(updated 01/20/2026)

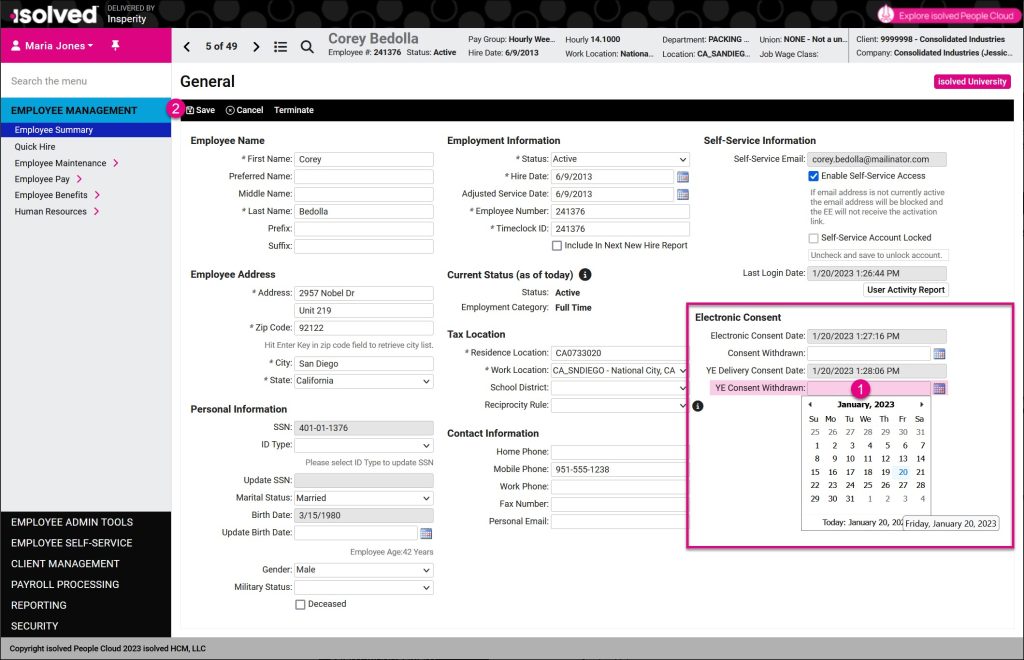

If an employee who has previously consented to electronic delivery of their tax forms would like to withdraw that consent, a client administrator will need to enter that on their General screen. To do this, go to Employee Management > Employee Maintenance > General, and select the employee.

Then, enter the date in the YE Consent Withdrawn field and click Save to capture the change.

For 2025 tax forms, employees’ consent status on the last payroll processed will determine if they can access their forms online.

- For employees who accepted electronic delivery by that date, their 2025 Form W-2, Wage and Tax Statement, or Form 1099-NEC, 1099 Non-Employee Compensation, will be available in the Adaptive Employee Experience (AEX) and ESS Classic View on Wednesday, January 21, 2026.

- For employees who had declined electronic year-end tax forms by that date, their paper W-2 or 1099-NEC forms will be mailed by Saturday, January 31, 2026.

Withdrawing consent for electronic delivery of year-end tax forms after their last payroll is processed will not result in employees receiving a mailed copy of their 2025 tax forms.

If employees change their mind after the 2025 tax year deadline, employers can print a paper copy of their W-2 or 1099-NEC forms from W2/ACA/1099 Forms on the Employee Self-Service menu on or after January 21, 2026 and provide it to them.