Updated 05/01/2024

SB 1162 enhances the existing California pay data reporting system

Understanding the Legislation

On September 27, 2022, California Governor Gavin Newsom signed Senate Bill (SB) 1162, part of which expands California pay data reporting obligations. The goal of California’s SB 1163 Pay Equity law is to:

- Identify pay discrimination

- Analyze pay data and identify wage patterns

- Prioritize resources for enforcement

- Prosecute employers with inequitable practices

California law requires private employers of 100 or more employees (anywhere, as long as they have one employee in California) to annually report pay, demographic, and other workforce data to the Civil Rights Department (CRD), including:

- the number of employees within each establishment

- by race, ethnicity, and sex within each

- job category (for example, Professionals, Technicians, Laborers, and Service Workers)

- the number of employees within each of 12 specific pay band during the prior year.

SB 1162, which took effect on January 1, 2023, enhances the existing California pay data reporting system by requiring affected employers to:

- Submit a separate pay data report for employees hired through labor contractors if your company hired 100 or more contract workers in the last calendar year with at least one of those contractors being in California.

- Report the median and mean hourly rate for each combination of race, ethnicity, and sex for each job category.

In addition to these new employer obligations, SB 1162 eliminated the option for an employer to submit a federal EEO-1 report to the CRD to satisfy its state pay data reporting requirement and authorizes the CRD to obtain civil penalties against employers that fail to file their pay data reports timely.

Get your data ready!

The reporting deadline for the new pay data reports is May 8, 2024.

Senate Bill (SB) 1162 expanded pay data obligations may require you to make updates to your isolved data. Insperity is here to help. We will walk you through the process of verifying your data, step-by-step, to ensure you have the data required to run your CA pay data report.

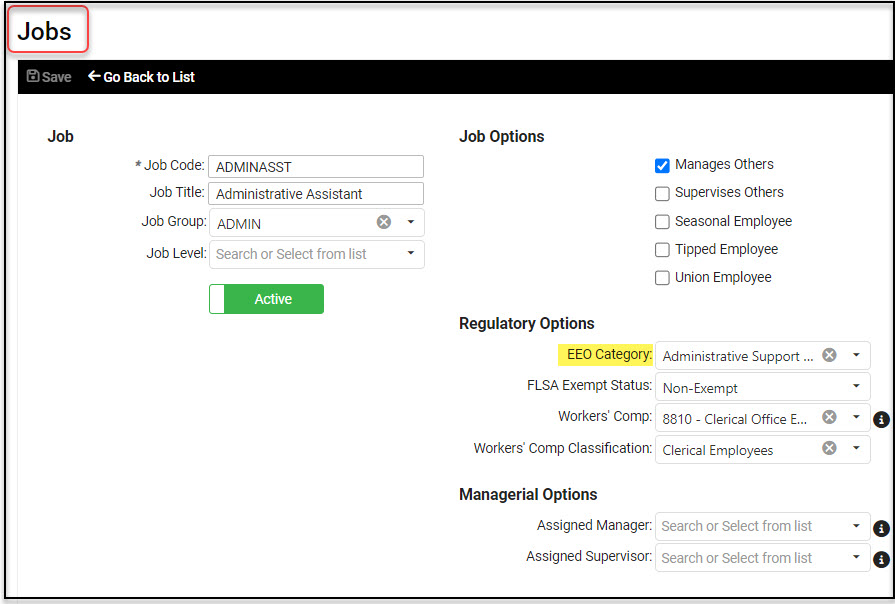

Requirement 1: All Jobs must have an EEO Category assigned

Navigate to Client Management > Job > Jobs and ensure the EEO Category is populated for all your jobs in isolved. Don’t forget to check any Jobs that may be inactive as well. If the job was active in the prior calendar year, it will need to have an EEO Category assigned as well.

Requirements 2 and 3: All employees must have a gender and ethnic origin assigned

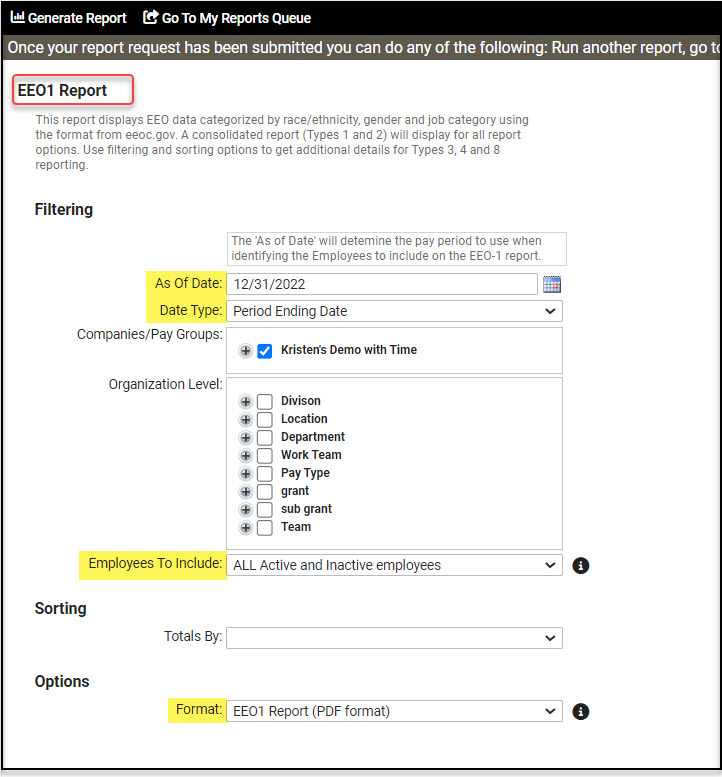

An easy way to identify where updates are needed is to run the EEO-1 report. Navigate to Reporting > Client Reports and select a Report Category of HR – Compliance to filter your report list. Select the EEO1 Report – As Of Date and enter the following report criteria:

- As Of Date: Enter the period end date for the payroll selected for your pay data report

- Date Type: Select “Period Ending Date”

- Employees To Include: Keep the default “ALL Active and Inactive employees”

- Format: Select the EEO1 Report (PDF format)

When viewing the report, page down and you will see a list of errors that need correction:

- All employees must be assigned a job

- All employees must have a gender and ethnic origin

Update your data

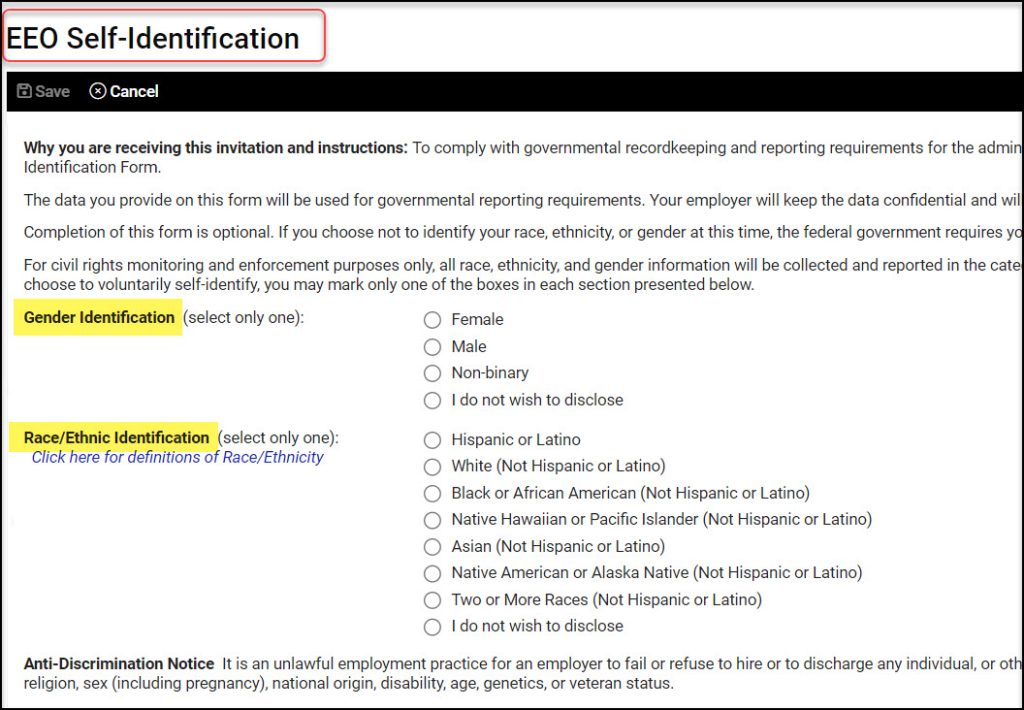

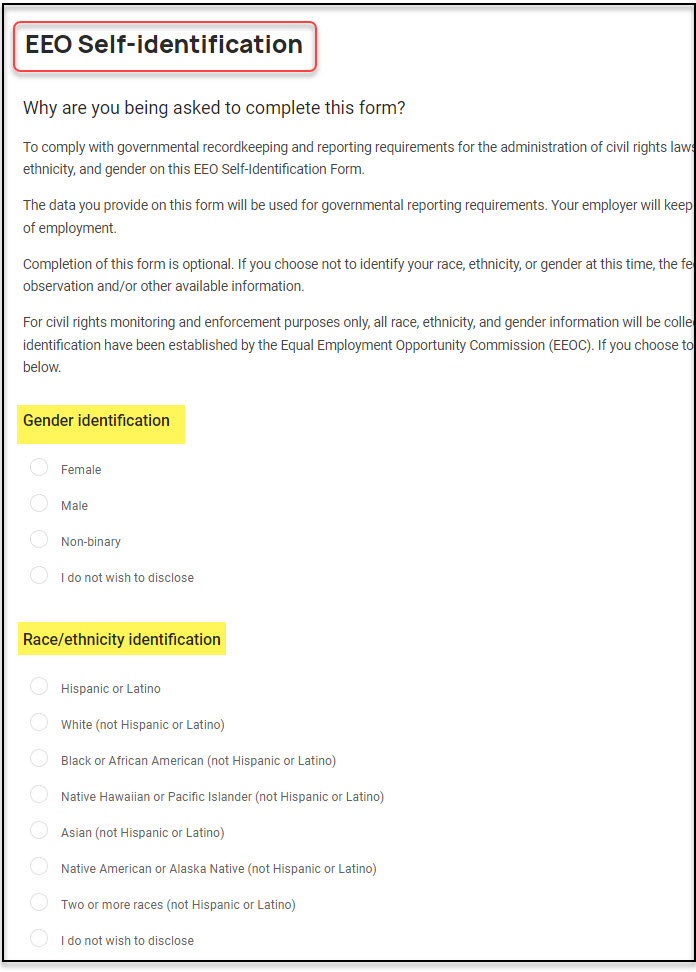

Ask your employees to add missing gender or ethnic origin data through employee self-service. If your employees do not have the security to make these updates, contact your Payroll Specialist and they can add the appropriate roles to allow this access.

Please note: if an employee is not comfortable answering the questions, they can select the option “I do not wish to disclose”, but the field cannot be left blank.

For clients using Employee Self-Service in Classic View, employees will navigate to Employee Self-Service > Federal Reporting Data > EEO Self-Identification to update their gender and race/ethnicity identification selections.

For clients using Employee Self-Service in the modern Adaptive Employee Experience (AEX), employees will navigate to Personal > Personal Information > Federal Reporting > EEO to update their gender and race/ethnicity identification selections.

Ensure all work locations are tied to an Establishment

Navigate to Client Management > Client Maintenance > Establishments and ensure all your work locations are tied to an establishment in isolved. If you already have an establishment created, verify all your work locations are associated with the establishment. If you need to create an establishment, click the Add New button to create your establishment and then select your work locations that you want to tie to your establishment.

Verify Remote Worker Counts

California implemented a new requirement to include remote worker data for the 2023 reporting year. For clients taking advantage of People Cloud’s Remote Worker feature, when you file your 2025 report the remote worker data will automatically pull in based on the snapshot period. Because isolved didn’t track remote worker status when payrolls were run in 2023, the report will pull in remote worker data based on the day the report was run. You can take advantage of the Employee Change Log or Employee Audit If you would like to audit your data to determine if any remote workers changed status between the snapshot period and the time you run the Pay Data Report.

Clients who are not taking advantage of People’s Cloud’s Remote Worker feature will have to manually enter the remote worker data into the Pay Data Report. Please contact your Payroll Specialist if you would like to take advantage of the Remote Worker feature.

Run your California Pay Data Report

Run your EEO1 Client Report again to verify all of your data has been updated. Look Good? Now you are ready to run your California Pay Date report. Navigate to Reporting > Client Reports and select the Report Category “Hr – Compliance” to easily access the CA Pay Data Report in isolved and submit it your data through the California Pay Date Reporting Portal.

For assistance with California Pay Data reporting, contact your Payroll Specialist.