Friday, November 12th, 2021

Highlights

isolved version 7.21 continues to enhance ACA processing to simplify the configuration, verification, and approval process and to give companies more control over affordability calculations. New missing punch notification options have been added for Time users, and the Pennsylvania certified payroll report has been updated. This updated version will be available when you log in on Friday, November 12th, 2021.

Benefits

- The updated ACA Report Options screen makes it easier to select the right options for accurate 2021 reporting

- The ACA Forms Approval screen has been streamlined so you can easily follow the process to review and approve your forms

Time

- New notifications are available for missing punch requests

- You can now require employees to punch using the isolved GO mobile app with location services enabled so you can capture their geographic location every time

- For plans with an annual limit on the amount time employees can use, they can more easily see how much time is left to take when requesting time off and when reviewing balances

Reporting

- Pennsylvania state certified payroll reports have been updated to meet PennDOT current standards

Benefits

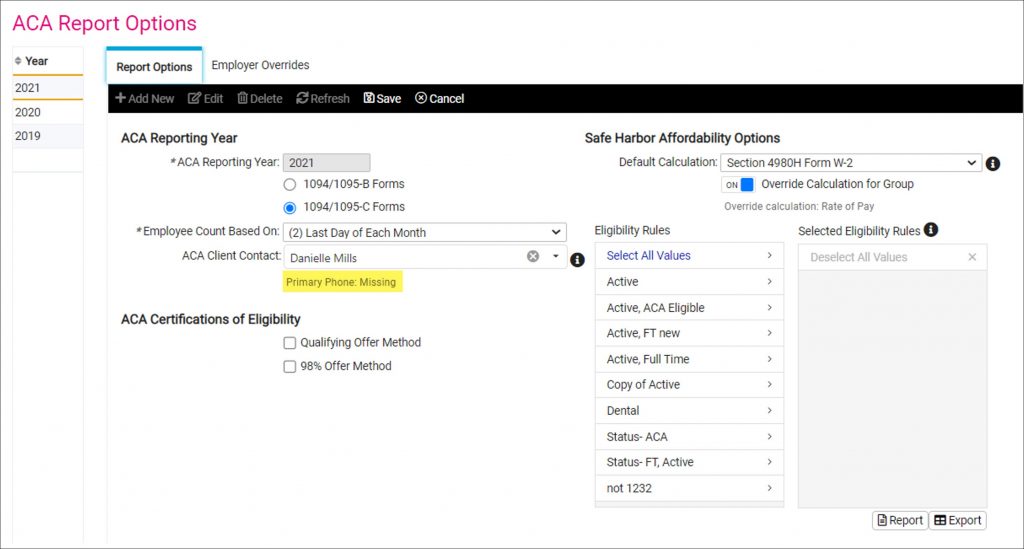

Select the right reporting options for 2021 using the updated ACA Report Options screen

Ensure form contacts are configured correctly and gain more control over safe harbor calculations and aggregated ALE group reporting

The updated ACA Report Options screen is available from the ACA Setup Options menu in Client Management. The screen is still used to define the options for each ACA reporting year, but it’s easier to understand and provides more detailed choices.

Validated contact information reduces filing errors

When choosing the contact whose signature will be listed on Form 1094, their information will now be validated. To file electronically without errors, we must have their full name, title, and phone number. If one of those values is missing from their contact record, a notification will appear below the selected contact.

Control safe harbor affordability options for different groups of employees

Before version 7.21, isolved determined if employee health plans were affordable by applying the safe harbor options in this order:

- Federal poverty line safe harbor

isolved uses the mainland federal poverty level for a household size of 1 published by the Department of Health and Human Services each year and the ACA affordability threshold set by the IRS to determine this safe harbor. For 2021, the mainland FPL is $12,880 and the ACA affordability threshold is 9.83%, so health insurance plans that cost employees $12,880 * 9.83% = $105.51 per month or less are affordable by ACA standards. For each medical plan where the employee meets the eligibility criteria, isolved evaluates the monthly premium for Employee Only coverage. If it is below $105.51 in 2021, the coverage will be coded as affordable on line 14 of Form 1095. If not, additional safe harbor methods will be evaluated. - Form W-2 wages safe harbor

This method uses the employee’s annual compensation reported in Box 1 of their W-2 to determine affordability. It multiplies the employee’s annual Box 1 wages by the 9.83% affordability threshold for 2021 and then prorates for the number of months the employee worked in the year. For example, if an employee earned $50,000 in Box 1 wages on their W-2 and worked 9 months of the year, isolved would perform this calculation:

$50,000 annual compensation * 9.83% = $4,915

$4,915 * 9 months worked / 12 months in the year = $3,686.25

$3,686.25 / 9 months worked = $409.58

If the employee is eligible for a medical plan whose monthly premium for Employee Only coverage is $409.58 or less, the coverage will be coded as affordable on line 14 of Form 1095. If not, additional safe harbor methods will be evaluated.

- Rate of pay safe harbor

This method uses the employee’s hourly rate or monthly salary to determine affordability. For hourly employees, isolved will find the salary record effective on the first day of the coverage period. It will multiply the hourly rate by the ACA affordability threshold and then multiply it by 130, the minimum monthly hours required to considered full-time. For example, if an employee is paid $15.00 per hour on the first day of their coverage period, isolved will perform this calculation:

$15.00 / hour * 9.83% * 130 = $191.69

If the employee is eligible for a medical plan whose monthly premium for Employee Only coverage is $191.69 or less, the coverage will be coded as affordable on line 14 of Form 1095. If not, the coverage will be coded as unaffordable.

For salaried employees, isolved uses their annual salary multiplied by the ACA affordability threshold and then divided by 12 to determine the maximum amount they can pay for affordable health insurance coverage.

isolved will continue to evaluate the federal poverty line safe harbor first, but now you can choose the order that isolved evaluates the other safe harbor standards. Choose your preferred method in the new Default Calculation field.

If commissioned employees meet the ACA affordability safe harbor based on annual W-2 wages while hourly and salaried employees should use the rate of pay method, you can now define your safe harbor method for each group. Enable the new Override Calculation for Group option and then select the eligibility rule that defines the group.

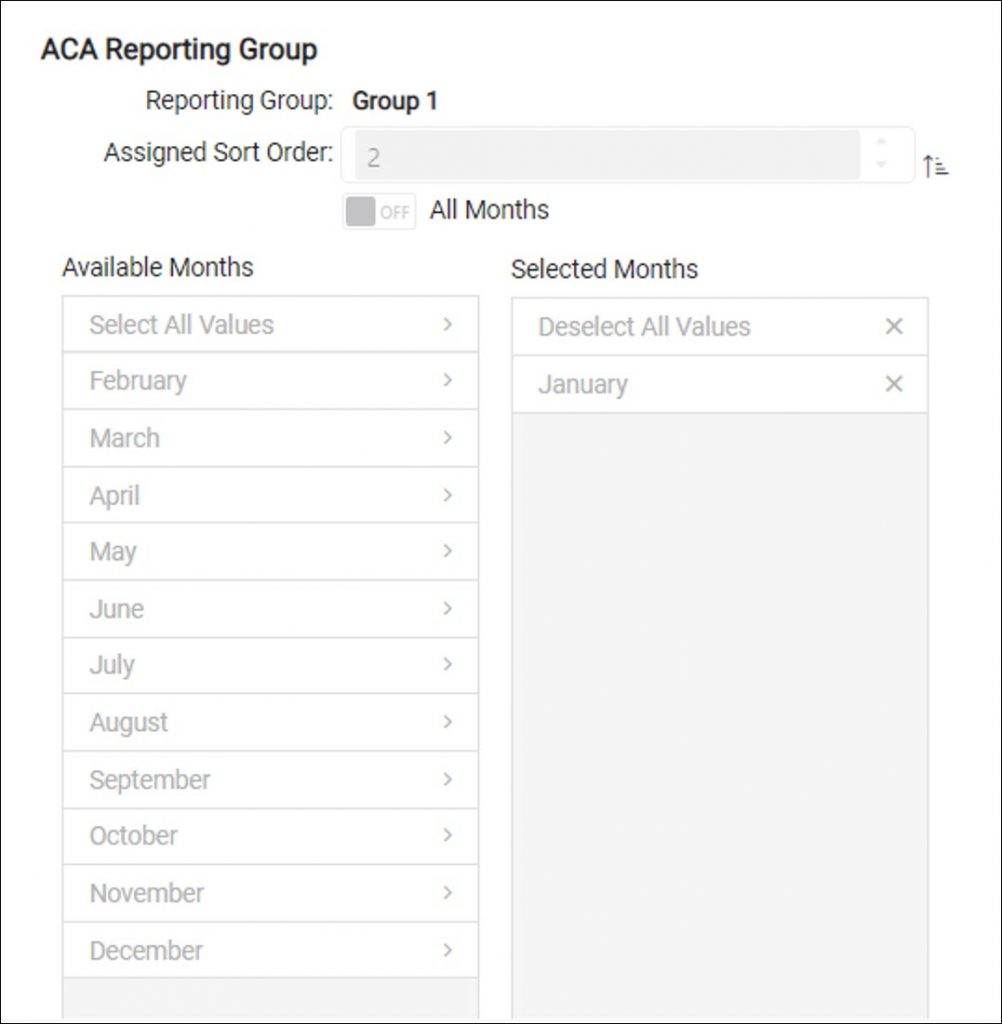

Define ALE aggregated reporting groups by month

If you have more than one legal company that must be reported together for ACA purposes, you can use the same aggregated ALE group for all months of the year or change the groups for specific months. This is useful for companies who acquired new companies or divested companies within the year.

You can also define the order the legal companies appear in Part IV, Other ALE Members of Aggregated ALE Group, on Form 1094.

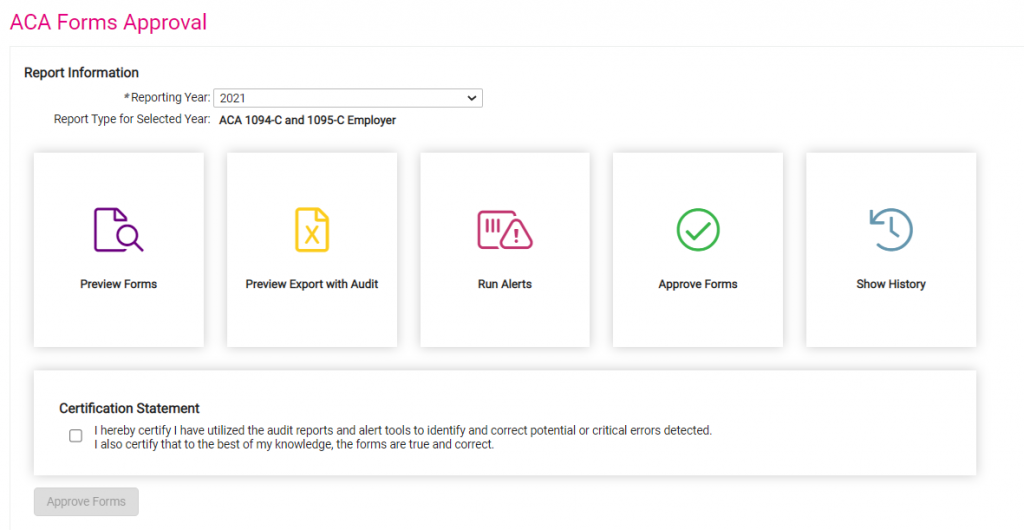

Redesigned ACA Forms Approval screen streamlines the workflow

Ensure form contacts are configured correctly and gain more control over safe harbor calculations and aggregated ALE group reporting

The actions you need to take to review and approve your ACA forms are easy to follow since they’ve been arranged into individual tasks on the redesigned ACA Forms Approval screen. This screen is still located on the ACA Setup Options menu in Client Management.

Client administrators with the Client ACA Setup Options role will be granted access to the new Client ACA Management dashboard automatically.

- Preview Forms will generate a PDF of the 1094 and 1095 forms that will be printed and filed. Once you select that option, a link will appear letting you know the results are generating with a shortcut to your reports queue. When you look in the reports queue, the forms will be listed as ACA 1094-C and 1095-C Employer in the list. (For self-insured companies who are not ALEs and need to file B forms, the report will be titled ACA 1094-B and 1095-B Employer.)

- Preview Export with Audit will generate an Excel version of the 1095 form. It has been enhanced to include tabs for each month so you can see which employees were included in the monthly counts in Part III, ALE Member Information – Monthly, of Form 1094. The employees are categorized as full-time and part-time to help you research how the monthly counts were determined. When you look in the reports queue, this report will be named ACA 1095-C Form Preview in the list with a report format of Excel in the Report Parameters

- Run Alerts will generate a PDF version of the 1095 form audit report. It will include any critical errors or warnings that need to be addressed. When you look in the reports queue, this report will also be named ACA 1095-C Form Preview in the list, but the report format is PDF in the Report Parameters to help you distinguish it from the Preview Export with Audit option

- Click Approve Forms when you have finished your review and are confident the forms are ready to print and file. You will be prompted to certify that you audited the forms, and they are ready to true and correct to the best of your knowledge. You will receive a warning if the approval process does not complete successfully and can reset and reapprove them. Once forms are approved, the username of the approver and the date the forms were approved will be shown and the button will say Approved.

- Show History displays the full form approval history. If the forms were unapproved and reapproved, the final approval will show Yes in the Output Generated column to indicate those forms are the ones you see in Year End Report Archive and employees can access from their Year-End Forms menu in ESS.

Self-insured employers who are too small to qualify as Applicable Large Employers (ALEs) and must file 1094-B and 1095-B forms will only see 3 options in their ACA Forms Approval workflow: Preview Forms, Approve Forms, and Show History.

For more information about ACA form setup and approval, contact your Benefits Specialist.

Time

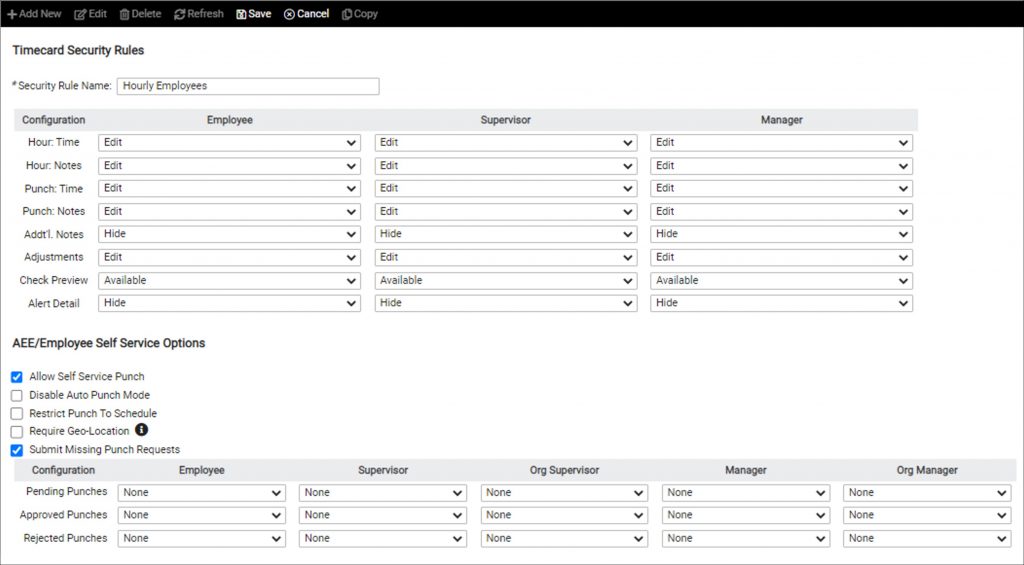

New notifications are available when employees submit missing punch requests

Employees, supervisors, and managers can now receive notifications when missed punches are submitted, approved, or rejected

New options have been added to the Time Card Permission Rules in the Time Management section of Client Management when Submit Missing Punch Requests is enabled. Previously, notifications were only available as timecard alerts when punches were approved. Now you can define notifications when punches are submitted, approved, or rejected.

You can even choose different notification settings for assigned and organization supervisors or managers.

Always capture GPS locations when employees punch

The new Require Geo-Location feature disables browser punching and requires employees to use the isolved GO mobile app to record their location when they punch

For companies whose employees work remotely or in the field, ensuring they’re at the job site when they punch can be mission-critical. While isolved GO has always captured the GPS coordinates from their mobile device when employees punch, this new feature disables punching through the browser to enforce mobile time collection. Employees will also be required to turn on location services on their phone or tablet with this option enabled. Employees can still log into Employee Self-Service (ESS) through the browser and perform other tasks, and they can still submit missing punch requests.

Updates to Time Off Requests and Time Off Balances help employees understand their available leave

New Available and Balance fields help employees understand how much leave they can request if plans have a limit on taken time in the plan year

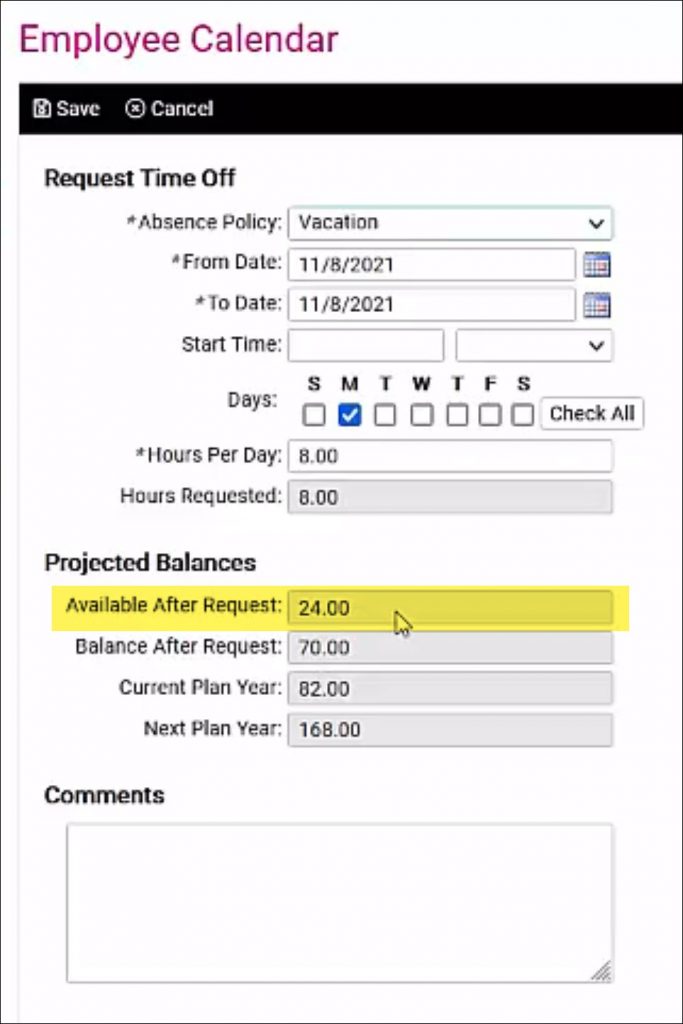

For plans with a year-to-date taken limit defined, employees were confused when they were not allowed to request their full available balance. For these types of plans, a new Available After Request field is shown on the Request Time Off screen. This field shows the amount of time employees actually have left to take after being limited by the YTD taken limit on the plan. In the example below, although the employee has accrued enough time to have a balance of 70.00 hours, they can still only take 24.00 hours for the remainder of the year until they hit the YTD taken limit.

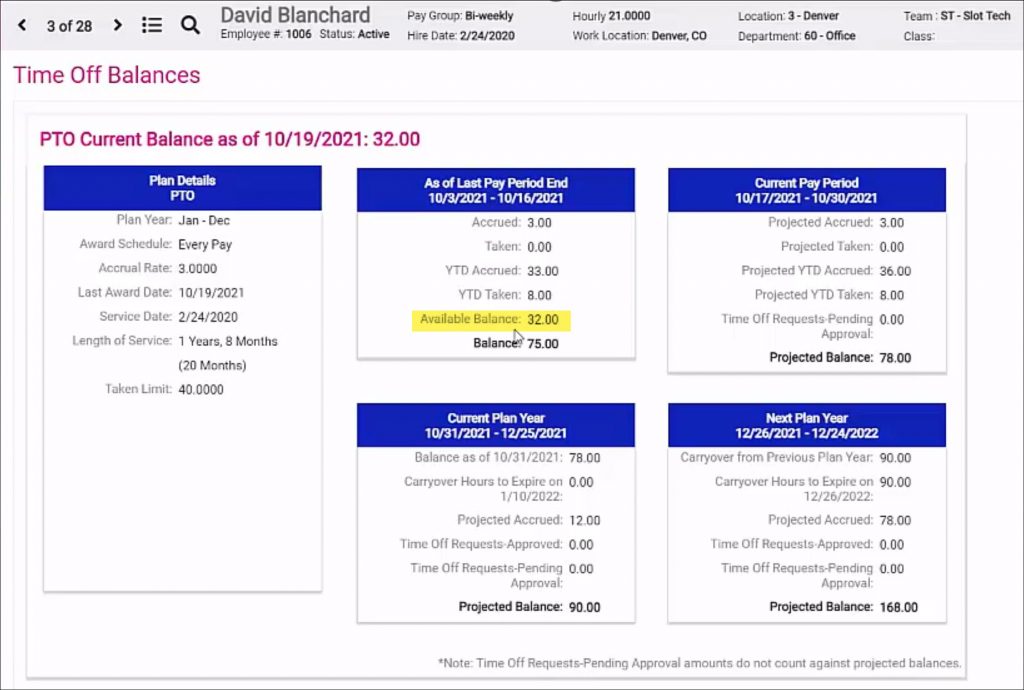

The Time Off Balances screen in Employee Self-Service has also been updated to include an Available Balance field if plans have a YTD taken limit. That field shows how much time the employee has left to take before they reach the year-to-date taken limit.

For assistance with isolved Time configuration, contact time.support@insperity.com.

Reporting

Updated Pennsylvania Certified Payroll Reports meet compliance requirements

The PA form LLC-25, Weekly Payroll Certification for Public Works Projects, has been updated

The PA LLC-25 has been updated to meet the latest Pennsylvania Department of Transportation records issuance requirements for employers with PennDOT contracts.

isolved University

For more information, review these updated articles in isolved University:

- ACA Process – Report Options – https://learning.myisolved.com/library/articles/2171

- ACA Process – ACA Forms Approval – https://learning.myisolved.com/library/articles/2190

- Time Card Permissions – https://learning.myisolved.com/library/articles/412

Download the release notes

Download the release notes: isolved Product Release v7.21