Friday, February 28th, 2025

Highlights

isolved People Cloud version 11.02 includes isolved People Cloud version 11.02 includes important information about new security enhancements, an updated release schedule for AEE, multiple payroll and tax updates, improvements to the Hours Detail Export, and information about usability enhancements.

- Security / Identity enhancements to combat fraud

Adaptive Employee Experience (AEE)

- New Release Schedule for AEE Items

- Payroll Register Export by Date Range includes additional information

- Santa Fe and Santa Fe County minimum wage updates

- New withholding statuses for Utah Form W-4

- Additional Tax information is now displayed in Individual Time Entry

- Excessive Direct Deposits notification update

- Status update on the DOL-approved changes to the WH-347 Federal Certified Payroll report

- Biweekly Certified Payroll Report (WH-347) enhanced to include contractor/subcontractor status

- Hours Detail Export enhanced to include timesheet verification information

Human Resources

- Client Job screen and Workers’ Comp Classification

- Subtle screen updates provide a fresh look and feel

Security

Security / Identity enhancements to combat fraud

To further enhance the security of your People Cloud account, we are introducing two important updates you need to be aware of. These features will help safeguard accounts by proactively detecting security risks and alerting users of any suspicious activity.

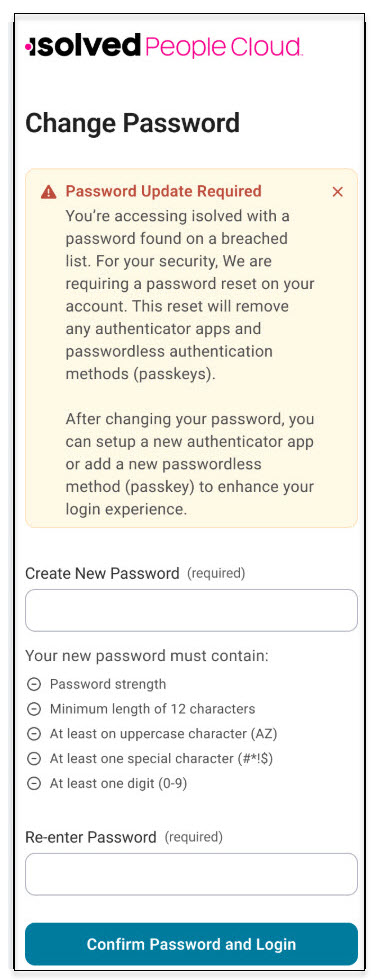

Breached Password Protection feature – live on Thursday, February 27th

Automatic Detection – Our system continuously checks passwords against a comprehensive third-party database of known breaches. If a compromised password is detected, it will be flagged automatically.

Mandatory Password Change – Users with breached passwords must update their password upon their next login.

Stronger Password Enforcement – If a user attempts to set a new password that is also on the breached list, they will be required to choose a more secure password.

Unrecognized device usage emails – live on Friday, February 28th

Enhanced Security Alerts – An email notification will be sent when an account is accessed from an unrecognized device, helping them detect unauthorized access and take action if needed.

Detection Based on IP Address and Browser – The system will assess login activity based on IP address and browser data with plans to incorporate additional security factors in the future for even greater accuracy.

Adaptive Employee Experience (AEE)

New Release Schedule for AEE Items

AEE items will now be released at 2:15 p.m. EST on the Monday following the standard regular release date on Fridays.

Payroll & Tax

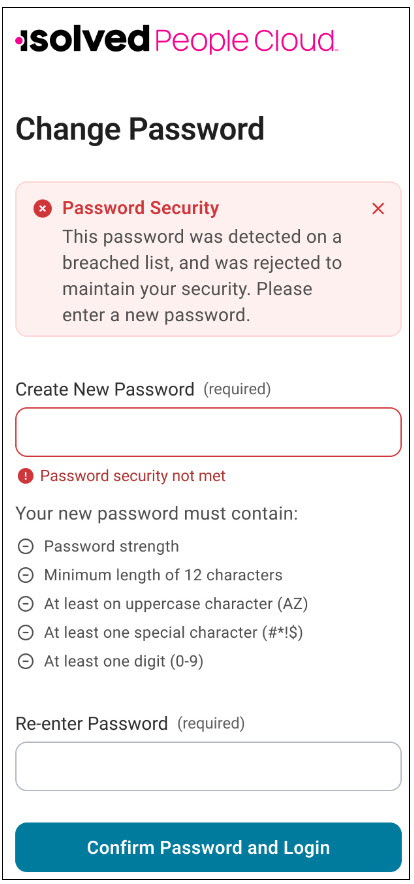

Payroll Register Export by Date Range includes additional information

The following columns have been added to the Employee Date Range Totals tab of the Payroll Register Export by Date Range:

- Status

- Birthdate

- SSN

- Hire Date

- Term Date

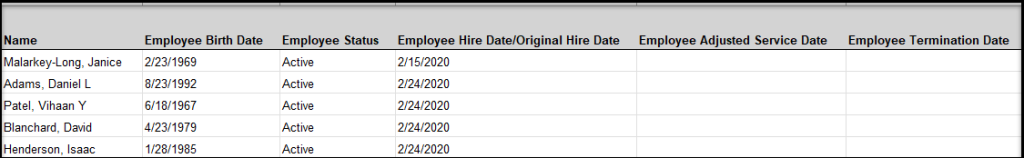

Minimum Wage Updates

New Mexico Minimum wage changes in these jurisdictions are included in this release:

These minimum wage rate changes will not automatically update employee salary records. See Reviewing pay information for minimum wage compliance to learn how Workforce Acceleration can help you stay in compliance with minimum wage changes.

Utah withholding certificate W-4 Update

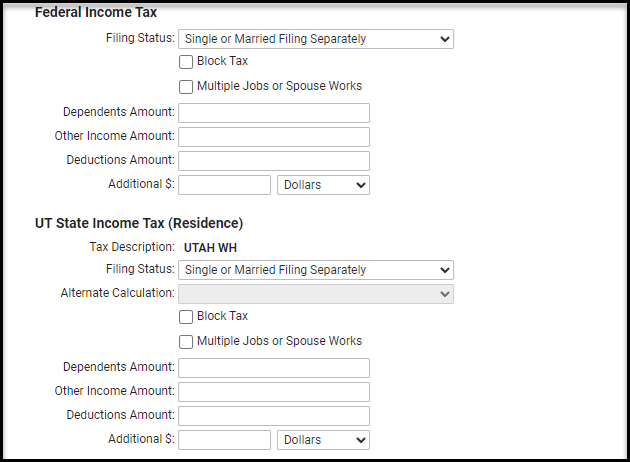

With this release, the Utah State Income Tax withholding certificate W-4 has been updated to align with the Federal W4 form. The following fields will display if your employee has one of the following filing statuses: UT-Single or Married Filing Separately, UT-Married filing jointly, or UT-Head of household:

- Multiple Jobs or Spouse Works

- Dependents Amount

- Other Income Amount

- Deductions Amount

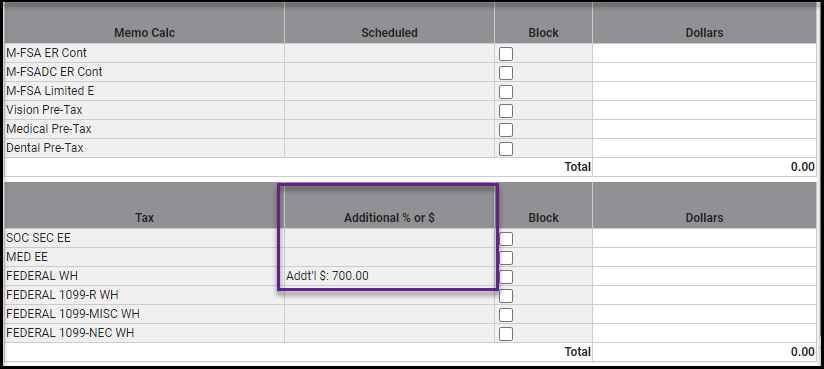

Individual Time Entry screen enhancement

An enhancement has been made to the Individual Time Entry screen. Prior to this release, when an employee had additional tax amounts and/or percents, they were not displayed in the Additional % or $ fields on the screen. With this release, additional tax information will now be displayed in the appropriate columns for all taxes.

Direct Deposit notification update

An update has been made to a recent enhancement targeted at reducing fraudulent direct deposit activity. Originally Client Users received a notification when ten percent or more of the employees being paid in a pay group had updated their direct deposit accounts. Due to the size of many of our clients, the ten percent threshold was triggering too many alerts.

The following changes have been made:

- Payrolls with fewer than 31 paid employees: If there are more than 3 employees with Direct Deposit changes, a notification will be sent.

- Payrolls with more than 30 paid employees – a notification will be sent if 10% or more employees change their Direct Deposit information.

Certified Payroll Report (WH-347) updates

DOL approved changes to the WH-347 Federal Certified Payroll report

On January 6, 2025, the Office of Management and Budget (OMB) approved changes to the WH-347 Federal Certified Payroll report to enhance clarity, simplify reporting, and ensure accurate representation of prevailing wages and fringe benefits. We are aware of these changes and are working towards accommodating them in isolved. In the meantime, the DOL has confirmed businesses can continue using the previous version of the WH-347 with an expiration date of September 30, 2026.

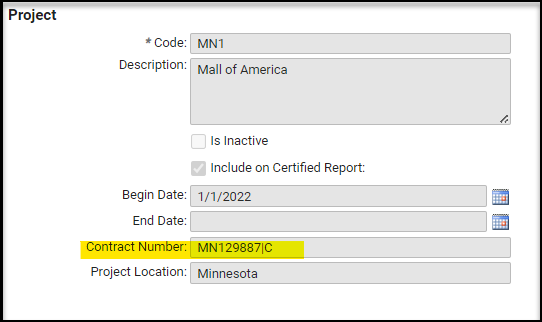

Biweekly Certified Payroll Report (WH-347) enhanced to identify Contractor / Subcontractor status

We have enhanced the Biweekly Certified Payroll Report (WH-347) in Client Reports to automate the identification of the Contractor or subcontractor for each project within the report.

If you are always the Contractor or Subcontractor for every project and would like this information automatically added to the Biweekly WH-347 form, please contact your Payroll Specialist so they can set this feature up for you.

If your role on a project may be one role or the other, you now have the ability to designate your role on a project-by-project basis.

To designate your role for a project, navigate to Client Management > Labor & GL > Labor Table and edit the Project labor field to view your list of projects. Edit the specific project for which you would like to designate your contractor/subcontractor status. In the Contract Number field add a “pipe” immediatley after the contract number and then a “C” to designate Contractor status or a “S” to designate Subcontractor status. To add a pipe, hold down the Shift key and press the pipe key which is normally found above the Enter key on your keyboard .

Time and Labor Management

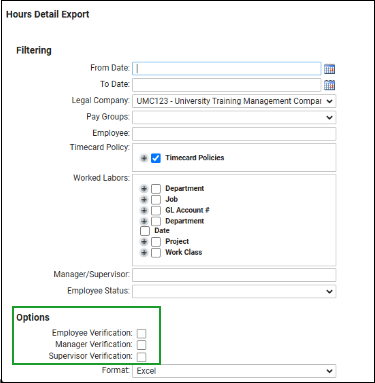

Additional Options added to the Hours Detail Export Date Range

Employee, Manager, and Supervisor Verification checkboxes have been added as Options on the Hours Detail Export by Date Range report screen. When one of the checkboxes is selected, the corresponding column will be included in the report and will display the date/time stamp associated with that individual’s verification of a timecard.

Human Resources

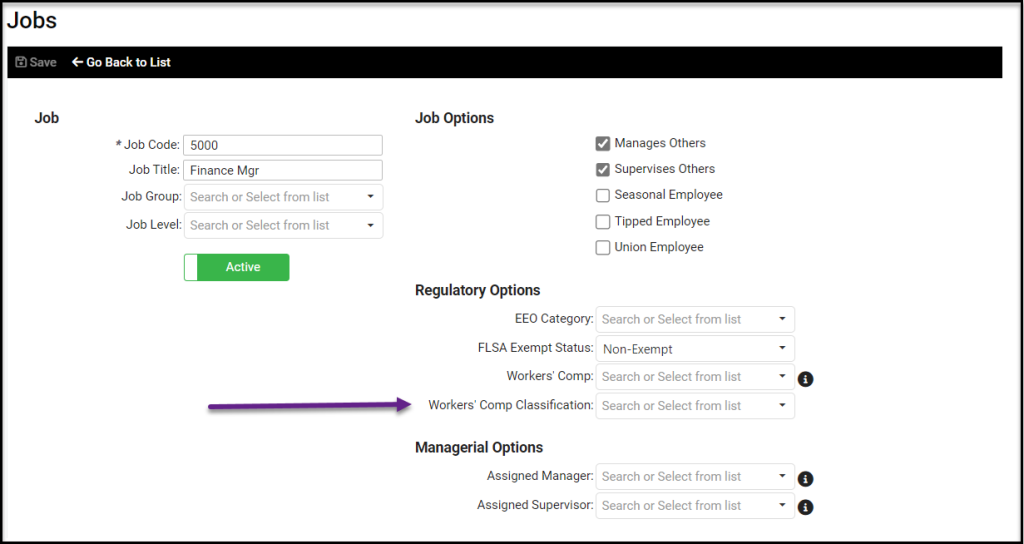

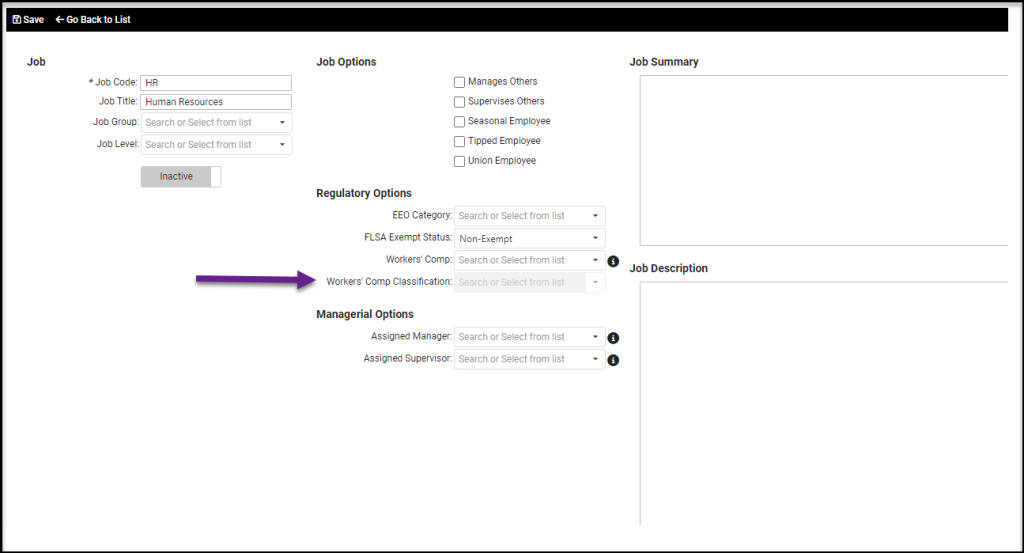

Client Job screen and Workers’ Comp Classification

Previously, the Workers’ Comp Classification field on the Jobs screen was able to be populated even when no Workers’ Comp code had been entered.With this enhancement, the Workers’ Comp Classification field is only enabled when there is a value in the Worker’s Comp field.

Usability

Subtle changes provide a fresh look and feel

Small updates aimed at improving usability are included in this release. This fresh look includes the following subtle design enhancements in isolved Classic View:

- Font & Spacing: Table headings, cell fonts, and row heights have been improved for better readability

- Clickable Text: Hyperlinks are now underlined to enhance discoverability

- Column Sorting: Sorted columns are now highlighted for better visibility

For more information about the changes in the 11.02 release, contact your Insperity Payroll Specialist.