For employers doing business in Oregon, Paid Leave Oregon contributions will begin with your January 3, 2023 pay date which may include a pay period that began in December 2022.

Using Workforce Acceleration to comply with Paid Leave Oregon legislation

- HR services through the HR resource center (requires log in) helps you understand how Paid Leave Oregon impacts your business

- Use the isolved People Cloud technology to collect and remit Paid Leave Oregon tax.

Understanding the Legislation

Paid Leave Oregon is a new program that was passed into law in 2019 and provides employees easy access to paid leave benefits for events that impact their families, health, and safety.

- Provides Oregon employees with up to 12 weeks off from work in a year. In some situations, they may be able to take up to two more weeks, for a total of 14 weeks. Paid Leave Oregon covers three kinds of paid leave: Family, Medical, and Safe Leave.

- The contribution rate for 2023 is 1% of gross wages up to $132,900.

- Employers and employees share the costs, which means you will pay 40% of the contribution and your employees will pay 60%. Your employees will participate in the program, no matter the size of your business.

- Small Employers, businesses with fewer than 25 employees, do not have to contribute to the program but do need to collect and remit their employee’s 60% contribution.

- Individuals who work full-time, seasonal, or part-time jobs, and those who work for more than one employer, will pay into the program.

- If an employer forgot to deduct employee contributions, they can retroactively deduct the contributions from the employee’s pay within the first quarter of noticing the mistake.

Important Dates

- January 1, 2023 – Date by which employers are required to notify their employees about the Paid Leave Oregon program.

- January 3, 2023 – Pay date for which Paid Leave Oregon contributions begin

- September 3, 2023 – Benefits will become available to workers.

Resources

- Oregon.gov Paid Leave Oregon

- Oregon.gov has an Employer Toolkit that includes several resources to help your employees navigate the upcoming changes, tools to give your employees, and more.

- Paid Leave Oregon Employer FAQs

Legislation FAQ

The size of the business is based on an average headcount of employees working in and outside of Oregon (part-time and full-time employees). This number doesn’t include any employees hired to temporarily replace eligible employees when they take paid leave.

Example: An Oregon company has three employees working in Oregon, 21 employees working in Idaho, and four working in Arizona. Because the company has 25 or more employees, they are subject to the employer contribution of 40% of the contribution rate. However, they will only pay the employer contribution on the three employee’s wages that work in Oregon.

Example: An employee has a hybrid schedule and routinely works remotely two or three days a week outside of Oregon.

Employees who have a hybrid schedule and whose work within Oregon is intermittent and irregular (temporary, transitory, or isolated in nature) will not contribute to Paid Leave Oregon on any of the wages.

Example: An employee has a hybrid schedule and works mainly from outside of Oregon and occasionally works in Oregon.

Employees who have a hybrid schedule and whose work outside of Oregon is intermittent and irregular (temporary, transitory, or isolated in nature) will contribute to Paid Leave Oregon on all wages earned in and outside of Oregon.

Example: An employee has a hybrid schedule and works mainly within Oregon but occasionally works in Idaho.

If an employer has 25 or more employees, they must pay the employer’s share of the contribution for employees who earn wages in Oregon. If an employer has fewer than 25 employees, the employer is not required to pay the employer’s share of the contribution for employees who earn wages in Oregon. However, employees working and living in Oregon would still pay the employee contribution.

Oregon residents who physically do all their work in another state do not pay contributions for Paid Leave Oregon and are not eligible for the program.

The Oregon quarterly tax forms will automatically be updated to show all wages eligible for contributions under Paid Leave Oregon, the employee count, and contributions due. Insperity will also file a Form 132, Oregon Employee Detail Report that includes paid leave subject wages. Form OQ and Form 132 together make up the Oregon Combined Payroll Tax Report. The Oregon Combined Payroll Tax Report is due on or before the last day of the month following the close of the calendar quarter.

You will likely not need to contribute to two states for the same employee. If your employee works primarily in Oregon, you will collect employee contributions and pay employer contributions into Paid Leave Oregon on all wages earned in Washington and Oregon.

The State of Oregon Employment Department is working with Washington to make sure they both follow the same rules for contributions, so employees do not have to pay twice.

Example: An Oregon company has three employees working in Oregon, 21 employees working in Idaho, and four working in Arizona. Because the company has 25 or more employees, they are subject to the employer contribution of 40% of the contribution rate. However, they will only pay the employer contribution on the three employee’s wages that work in Oregon.

• As a small employer, you are not required to pay the employer portion of Paid Leave Oregon contributions, but you will still need to submit your employees’ portions.

• Even though you do not make payments, your employees are still covered and get the same benefits.

• Payments are still taken from their paychecks, and you’ll still collect and submit them.

Paid Leave Oregon contributions will begin with your January 3, 2023 pay date which may include a pay period that began in December 2022. The employer of the contribution will be impounded with the rest of your tax obligations. Review the tax section of the Payroll Summary for details.

Wages for Paid Leave Oregon include:

• Salaries and hourly pay

• Piece rate and by the job pay

• Vacation, sick, and holiday pay, and paid time off (PTO)

• Bonuses, fees, and prizes from an employer

• Compensatory time and stand by pay

• Commission or guaranteed wage payments

• Sickness and accident disability payments

• Dividends and distributions for services

• Tips and gratuities

• Dismissal and separation allowance

• Compensation other than cash, such as room and board (except for agricultural and domestic employees)

• Fringe benefits, such as company vehicles, company paid parking, sick pay by third parties (e.g., insurance companies), and dependent care

You are automatically covered if:

• You work in Oregon; and

• You earned at least $1,000 the year before you apply for benefits; and

• You have a life event that qualifies you

This means that if you work a seasonal, full-time, or part-time job in Oregon, or for one or more employers, you may qualify. Many employees will get 100% of their wages replaced. Your benefit amount is based on your average wage in the previous year.

Paid Leave Oregon in isolved People Cloud

Implementing Paid Leave Oregon deductions

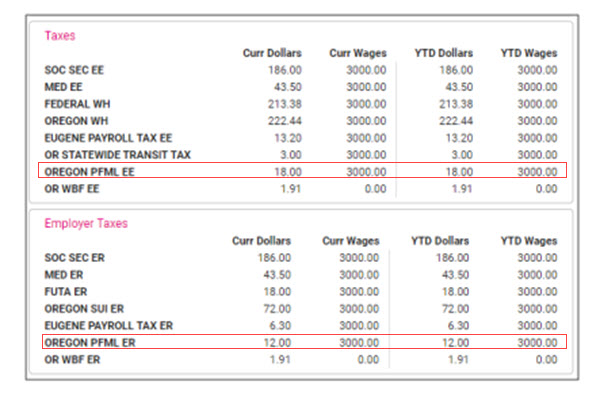

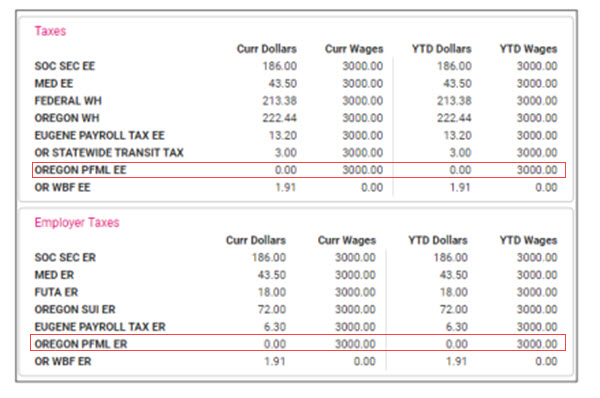

Effective 1/1/2023, the system will automatically add the OR – OR Paid Family and Medical Leave Employee and Employer to each legal company doing business in the state of Oregon. The rates will automatically be added and cannot be edited. Therefore, if an employee receives Gross Wages of $3,000.00, it would be multiplied by .6% and then divided appropriately between the employer and employee. See below:

Employers with less than 25 employees

Employers with less than 25 employees are not subject to the employer portion of the tax. Please contact your Insperity Payroll Specialist who will ensure the employer portion of the tax will not be taken.

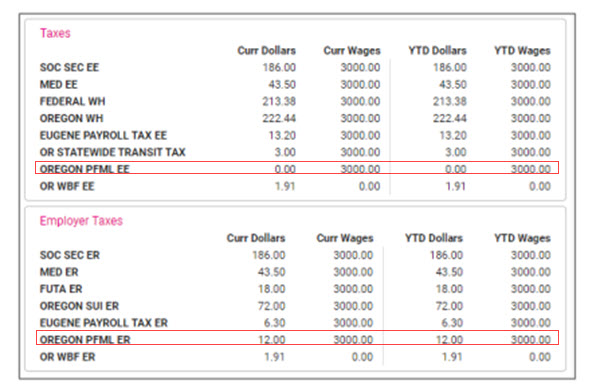

Since the employee must still pay the tax and the wages must still be reported, this will just block the tax calculation for the employer portion of the premium. See below:

Employers with approved private plans

If an employer has a state approved Private Plan, the employer is still required to report the employee wages and hours. Therefore, your Insperity Payroll Specialist will change the Tax Status for both the employee and employer portion to block the tax from calculating. This will stop the withholding, but the wages will still be reported.

The pay stub will still show the taxable wages for both the employee and employer portion of the OR- Paid Family and Medical Leave, but no tax will be withheld.

Block tax for certain employees

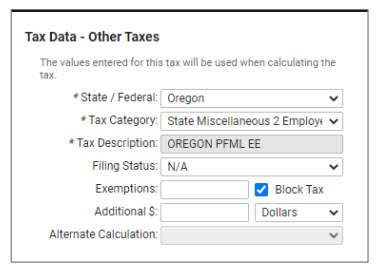

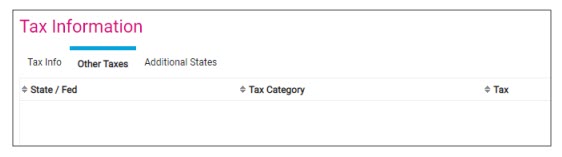

If an employee should not have tax withheld navigate to Employee Management > Employee Pay > Tax Information and click on the Other Taxes tab.

Click on the Add New icon and select the following:

• Select “Oregon” from the State / Federal drop-down menu.

• Select “State Miscellaneous 2 Employee” from the Tax Category drop-down menu.

• Put a check mark in the Block Tax option.