To assist in finalizing W-2 data for year-end, the following reports can be reviewed to determine if any changes are needed. To prevent tax amendments and charges, contact your Payroll Specialist immediately if you still have tax changes to enter that impact the forms.

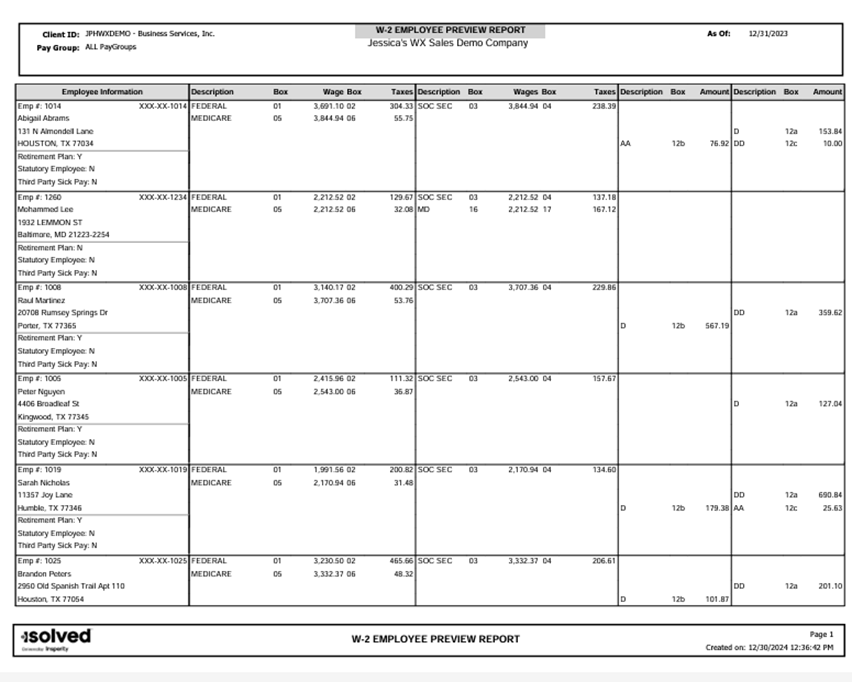

Employee W-2 Preview Report

Run the Employee W-2 Preview report to validate employee tax form details. The W-2 Preview report can be run under Reporting > My Reports by selecting Employee W2 Preview.

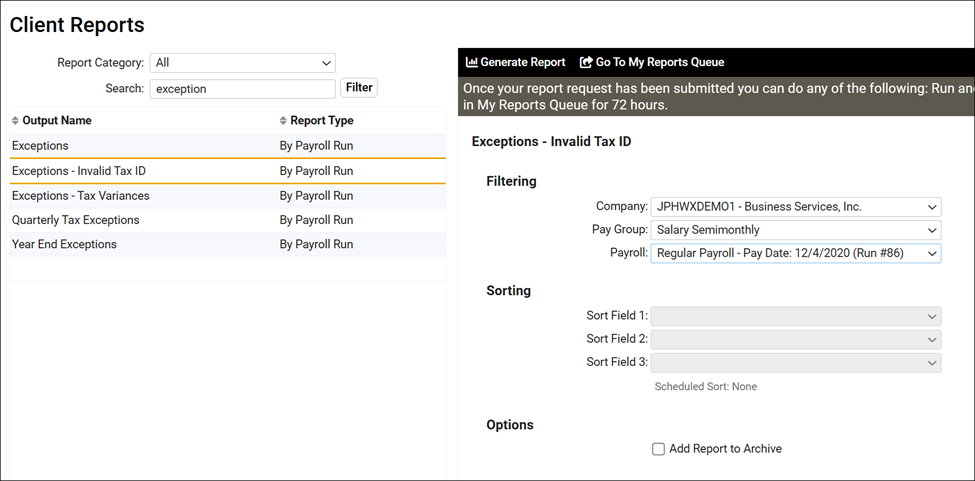

Exception Reporting

The system includes exception reports that can help you identify discrepancies that will cause errors in year-end tax form processing. These reports can be run from Reporting > My Reports

The following reports are useful to review by December 31:

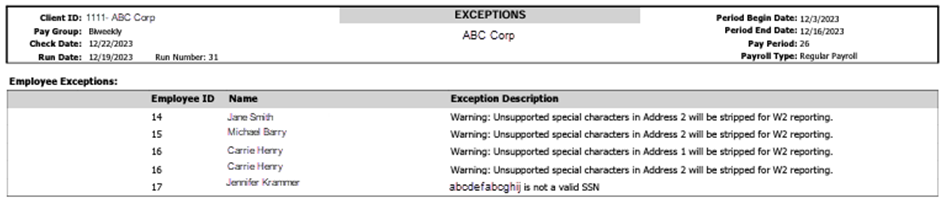

Exception Report

The exception report displays missing or incorrect employee tax IDs, including Social Security Numbers, or issues with tax withholding for Social Security, Medicare, and unemployment.

Example 1:

Example 2:

Exceptions – Invalid Tax ID Report

The Exceptions – Invalid Tax ID report lists any taxes in an Applied For status that are missing valid Tax Identification Numbers. Your business must be registered with an active ID in each jurisdiction that requires tax filing. It is imperative that you provide these ID numbers to Insperity Tax Services so they can file returns and remit payments electronically on your behalf. If that information is missing, you may be subject to penalties and interest for missed filing or nonpayment.

Exceptions – Tax Variances

The Exceptions – Tax Variances report lists employees whose month-to-date, quarter-to-date, or year-to-date tax withholdings are not correct based on the taxable wages recorded in isolved. The report uses the current tax rates in effect for the payroll and multiplies them by the subject wages, and then compares to the tax amount processed in the payroll. Variances are calculated for:

- Medicare – employee and employer contributions

- Social Security – employee and employer contributions

- California State Disability Insurance

Some variances are expected, depending on the reason. For example:

- Restaurants with tipped employees may regularly owe Medicare and Social Security tax if they don’t earn enough wages to cover the taxes on their tips.

- For California employers who contribute to their employee’s Health Savings Accounts, those contributions are taxable for State Disability Insurance and will reflect a variance. Manual collection may be required.

But many variances will create incorrect W-2 or 1099-NEC forms for your employees or incorrect tax filings. If you have any questions about the reasons for the variances, contact your Insperity Payroll Specialist.