Friday, September 8, 2023

Highlights

isolved version 9.17 includes important information regarding state and local tax updates, Report Archive screen updates, enhancements to the isolved Benefits COBRA Portal, and Applicant Tracking enhancements.

Payroll & Tax

- The Report Archive has been enhanced to reduce the number of clicks it takes to view information

- State and local Tax rates have been updated to ensure compliance

Benefit Services

- COBRA Portal Open Enrollment enhancements

Applicant Tracking

- Bulk enhancements for updating and closing jobs

- New caution notification and hover messages for certain Indeed job postings

HR & Performance Management

- Enhancements to Performance Reviews screens

Self-Service

- Classic onboarding and ESS have been updated to use the new Work Opportunity Tax Credit form 9061

Training & Development

- Improved search capabilities in isolved University

Payroll & Tax

Report Archive enhancements

The Report Archive screen has been enhanced to reduce the number of clicks required to view or take action on a payroll report.

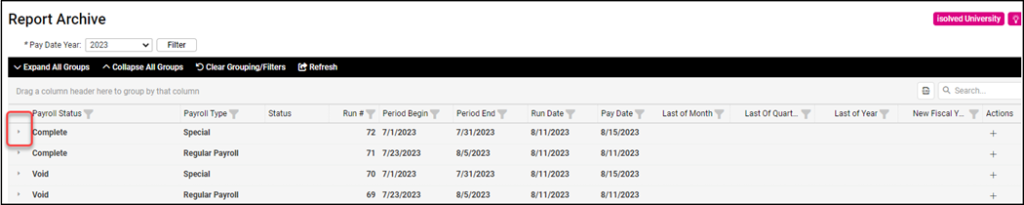

Click on the icon to the left of the Payroll Status to view a list of reports associated with a payroll run.

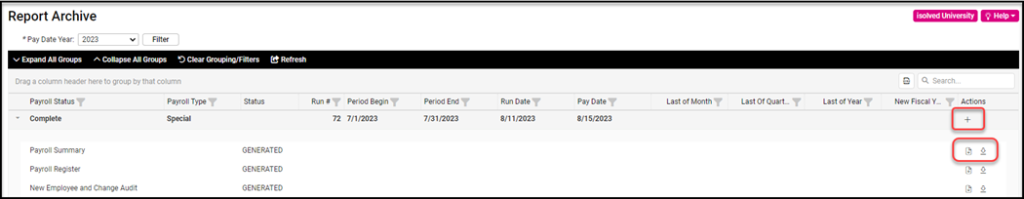

Select the pdf icon in the Actions column of a payroll report to see the report in pdf format. To download a report, select the download icon in the Actions column. To regenerate a report, select the plus-sign icon found in the Action column of the payroll run.

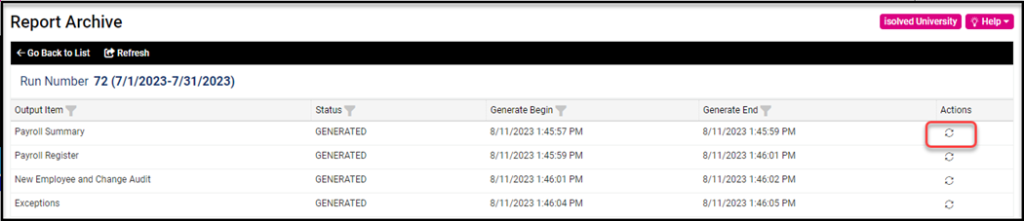

The following screen will display after a user selects the View icon in the Action column of the payroll run. To regenerate a report, click the regenerate icon Click on the Refresh link in the black action bar to see the status of the report refresh.

Tax rate updates

Employees may notice changes to withholding amounts in some states and local jurisdictions. Insperity works with isolved to ensure your tax rates, standard deductions, exemptions, and tax location codes are always in compliance so you don’t have to worry about it.

The following changes were included in the version 9.17 release on Friday, September 8, 2023, so employees will see these updates reflected in all payments processed after that date:

- Colorado, Sheridan, Arapahoe County

- Changed the Occupational Privilege Tax calculation to consider wages from all sources when determining if the minimum threshold is met for the employee and employer, effective 1/1/23.

- Kentucky, Hanson, Hopkins County

- Added an Occupational License Fee of 1.5%, effective 7/1/23. The total tax rate is 2%: .5% Hopkins County and 1.5% Hanson.

- Ohio

- Lakeview, Logan County

- Decreased the tax rate from 1.5% to 1% effective 7/1/23.

- Montgomery, Hamilton County

- Taxes will be collected by the Regional Income Tax Agency (RITA) effective 10-1-23

- Allows an exemption from Montgomery Municipal Tax under Military Spouse Residency Relief Act (MSRRA), effective 10-1-23.

- Lakeview, Logan County

- Pennsylvania, South Manheim Township, Schuylkill County

- Decreased the Local Services Tax from $10 to $5, effective 1-1-23.

Benefit Services

COBRA client portal enhancements

Additional Open Enrollment Functionality

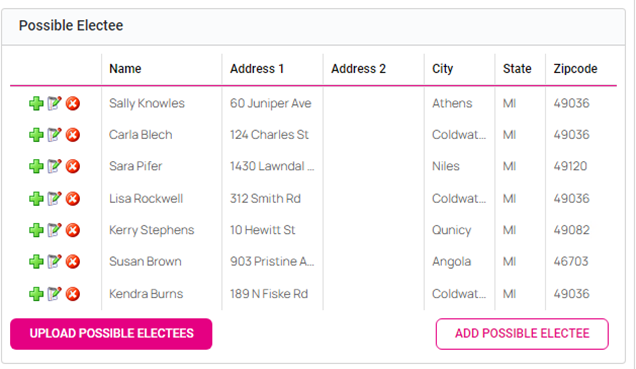

For those clients taking advantage of isolved Benefits Services, you can now add Possible Electees when initiating Open Enrollment through the online portal. Possible Electees are individuals in their 60-day COBRA election period who have not yet elected or declined COBRA, these are individuals who are not listed within the Launch Pad.

The ability to export and import the list of participants has been added to the Open Enrollment process.

Open Enrollment packet attachments

For those clients taking advantage of Open Enrollment services through isolved Benefit Services, isolved has increased the number of documents that can be attached to the Open Enrollment packets.

For assistance with isolved Benefits Services, please call (866) 320-3040.

Applicant Tracking

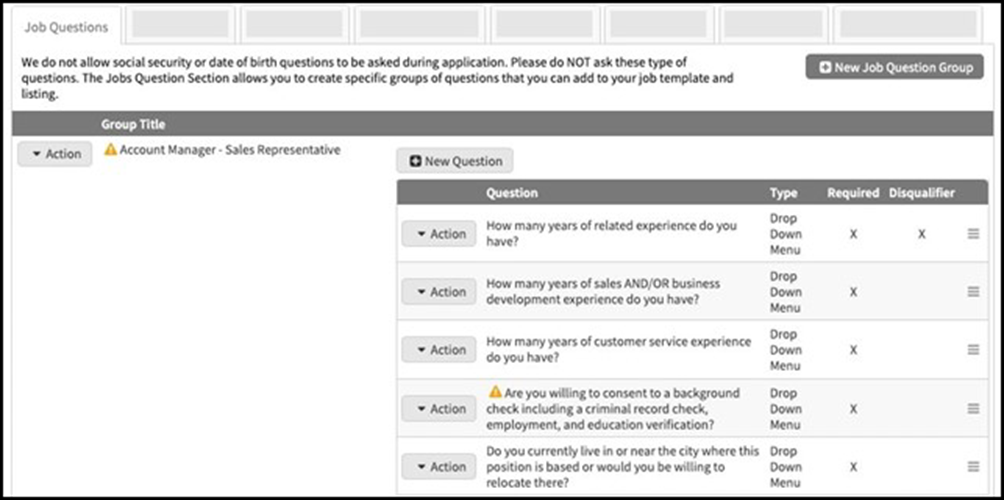

New caution notification on certain Indeed job ads

Indeed will limit the visibility of a job ads that includes questions related to background checks or drug disclaimers. A caution icon will display next to a specific question on the Job Questions tab if that question will reduce the visibility of the ad.

The caution icon includes the following hover message:

“Traffic for your job listing is our top priority. To avoid a disruption in your job’s visibility on Indeed, background screening requirements should only be mentioned when this is mandatory based on the job title rather than in other instances (ex. childcare, police, federal agent). Exceptions are NY and NJ. Conviction history mentioned in the job description for those states will impact your job’s visibility.

Instead, you may:

- Include these questions in the Background & Drug Screening Disclaimer section above.

- Speak with our Support Team or your Account Manager to include them later in the application process. Or,

- Reach out to Indeed directly to see if they will accept this phrase”

For more information on this policy in Indeed, see the Policy – Conviction History Disclosure in the Indeed Help Center.

Bulk update job listings

Individual checkboxes for each job listing, as well as options to “Select All” or “Select None” have been added to apply bulk updates for the following activities:

- Close jobs in bulk

- Close & Archive jobs in bulk

- Update Job Status in bulk

- Update Assigned Admins in bulk

- Update Archive status in bulk

To see these options at the bottom of the Job Listings area, turn on the following toggles:

- Enable Job Listings in Bulk

- Enable Job Assigning for All Admins

- Enable Job Listing Statuses

HR & Performance Management

Performance Reviews screen enhancement

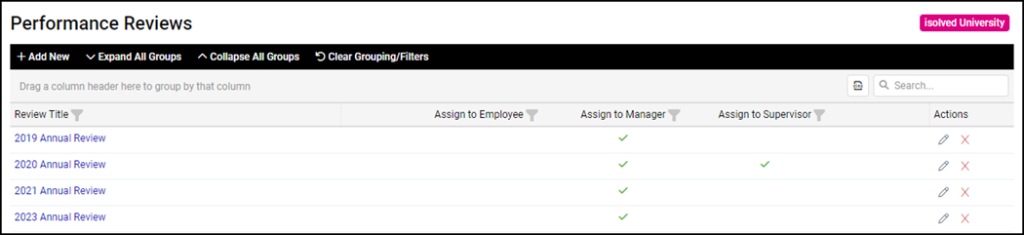

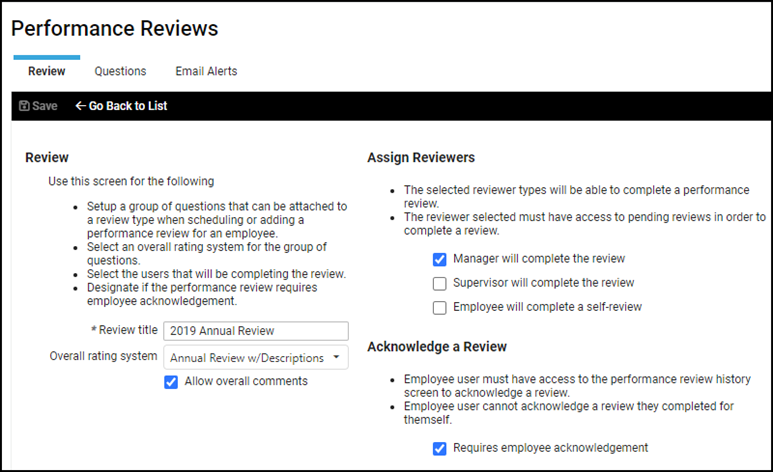

To enhance usability and as a continuation toward a more modern look, the layout of the Performance Reviews screen under Client Management > HR Management > Performance > Performance Reviews has been updated and now includes the ability to export review data.

To view or update detailed information related to a review period, click on the pencil icon in the Actions column.

Employee Self-Service

Updated WOTC form

Onboarding and employee self-service has been updated to use the new Work Opportunity Tax Credit form 9061 released by the US Department of Labor.

The Work Opportunity Tax Credit (WOTC) is a Federal tax credit incentive that Congress provides to employers for hiring individuals from certain target groups who have consistently faced significant barriers to employment. The isolved system allows employers to capture the information from newly hired employees, necessary to determine whether the employer qualifies for a tax credit for hiring individuals from the target groups and create the forms for submission to the State Workforce Agency.

Please note, given the questions on Form 9061 no longer map directly to IRS form 8850, Form 9061 is the only form that can be completed by a new hire.

Training & Development

isolved University search enhancement

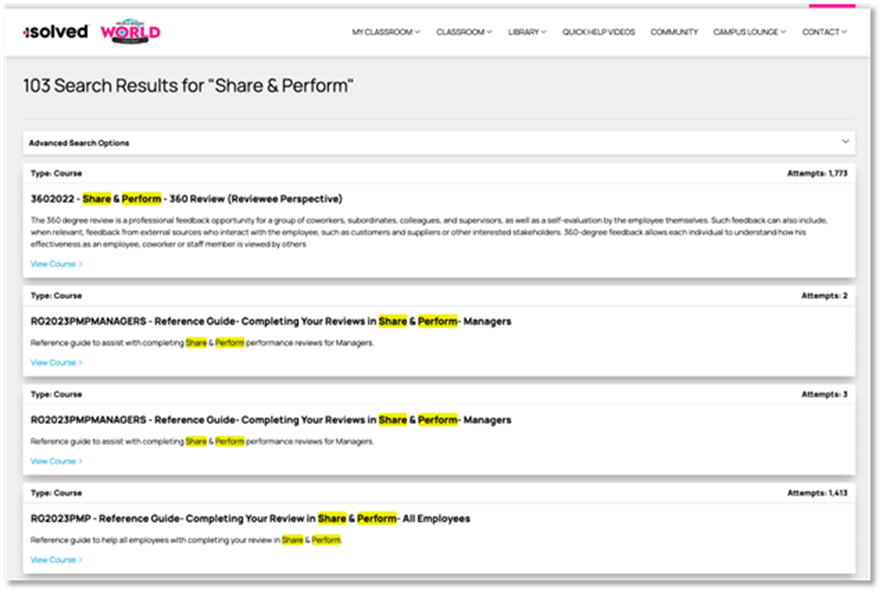

The global search function within the University has been enhanced with an improved search engine. This new search engine provides numerous new features, including:

- Typo tolerance: accurate search results may be returned now even if there are minor typos in the search terms.

- Improved relevancy: search results are now more relevant to the search terms.

- Search highlighting: the keywords that match your search terms are now highlighted in the search results, making it easy to identify why a particular resource has been found in the search.

For more information about the changes in isolved version 9.17, please contact your Payroll Specialist.