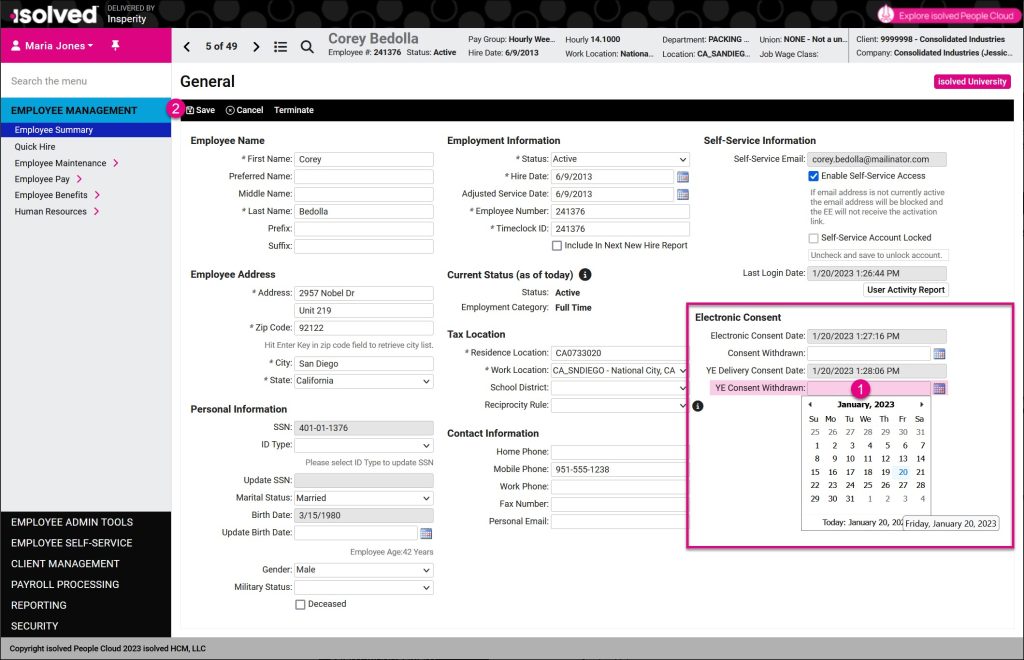

If an employee who has previously consented to electronic delivery of their tax forms would like to withdraw that consent, a client administrator will need to enter that on their General screen. To do this, go to Employee Management > Employee Maintenance > General, and select the employee.

Then, enter the date in the YE Consent Withdrawn field and click Save to capture the change.

For 2023 tax forms, employee’s consent status on January 15, 2024 will determine if they can access their forms online.

- For employees who had accepted electronic delivery on that date, their 2023 Form W-2, Wage and Tax Statement or Form 1099-NEC, 1099 Non-Employee Compensation will be available in the Adaptive Employee Experience (AEX) and ESS Classic View on January 19, 2024.

- For employees who had declined electronic year-end tax forms on that date, their paper W-2 or 1099-NEC forms will be mailed on January 31, 2024.

Withdrawing consent for electronic delivery of year-end tax forms after January 15, 2024 will not result in employees receiving a mailed copy of their 2023 tax forms.

If employees change their mind after the 2023 tax year deadline, employers can print a paper copy of their W-2 or 1099-NEC forms from W2/ACA/1099 Forms on the Employee Self-Service menu on or after January 19, 2024 and provide it to them.

Updated 09/23