Some states require Standard Occupational Classification (SOC) codes on unemployment tax returns to track employment by job type.

What are SOC codes?

The US Bureau of Labor Statistics (BLS) developed Standard Occupational Classification (SOC) codes to provide a consistent way of analyzing the different job titles and roles that employees perform in the American economy. They provide a standardized framework for:

- Data collection and reporting: Government agencies use SOC codes to gather and report employment statistics, including employment levels, wages, and demographic information.

- Research and analysis: Researchers, policymakers, and labor economists rely on SOC codes to conduct studies, analyze trends, and make informed decisions related to workforce development, labor market trends, and education policy.

- Workforce planning: Employers utilize SOC codes to develop job descriptions, classify positions, and align their workforce with industry standards. HR professionals leverage SOC codes during recruitment, talent management, and workforce planning.

Which states require SOC codes on their unemployment tax returns?

While federal agencies have used SOC codes since they were developed, some states are leveraging them to measure and analyze economic and employment trends by job category.

Employers must include SOC codes for each employee reported on their quarterly unemployment wage reports in these jurisdictions:

| Jurisdiction | SOC codes required on unemployment tax returns effective: | Find SOC codes by state: |

| Alaska | Prior to 2016 | https://live.laborstats.alaska.gov/article/alaska-occupation-and-geographic-coding-resources |

| Louisiana | Q1 2023 | |

| South Carolina | Q1 2024 | https://dew.sc.gov/soc-occucoder |

| Washington | Q4 2022 | https://www.onetonline.org/ |

| West Virginia | Q1 2024 | Uses federal SOC codes: https://www.bls.gov/oes/current/oes_stru.htm |

Indiana does not require employers to include SOC codes, but the state changed unemployment contribution and payroll data collection in 2019 to allow optional reporting. You can find Indiana occupational codes by job title here: https://www.hoosierdata.in.gov/coder/

What happens if I fail to provide SOC codes in states that require them?

Failing to provide SOC codes in states that require their use on quarterly unemployment wage reports can result in various penalties and consequences for employers. These penalties may include:

- Fines and penalties: Employers who fail to comply with state reporting requirements regarding SOC codes may face fines or penalties imposed by state labor agencies or regulatory authorities.

- Data inaccuracies: Without accurate SOC codes, government agencies, researchers, and policymakers may encounter challenges in analyzing labor market data, which could lead to misinterpretation of trends and ineffective policy decisions.

- Compliance issues: Non-compliance with state reporting requirements may result in audits, investigations, or other enforcement actions by state labor agencies or regulatory authorities, potentially tarnishing an employer’s reputation and credibility.

SOC codes have been required for employees with work locations in Alaska, Louisiana, and Washington. With the isolved version 10.03 release, they are also required for employees with work locations in South Carolina and West Virginia.

Assign SOC codes to employees

To ensure compliance, the following screens require SOC codes when adding or updating:

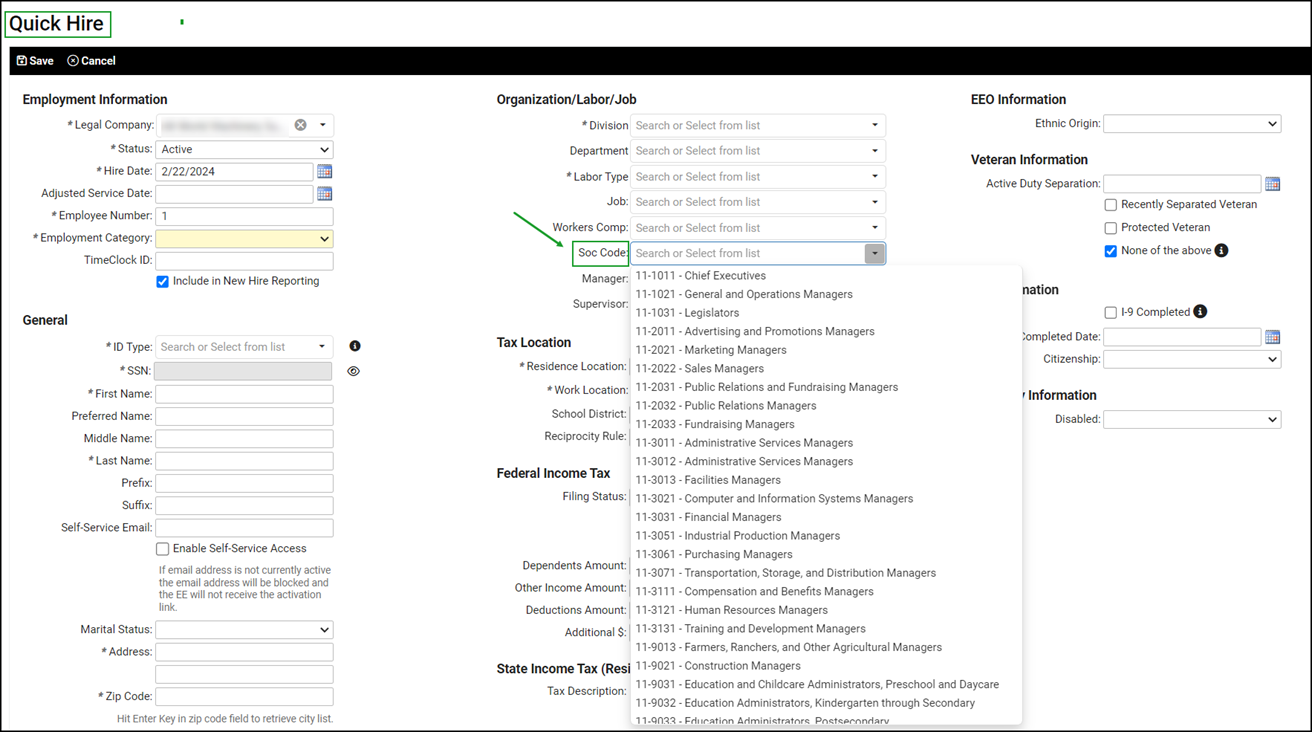

1. Quick Hire

The SOC Code field in the Organization/Labor/Job section of the Quick Hire screen is required to save a new employee with a work location in Alaska, Louisiana, South Carolina, Washington, and West Virginia.

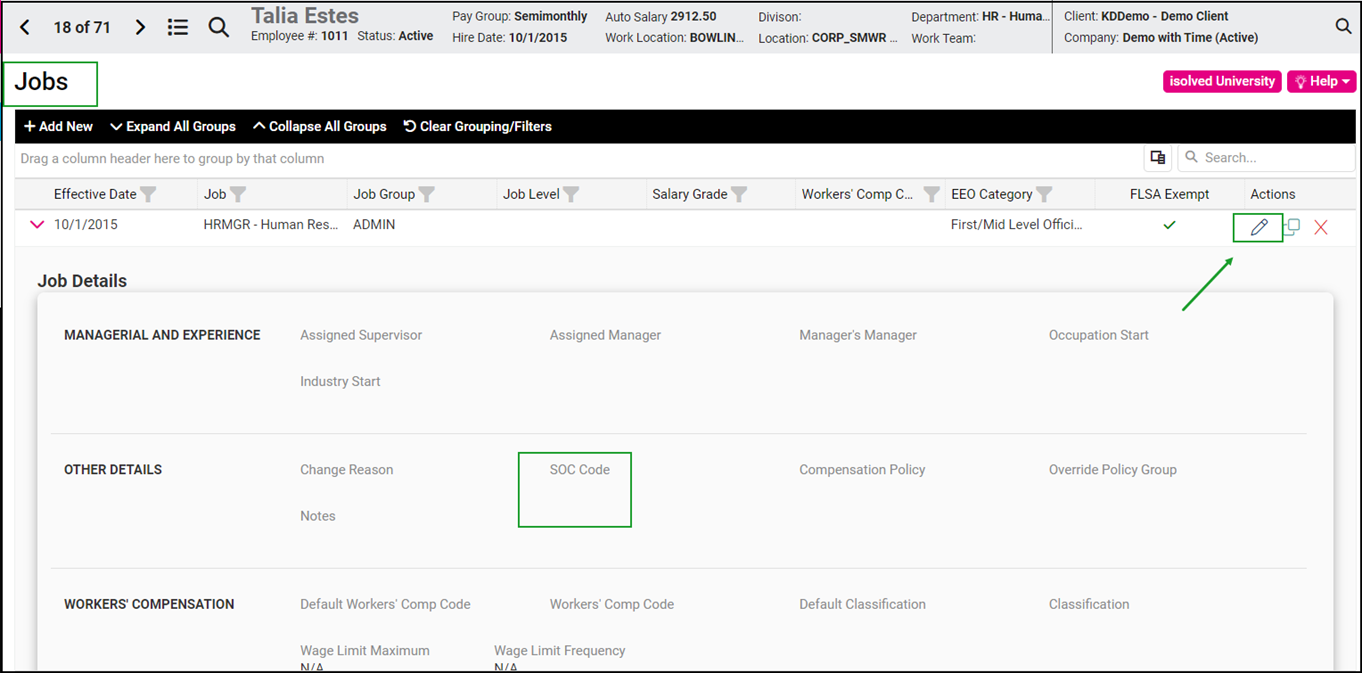

2. Employee Jobs

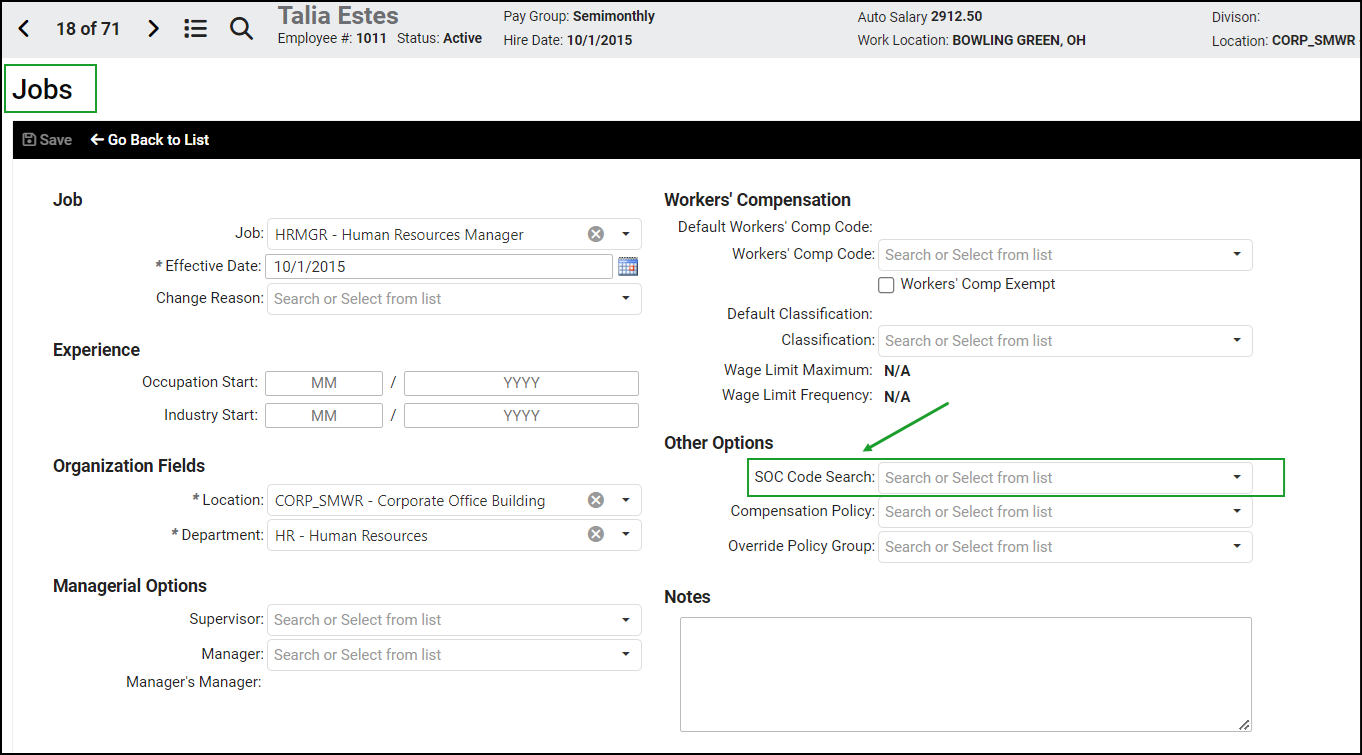

Enter Standard Occupational Classification (SOC) codes on employee job records in isolved People Cloud to ensure accurate tax reporting.

- Navigate to Employee Management > Employee Summary and switch to the list view. Click the Column Chooser and select Work Location or Workers’ Comp State to add them to your view. Filter for employees with work locations in Alaska, Louisiana, South Carolina, Washington, and West Virginia.

- Select the first employee in the list and then click the Job heading in their Job Information section, or select Employee Management > Employee Maintenance > Jobs from the menu. Review the employee’s current job record for the employees in your filtered list. The SOC Code is displayed in the OTHER DETAILS section of the Job Details.

- If the SOC Code is missing, use the pencil icon in the Actions column on the right to edit the current job record. In the SOC Code Search field, type the SOC code or select from the list and then click Save.

- If the SOC code is incorrect, add a new Job record and include the updated SOC code. Adding a new job record is recommended to preserve job history.

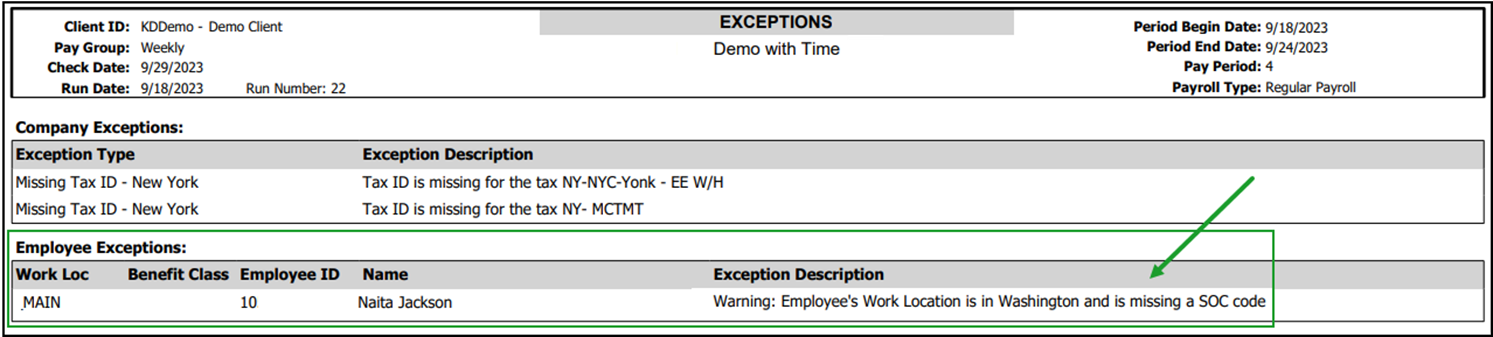

Use reports to verify SOC assignments

The Payroll Exception Report is available when previewing your payrolls. It will include any employees with missing SOC codes if they have a work location in Alaska, Louisiana, South Carolina, Washington, or West Virginia.

Please monitor this report with each payroll and assign SOC codes to employees who need them.

For help reviewing or updating employee SOC codes, contact your Insperity Payroll Specialist.