Friday, February 7th, 2025

Highlights

isolved People Cloud version 11.01 includes additional 2025 tax and tax form updates, exciting updates in Applicant Tracking, a new unread message indicator in Adaptive, several performance improvements, enhancements to the Garnishment summary screen, and other updates.

Employee & Manager Self-Service

- Time Card Calendar View optimization in Classic View

- New red dot indicator for unread messages in Adaptive

Payroll & Tax

- 2025 tax form updates

- Additional January 2025 tax updates

- Garnishment summary screen enhancements

- Direct deposit notification email changes

Time and Labor Management

- Performance improvements in My Dashboard in Classic View

Reporting and Analytics

- Payroll Register Export by Date updates

Applicant Tracking

- Candidate Matching AI updates – coming soon!

Employee & Manager Self-Service

Labor fields and labor groups load faster

In this release, we optimized the loading of labor values in the Time Card Calendar View in Classic View to resolve issues some clients have reported with the page locking up with large numbers of labor group items and/or labor fields.

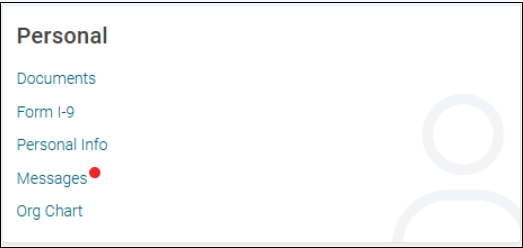

New red dot indicator for unread messages in Adaptive

Now it’s easy to know when you have unread messages or messages that require acknowledgement in AEE! The Personal section of the Home page in Adaptive has been enhanced to display a red dot indicator next to the Messages link to let you have messages that need to be addressed.

Payroll & Tax

New Federal and State Tax Form Updates

With this release, we have updated employee federal and state tax forms used in onboarding and when employees take advantage of the Tax Updates functionality within employee self-service.

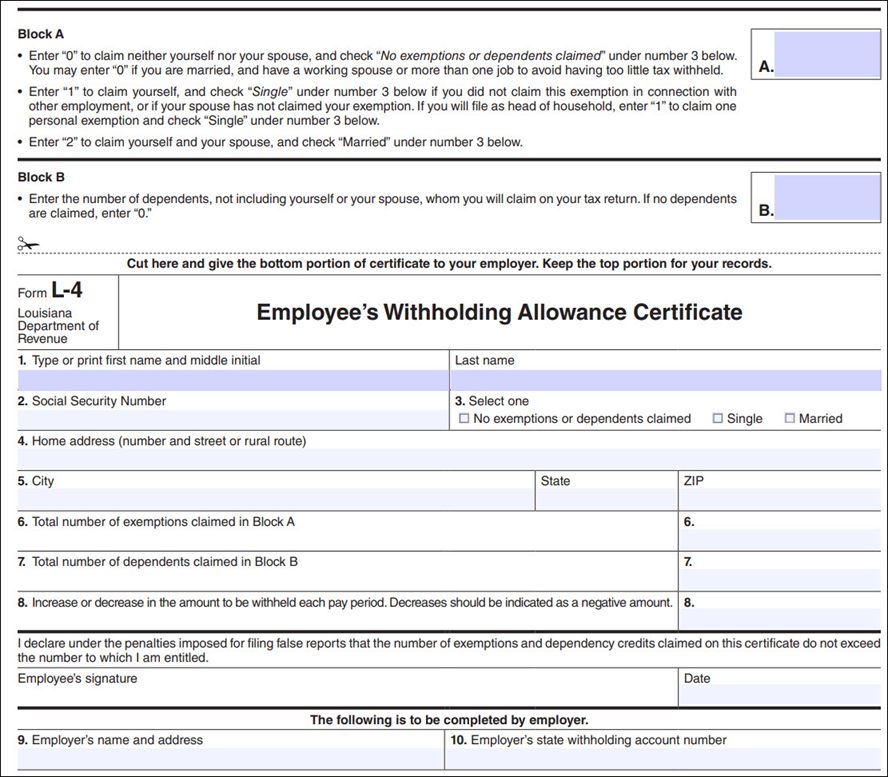

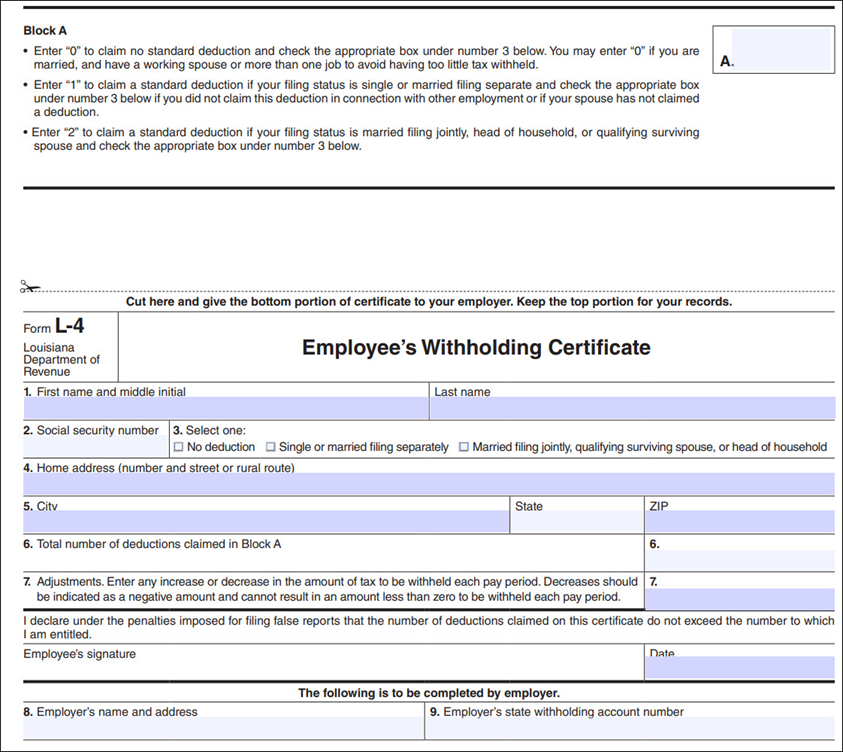

Louisiana withholding certificate Form L-4

With this release, the new Louisiana withholding certificate, Form L-4, is now available to employees in Onboarding and the Tax Update Wizard in self-service.

While employees are not required to update their exemptions and dependents shown on the Form L-4 currently on file in isolved, the Louisiana Department of Revenue suggests that employees with additional withholding amounts (Line 8 of Form L-4) should review their Form L-4 to confirm the appropriate amount of Louisiana income tax is withheld.

Old Form L-4

New Form L-4

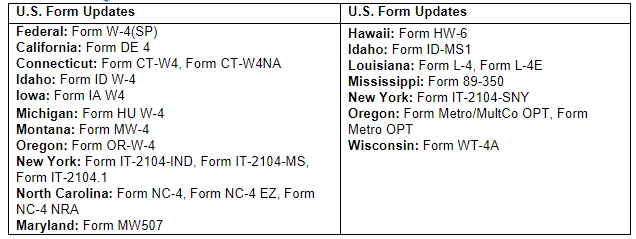

All federal and state tax form updates

The chart below lists all tax forms that have changed. For detailed information about the tax form changes, please review this document for the changes listed in column 1 in the chart and this document for the changes listed in column 2.

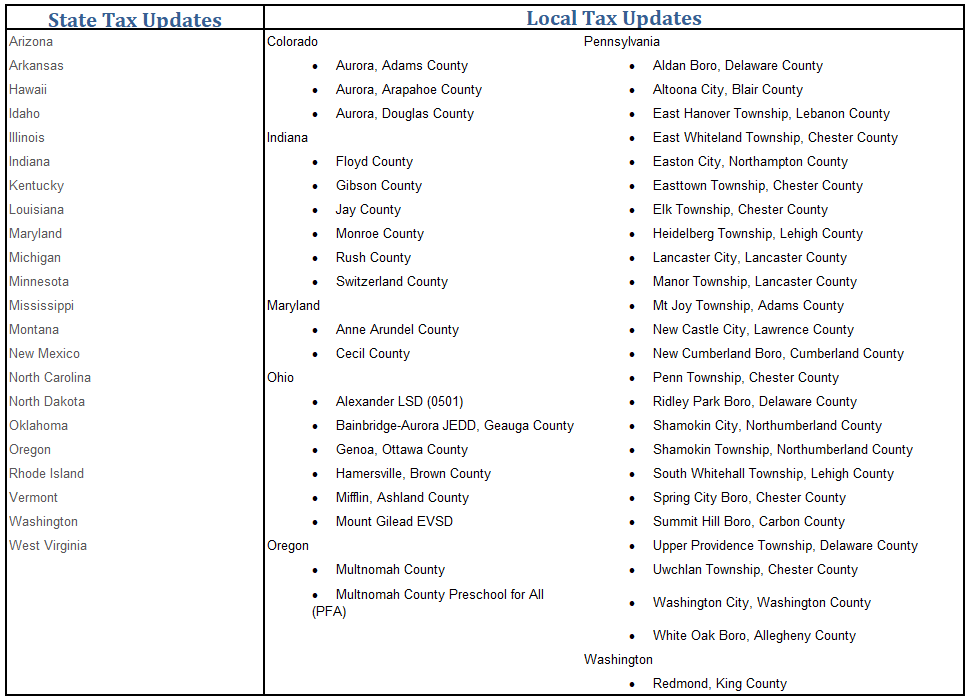

State and local tax updates

All tax changes are effective January 1, 2025, unless otherwise noted. Please refer to the full document of tax changes to view details for each tax update listed in the chart below. Notable changes with possible action items are:

Employee Garnishment summary screen updates

The Employee Garnishments summary screen has been enhanced to show additional details for Child Support garnishments. We have added the following information to the summary screen:

- The column heading Amount has been updated to Total Amount

- The following columns have been added to the page:

- Past Due Amount: The dollar amount of the garnishment that is past due

- Current Amount: Total Amount of the garnishment minus the Past Due amount

- Percentage of: “Disposable Income”

- Not to exceed %/$: Cap of disposable income considered for the garnishment

Previous screen

New screen

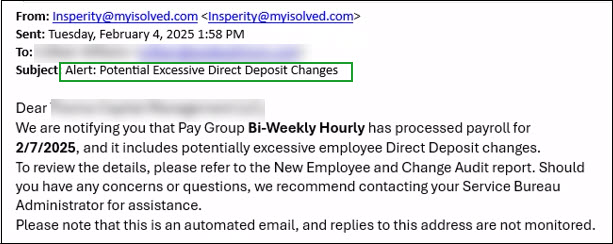

Direct Deposit notification changes

Client users who currently receive payroll process notifications will receive a new notification when ten percent or more of the employees being paid in the pay group have updated their direct deposit accounts. This improvement provides additional security to reduce fraudulent direct deposit changes.

Time and Labor Management

My Dashboard performance improvements

My Dashboard in Classic View has been optimized to load faster.

Reporting and Analytics

Payroll Register Export by Date Range updates

Updates were made to the Payroll Register Export by Date Range to resolve the following issues:

- Garnishments and child support amounts are now included in their respective columns on tabs 1 and 2

- The 365-day date range restriction has been updated to allow a range of 365 days to account for leap year

Applicant Tracking

Candidate matching AI model update

The Candidate Matching AI model will be updated within the next two weeks. You don’t need to do anything; this update will happen automatically!

You may see a small adjustment to the numerical score of previous applicants on active job listings. This update will apply to all applicants on active job listings and will standardize scoring among all applicants on those job listings, existing and future. You may also see scores for applicants who previously did not have one. Here’s what’s new:

Education data integration – enhanced matching with education profiles

The assessment of “fit” has been revamped based on education to consider the field of study, attained level, and labor market trends much more extensively.

This update enables more accurate matching for roles with specific educational requirements and offers a holistic view of candidates, especially recent graduates, and students with limited work experience.

Improved skill inferences from job titles – dynamic skill extraction

We’ve enhanced the ability to infer key skills directly from job titles. For example, recognizing that a “Java Engineer” is proficient in Java or that a “Deep Learning Scientist” may have experience with TensorFlow.

This update leads to a more precise understanding of candidate and job skill profiles, improving match quality by leveraging crucial details within job titles.

Flexible candidate profiles – support for early-career candidates

Candidates are no longer required to have a work history for the Candidate Matching models to make an assessment. They can have a combination of work experience, skills, and education – or none at all. Candidates without detailed profiles are assumed to have baseline competencies suitable for entry-level positions that typically require limited or no prerequisites.

This enhancement expands support to a broader talent pool, including early-career job seekers and students, allowing you to discover promising candidates who may have been overlooked previously.

If you have questions about Applicant Tracking, contact support@isolvedhire.com

For more information about the changes in isolved version 11.01, please contact your Insperity Payroll Specialist.