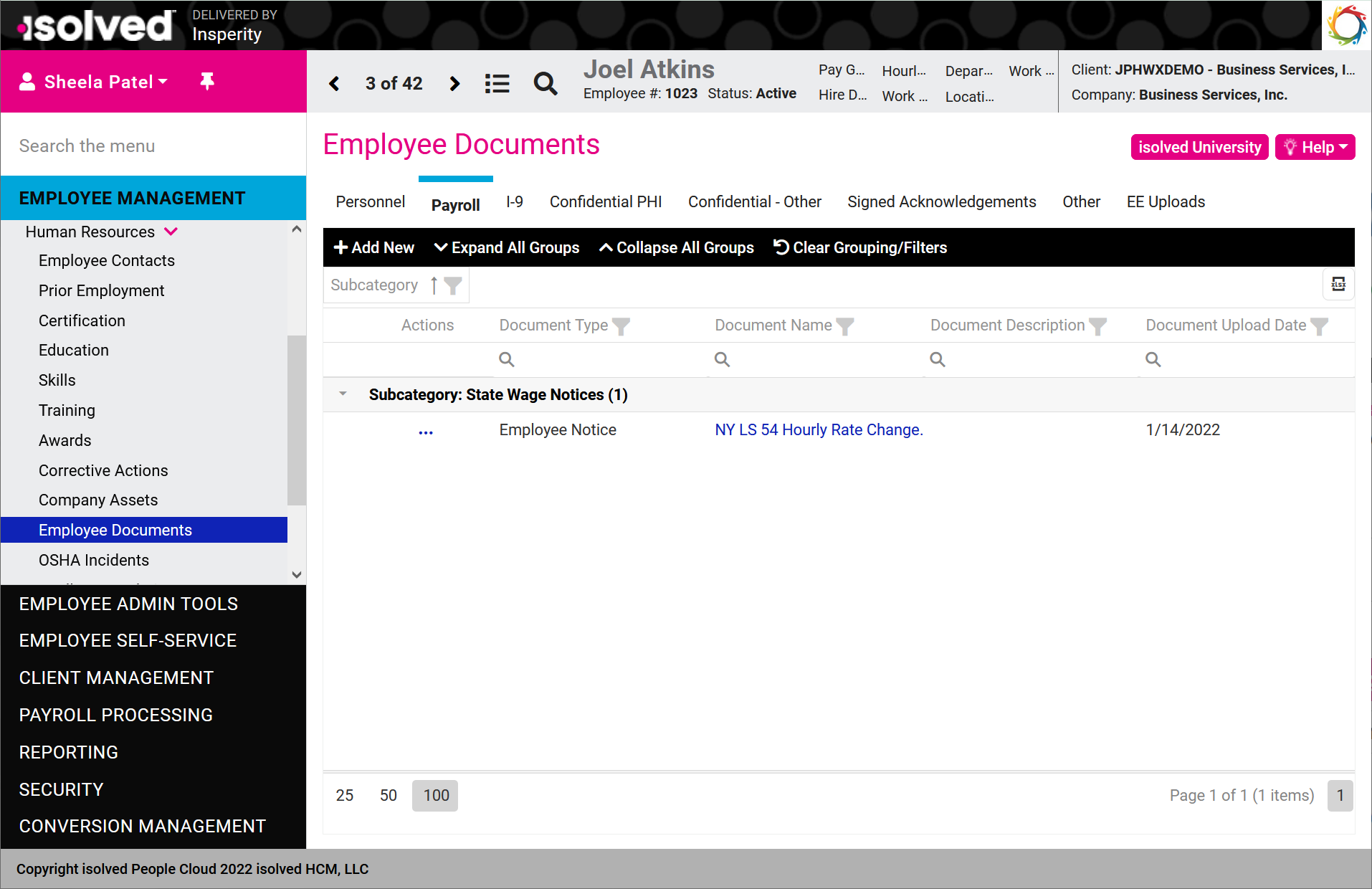

Completed forms are automatically saved on the Employee Documents screen in the category and subcategory you defined on the Client Notification template.

To configure this new feature, contact your Payroll Specialist and request the Client Wage Notice Management role.

Payroll & Tax

2022 Minimum Wage Updates

Ensure employees meet updated state and local minimum wage requirements

All state and local minimum wages have been updated for the 2022 calendar year. Review the current rates in the Minimum Wage Rates article in isolved University.

isolved does not automatically update employee pay rates to meet minimum wage requirements. You can quickly find employees who need rate increases to meet the new minimum rates using the Employee Salary/Hourly Rate List in Employee Analytics. For more information, refer to the How do I find employees who are paid below minimum wage article in the Insperity Help portal.

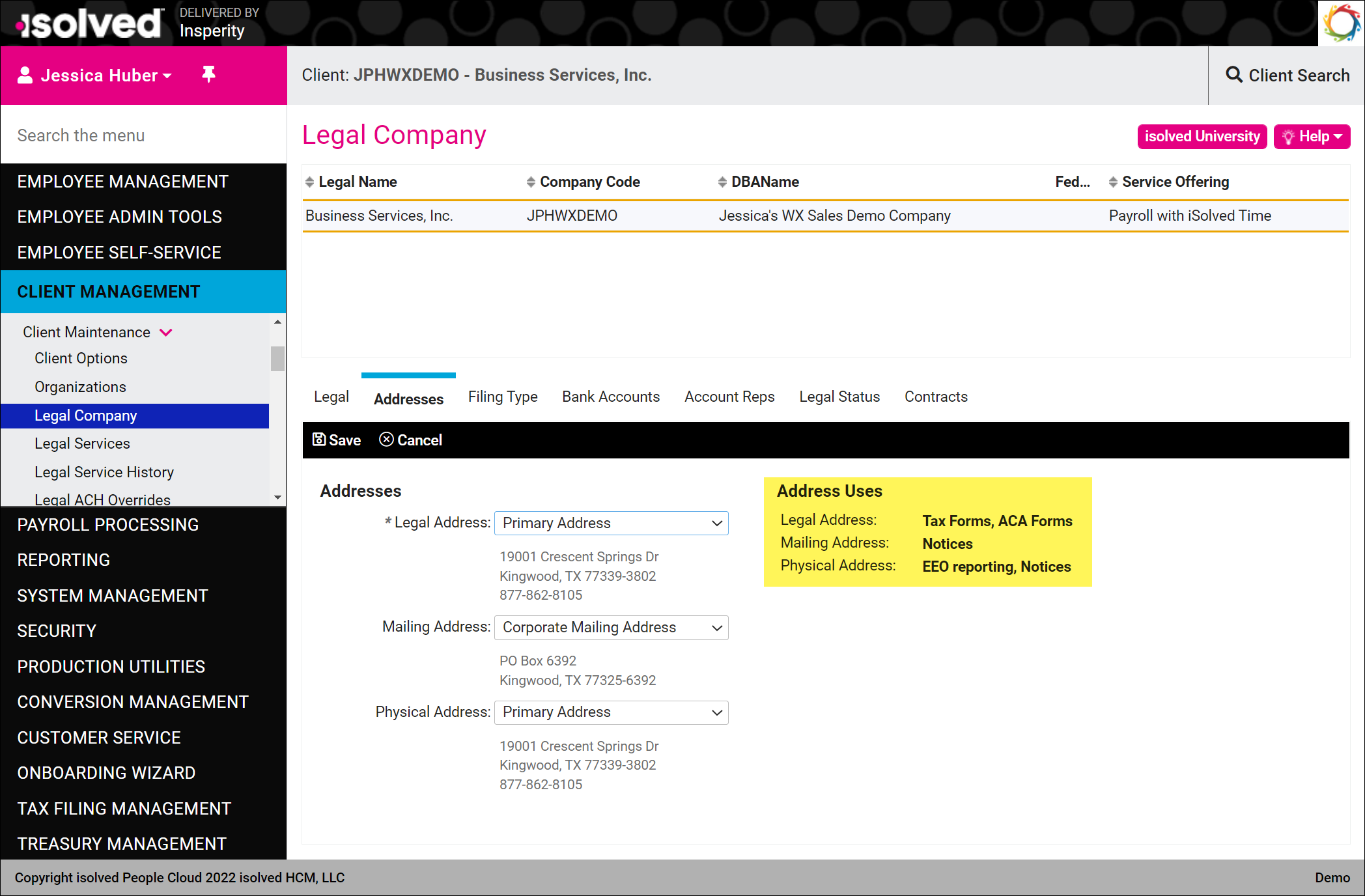

Provide accurate company address on HR, benefit, and tax forms

Specify separate legal, mailing, and physical address for your company

To support the new Client Wage Notices feature, you can now define a separate mailing address for your company. This mailing address will be printed on the state pay rate notices that require both the physical and mailing addresses.

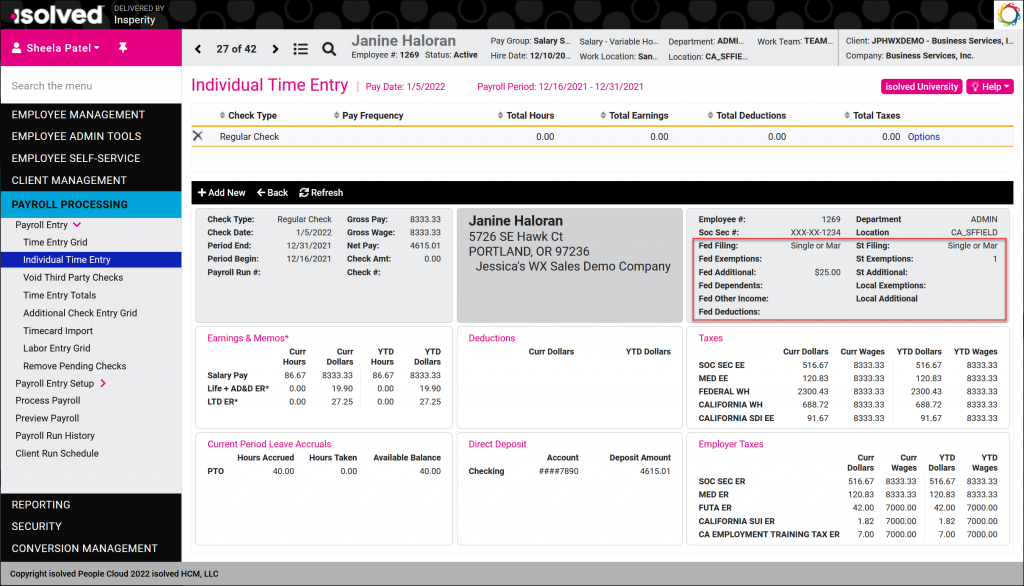

Updated Tax Filing information in individual check Preview

Verify employee federal and state withholdings when previewing checks in Individual Time Entry

Previewing checks for an employee in Individual Time Entry will now include the updated federal and state tax filing details in compliance with the latest tax forms.

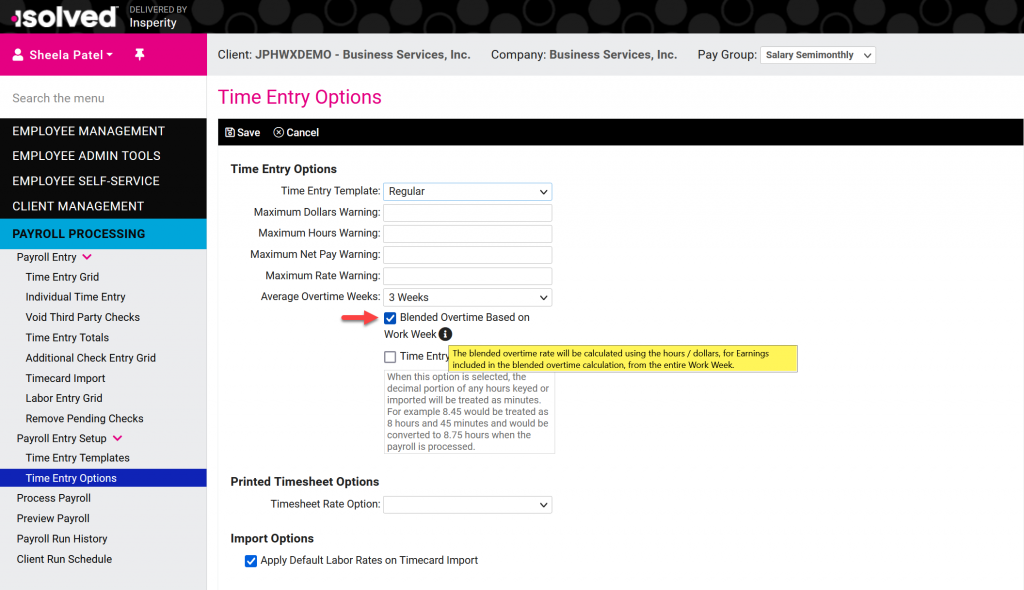

Weighted average overtime for semimonthly and monthly payrolls

Automate the calculation of overtime when employees receive multiple rates for semimonthly and monthly pay frequencies

The Federal government’s Fair Labor Standards Act requires that when work is performed at two or more rates, overtime must be paid at a blended rate. The blended rate is the weighted average of all non-overtime rates paid during that work period. The blended rate must be calculated for each workweek independently. Prior to version 8.00, isolved has not been able to support weighted average rate calculations for semimonthly and monthly pay periods, since some of the first and third weeks are paid in other pay periods. With this release, options will be available to automate these calculations for each workweek in the pay period. Select the new Blended Overtime Based on Work Week option in Time Entry Options for semimonthly or monthly payrolls to enable this feature.

Contact your Payroll Specialist to configure the updated weighted average overtime option.

isolved University

For more information, review these updated articles in isolved University:

- 2022 Minimum Wage List – https://learning.myisolved.com/library/documents/4349

- Employee Analytics – Certifications – https://learning.myisolved.com/library/articles/3087

Download the release notes

Download the release notes: isolved Product Release v8.00