Friday, July 9th, 2021

Highlights

isolved continues to listen to feedback from clients and improve the product based on your recommendations. Some enhancements requested by the community are included in isolved version 7.12 that will be available when you log in on Friday, July 9th, 2021.

Payroll

- You can now automatically prorate pay for salaried employees when they start working, receive a raise in the middle of a pay period, or are terminated.

- To improve performance, the Excel version of the Client Profile Report is now available as a separate report named Client Profile Export.

Time

- The Preview Check feature on the ESS Time Card is now working as expected. The earnings and hours in the time card are reflected properly in the check preview and match what will be exported to payroll when you commit time cards.

If you disabled the Preview Check feature on the ESS Time Card, contact time.support@insperity.com for assistance enabling it again.

Payroll

Prorating Salaries

Remove manual work by automatically prorating salaries

isolved can now automatically prorate salaries when employees have a pay change in the middle of the pay period. Previously, Insperity encouraged clients to make salary changes effective at the start of the pay period so they would correctly apply to all hours in the payroll for auto-paid employees. With this new feature, you can make pay changes effective in the middle of the pay period and isolved will automatically split the pay and apply the right salary. Auto-pay for new hires, rehires, and terminations is also split automatically with this new Pay Proration option.

Here are some examples to explain the new pay proration feature for auto-paid employees:

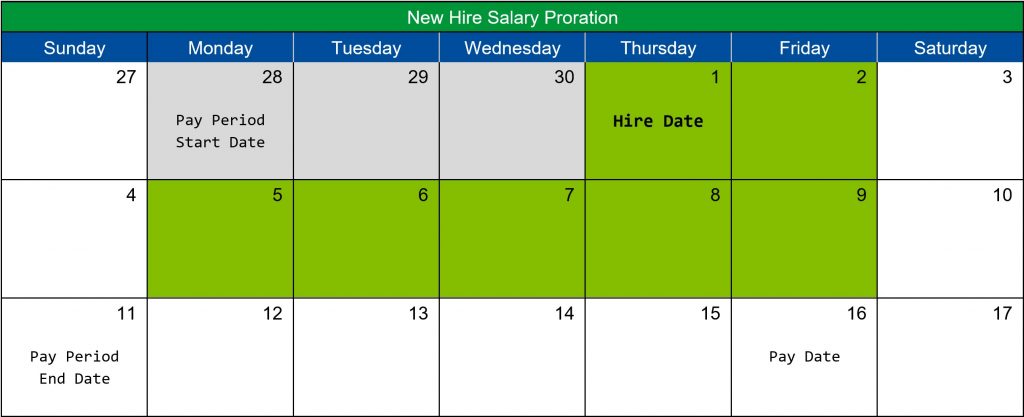

New Hires & Rehires

In this example, Katie Jenkins is hired on Thursday, 7/1/2021, with a biweekly salary of $2000.00. Her hire date falls in the middle of the pay period that runs from Monday, 6/28/2021, to Sunday, 7/11/2021. Employees in her Salary Biweekly pay group normally work Monday through Friday. Since she was hired on Thursday in the first week of the pay period, she will work 7 out of 10 working days in the period.

- Without salary proration, Katie will be paid the full pay period salary of $2000.00 in the 7/16/2021 payroll, unless you block the normal salary and manually enter the right amount.

- With salary proration enabled for a Monday through Friday workweek, Katie will be automatically paid 7/10 of her $2000.00 salary = $1400.00 in the 7/16/2021 payroll.

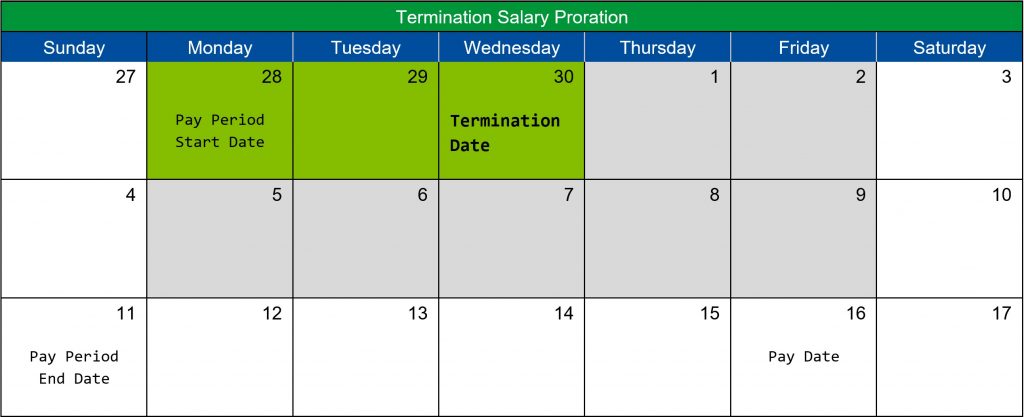

Terminations

In this example, Scott Johansen terminates his employment on Wednesday, 6/30/2021. He is an Auto Salary employee in the Salary Biweekly pay group and earns $2000.00 biweekly for working Monday through Friday. His termination date falls in the middle of the pay period that runs from Monday, 6/28/2021, to Sunday, 7/11/2021. Since he was terminated on Wednesday in the first week of the pay period, he will only work 3 out of 10 working days in the period.

- Without salary proration, Scott will be paid the full pay period salary of $2000.00 in the 7/16/2021 payroll, unless you remember to block the regular salary and manually edit his pay amount.

- With salary proration enabled for a Monday through Friday workweek, Scott will be automatically paid 3/10 of his $2000.00 salary = $600.00 in the 7/16/2021 payroll.

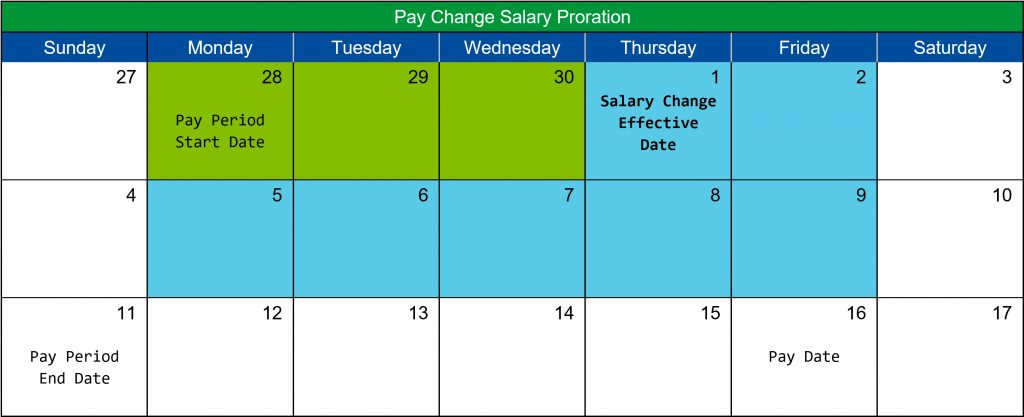

Salary Changes

In this example, Monique Miller receives a raise from $2100.00 to $2500.00 biweekly. She is auto-salaried in the Salary Biweekly pay group. Her raise is effective on Thursday, 7/1/2021, in the middle of the pay period that runs from Monday, 6/28/2021, to Sunday, 7/11/2021. Her previous biweekly salary of $2100.00 should be used to calculate her pay for the first 3 days of the pay period, and the new salary of $2500.00 should be used for the remaining 7 working days in the period.

- Without salary proration, Monique will be paid her new salary of $2500.00 in the 7/16/2021 payroll since it is effective within the pay period. To pay based on the raise effective date, you would need to remember to block the regular salary and manually edit her pay so she receives her prior rate through 6/30 and her new rate starting on 7/1.

- With salary proration enabled for a Monday through Friday workweek, Monique will be automatically paid 3/10 of her $2100.00 salary = $630.00 for 6/28/2021 – 6/30/2021 and 7/10 of her new $2500.00 salary = $1750.00 for 7/1/2021 -7/9/2021, for a total of $2380.00 in the 7/16/2021 payroll.

Pay changes based on Effective Date

For hourly employees with daily pay, rate changes will be applied on the pay effective date

If you enter hours by day in payroll, isolved will now apply hourly rate changes based on the effective date on the employee’s salary record. Only clients who require certified payroll reporting typically track hours by day in payroll. More commonly, clients summarize hours for the whole pay period by earning code, and these summary records are effective on the last day of the pay period. To take advantage of this new feature, you will need to enter hours by day in payroll.

If you manually enter time or use isolved Time, contact time.support@insperity.com or your Payroll Specialist to start entering hours by date in payroll to take advantage of the new functionality.

Here is an example to explain how the new pay proration feature works for hourly employees:

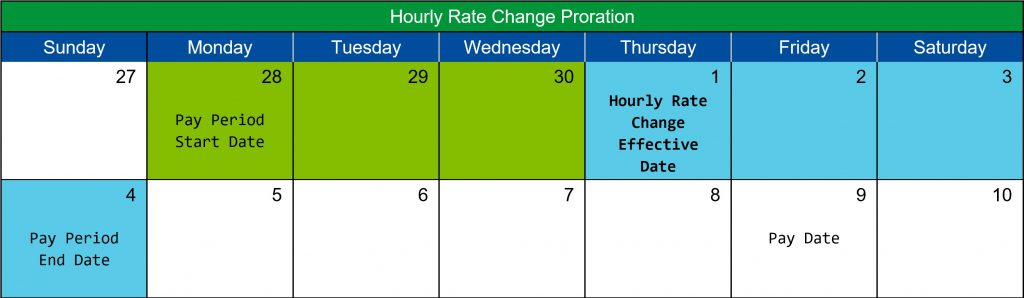

Hourly Rate Changes

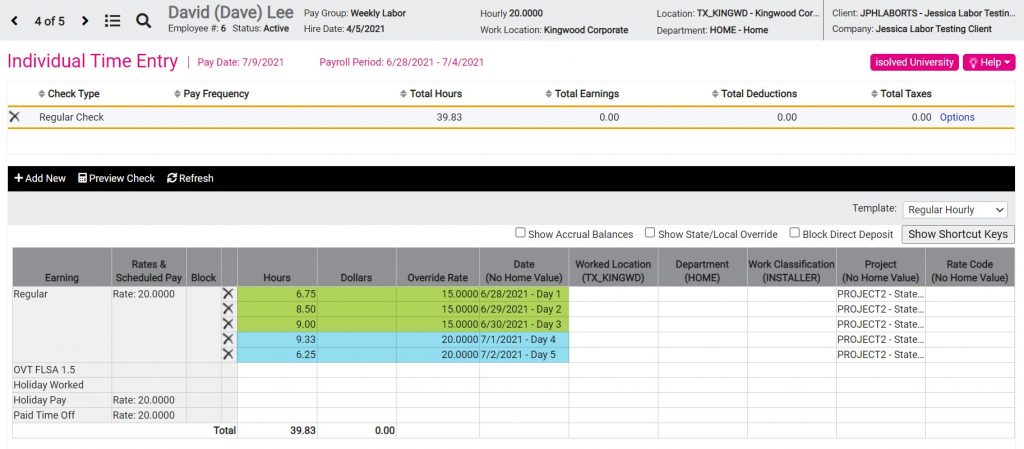

In this example, Dave Lee receives a raise from $15.00 / hr to $20.00 / hr. He is paid weekly in the Hourly pay group. His raise is effective on Thursday, 7/1/2021, in the middle of the pay period that runs from Monday, 6/28/2021, to Sunday, 7/4/2021. His previous hourly rate of $15.00 / hr should be used to calculate his pay for the first 3 days of the pay period, and the new rate of $20.00 / hr should be used for the remaining 4 days in the period.

Dave works the following hours in the 6/28/2021 – 7/4/2021 pay period:

- Without proration, Dave will be paid his new rate of $20.00 / hr for all hours in the pay period, unless you enter override rates to pay the appropriate rate for each day. This would result in a total gross pay of 39.83 hours * $20.00 / hr = $796.60 for the 7/9/2021 payroll.

- With proration enabled, you do not need to enter rate overrides for Dave. isolved will automatically apply the $15.00 /hr rate for the hours Dave worked through 6/30/2021 and $20.00 / hr for the hours Dave worked from 7/1/2021 through the end of the pay period on 7/4/2021. Using the pay effective date, Dave would receive gross pay of 24.25 hours * $15.00 / hr = $363.75 through 6/30/2021 and 15.58 hours * $20.00 / hr = $311.60 for the hours in the remainder of the period, for a total gross pay of $675.35.

Enabling Pay Proration

Pay proration can be enabled for just the pay groups you need. For auto-paid employees, you will need to indicate which days of the workweek should be included in the calculation.

Contact with your Payroll Specialist to enable this new feature for your Auto Salary, Auto Hourly, or Hourly employees.

isolved University

For more information, review the new Prorated Pay article in isolved University at https://learning.myisolved.com/library/articles/2572.

Download the release notes

Download the release notes: isolved Product Release v7.12