Learn how to use the Employee Salary / Hourly Rate List dashboard to identify employees who need pay increases to stay in compliance with minimum wage changes.

Minimum Wage Maintenance

When legislation is passed to change federal, state, and local minimum wage rates, isolved system rate tables are automatically updated to help you stay in compliance. But the system will not automatically change employee pay, since you are always in control of what your employees earn.

Workforce Acceleration can help

You can stay on top of changing pay requirements with the Insperity HR Resource Center. Register for automatic updates in states where you work to learn about legislative changes, including minimum wage increases.

Reviewing wage rates for compliance

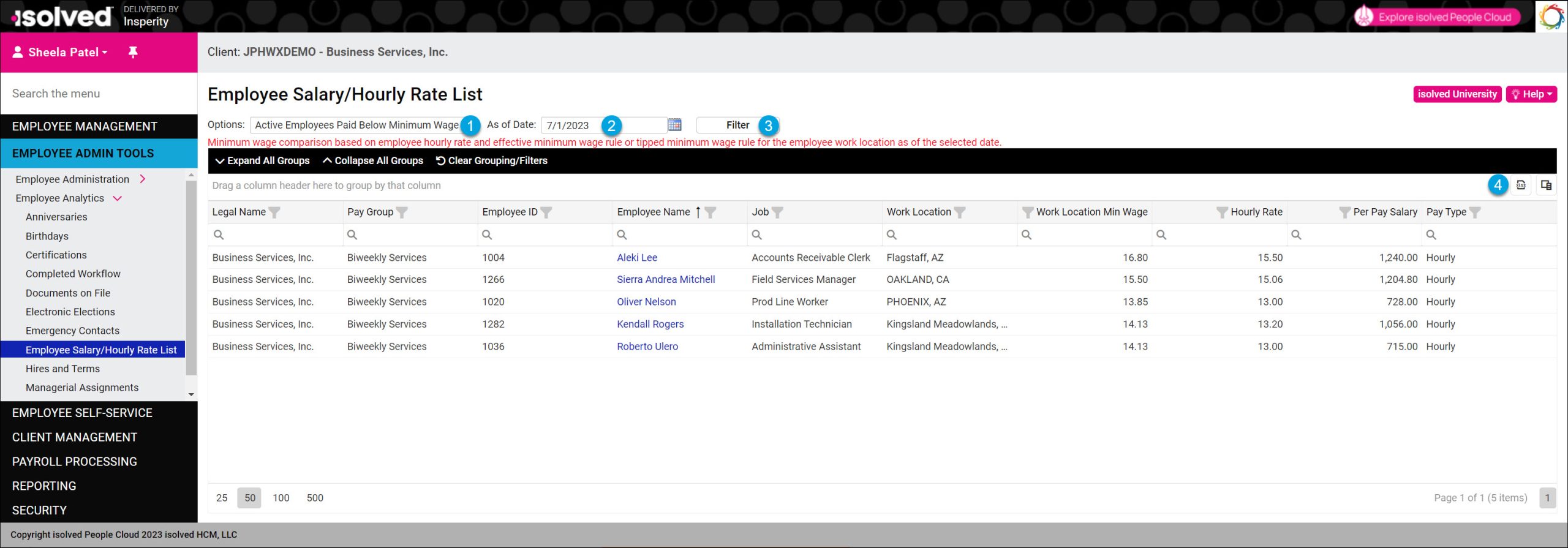

Tools are available in isolved People Cloud so you can easily identify employees who might fall below minimum wage in the future. The Employee Salary/Hourly Rate List in the Employee Analytics section of Employee Admin Tools provides a filter to show impacted employees on the date you select.

- On the Options menu, select Active Employees Paid Below Minimum Wage. This option reviews each employee based on their primary work location. If they are designated as a tipped employee on their job record, the system will use the tipped minimum wage instead of the regular minimum wage rate for the jurisdiction.

- Enter the effective date of the minimum wage rates you want to evaluate.

- Click Filter to apply your selections.

- Export your list to Microsoft Excel if you want to keep a copy or create a template to upload salary changes.

More Information

For more tools to leverage Insperity Workforce Acceleration to manage employee pay, see:

* These resources require access to isolved University. You will need to log in to view the content. This article can help if you need to register for the University.

If you have questions or need assistance accessing the content, please contact your Payroll Specialist.