Friday, February 25th, 2022

Highlights

isolved version 8.03 includes new and updated state tax forms, updates to the California Pay Data Report and a new Sort Field description when running labor Allocation reports. These enhancements will be available when you log into isolved on Friday, February 25th, 2022.

HR

- The California Pay Data Report has been updated to meet 2021 requirements

Payroll & Tax

- Updates have been made to Labor Allocation Reports to describe the Sort Fields

- The Missouri Form MO W-4 is no longer required for residents working 100% out-of-state

- The latest Nebraska Form W-4N has been added for onboarding and tax updates

HR

The California Pay Data Report Updates

For clients in California, the CA Pay Data Report has been to meet 2021 requirements

California employers with 100 or more employees must report pay and hours-worked data by establishment, job category, sex, race, and ethnicity to the Department of Fair Employment and Housing (DFEH) by March 31, 2021 and annually thereafter. For more information on requirements and filings, please visit https://www.dfeh.ca.gov/paydatareporting/

The CA Pay Data Report has been updated to meet 2021 requirements and is available for clients to preview and use for this year’s filings.

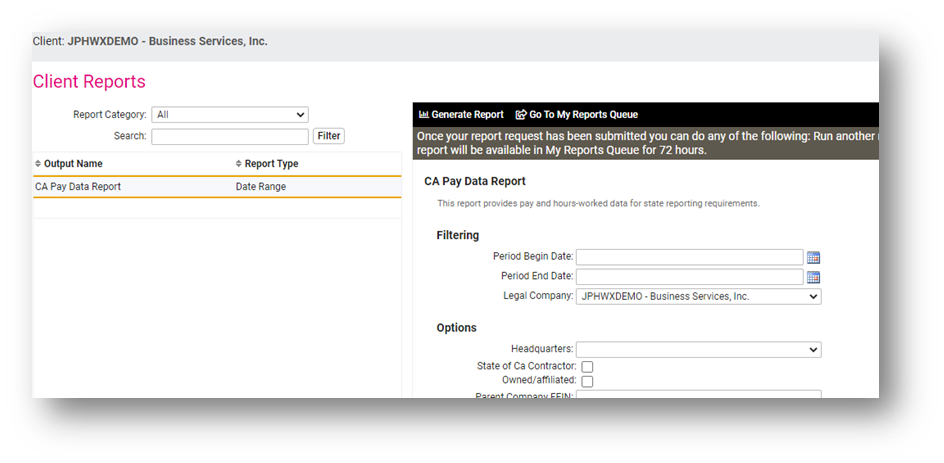

Client Reports screen:

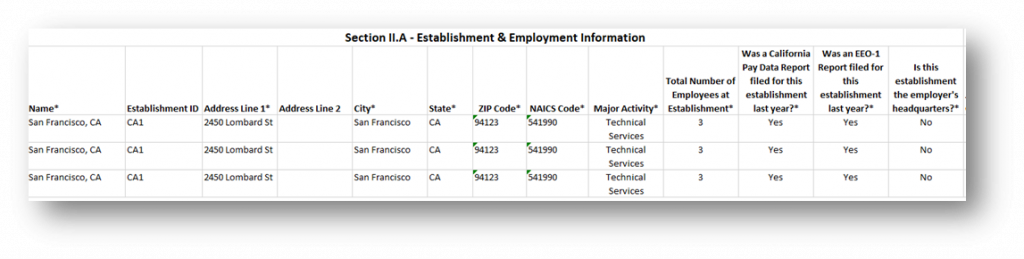

Report example:

Payroll & Tax

Updates have been made to Labor Allocation Reports

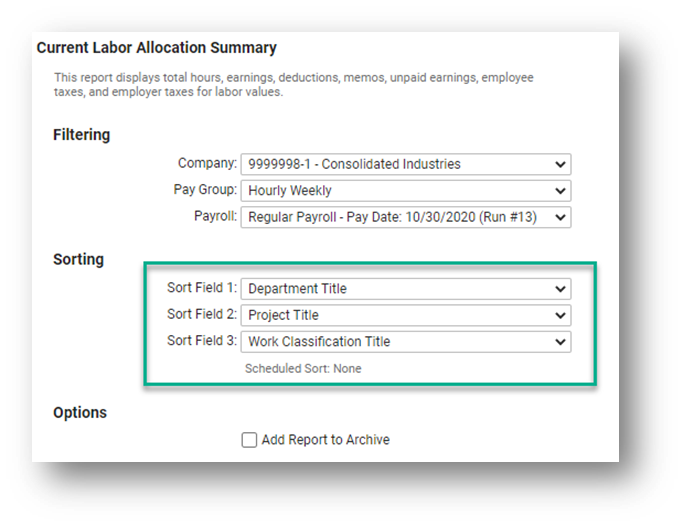

Administrators will now see a Report Description describing the Sorting the sort field options

When running specific labor allocation reports, clients can use the Sort Fields to define which labor fields to report on for labor allocations. Sort Fields 1 and 2 can be used for Sorting and Org/Labor with sub-total. Sort field 3 is only used for sorting and order and won’t create an additional sub-total on the report.

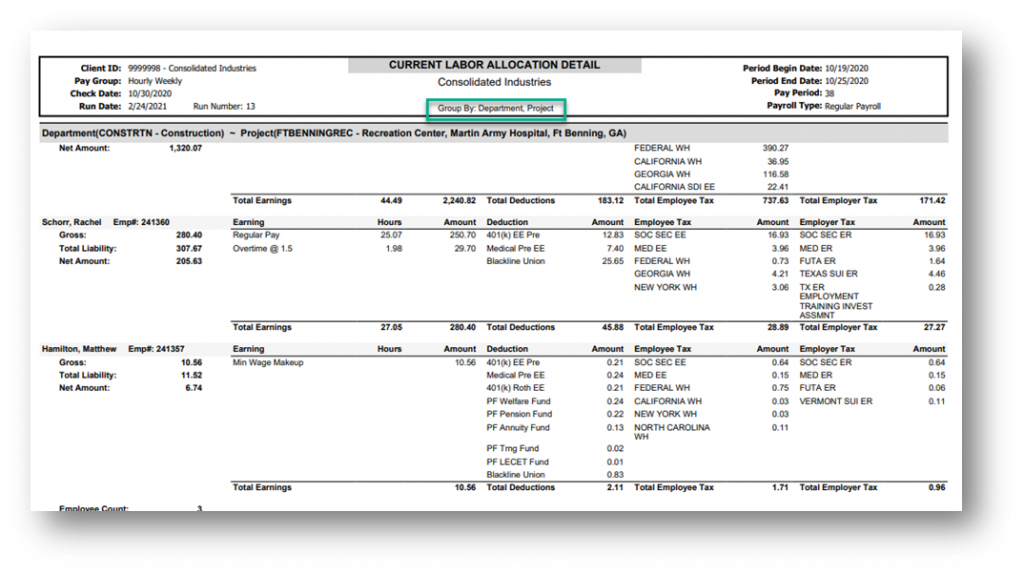

For example, if a client has labor fields defined for Department, Project, and Work Classification, and all three are select where department is Sort Field 1, Project is Sort Field 2, and Work Classification is Sort Field 3, when the report is generated, the client will see the data grouped by department and project with sub-totals. Clients will not see it grouped by Work Classification because it is only used to sort and control the order.

Report Example:

The Report Description on the following reports has been updated to include the following text:

“Note: Sort Fields 1 and 2 can be used for Sorting and Org/Labor sub-totals. Sort Field 3 is only used for sorting”

If a report already has data in the Description field, this note is added to that data; it will not replace the data.

Impacted Reports:

- Current Labor Allocation Detail

- Current Labor Allocation Detail (with Rates)

- Current Labor Allocation Summary

- Custom Labor Allocation Detail

- Custom Labor Allocation Summary

- Labor Allocation Detail

- Labor Allocation Summary

- MTD Labor Allocation by Pay Date

- MTD Labor Allocation by Period End

Missouri Form MO W-4 Requirements

The Missouri Form MO W-4 is no longer required for residents working 100% out-of-state

Form MO W-4 will no longer be presented during onboarding when a Missouri resident works 100% out-of-state. This will allow for proper deduction and payroll processing.

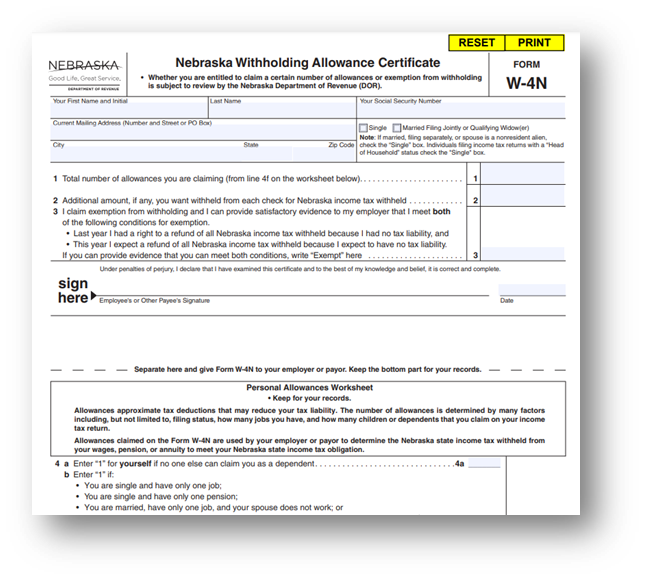

The Nebraska Withholding Allowance Certificate is Now Available

The latest Nebraska Form W-4N has been added for onboarding and tax updates

The form is now available for new Nebraska employees in onboarding and for existing employees in the Tax Updates Wizard.

Contact your Payroll Specialist if you have any questions about the updates in isolved version 8.03.

Download the release notes

Download the release notes: isolved Product Release v8.03