Friday, September 22, 2023

Highlights

isolved version 9.18 includes important information about New York MSCMT tax updates, a sneak peek of Identity Phase 2 security updates coming soon, Report Archive and Accrual Plan screen updates, and Applicant Tracking enhancements.

Applicant Tracking

- Updates to comply with new New York state pay transparency laws

- Enhancements to the background check and drug disclaimer in job ads

- Additional integration with isolved People Cloud for Salary information

Human Resources

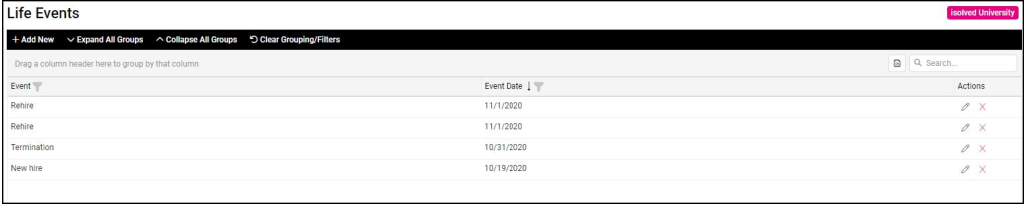

- The Employee Life Events page gets an updated look and the ability to export data

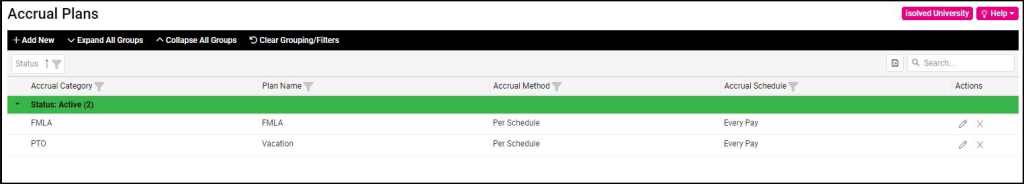

- The Accrual Plans page receives a facelift and the ability to export data

Payroll & Tax

- Report Archive updates make it easier to see payroll report transmission status

- New York Metropolitan Commuter Transportation Mobility tax (MCTMT) updates

Security

- Identity Phase 2 – Two Factor Authentication – coming soon

Time & Labor Management

- Clients with multiple legal companies can now share a hardware clock

Applicant Tracking

Pay Range Required in New York

While we encourage the best practice of including pay range in all your job ads, this information is not typically required except in states that have implemented pay transparency laws.

To comply with the New York state pay transparency laws which go into effect September 2023, the pay rate or range is now required for all job listings with the job ad location in the state of New York. This requirement was implemented in the Applicant Tracking as of the evening of August 31st.

When creating a job listing, an error message will display if either the Job Location or Job Ad Location is assigned to a state where the Pay Rate is required and the Pay fields are empty. You will receive the following error and will be unable to save the job until pay information is entered in the Minimum and/or the Maximum Pay field.

Improved Background Check Disclaimer

Enhancements have been made to the Background Check & Drug Disclaimer section to ensure your recruitment process is smooth and compliant.

In addition to displaying the background disclaimer on the job ad on the career site, updates have been made to expand its visibility by including it at the bottom of job ads for all job boards– except Indeed.

If you want to ensure applicants on Indeed view the disclaimer as part of their application process, contact your account manager or support and request to include it in an email template or the applicant statement. Our team is more than happy to help! Alternatively, you can also get in touch with Indeed directly to inquire whether they will accept the specific background language you wish to use.

For additional information about background and drug disclaimers, please check here.

Improved integration between Applicant Tracking and isolved People Cloud

The Annual Salary field in isolved People Cloud is now available directly within Applicant Tracking. Save time by entering salary data before sending it to isolved People Cloud!

Human Resources

Employee Life Events page redesign

The Employee Life Events page gets an update grid and you can now export life even data to Excel.

Accrual Plans page redesign

The Accrual Plans grid has an updated layout and you can now export accrual plan data to Excel.

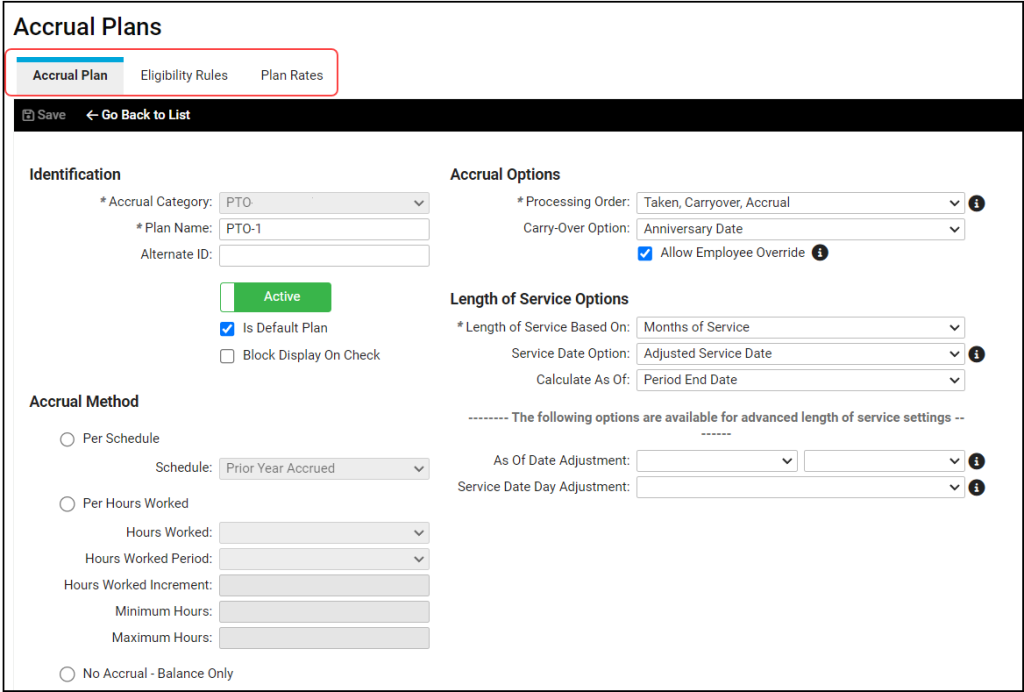

Accrual Plan information is easily found by clicking on the tabs at the top of the page.

Payroll & Tax

Report Archive updates

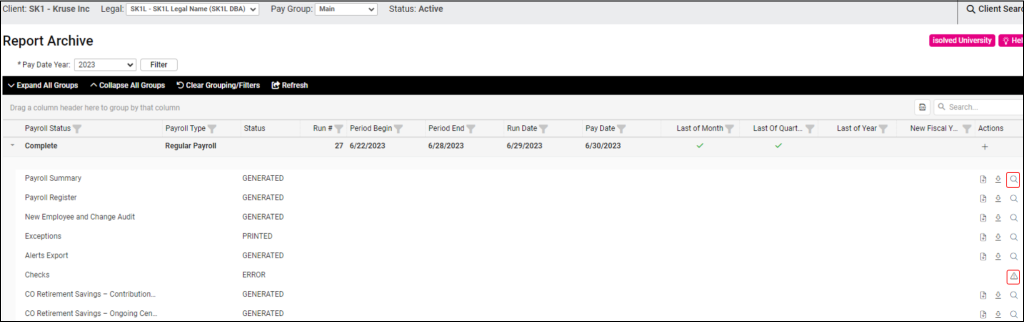

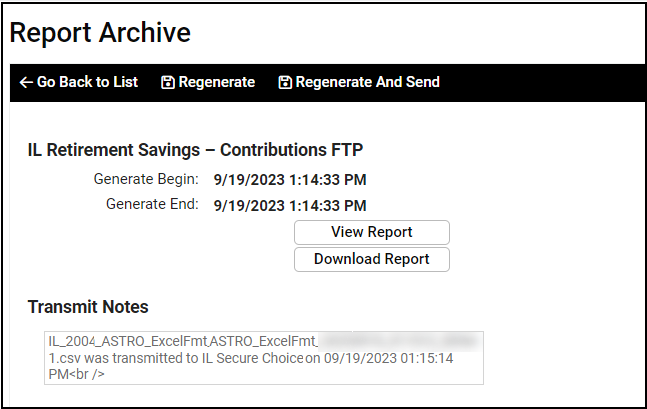

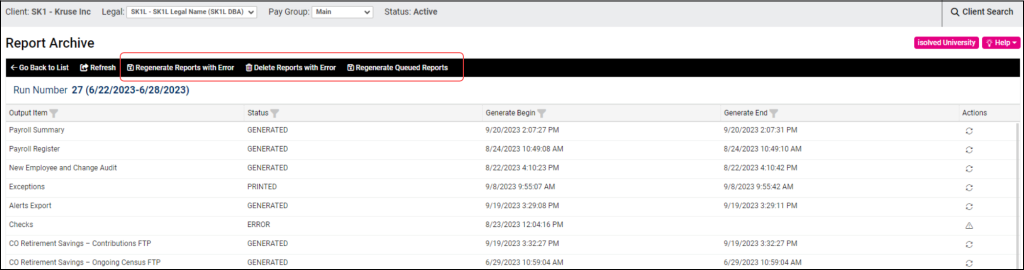

Following the Report Archive screen enhancements included in release 9.17, is the addition of payroll report and transmission information and the ability to regenerate or regenerate and send directly from the Report Archive.

Click on the magnifying glass icon in the Action column to view report generation time/date stamps and transmission status. Failed reports and transmissions will be identified with an alert icon. View alert details by clicking on the icon and regenerate or regenerate and send when you are ready.

To regenerate all reports with errors or queued reports or to delete all reports with errors, click on the plus-sign next to the payroll run in the Report Archive and select the appropriate action from the black action bar.

Changes to the New York MCTMT

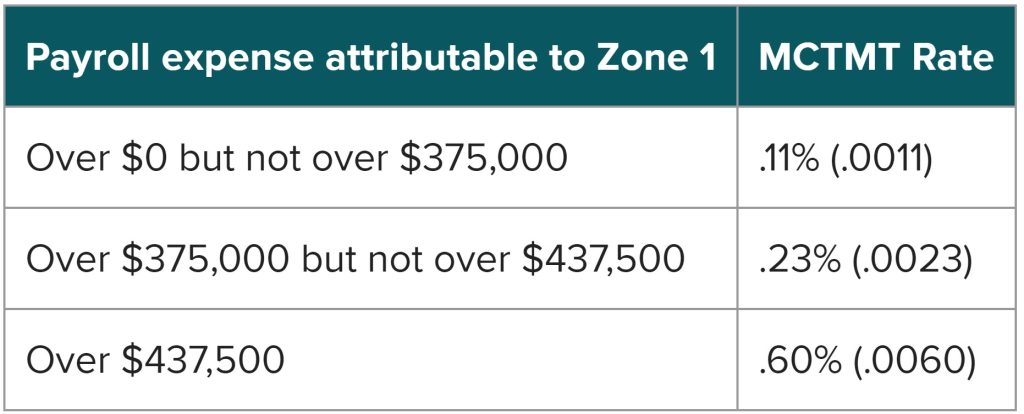

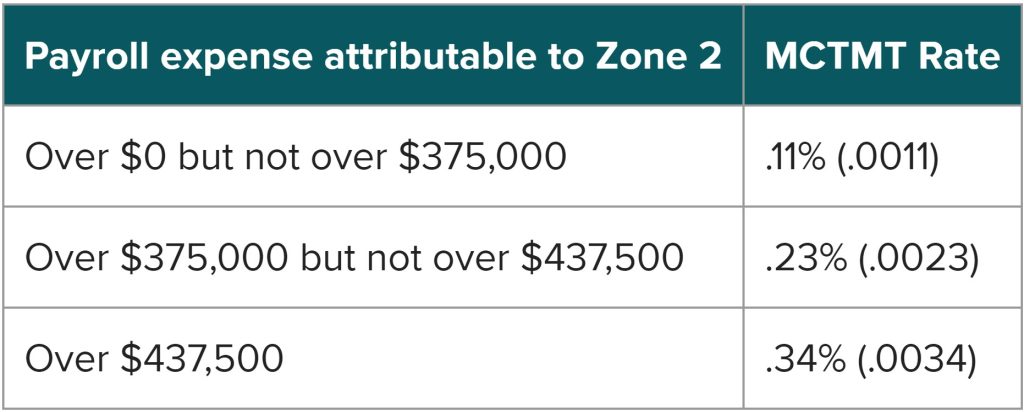

For employers with work locations in the New York Metropolitan Commuter Transportation District, changes are effective for the third quarter that base rates on two different zones. With this release, the system will use your existing work locations to determine the right zone based on geographical code (geocode).

- Zone 1 will automatically include the 5 boroughs of New York:

- Bronx County will be assigned to geocodes beginning with NY005

- Kings County will be assigned to geocodes beginning with NY047

- Manhattan County will be assigned to geocodes beginning with NY061

- Queens County will be assigned to geocodes beginning with NY081nnnn

- Richmond County will be assigned to geocodes beginning with NY085nnnn

- Zone 2 will automatically include the other counties in the Metropolitan Commuter Transportation District:

- Dutchess County will be assigned to geocodes beginning with NY027nnnn

- Nassau County will be assigned to geocodes beginning with NY059nnnn

- Orange County will be assigned to geocodes beginning with NY071nnnn

- Putnam County will be assigned to geocodes beginning with NY079nnnn

- Rockland County will be assigned to geocodes beginning with NY087nnnn

- Suffolk County will be assigned to geocodes beginning with NY103nnnn

- Westchester County will be assigned to geocodes beginning with NY119nnnn

Effective starting this quarter, 7/1/2023, the gross payroll will be used to determine eligibility for the tax. While the rates are based on gross payroll in each zone, eligibility is based on gross payroll for all hours worked in the whole Metropolitan Commuter Transportation District across both zones. Once an employer has accumulated $312,500 in MCTDT taxable wages in Q3 2023, they are eligible for the tax.

Once an employer becomes eligible, taxable wages will be divided by zone based on the work location associated with paid earnings to determine the tax rate.

A new report will be available with the version 9.19 release on October 6, 2023 to help employers with work locations in the New York Metropolitan Commuter Transportation District review their taxable wages and effective tax rates by zone.

For more information about these tax changes, visit the New York State Department of Taxation and Finance website at https://www.tax.ny.gov/bus/mctmt/emp.htm.

Security

Identity Phase 2 is coming soon

The upcoming release of Identity Phase 2 on Friday, November 3rd will increase security for logging into isolved by requiring two-factor authentication for every login.

Two-factor authentication uses a second method of authenticating a user’s identity to prevent unauthorized access to the isolved system. This enhancement will help increase the security of isolved to a standard that is used by many tech companies.

Look for additional information in the HUB newsletter and upcoming release notes.

Time & Labor Management

Multiple companies can now share the same hardware clock

Clients with multiple legal companies who are using NXG G2+ and G7 clocks can now share a clock. Previously, each company was required to have their own clock.

For information related to time clocks, please contact your Time Support at WATime@insperity.com .

For more information about the changes in isolved version 9.18, please contact your Payroll Specialist.