Friday, January 17th, 2025

Highlights

isolved People Cloud version 11.00 includes additional 2025 federal and state tax form and state and local tax updates, multiple report enhancements, the addition of ICHRA coverage overrides, and several new relationship options for employee contacts, as well as other updates.

Payroll & Tax

- Additional 2025 state and local tax updates, including possible action items for employers in Minnesota and Louisiana

- New 2025 federal and state tax form updates

Human Resources

- New relationship options for employee contacts

Benefits

- New ICHRA coverage overrides

- ACA Lookback calculation correction

Reporting and Analytics

- Payroll Exceptions Report enhanced to show minimum wage alerts

- Payroll Based Journal Reporting updates

- Additional options for the Payroll Register Export by Date Range report

Payroll & Tax

New Federal and State Tax Form Updates

State and local minimum wage updates

With this release, we have updated employee federal and state tax forms used in onboarding and when employees take advantage of the Tax Updates functionality within employee self-service.

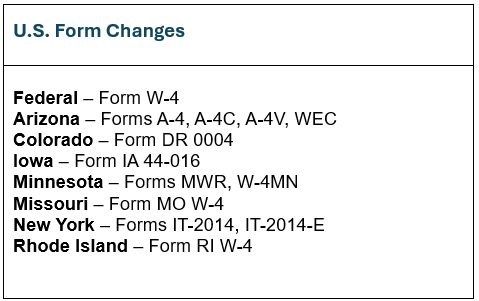

The chart below lists the tax forms that have changed. Please review this document for detailed information on specific form updates.

State and Local Tax Updates

The following state and local tax updates were deployed on Saturday, January 4, 2025, and unless otherwise noted, all tax changes are effective January 1, 2025. Notable changes with possible action items are:

Minnesota SUI Additional Assessment

Minnesota employers will see changes to state unemployment tax rates in 2025, following adjustments by the Department of Employment and Economic Development (DEED):

- The SUI and SUI Workforce Development fee wage base increased from $42,000 to $43,000

- The maximum employer SUI tax rate increased from 9% to 9.3%

- The SUI Additional Assessment is in effect for 2025 with a tax rate of 5%

Payrolls processed before January 4, 2025, with a 2025 pay date, calculated Minnesota SUI using 2024 tax rates and excluded the 5% Additional Assessment. The next payroll will automatically collect the SUI tax. However, since the Additional Assessment is a flat rate, an adjustment will be needed to collect the correct tax amount.

Louisiana State Withholding

On Dec. 4, 2024, Louisiana Governor Jeff Landry signed tax reform legislation enacting sweeping changes to several state taxes. Included in that legislation was House Bill 2, which flattens income tax rates by implementing a single-rate individual income tax of 3.09% and a higher $12,400 standard deduction indexed to inflation.

If you followed the workaround instructions provided in the isolved v10.22 release notes and blocked the standard Louisiana income tax withholding calculations for employees in order to ensure your early January payrolls were taxed using the 2025 Louisiana withholding rate, you should revert those changes. By removing the override for an employee, you ensure any future changes to the withholding rate will be automatically applied:

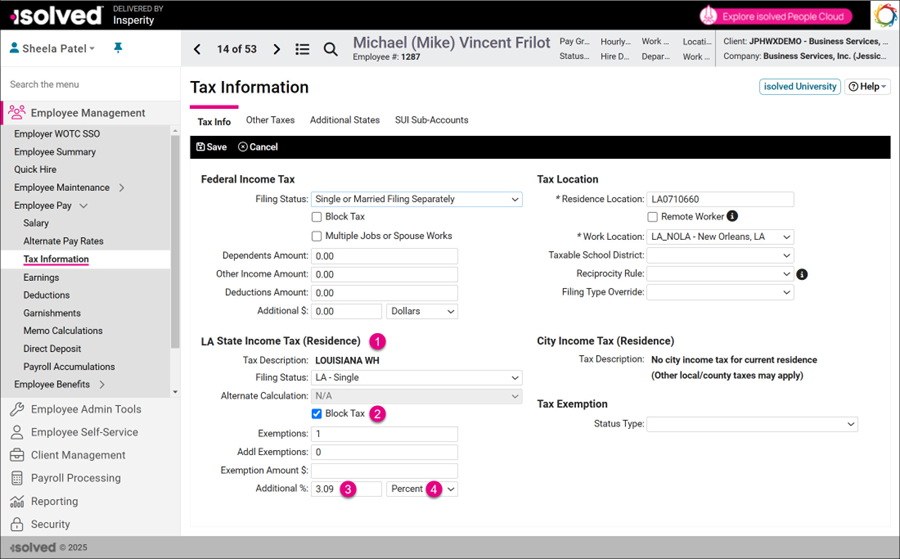

- Navigate to Employee Management > Payroll > Employee Tax and locate the LA State Income Tax section. Depending on whether the employee lives or works in the state, it may be listed as Residence or Work.

- Remove the check by the Block Tax option to reinstate the standard Louisiana income tax withholding calculations

- Remove the 3.09 amount entered in the Additional line

- Save your changes

If you did not follow the workaround previously provided and have a payroll with a 2025 pay date that was processed before January 4, 2025, the Louisiana state withholding in that payroll was calculated using 2024 tax rates.

Other State and Local Tax Updates

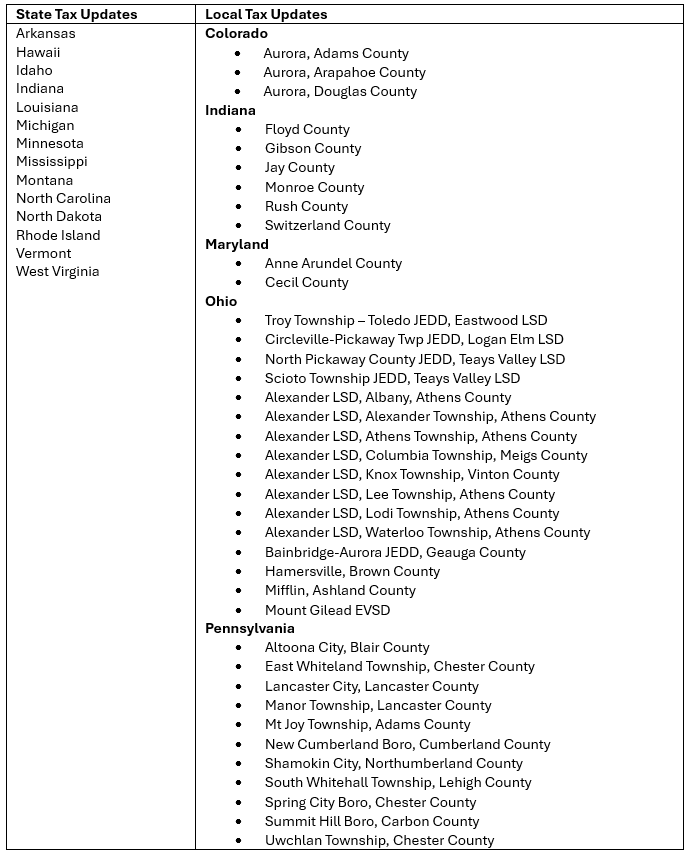

Please refer to the full document of tax changes to view details for each tax update listed in the chart below

Human Resources

New Relationship Options for Employee Contacts

Contact Types of Ward and Civil Union Partner now available

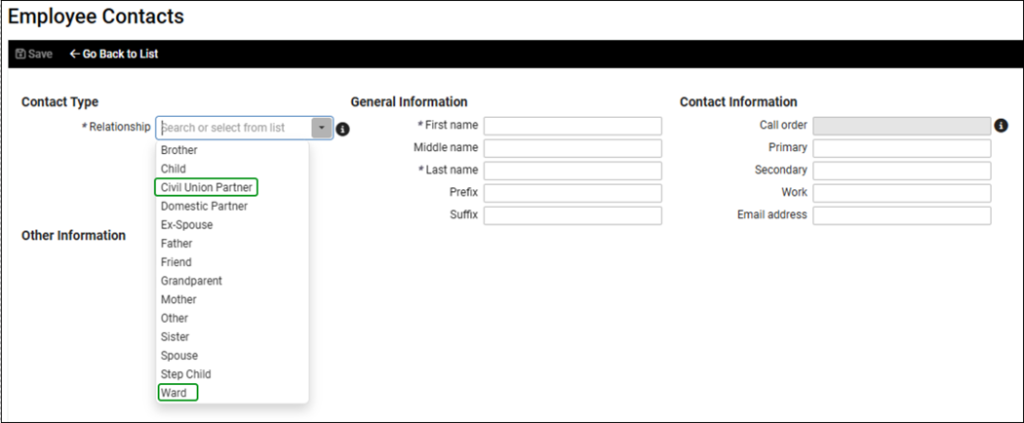

TIn preparation for some Life Events updates that are coming soon, we’ve added two new contact relationship types, ‘Ward’ and ‘Civil Union Partner’, to the Relationship dropdown on all applicable screens, including Onboarding and Beneficiaries.

For those who are curious about what those two terms mean: a ward is a minor the court appoints to a guardian, and a civil union partner is a person who is in a legally recognized partnership, like a marriage.

Benefits

Addition of Employer-sponsored ICHRA Coverage Override

Enhancements to the ACA Report Overrides page and import

As more clients are starting to offer employer-sponsored Individual Coverage Health Reimbursement Arrangement (ICHRA) plans, we’ve received requests to update the ACA reporting metrics to support that. And we heard you!

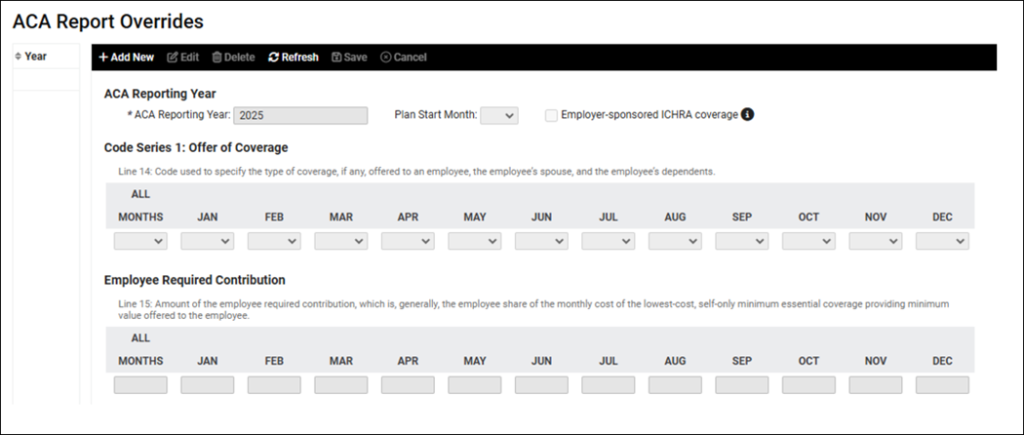

This release adds a new “Employee-sponsored ICHRA coverage” checkbox to the ACA Report Overrides screen. When this new option is selected:

- The correct “G” code for Box 8 of the 1095B form will be populated

- The 1095B PDF form will display code “G” rather than “B” in Box 8

- The 1095B xml will display code “G” rather than “B” in Box 8

The ACA Report Overrides import was also enhanced to include an “Employee-sponsored ICHRA coverage” field with true/false selections. When the “true” selection is chosen, the same changes as listed above will occur when the file is imported.

ACA Lookback Enhancement

ACA Calculation Correction

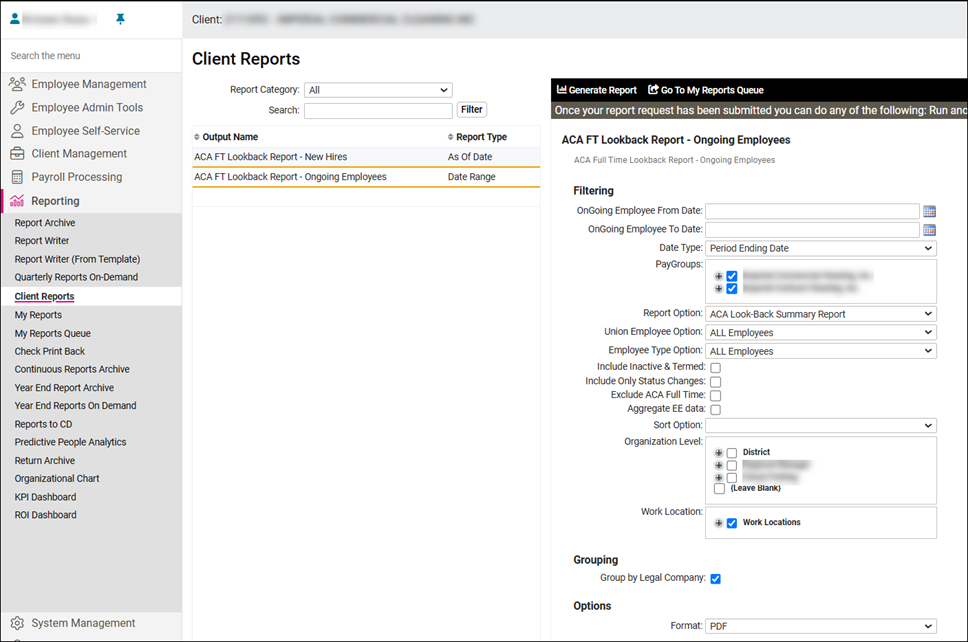

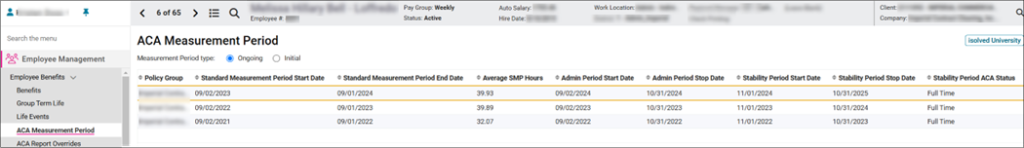

This release resolves an issue with the ACA calculation that resulted in a payroll being excluded when the begin date of an ACA measurement period and a payroll begin date were the same. The Client Report “ACA Lookback Report – Ongoing Employees” and the Employee Benefits > ACA Measurement Period page now include a payroll when those dates are the same.

Reporting and Analytics

Enhancements to Payroll Reports

Payroll Exceptions Report now includes minimum wage alerts

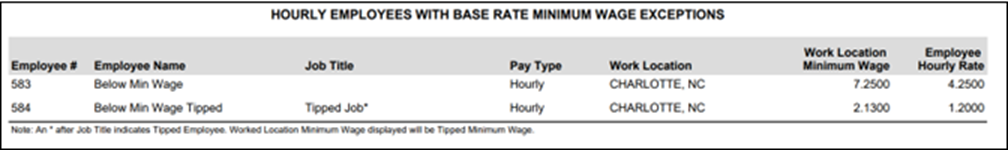

With this release, we’ve added a new section to the Exceptions Report to alert you when an employee is paid under minimum wage.

Options updated for the Payroll Register Export by Date Range report

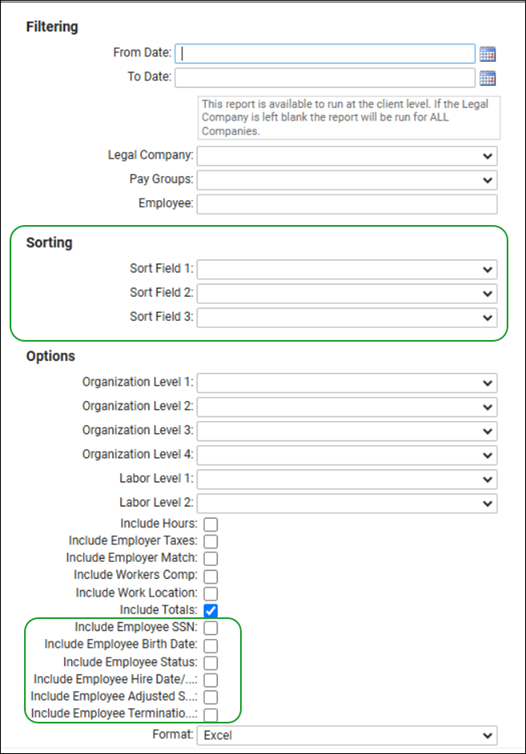

The “Payroll Register Export by Date Range” report has been updated to include more options. A new section allows for up to three sort levels to be defined for the report and adds increased flexibility around what data you want to display in your export, including:

- Employee SSN

- Employee Birth Date

- Employee Status

- Employee Hire Date

- Employee Adjusted Service Date

- Employee Termination Date

Other enhancements include the report date range being limited to one year and the report columns are now sorted by sequence number.

Payroll Based Journaling Reporting updates

The “Payroll Based Journaling Reporting” report has been updated to v4.00.0 and an option has been added to include a Terminated Employee line on all records.

For more information about the changes in isolved version 11.00, please contact your Insperity Payroll Specialist.