If you are an employer with a work location in California, Connecticut, Illinois, or New York, you may be subject to additional Federal Unemployment tax (FUTA) for 2022.

Employers fund State Unemployment Insurance (SUI) benefits through contributions to the state’s UI Trust Fund on behalf of each employee. They also pay Federal Unemployment taxes (FUTA) to the federal government for each employee. Generally, federal law provides employers with a 5.4% FUTA tax credit toward the 6.0% regular unemployment tax when they file their annual Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return. This generally results in a FUTA tax liability of 0.6% on the first $7,000 of eligible wages for each employee.

When states need additional money to pay unemployment claims, the United States Department of Labor (DOL) provides loans. If states have outstanding FUTA loans on January 1st for at least two consecutive years and cannot pay the loan balance by November 10th of the second year, they are subject to a credit reduction on their FUTA rate until the state has paid off the loan. Due to the impact of the COVID-19 crisis, these states had an outstanding federal loan balance for two consecutive years and failed to pay back the loans by the November 10, 2022 deadline, so the Federal Unemployment Tax (FUTA) credit will be reduced:

| Jurisdiction | FUTA Credit Reduction | Resulting FUTA Rate | Additional Tax (per EE) |

| California | 0.3% | 0.9% | Up to $21.00 |

| Connecticut | 0.3% | 0.9% | Up to $21.00 |

| Illinois | 0.3% | 0.9% | Up to $21.00 |

| New York | 0.3% | 0.9% | Up to $21.00 |

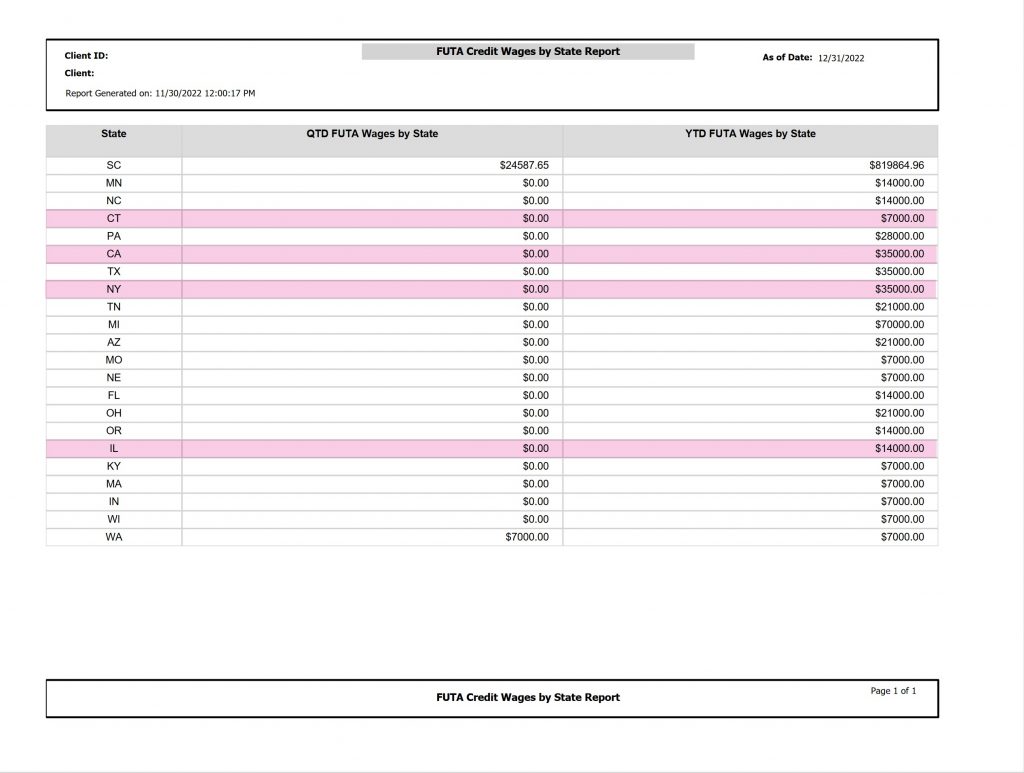

To determine if you are impacted by the FUTA credit reduction in these states, you can run the FUTA Credit Wages by State report in isolved People Cloud. This report is available in the Tax Report Category from Reporting > Client Reports.

If the report shows taxable wages in the YTD FUTA Wages by State column for California, Connecticut, Illinois, or New York, then you will be impacted.

The first payroll with a check date on or after Friday, December 2nd, 2022, will include the additional Federal Unemployment Tax (FUTA) payment for employees who work in the affected states.

If you do not plan to process any payrolls with checks dated on or after December 2nd, 2022, please contact your Payroll Specialist or Insperity Tax at IPS.Tax@insperity.com for assistance with a Federal Unemployment Tax (FUTA) adjustment to ensure compliance.

For more information about unemployment tax credit reductions, visit:

- https://www.irs.gov/businesses/small-businesses-self-employed/futa-credit-reduction

- https://edd.ca.gov/en/payroll_taxes/federal-unemployment-tax-act/

- https://www.ctdol.state.ct.us/uitax/futataxcreditreductions.htm

- https://www.osc.state.ny.us/reports/update-new-yorks-unemployment-insurance-trust-fund-challenges-continue