Friday, December 2nd, 2022

Highlights

isolved version 8.23 includes information regarding information regarding 2022 FUTA Credit Reductions for certain states and updates to the Client and Employee-level Jobs menu options and screens.

Payroll

- 2022 FUTA Credit Reduction rates for California, Connecticut, Illinois, and New York

HR

- Design updates to Client and Employee-level Job screens and a new Job Levels page

Payroll

2022 FUTA Credit Reduction states and rates

California, Connecticut, Illinois, and New York have 2022 FUTA Credit Reductions

The Department of Labor released the 2022 FUTA Credit Reduction states and rates on November 10, 2022:

- California – 0.3%

- Connecticut – 0.3%

- Illinois – 0.3%

- New York – 0.3%

- Virgin Islands – 3.6%

isolved will automatically calculate the additional state unemployment tax that needs to be collected due to the FUTA Credit Reduction and the additional impound will take place on the first payroll processed with a check date of December 2, 2022, or later.

Unsure if your company is affected by the credit reduction? Navigate to Reporting > Client Reports and select filter your client reports by the “Tax” Report Category. Select the FUTA Credit Wages by State report and run it with a current “As of Date”. If the report returns YTD FUTA Wages for CA, CT, IL, or NY, you will be affected by the FUTA Credit Reduction.

HR

Design Updates to Client and Employee-level Job screens

Menu and Job page updates and additional functionality

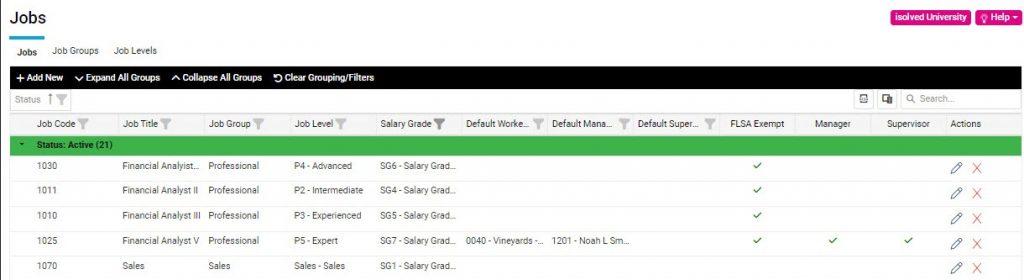

You will notice as part of this release that the menu under Client Management > Job has been updated. Not only has Job Groups been combined as a tab on the Jobs screen, but the Salary Grades table has been moved to the Jobs menu for ease of access.

The Jobs screen has been updated with a new look and feel and some additional features have been added. The updated Client Jobs screen now has three tabs across the top of the page:

- The Jobs tab defines your jobs at a client level

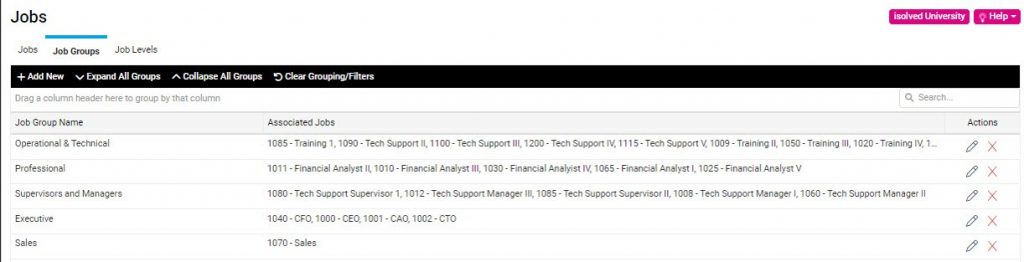

- Job Groups is the second tab on the Jobs page and is no longer found as a its own menu option under Jobs

- Job Levels is the third tab on the redesigned Jobs screen and is new functionality

The updated Jobs tab on the Jobs screen allows you to filter, sort, add/remove columns, and export your job data to a spreadsheet. By default, the Jobs screen will show Jot Titles grouped by Status, but you can create a different grouping by dragging and dropping column headers to and from the grouping area. In addition to these changes, the size of the Job Title field has been increased from 50 to 100 characters.

The most common use of Job Groups is for reporting and eligibility purposes. The Job Groups tab now allows you to quickly and easily see all jobs associated with a Job Group, create a new Job Group, or make an update to an existing Job Group.

The new Job Levels tab will allow you to capture Job Levels which can be tied to salary grades and client jobs. The screen capture below provides some examples of how this might be used, but you can use the descriptions and salary grades that make sense for your company. For those clients taking advantage of Salary Grades, a new Job Level will be created for each existing Salary Group you have defined, and it will be named the same as the existing salary grade.

The Employee Jobs page will follow suit from the Client Jobs page with its updated look and feel.

After selecting a job from the Employee Jobs page, you will find additional fields that allow you to collect Experience Information to track dates the employee started in their occupation and industry. For those clients taking advantage of Salary Grades, you will see Employee Compensation Metrics, including the Compra Ratio and a new Salary Penetration field which is displayed on the active job record and compares the current salary of the employee to the total pay range for the job.

For more information about the changes in the version 8.23 release, contact your Payroll Specialist.

Download the release notes

Download the release notes: isolved Product Release v8.23