Friday, January 26th, 2024

Highlights

isolved version 10.01 includes important information about Identity Phase2, 2024 tax changes, Federal and State Tax Form updates, and Applicant Tracking enhancements.

Identity & Access Management

- Identity Phase 2 Security Enhancements – coming February 29th *new date*

Payroll & Tax

- Stay informed of 2024 tax changes and action items for Georgia and Iowa

- 2024 Federal and State Tax Form updates

- 2024 Changes to Alabama Overtime

Applicant Tracking

- The ability to create and assign tags to show for applications has been released

- Applicant messages can now be scheduled via email or text

Identity & Access Management

Multi-factor authentication has a new release date!

The isolved security enhancements associated with IdentityServer Phase 2 is tentatively scheduled to be released Thursday, February 29th.

These Phase 2 enhancements provide additional security measures to help prevent fraudsters from accessing your critical employee information, including multi-factor authentication and a reduced inactivity timeout. Cybercriminals have become more sophisticated, so your Insperity Workforce Acceleration™ technology is changing to keep pace.

Watch this quick video overview showing how logging in will change after December 1st, 2023. Changes are also coming to the timing of automatic logouts in the upcoming release for added security. This article common questions and includes additional resources.

Payroll & Tax

2024 Tax Changes

Additional 2024 Federal, state, and local tax updates

Starting with payrolls processed with a pay date on or after January 1, 2024, all the tax changes included in the full 2024 Tax Changes document will automatically take effect (unless otherwise noted).

Here is a document that shows the recent 1/18/24 updates.

Notable changes with possible action items:

Georgia Withholding

A filing status of “Married Filing Separately or Married Filing Jointly Both Spouses Working” (Filing Status – 64) has been added to be consistent with the 2024 GA W-4. Georgia does not require all employees to file a new GAW-4 for 2024.

The following filing statuses will be eliminated in an upcoming release.

- Married filing separately (Filing Status – 4)

- Married filing jointly both spouses working” (Filing Status – 20)

NOTE: Existing employees that have the filing status will remain; however, the option to choose it in the dropdown going forward will no longer be available. Employees using these filing statuses can update their form to “Married Filing Separately or Married Filing Jointly Both Spouses Working” (Filing Status – 64).

Not sure who this impacts? There is report called Employee Profile that shows this information. Make sure to run the one with the “As Of Date” version in Excel. Then scroll over to the columns with Resident State Filing Status and Work State Filing Status to see utilization.

All filing statuses use the same standard deduction amount of 12,000.00 with the exception being ‘Married filing Jointly 1 Spouse Working’ which uses 24,000.00. So there is no change in the calculation.

Please reach out to your Insperity Payroll Specialist for questions or support.

Iowa Withholding

Iowa no longer requests the number of allowances claimed on the state’s W4 form; they now require the actual allowance dollar amount to be provided on Line 6 of the 2024 IA W-4. The allowance dollar amount is used to determine the amount of the Standard Deduction to reduce taxable wages. Then, the actual allowance dollar amount is used as a tax credit.

The Exemption field, which is used to send the amount of allowances claimed, has been updated to pass line 6 Total Allowance Dollar Amount (rounded to the nearest whole dollar). We will use this value to find the Standard Deduction amount and will also be used as a Tax Credit. Furthermore, as the instructions in the Withholding Guide state, “For employees who do not file an updated W-4 using the 2024 IA W-4 form, use $40 as the total allowance amount.” This will not be automatically updated.

Not sure who this impacts? There is report called Employee Profile that shows this information. Make sure to run the one with the “As Of Date” version in Excel. Then scroll over to the columns with Resident State Filing Status and Work State Filing Status to see utilization.

2024 Tax Form Updates

With this release, we have made updates to the federal W-4(SP) and several state employee withholding forms.

Federal Form W-4 (SP)

Form W-4 (SP) changes have been made (in Spanish). Please view the W-4 (SP) Tax Form Changes – Release 10.01 for details on what has changed on the form.

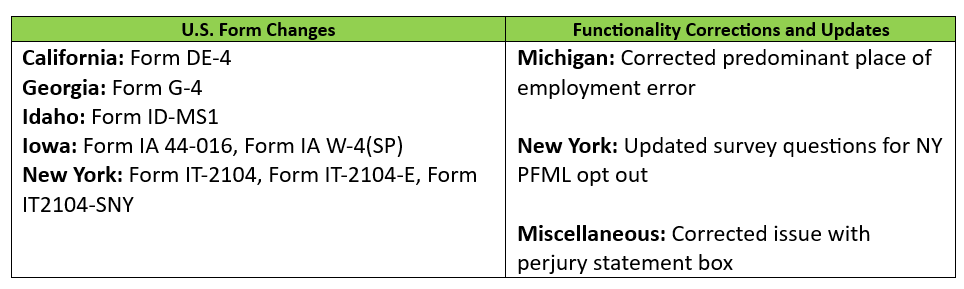

State tax form changes

With this release, we have made updates to State withholding forms, employee withholding forms that are used in onboarding, and those using the Tax Updates functionality in self-service.

The chat below lists the changes and updates, please view the State Tax Form Changes – Release 10.01 for details on what has changed on the forms and in self-service.

2024 Changes to Alabama Overtime

Hourly employees exempt from Alabama state income tax on overtime earnings

Reminder! If you have employees in Alabama and have not yet contacted your Payroll Specialist or Time Support at WATime@insperity.com, please do so ASAP.

NEW! Every client with an Alabama work location has to report 2023 overtime by January 31, 2024. The report provides the total number of employees that received overtime pay and a cumulative amount of overtime received in the year.

We are actively creating a Report Writer report for each client and Insperity will provide the report to the state by the deadline.

Visit the 9.24 release article for the full Alabama Overtime announcement.

Applicant Tracking

Custom Application Tags

You can now create and assign tags

You now have the power to create and assign tags to show for applications within your organization or career site, allowing for a tailored and efficient way to categorize candidates based on specific skills, qualifications, or attributes. Assign tags to highlight key information on an application, making it a cinch to find and collaborate on those standout candidates later.

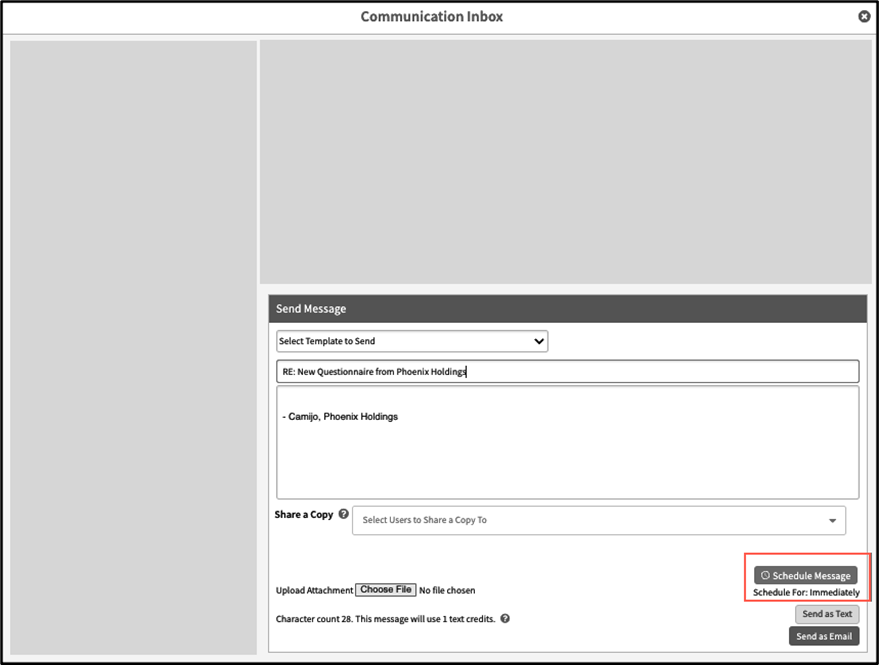

Schedule a Message

You can now schedule applicant messages via email or text!

Plan and organize your communications in advance, giving you the flexibility to craft important messages during your non-peak hours, then set the schedule for when it’s ready to go.

In the Communication Inbox, select Send Message, then you’ll scroll down and click Schedule Message. The Schedule Send box pops up with calendar and clock icons. Select each to schedule the date and time of your message – up to two weeks in advance!

For more information about the changes in the 10.01 release, contact your Payroll Specialist.