Friday, June 10th, 2021

Highlights

The latest isolved release focuses on benefits enrollment. Some long-awaited report updates are included too. This release will be available when you log into isolved on Friday, June 10th, 2021.

- Streamlined New Employee and Change Audit reports

- Enhancements to COVID-19 reports

- Improved readability on the executive dashboards

- Now you can require employees to specify the SSN and gender when they enter new dependents, but not require them for beneficiaries

- Employee benefit enrollment is streamlined for new hires, life events, and open enrollment

HR, Payroll & Time

New Employee and Change Audit report update

The New Employee and Change Audit report has been updated so it is focused on the employees in the current payroll. It will now exclude changes for employees who were terminated in previous pay periods. These changes were also made to the New Employee and Change Audit Detail and New Employee and Change Audit Detail Export reports.

Executive Dashboard Updates

For enhanced readability on the Executive Dashboard and ACA Executive Dashboard, the layout has been updated so you can read the full description for each category in the pie charts.

COVID-19 Report Enhancements

ERC Report Enhancements

To support the changes to the Employee Retention Credit in the American Rescue Plan Act of 2021 (ARPA), enhancements have been made to the 2021 ERC reports in isolved. The CARES Act Retention Credit < 500 ees (2021) and CARES Act Retention Credit > 500 ees (2021) reports have been updated with these changes:

- The reports allow retention credit through 12/31/2021

- Loan exclusion dates are now shown on the Pay Group Summary tab in the Excel version.

Since you cannot use the same wages for Employee Retention Credit and to qualify for Paycheck Protection Program loan forgiveness, loan exclusion dates allow you to exclude the payrolls that will be used for loan forgiveness so they are not included in your ERC calculations - ARPA allows recovery start up businesses to qualify for Employee Retention Credit in the third and fourth quarters of 2021. For businesses with this designation, the report will limit the Employee Retention Credit to $50,000 per quarter for Q3 & Q4 2021

The Excel versions of the 2020 ERC reports have also been updated to include the Loan exclusion dates on the Pay Group Summary tab. These reports are named CARES Act Retention Credit < 100 ees (2020) and CARES Act Retention Credit > 100 ees (2020) in the * COVID-19 Reports category in isolved.

PPP Report Enhancements

This release corrects an issue with owner’s wages on the CARES PPP Loan Forgiveness Report 2021. These wages were not limiting correctly on Line 9 of the Schedule A. Now, they will reflect the lowest of these values:

- Loan period wages

- Prior year loan period equivalent wages. If you choose 2019 as the Owner Compensation used in Loan Application, it will use the 2019 loan period equivalent wages, and it will use 2020 equivalent wages if you choose 2020 (Only allowed with 2021 PPP loan)

- Loan period equivalent of $100,000 up to a maximum of $20,833

Benefits

Different Requirements for Dependents and Beneficiaries

Employees need to enter the Social Security Number and date of birth for dependents in isolved so that information can be sent to the benefit insurance carriers since they are covered on the plans. Since beneficiaries aren’t covered, it’s not necessary to collect that information. You can now require SSN and birthdate for just dependents and not beneficiaries in online enrollment in isolved.

Streamlined Benefit Enrollment

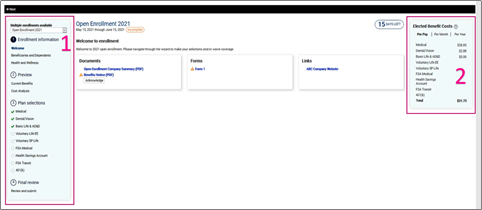

Employees will see a modernized look for new hire, life event, and open enrollment with this release. Employees have access to new guides in isolved University to help them use the updated online benefit enrollment wizard:

- Open Enrollment from an Employee’s Perspective guides them through the open enrollment wizard

- The HCM Benefits – Employee Self-Service Guide has also been updated if employees click the Help option within the wizard

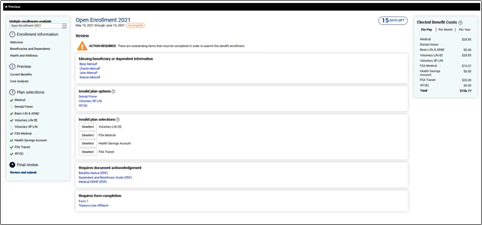

Benefit Enrollment is more intuitive

- The enrollment process is easier to understand and navigate with the updated Enrollment Information menu on the left

- The Elected Benefit Costs section on the right updates as employees make their election choices, so they can see the impact on their paycheck in real-time.

Employees can keep their current elections automatically

If you allowed employees to keep their current plan year selection in open enrollment, they will no longer need to click Keep Current Election as they walk through the wizard. Instead, their existing plan options are automatically selected when they begin enrollment, but they can still make a different choice for the upcoming plan year by choosing a new plan or coverage option.

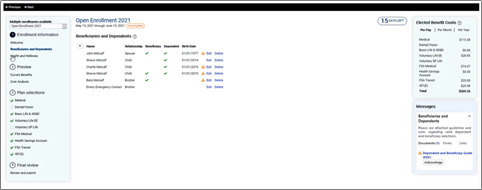

See beneficiary and dependent information more easily

The Beneficiaries and Dependents section of the benefit enrollment wizard has been streamlined so employees can see all of their beneficiaries and dependents at a glance. They can see more details for existing ones, and can easily add, edit, or delete new ones.

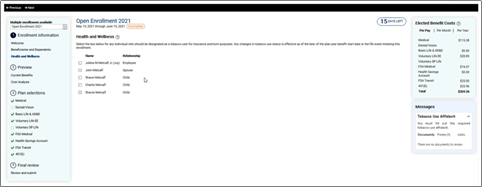

Health and Wellness updates

The Tobacco Use Status section of the benefit enrollment wizard is now Health and Wellness. If you have benefits whose rates vary based on tobacco usage, employees can quickly make this selection for themselves and their dependents.

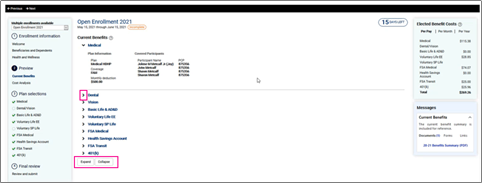

Review Current Benefits

The Current Elections section of the benefit enrollment wizard is now Current Benefits. Employees can expand each benefit to see the details, including their current plans, coverage, dependents, and monthly costs.

Streamlined Coverage Selection

Once an employee has chosen their benefit plan, coverage choices are now displayed as buttons instead of a list so employees can easily make their selection.

Fewer mistakes during Final Review

The confirmation page has been replaced with a two-step final review process before employees submit their elections.

Review

The Review step checks for missing information or invalid plan choices, helping employees make selections that meet your benefit requirements.

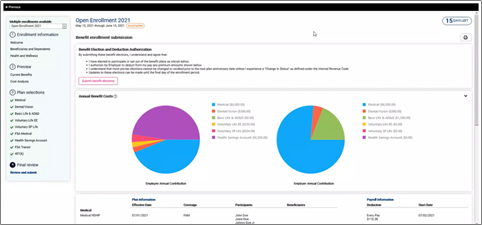

Benefit Enrollment Submission

Once employees have corrected any issues identified in the Review step, Benefit Enrollment Submission gives them tools to review their enrollment choices before they submit. Colorful pie charts help employees review annual contributions and plan details at a glance. Plan information and payroll deduction details are available as they scroll down so they can double-check their elections and know they’ve made the right choices. They can save a copy of their completed enrollment by clicking the printer icon in the top right.

Download the release notes

Download the release notes: isolved Product Release v7.10