Friday, January 13th, 2023

Highlights

isolved version 9.00 includes information about a new time card report, 2023 tax and tax form updates, OregonSaves report changes, information about Arizona withholding tax rates, plus a sneak peak of a few upcoming changes.

Benefits

- New Benefit Reconciliation Utility is coming soon

Payroll

- 2023 federal, state and local tax updates

- Isolved federal and state tax form updates

- OregonSaves report updates

- Arizona reduced withholding rates

Time and Labor Management

- New Time Card Data with Notes report

- Time card objections are coming soon

Benefits

Benefit Reconciliation Utility – coming soon

Easily identify variances between schedule premiums and actual contributions

The Benefit Reconciliation Utility will assist in determining any variances between schedule premiums and payroll contributions each month. With upcoming releases, we will include additional sneak peaks into the functionality that will be included in this new employee utility.

With this release you may see a new icon on the Employee Benefits page under Actions. This icon is not functional yet, but when the Benefit Reconciliation Utility is rolled out it will take you to an Allocation Table for that benefit plan.

The Allocation Table will display the schedule and actual plan employer and employee premium contributions for each month of the plan year and show any variances between the two.

Payroll

2023 tax changes

Isolved federal, state, and local tax updates

When you process payrolls in isolved with a pay date on or after January 1, 2023, the tax changes included in the 2023 Tax Changes document will automatically take effect.

Isolved tax form updates

The tax wizard used in Onboarding and for employee tax updates in the Adaptive Employee Experience (AEX) and Classic View has been updated for 2023. The following tax form changes have been made:

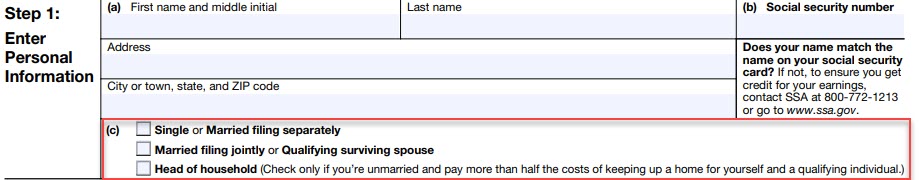

Form W-4 –Federal Employee’s Withholding Certificate

- The form year was updated from 2022 to 2023

- The second filing status in Step 1(c) has been updated from “Married filing jointly or Qualifying widow(er)” to “Married filing jointly or Qualifying surviving spouse.”

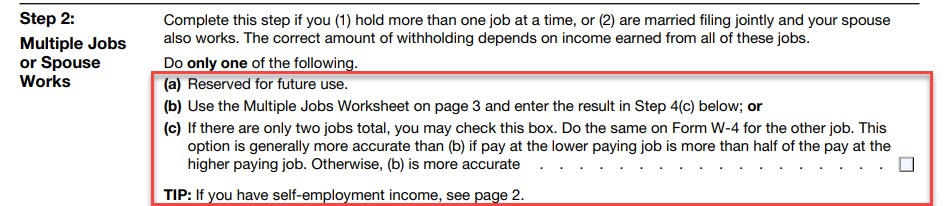

- Step 2(a), Step 2(b), and Step 2(c) have been updated, along with the TIP verbiage for this question.

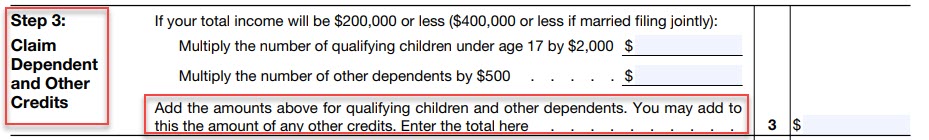

- Language in Step 3 has been updated along with the step title that now reads “Step 3: Claim Dependent and Other Credits”.

- In the second line of the deduction worksheet for Step 4(b), the amounts for each filing status have been updated as follows:

- Married filing jointly or qualifying surviving spouse was updated from $25,900 to $27,700

- Head of household was updated from $19,400 to $20,800

- Single or married filing separately was updated from $12,950 to $13,850

- The dollar amounts have been updated in the tables for the three filing statuses on page 4

- The form instructions have been updated

Additionally, Forms NM101, ND104, and UT101 have been updated with the changes above since New Mexico, North Dakota, and Utah use the Federal W-4 for state withholding.

View the updated 2023 Form W-4 on the IRS website.

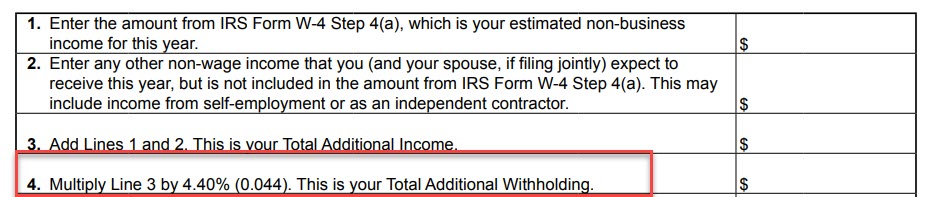

Colorado Form DR 0004 – Colorado Employee Withholding Certificate

- The standard allowances for all filing statuses have changed

- Box four in worksheet 2: Additional Withholding has been updated to divide by 4.40% instead of 4.55%.

View the updated 2023 Form DR 0004 on the Colorado Department of Revenue website.

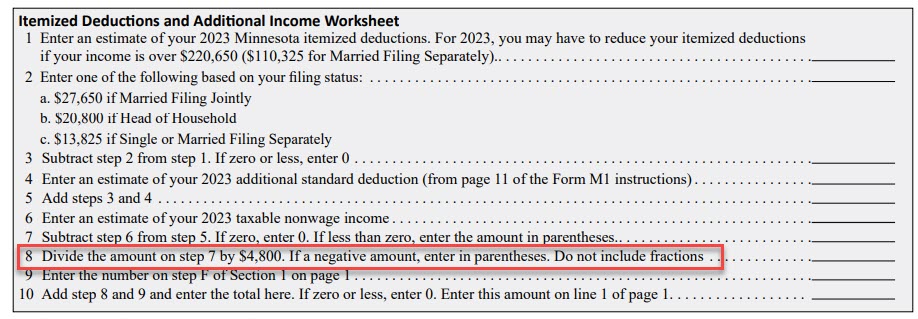

Minnesota Form W-4MN – Minnesota Withholding Allowance/Exemption Certificate

- Itemized deduction values for all filing status and income thresholds have been updated in the Itemized Deductions and Additional Income Worksheet.

- Line 8 in The Itemized Deductions and Additional Income Worksheet has been updated to divide by $4,800 from $4,450.

View the updated 2023 Form W-4MN on the Minnesota Department of Revenue website.

North Carolina Form NC-4 –Employee’s Withholding Allowance Certificate

- In Part II on the worksheet, the divisible number has been updated from $128 to $122

- The additional withholding amounts for all filing statuses within the Multiple Jobs section have been updated.

View the updated 2023 Form NC-4 on the North Carolina Department of Revenue website.

North Carolina Form NC-4 NRA– Nonresident Alien Employee’s Withholding Allowance Certificate

- The additional withholding per pay period allowance has been updated:

- Weekly has been updated from $12 to $13

- Biweekly has been updated from $24 to $25

- Semimonthly has been updated from $26 to $28

- Monthly has been updated from $52 to $55

View the updated 2023 Form NC-4 NRA on the North Carolina Department of Revenue website.

Wisconsin Form WT-4A – Worksheet for Employee Withholding Agreement

- The standard deduction and tax rate schedules for full-year residents and the explanation have been updated for 2023.

View the updated 2023 Form WT-4A on the State of Wisconsin Department of Revenue.

Other State Form Updates

The following state forms have been updated to reflect the current year and form number. No other significant changes were made to the forms.

- Arizona form changes:

- Form A-4C– Arizona Request for Reduced Withholding to Designate for Tax Credits

- Form AZ102 – Arizona Employee Withholding Exemption Certificate

- Connecticut form changes:

- Form CT-W4 – Connecticut Employee’s Withholding Certificate

- Form CT-W4NA – Connecticut Employee’s Withholding Certificate Nonresident Apportionment

- Minnesota form change:

- Form MWR – Reciprocity Exemption/Affidavit of Residency for Tax Year 2022

- Missouri form change:

- Form MO W-4 – Employee’s Withholding Certificate

- New York form changes:

- Form IT-2014 – Employee Withholding Allowance Certificate

- Form IT-2104-E – Certificate of Exemption from Withholding

- Form IT-2104-SNY – Certificate of Exemption from Withholding for START-UP NY Program

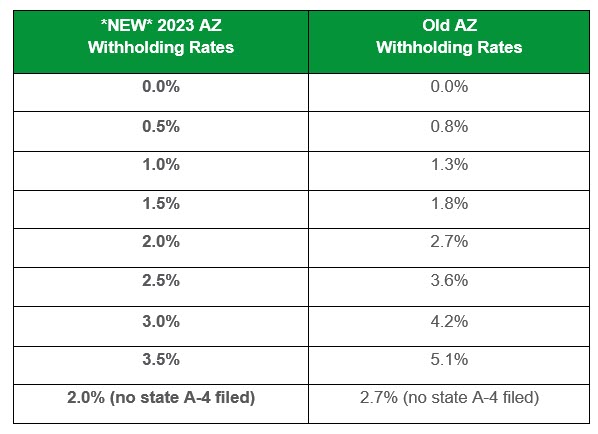

Arizona reduced individual withholding tax rates

Employees required to complete a new Form A-4

Arizona’s individual Income Tax Withholding Form (Arizona Form A-4) has been updated to reflect lower individual income tax rates and the rates are available within the isolved Tax Update screen. There are seven new withholding election rates while retaining the zero withholding rate option.

Every Arizona employer is required to make this form available to its Arizona employees by January 31, 2023. A release in late January will remove the old rate options and any existing employees who have not updated their Form A-4 will have their taxes calculated at the default rate of 2% until updated.

For more information about Arizona’s withholding tax changes, visit Arizona’s Department of Revenue website.

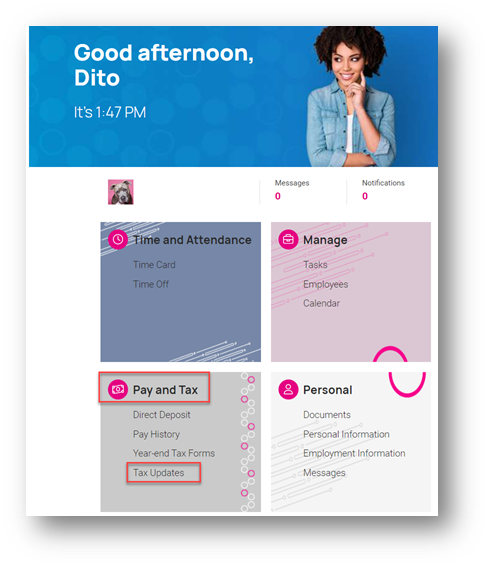

Employees can easily complete the A-4 form within isolved:

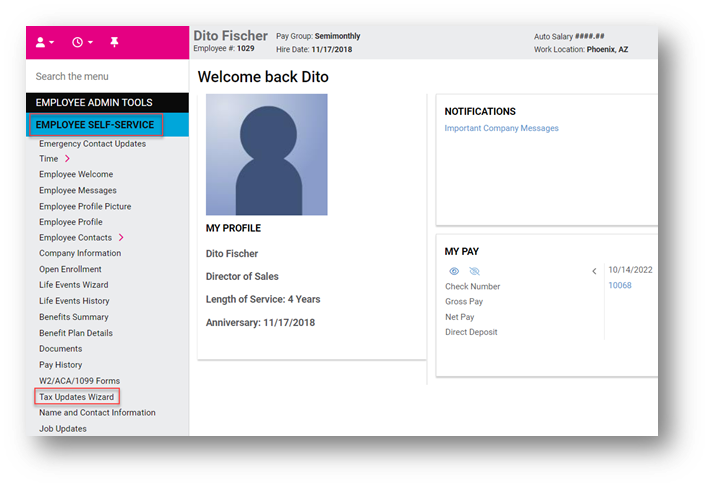

For those clients taking advantage of the modern Adaptive Employee Experience (AEX), employees can create a new A-4 by selecting the Tax Updates option.

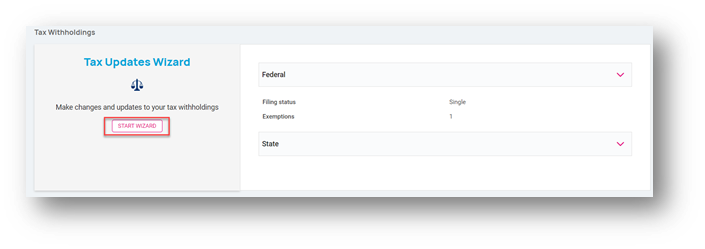

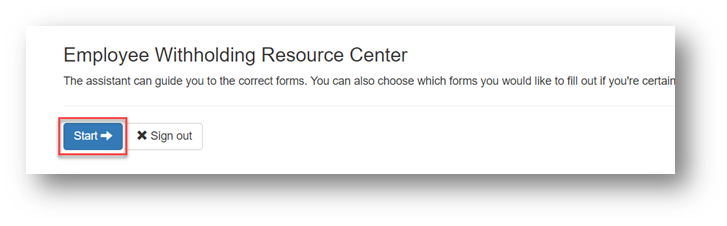

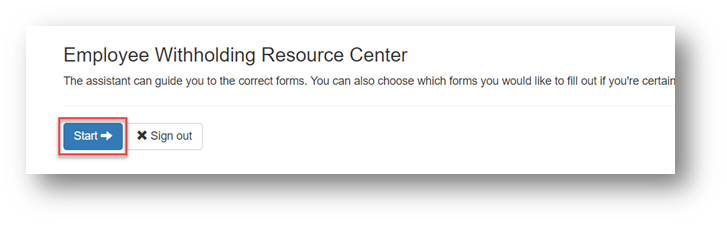

Within the Tax Updates page, the employee may access the A-4 by selecting the Start Wizard button and then clicking the blue Start button on the Employee Withholding Resource Center page that follows.

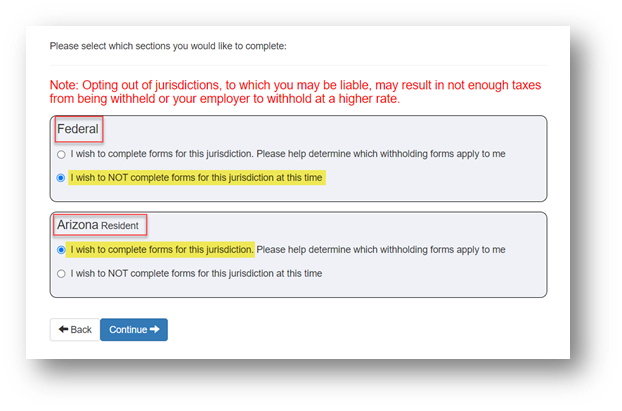

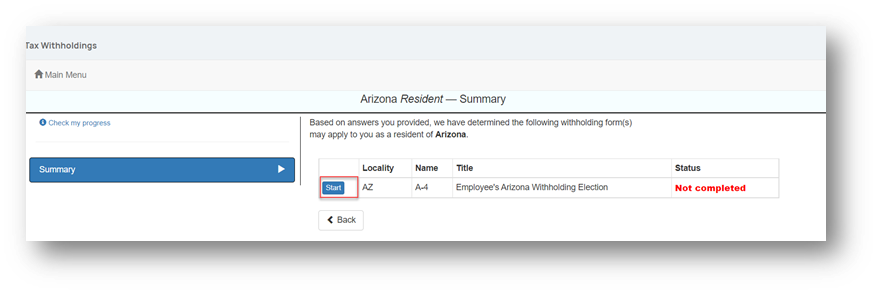

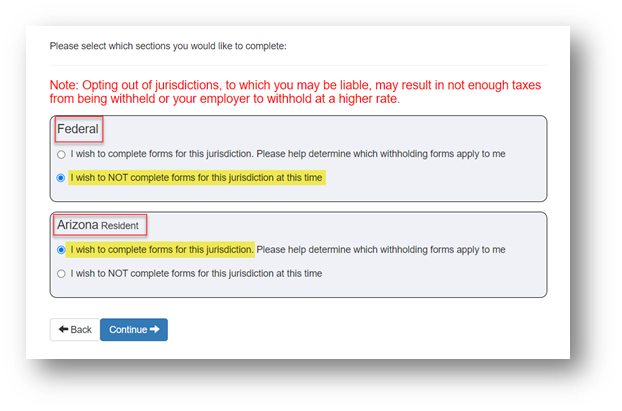

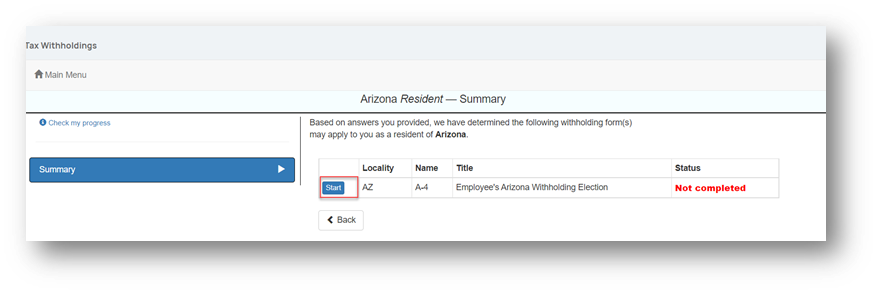

If the employee is only going to create a new Form A-4, they would select the “I wish to NOT complete forms for this jurisdiction at this time” under the Federal forms section of the screen. The “I wish to complete forms for this jurisdiction” option defaults to selected for the Arizona Resident section of the screen. Clicking on the blue Continue button will lead the employee through a series of questions to confirm the A-4 form applies to their situation and allow them to complete the A-4 form by clicking the blue Start button.

For those clients who remain on the Employee Self-Service Classic View, employees can create a new Form A-4 by selecting the Tax Updates Wizard menu option within the Employee Self-Service menu and then selecting the Start button on the Employee Withholding Resource Center page.

If the employee is only going to create a new Form A-4, they would select the “I wish to NOT complete forms for this jurisdiction at this time” under the Federal forms section of the screen. The “I wish to complete forms for this jurisdiction” option defaults to selected for the Arizona Resident section of the screen. Clicking on the blue Continue button will lead the employee through a series of questions to confirm the A-4 form applies to their situation and allow them to complete the A-4 form by clicking the blue Start button.

Oregon changes service providers for OregonSaves

Isolved OR Retirement Savings Contribution and Census reports updated

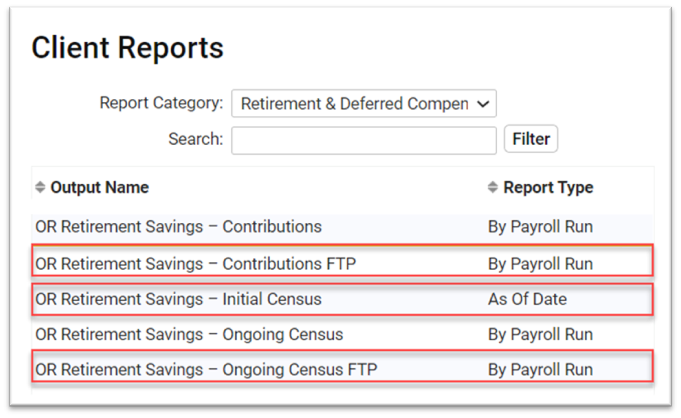

OregonSaves was established in 2017 and is the nation’s first automatic-enrollment, payroll deduction IRA program for private sector workers. The state of Oregon recently announced a change in service providers for the OregonSaves program. The switch to the new service provider, Vestwell State Savings, required changes to several of the Client Reports that are used to communicate census and payroll information to the state. Minor format updates were made the reports highlighted below and are available for use:

In addition to the change of service provider, the OregonSaves program also recently added an additional group size for businesses to register and established new deadlines. Businesses with 3-4 employees have until March 1, 2023 to enroll in OregonSaves, while employers with 1-2 employees have a deadline to comply of July 31, 2023.

Visit the OregonSaves website for additional information and FAQs.

Time and Labor Management

New Time Card Data with Notes report

Report on time card data including notes

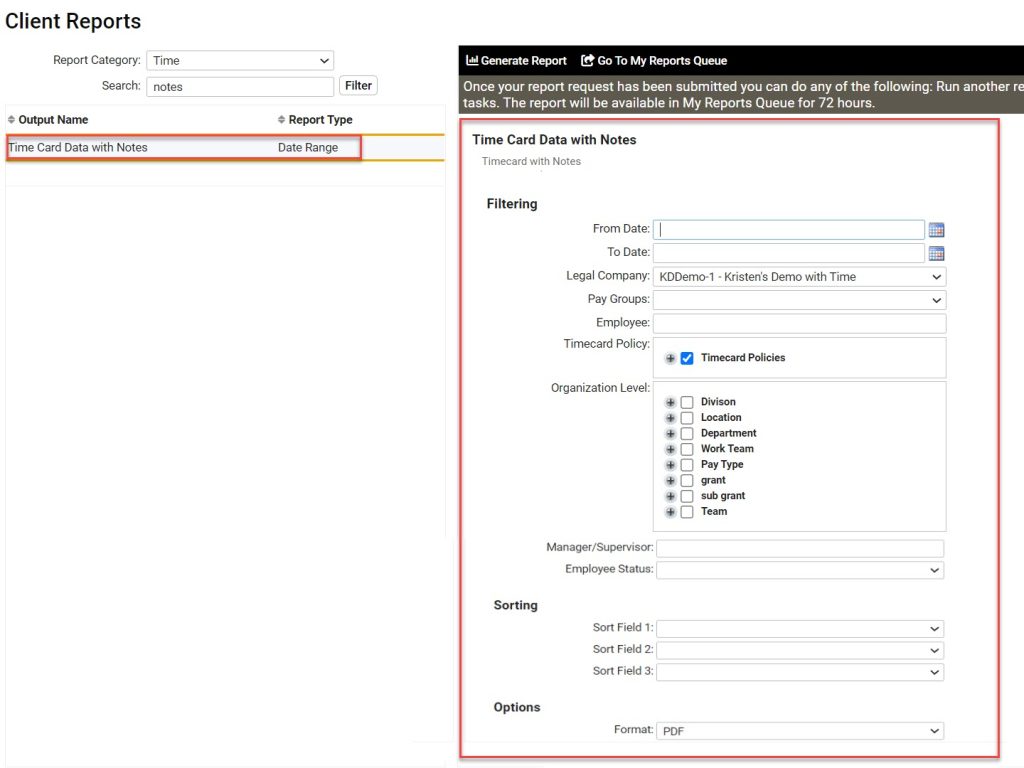

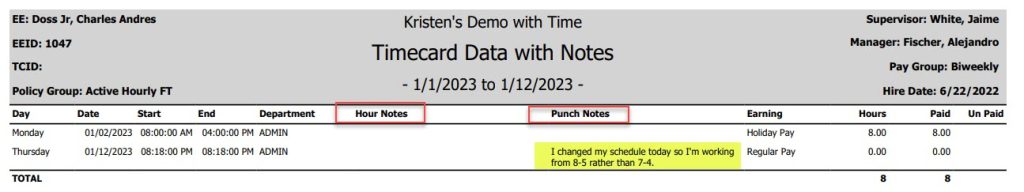

For those clients taking advantage of isolved’s Time and Labor Management module, you now have access to a new report that will display time card information along with any hours or punch notes that were entered on the time card. To access the new Time Card Data with Notes report, navigate to Reporting > Client Reports and filter the Report Category by “Time”.

There are many options available that allow you to control the data that the report retrieves so you only see the information that is meaningful to you.

Time card objections – coming soon

Allow employee objections to time cards

Those clients taking advantage of isolved’s Time and Labor Management product will be able to include employee objections to their time card verification process. Employees will have an opportunity to object to their time card and must enter comments as to why they feel the information is not accurate. Supervisors/Managers can be notified by email/AEX so they can address concerns the employee may have.

For more information about the changes in the version 9.00 release, contact your Payroll Specialist.

Download the release notes

Download the release notes: isolved Product Release v9.00