Friday, December 6th, 2024

Highlights

isolved People Cloud version 10.20 includes benefit and tax limit changes for 2025, tax locality changes for work locations, and minimum wage updates that take effect in the new year. New York PFL reports have been updated for the fourth quarter. This release also includes usability enhancements for time, scheduling and leave management.

Adaptive Employee Experience (AEE)

- The scheduling screen has been updated to load faster for Managers in the Adaptive Employee Experience (AEE) and isolved People Cloud mobile app

* Remember, updates to AEE and the mobile app will not be applied until 9PM Eastern

Payroll & Tax

- 2024 Federal Unemployment Tax Credit Reductions

- 2025 minimum wage updates for multiple state and local jurisdictions

- Benefit and tax limit increases for 2025

- Geocode changes for localities in Alabama, Colorado, Georgia, Maryland, Mississippi, and Missouri

- Forward your 2025 IRS and state notifications to Insperity – action required!

- Year-end information available on the Help Center

Time and Labor Management

- Virtual Clock now uses the same logic as punches to determine time zones from employee work locations

- For managers taking advantage of resource scheduling, notifications are now sent to employees when you approve individual shift requests

Leave Management

- The Admin Calendar now displays time off requests correctly even in day and week view

Reporting and Analytics

- NY DBL PFL reports updated to use 2024 annual limits for Q4

Applicant Tracking

- Employee Referral transition to Job Sharer portal

Adaptive Employee Experience (AEE)

Faster scheduling for managers

Employee schedules load faster now for supervisors and managers

Schedules in the Adaptive Employee Experience (AEE) and isolved People Cloud mobile app will load faster for supervisors and managers with technology updates in this release to reduce latency. These performance improvements should eliminate the timeout issues that managers with a lot of direct reports were experiencing.

Payroll & Tax

2024 Federal Unemployment Tax Credit Reductions

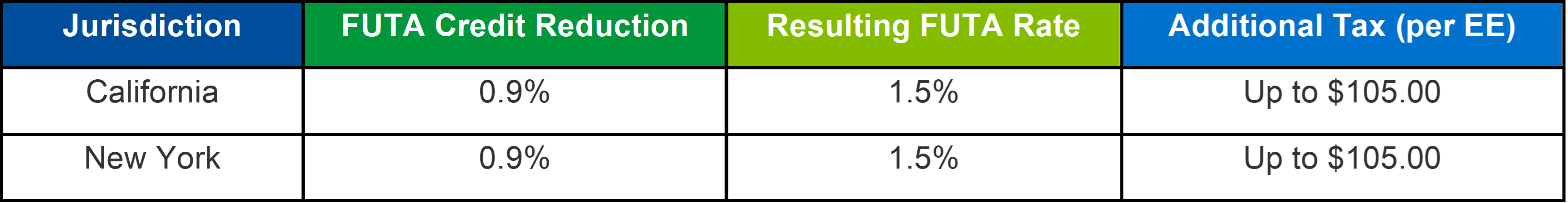

Additional FUTA Tax for employers in California and New York

If you are an employer with a work location in California or New York, you may be subject to additional Federal Unemployment tax (FUTA) for 2024. These states had an outstanding federal loan balance from 2022 through 2024 and did not repay all their advances by the November 10, 2024 deadline, so the Federal Unemployment Tax (FUTA) credit will be reduced.

The first payroll with a pay date on or after December 1st, 2024 will include the additional Federal Unemployment Tax (FUTA) payment for employees who work in the affected states.

If you do not plan to process any payrolls on or after December 1st, 2024, please contact your Payroll Specialist or Insperity Tax at wx.tax@insperity.com for assistance with a Federal Unemployment Tax (FUTA) adjustment to ensure compliance.

Local Tax Jurisdiction changes

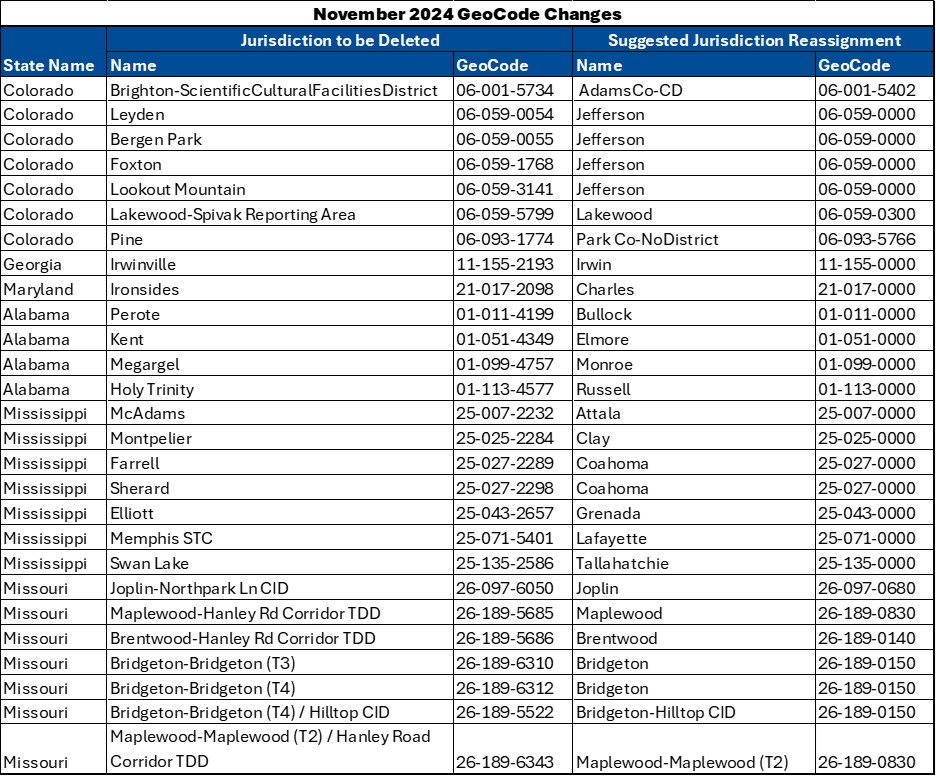

November GeoCode changes

Periodically, tax geographical location codes (GeoCodes) are updated or deleted when jurisdictions merge or change how they are reported for tax purposes.

If you have work locations in the deleted areas, please contact your Payroll Specialist who can work with you to create new work locations using the new geocode.

Minimum Wage Updates for 2025

State and local minimum wage updates

A number of 2025 minimum wages have been updated based on information provided by each jurisdiction. The file below shows all the known 2025 minimum wage changes with the additional changes included in this release.

2025 Minimum Wage Changes in version 10.20

These minimum wage changes will not automatically update employee salary records. See Reviewing pay information for minimum wage compliance to learn how Workforce Acceleration can help you stay in compliance with minimum wage changes.

2025 IRS and State Notifications

Forward unemployment rate and tax filing frequency notices to Insperity

Unemployment rates and tax filing frequency changes are mailed to the taxpayer, not to Insperity. It is imperative these tax-related communications are forwarded to Insperity immediately.

For those clients in the states of Washington and Wyoming, we also require your 2025 Workers Compensation rates, as those are remitted with tax payments.

We require this information to ensure your taxes are paid accurately and timely in 2025. Please send your information to ips.tax@insperity.com

Stay on track for a successful year end

Year End Central in the Insperity Help Center is your one-stop resource

The year-end central section of the Insperity® Help Center includes helpful articles to make sure everything is correct before you run your last payroll of the year. It includes resources to:

- Review banking holidays that might impact your payroll schedule

- Understand how to submit tax adjustments for fringe benefits, third party sick pay, and other critical payroll details that need to be processed before year-end for accurate W-2s and quarterly tax reports

- Reminders to help employees confirm their electronic consent for year-end forms, make sure their SSN and address are correct, and understand when they can expect to see their annual tax forms

- For Applicable Large Employers (ALEs), understand key deadlines for 1095 form approval and filing.

Time and Labor Management

Virtual Clock updates for time zones

More accurate time zone reporting for employees who use Virtual Clock on mobile devices

Virtual Clock now uses the time zone from the employee’s work location and the server time to calculate the correct time zone. This functionality mirrors the way punches in the Adaptive Employee Experience (AEE) determine the correct punch time, so there should no longer be any discrepancies based on time collection method.

Employee scheduling notifications

Employees now receive notifications when individual shifts are published

When managers collaborate to create schedules in draft mode, schedule posting notifications are now sent to employees when individual shifts are posted or when they schedules are published in bulk.

Leave Management

Take advantage of Day and Week views in the Admin Calendar

Time off is displayed correctly, even for days or weeks with many requests

The Admin Calendar in ESS Classic View now displays pending and approved time off correctly in Day and Week view, even for users with a lot of leave requests.

Reporting and Analytics

NY PFL reporting wage limit changes for Q4 2024

Reports use PFL wage limits based on the reporting quarter

The NY DBL PFL Audit Detail Report and the NY DBL PFL Audit Report have been corrected to use capped wage limits based on the quarter you’re reporting. If you’re running the report for Q4 2024, the 2024 weekly and annual covered wage limits will be used. The updated 2025 limits will be applied if you’re running the reports for quarters in the new year.

- When reporting for quarters in 2024:

- PFL Covered Wages: weekly cap of $1,151.16

- PFL YTD Capped Wages: limited to $89,343.80 annually

- When reporting for quarters in 2025:

- PFL Covered Wages: weekly cap of $1,757.19

- PFL YTD Capped Wages: limited to $91,373.88 annually

Applicant Tracking

Reminder: The Employee Referral Portal is Retiring Soon!

Start using the Job Sharer Portal now

Don’t forget that by the end of this year, the legacy Employee Referral Portal will be fully retired and replaced by the enhanced Job Sharer Portal. The improved platform makes it easier than ever to expand your referral program beyond employees while keeping internal job openings secure.

Check out the Job Sharer Portal Overview to learn how it helps everyone socialize your job ads to expand your reach.

If you haven’t transitioned yet, our Account Management and Support teams may reach out to guide you through the transition.

For more information about the changes in the 10.20, please contact your Insperity Payroll Specialist.