Updated June 21, 2024

The “White Collar Exemption” is a designation within the Fair Labor Standards Act (FLSA) that authorizes the exemption of select employees from the federally mandated minimum wage and overtime pay provisions. Eligibility for this exemption is contingent upon meeting predefined criteria concerning an employee’s professional duties and compensation framework. Detailed information and responses to frequently asked questions about the White Collar Exemption are available below for review.

When will the new rule become effective?

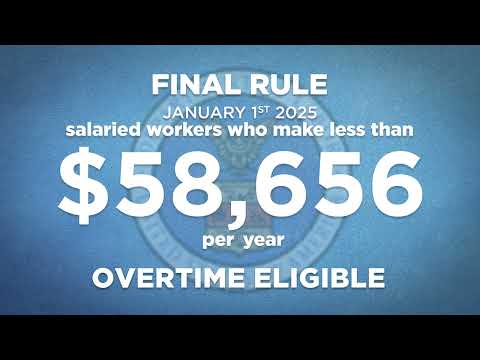

The Department of Labor (DOL) Final Rule was published in the Federal Register on April 26, 2024, and will be effective in two stages on July 1, 2024, and January 1, 2025.

What are the changes to the standard overtime salary threshold for white-collar exemptions?

The final rule introduces increases to the standard salary level and the highly compensated employee total annual compensation threshold, with future updates every three years. In simple terms, employees earning less than the standard salary on the respective dates must be paid overtime for hours worked over 40 in a workweek. The table below shows these planned increases.

|

Date |

Standard Salary Level |

Highly Compensated Employee Total Annual Compensated Threshold |

|

Before July 1, 2024 |

$684 per week (or $35,568 per year) |

$107,432 per year, including at least $684 per week paid on a salary or fee basis. |

|

July 1, 2024 |

$844 per week (or $43,888 per year) |

$132,964 per year, including at least $844 per week paid on a salary or fee basis |

|

January 1, 2025 |

$1,128 per week (or $58,656 per year) |

$151,164 per year, including at least $1,128 per week paid on a salary or fee basis |

|

July 1, 2027 and every 3 years afterwards |

To be determined by applying the methodology used to set the salary level in effect at the time of the update. |

To be determined by applying the methodology used to set the salary level in effect at the time of the update. |

Restoring and Extending Overtime Protections

What changes have been made to the salary threshold for highly compensated employees (HCE)?

The salary threshold for highly compensated employees has been raised from $107,432 per year to $132,964 on July 1, 2024, and $151,164 on January 1, 2025. Employees earning above this amount may qualify for an exemption from overtime pay if they meet certain criteria, including performing office or non-manual work and regularly performing at least one of the duties of an exempt executive, administrative, or professional employee.

What are the criteria for the white-collar exemptions?

To qualify for a white-collar exemption (executive, administrative, professional, HCE) employees must meet the following criteria:

- Be paid on a salary basis,

- Meet the new salary threshold

- Perform primary duties that meet the criteria for their specific exemption category.

Will there be automatic increases to the salary thresholds?

Yes, under the new rules, the salary thresholds for both standard and highly compensated employee exemptions will be subject to automatic adjustments every three years.

When will the first automatic increase take place?

The first automatic increase is scheduled to occur on July 1, 2027, and subsequent increases will occur every three years thereafter.

How will employers be notified of the automatic increases?

The Department of Labor (DOL) will publish updated salary thresholds in the Federal Register and on their website before the increase’s effective date.

What should employers do to comply with the new regulations?

Employers should review their current payroll practices and make necessary adjustments to ensure compliance with the new salary thresholds. This may include raising salaries to meet the new thresholds or reclassifying employees as non-exempt and paying overtime as required.

How do these changes impact part-time employees?

Part time employees who are classified as exempt must also make the minimum salary threshold.

Are there any exceptions to these changes?

Certain employees, such as teachers, doctors, and lawyers, may be exempt from the salary threshold requirements and the outside sales exemption does not have a salary test component. Additionally, some states may have more stringent overtime rules that supersede federal regulations. Please consult with your legal counsel to determine which exceptions impact your business.

What states have a minimum exempt salary that exceeds the federal requirement?

- Alaska: $48,796.80 (second increase)

- Colorado: $55,000.00 (second increase)

- California: $66,560.00

- Washington: $67,724.80

- All New York Employees: $58,458.40 (second increase)

- New York City Counties, Long Island and Westchester: $62,400.00

Are there states that are exempt from the highly compensated employee (HCE) exemption?

Yes. Illinois, Maine, Maryland, Minnesota, Oregon, Washington, Wisconsin, Pennsylvania, New York, Colorado, California, Hawaii, and Connecticut.

Is action required for HCE cases if the employees are in locations that don’t recognize HCE?

The laws regarding the HCE exemption are not always clear and employees often move locations. For those reasons, we ask that you confirm with clients that the HCE exemption was not used, even in locations that don’t recognize it.

* California law is clear that the HCE is not recognized

Is there a report available that shows employees’ salaries and designation as exempt or non-exempt?

Yes. The FLSA Exemption Threshold Report provides this information. It can be accessed in isolved through this path: Reporting>Client Reports>FLSA Exemption Threshold Report. The Employee_Census_Report is also available as an additional resource and can be accessed in isolved by following this path: Reporting>Client Reports>Employee Census Report.

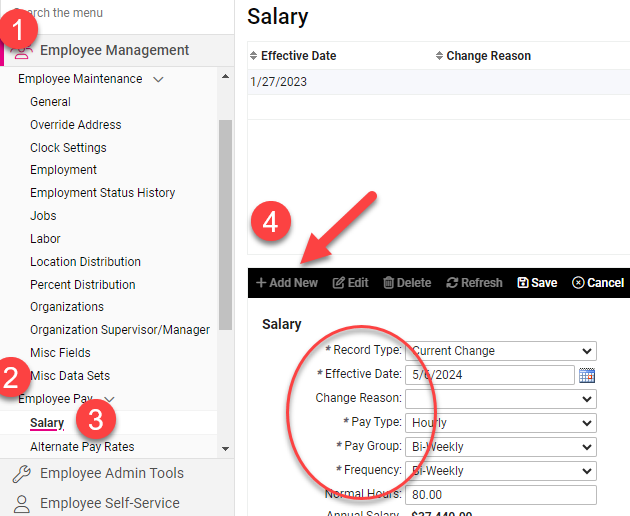

How do clients change employees’ salaries?

Clients can use the “Employee Management” function in isolved to make these changes.

To change an employee’s salary, clients will need to follow this path: Employee Management>Employee Pay>Add New>Enter:

- Record Type

- Effective Date of Change

- Change Reason (optional)

- Pay Type

- Pay Group

- Pay Frequency

- Salary (Annual, Per Pay, or Hourly Rate)

Then, save the new salary record.

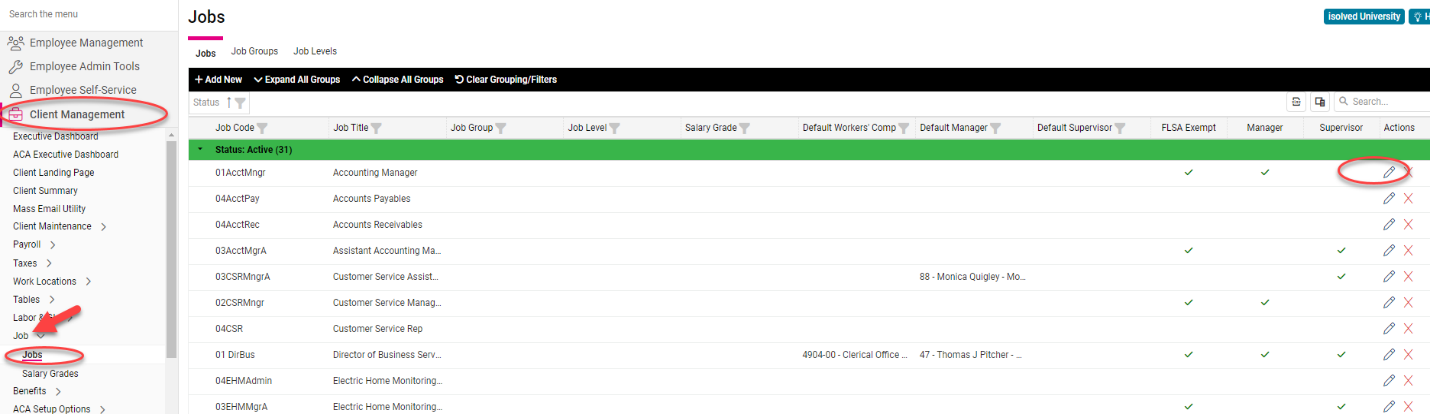

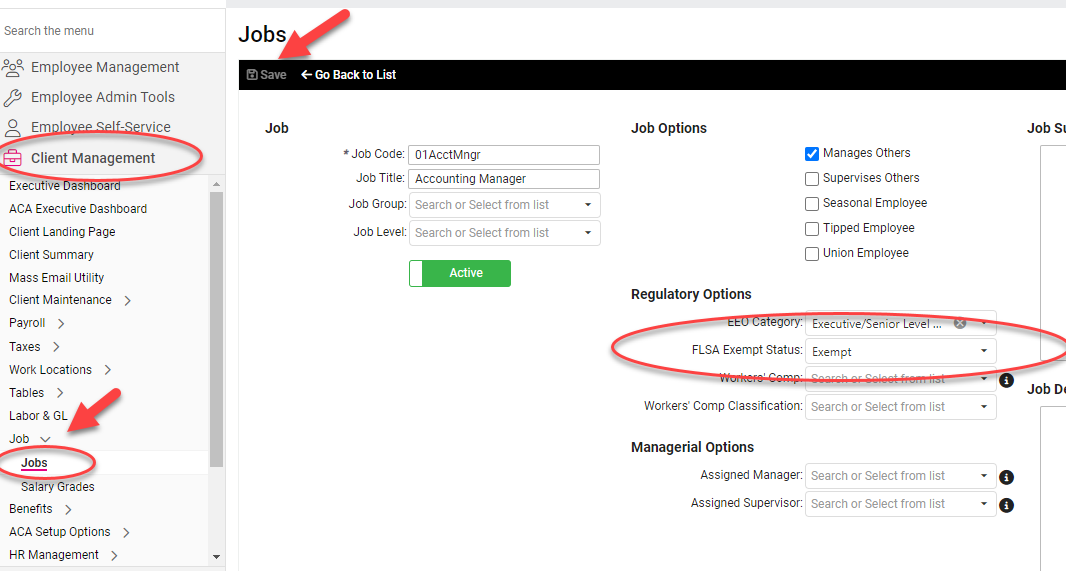

How do clients change exempt statuses?

Clients can update the FLSA exempt status by updating the FLSA status on the Job Code. Updates can be made through Client Management>Jobs>Jobs>Edit. Then, select the FLSA Exempt Status for the job code and click Save.

As stated in the Master Service Agreement (MSA), compliance with the FLSA and any similar state law is the client’s responsibility. By providing the information and suggestions contained in this communication, Insperity is not assuming any liability or responsibility for FLSA compliance and is not intending to amend or alter in any way the terms of the MSA. We recommend that you periodically (at least once a year) review your classifications to confirm that they remain appropriate, especially concerning exempt positions. FLSA classification can be a difficult and inexact process. We suggest that you consult with legal counsel experienced in wage and hour law to assist you in fulfilling your responsibilities under the FLSA regulation.