Friday, January 28th, 2022

Highlights

isolved version 8.01 includes additional updates to federal and state withholding tax forms to comply with 2022 requirements and support for additional wage notices. New sorting and filtering options makes pay stub reporting for administrators. These enhancements will be available when you log into isolved on Friday, January 28th, 2022.

Onboarding & Employee Self-Service (ESS)

- Additional form updates have been made in the Tax Wizard to comply with the latest 2022 formats

- You can now resend emails that originated as mass emails from the Self-Service Management screen

HR

- Additional New York state pay rate notices are available for exempt employees

- A wage notice has been added to comply with the California Wage Theft Protection Act of 2011

Payroll

- New configuration options for pay stub reporting

Onboarding & Employee Self-Service (ESS)

Updated 2022 tax withholding forms in the Tax Wizard

Additional updates to ensure compliance with the latest federal and state tax withholding forms

Additional federal and state tax forms have been updated in the Tax Wizard in onboarding and Employee Self-Service (ESS). The following forms have been updated to support 2022 requirements:

- Federal W-4(SP) – Certificado de Retenciones del Empleado (Spanish-language version of Employee’s Withholding Certificate)

- Louisiana L-4 – Employee Withholding Exemption Certificate

- Maine W4-ME – MAINE Employee’s Withholding Allowance Certificate

- Maine WHEX – Personal Withholding Allowance Variance Certificate

- Mississippi 89-350-20-3-1-000 (Rev. 09/20) – Mississippi Employee’s Withholding Exemption Certificate

- 2022 Formulario OR-W-4 – Declaración de retenciones y certificado de exención de Oregon (Spanish-language version of Oregon Employee’s Withholding Statement)

Employees can submit updated versions of these forms using the Tax Wizard in Employee Self-Service (ESS).

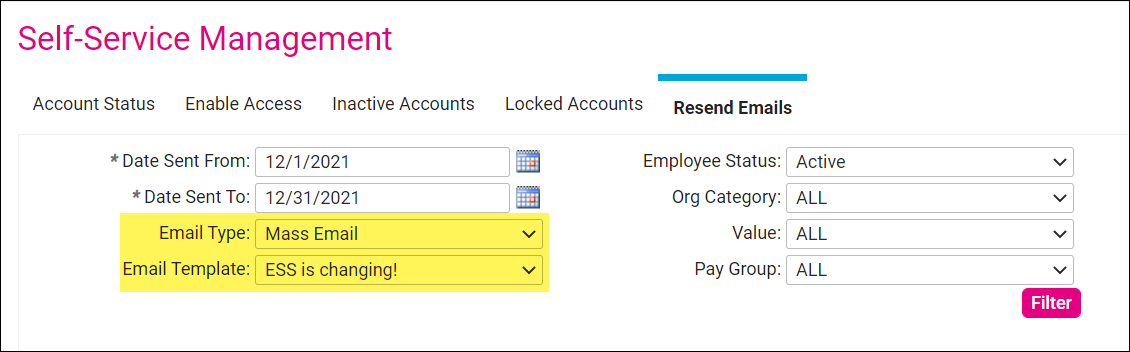

Resend mass email templates to individual employees

Updates to the Resend Emails option in Self-Service Management

When you use the mass email option to send emails to groups of employees, individual emails may need to be resent. You can now select the email templates configured for mass emails and resend them from the Resend Emails tab in Self-Service Management.

HR

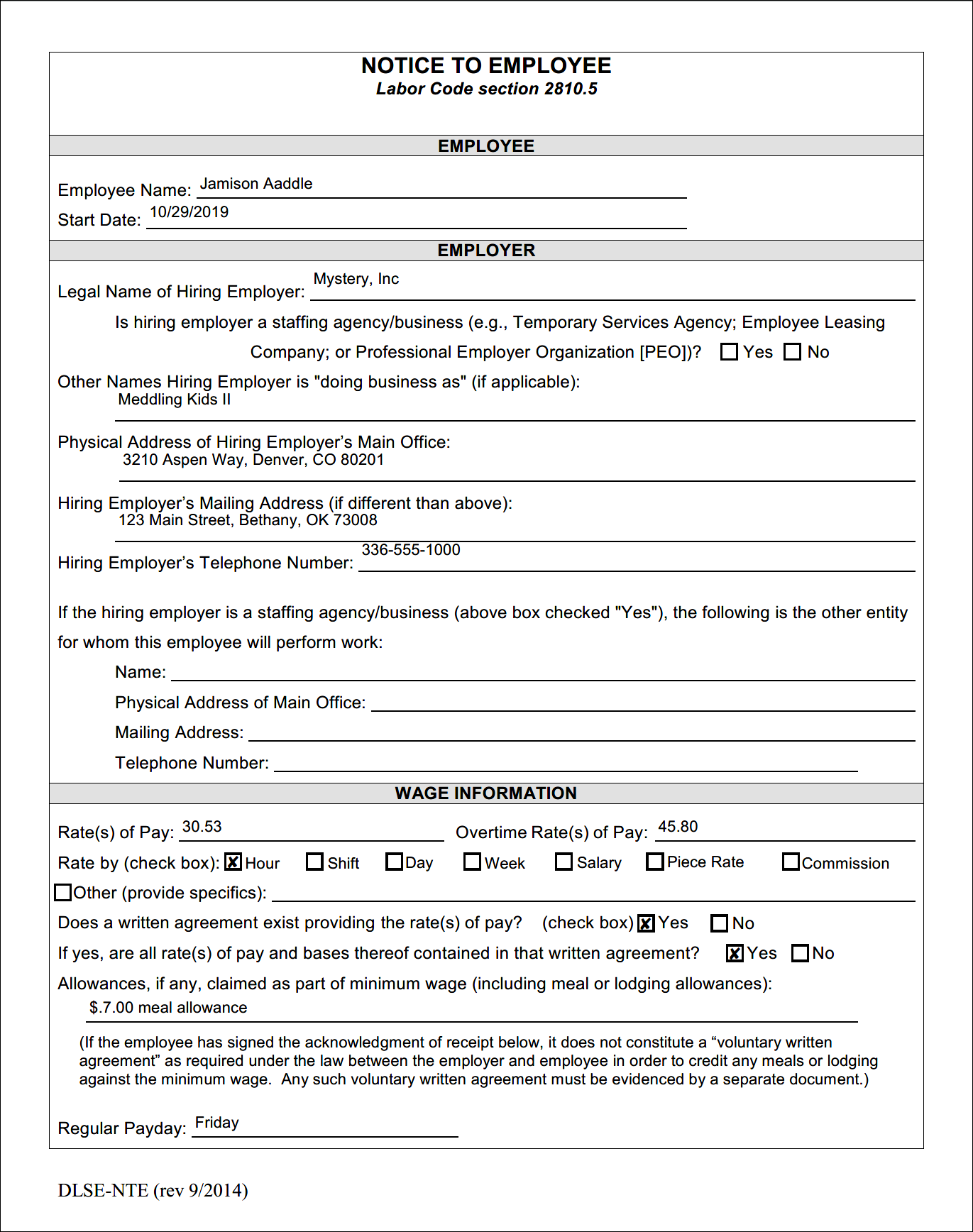

Provide NY LS 59 and CA Pay Rate Notices through ESS

Employees can review and electronically sign state wage notices when they are hired or when they receive a rate change in California and New York

New wage notices have been added as part of the continued commitment to support wage notice requirements in all states that require them. The 8.01 release includes support for these forms:

- LS 59 – New York State Labor Law Notice for Exempt Employees

- CA DLSE-NTE – NOTICE TO EMPLOYEE Labor Code section 2810.5

To configure these new forms, contact your Payroll Specialist and request the Client Wage Notice Management role.

Payroll

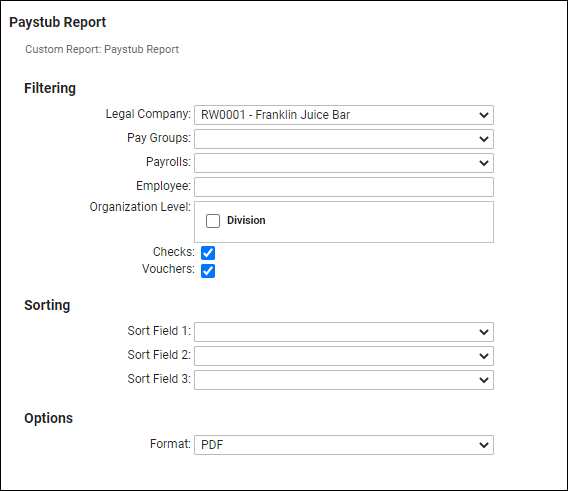

Configurable Pay Stub Reporting

Administrators can now review employee pay stubs for just the employees they need

The Paystub Report allows administrators to view and print pay stubs for all employees at once. With isolved version 8.01, new filtering and sorting options have been added. Now you can:

- Enter the name or employee number for an individual and report on just their pay stubs

- Include just specific divisions, departments, or other organization groups

- Include just printed checks or direct deposit vouchers

- Sort by name, employee number, employment status, and organization groups

Contact your Payroll Specialist if you have any questions about the updates in isolved version 8.01.

isolved University

For more information, review these updated articles in isolved University:

- Employee Notices – https://learning.myisolved.com/library/articles/3062

Download the release notes

Download the release notes: isolved Product Release v8.01