Friday, December 3rd, 2021

Highlights

isolved version 7.22 includes new marital status options and an updated pay history view for employees, ACA logic and report updates for benefits and the ability to audit employee life events, and a new regular rate of pay calculation to meet California labor requirements. This updated version will be available when you log in on Friday, December 3rd, 2021.

Employee Management & ESS

- New options have been added to the employee marital status to better reflect how employees categorize their relationships

- Employee Self-Service (ESS) Pay History has been updated so pay stubs show current federal, state, and local tax information and the employee address where they have designated to receive paychecks

- Termination reasons will now display in alphabetical order to make it easier to find the correct one when terminating employees

Onboarding

- Since current EEO standards limit pre-employment inquiries about height and weight, that information has been removed from the Confirmation Statement at the end of the Onboarding wizard

Benefits

- The ACA processing logic was updated to include the 2021 affordability threshold of 9.83%

- The ACA Preview Report has been updated to meet the 2021 form requirements

- Life events have been added to the Employee Change Log so you can audit changes

Payroll & Tax

- COVID-19 sick leave earnings have been updated so they will reflect correctly in Box 14 of the W-2 for 2021

- For California employers, a new regular rate of pay calculation has been added to determine the correct hourly rate for meal and break penalties

- For Puerto Rico employers, the system has been updated to automatically calculate the youth tax exemption beginning in 2022

- A FUTA credit reduction of 3.3% will be applied in the next payroll for employees whose work location is in the U.S. Virgin Islands to capture the additional federal unemployment tax that is due

Employee Management & ESS

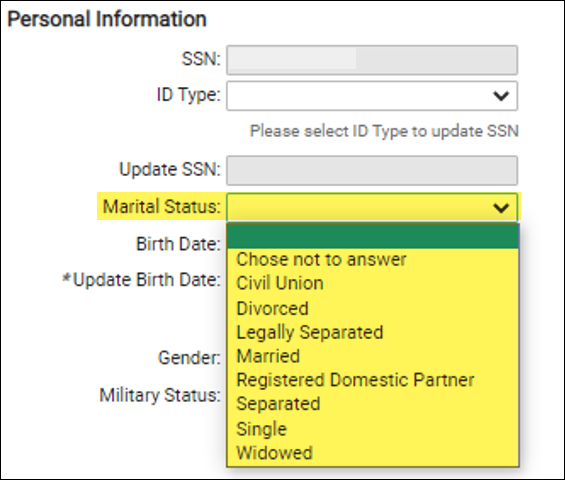

New employee marital status options have been added

Employees can better reflect their relationship status with new marital status choices

The Marital Status field on the employee General screen has been updated to give employees more flexibility when reporting their relationship status. The following new choices have been added:

- Chose not to answer

- Civil union

- Divorced

- Legally Separated

- Registered Domestic Partner

- Separated

- Widowed

These new choices will not impact tax reporting.

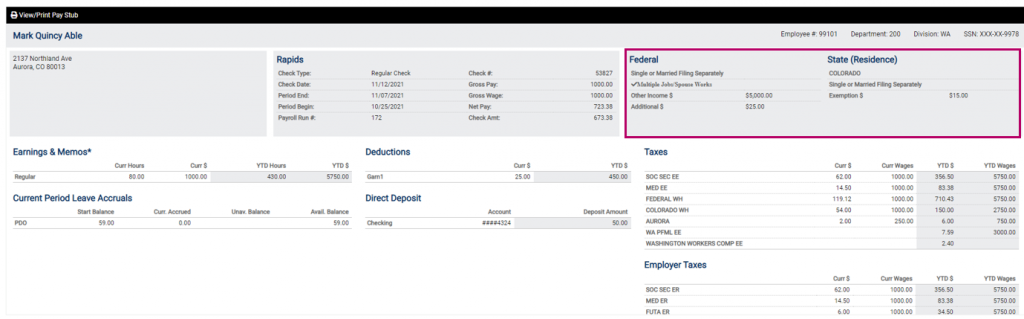

Pay stubs have been updated in ESS Pay History

Pay stubs have been updated to make room for the employee’s current federal, state, and local tax elections

The tax information section at the top of the employee’s pay stubs in Pay History now show the full federal and state tax election information. For employees who have designated an alternate address to receive pay, that address will now be shown on their pay stubs.

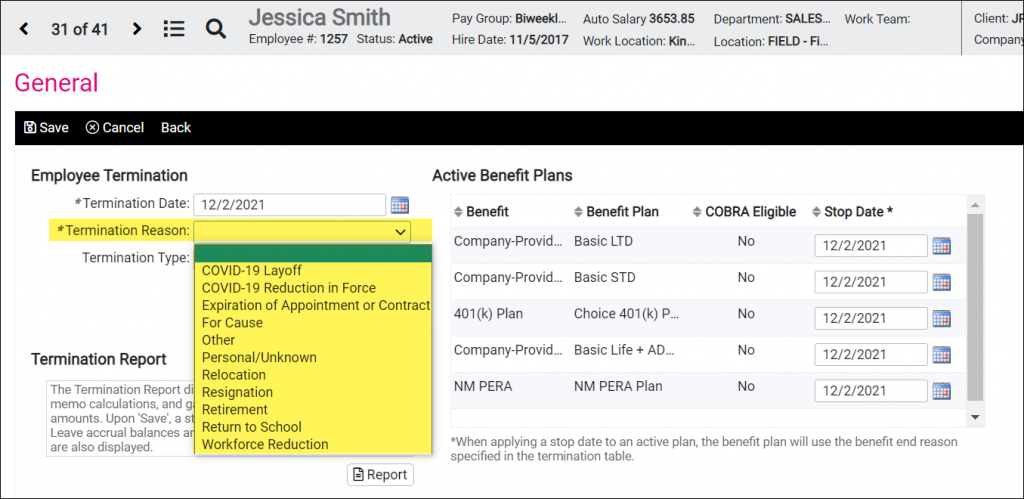

Termination Reasons are now listed alphabetically

Find the right termination reason more easily when terminating employees

When terminating an employee, the Termination Reasons now sort alphabetically by description rather than code. This makes it easier to find the termination reason you need.

Benefits

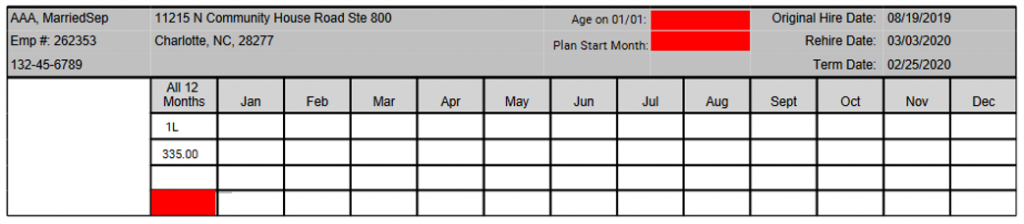

ACA logic and reporting has been updated to meet 2021 requirements

ACA processing and form preview reports use the 2021 standards for accurate filing

The ACA processing logic has been updated to use 9.83% of the mainland federal poverty level as the affordability standard, so plans that cost employees $105.51 per month or less will be coded as affordable.

The 1094-C and 1095-C preview reports have been updated to include new codes and fields published in the latest IRS draft instructions on September 22, 2021. In the employee information section, the employee age as of the January 1, 2021 and the plan start month have been added. A new line 17 has been added to the monthly breakdown section. This line is reserved for future use, so it will be blank.

For more information about ACA form auditing and approval, contact your Benefits Specialist.

You can now audit changes to employee life events

An audit trail has been added for the employee Life Events screen so you can track changes

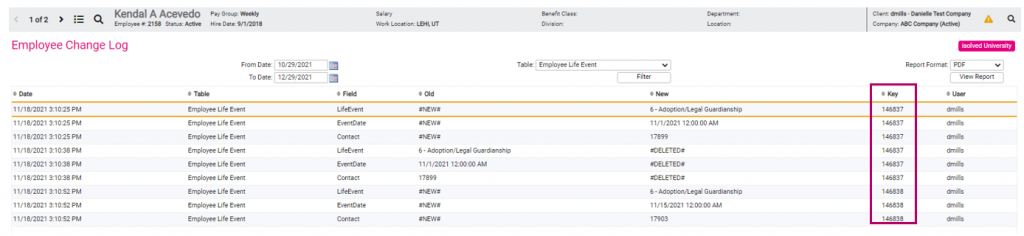

An Employee Life Events option has been added to the Employee Change Log in the Employee Utilities section of Employee Admin Tools. You can review all changes to the Employee Management > Employee Benefits > Life Events screen with this new option and see who added or updated employee records.

The PDF version of all Employee Change Log reports have been updated to include the Key column so you can easily see which records were affected. The report layout has changed to the wider landscape view to make all of the necessary fields visible.

Payroll & Tax

COVID-19 sick and FMLA leave earnings will reflect properly on 2021 W-2s

FFCRA and ARPA leave codes will reflect in Box 14 based on current IRS guidelines

The ACA processing logic has been updated to use 9.83% of the mainland federal poverty level as the affordability standard, so plans that cost employees $105.51 per month or less will be coded as affordable.

On September 7, 2021, the IRS updated their guidance on how to report qualified sick and family leave wages on the 2021 Form W-2. Based on this guidance, FFCRA and ARPA leave will be reflected in Box 14 on employee W-2s with the following codes that reflect the daily pay limit:

| Leave Type | isolved Earning Type | Box 14 Code |

| FFCRA Sick – Employee Qualifying Reason | EPSL-Employee | FFCRA Sick $511 |

| FFCRA Sick – Family Qualifying Reason | EPSL-Family 2/3 | FFCRA Sick $200 |

| FFCRA Emergency FMLA | EPFL-Day11+ 2/3 | FFCRA FMLA |

| ARPA Sick – Employee Qualifying Reason | EPSL-ARPA EE | ARPA Sick $511 |

| ARPA Sick – Family Qualifying Reason | EPSL-ARPA Fam | ARPA Sick $200 |

| ARPA Emergency FMLA | EPFL-ARPA FMLA | ARPA FMLA |

New hourly rate calculation for California meal and break penalty premiums

You can now automatically calculate the employee’s regular rate of pay

California employers must provide meal and rest breaks each day or pay a premium equal to an hour of pay. In July 2021, the California Supreme Court ruled that employers must use the employees “regular rate of pay” as defined in their overtime statutes when paying these penalty premiums, not the employee’s base hourly rate. The regular rate of pay is a weighted average of all compensation the employee receives in the workweek divided by the hours they worked.

For example, if an employee worked 40 hours in the workweek at $25 per hour and received a $100 production bonus, their regular rate of pay would be calculated as:

- Compensation in the workweek: (40 * $25.00) + $100 = $1100.00

- Hours worked in the workweek: 40

- Regular rate of pay: $1100.00 / 40 = $27.50

A new earning type has been added to calculate this rate for California employers when paying premiums for missed meals and breaks. This code allows you to specify the earnings that should be included in the compensation and hour calculations. It will also check the applicable minimum wage and pay that rate if the calculated regular rate of pay is less.

Contact your Payroll Specialist for assistance implementing the new earning type.

Puerto Rico Youth Tax Exemption will be automated in 2022

isolved will automatically apply the youth tax exemption for Puerto Rico employees who qualify

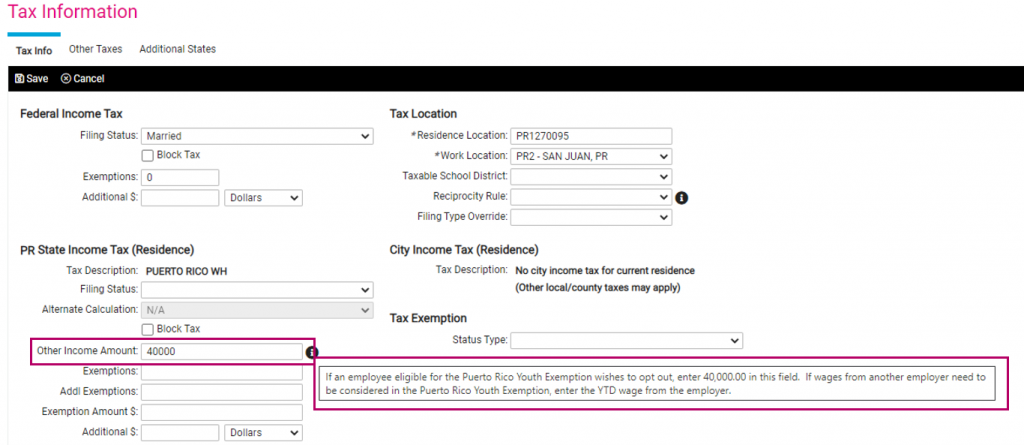

For salaried employees between the ages of 16 and 26 who reside in Puerto Rico, their first $40,000 in wages are exempt from Puerto Rico taxation. Beginning with payrolls in 2022, isolved will automatically exempt the first $40,000 in taxable wages if the employee’s age meets the eligibility requirements when the payroll is processed. To take advantage of this automation, the employee’s birthdate must be entered on their General screen in isolved.

Employers can opt out of this automatic calculation by entering $40,000 in the Other Income Amount field for Puerto Rico Resident State Income Tax on the Employee Tax screen.

U.S. Virgin Islands FUTA Credit Reduction

USVI employers must pay an additional 3.3% in federal unemployment before year-end

The United States Virgin Islands did not repay all of their federal unemployment advances prior to November 10, 2021 so employers in the USVI are subject to a FUTA credit reduction of 3.3% in 2021. For employees with a work location in the US Virgin Islands, the additional federal unemployment tax will automatically be withheld from their next payroll.

For questions about these tax changes, contact your Payroll Specialist.

Download the release notes

Download the release notes: isolved Product Release v7.22