In the modern workforce, employees expect to find the critical information they need electronically on any device: phones, tablets, and computers. As an Insperity Workforce Acceleration (WX) client, you can easily offer online tax forms to your employees and meet compliance requirements for electronic consent.

If you don’t already offer this option to your employees, you can follow these steps to empower employees to receive their W-2s, 1099-NECs, and 1095 ACA forms electronically in the Adaptive Employee Experience (AEX) and ESS Classic View:

- Ask your assigned payroll specialist to activate this feature for your company.

- Confirm that you have received notification from your payroll specialist that the activation is successful.

- Make your employees aware of this option available to them and encourage them to log in to Employee Self Service in isolved to complete their consent to receive their year-end forms electronically.

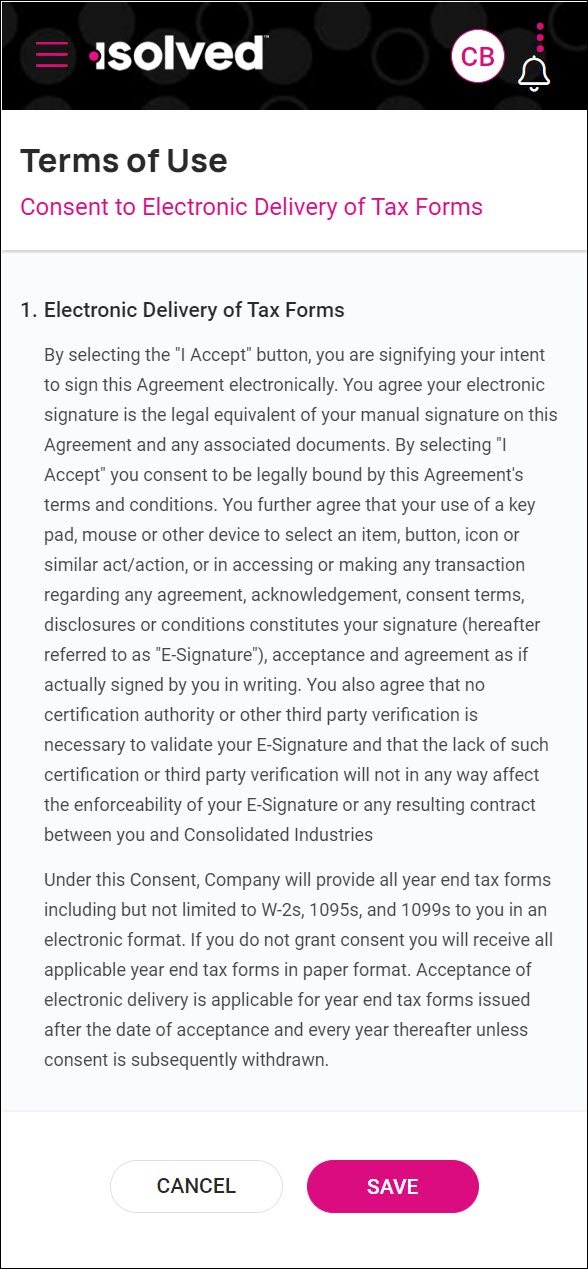

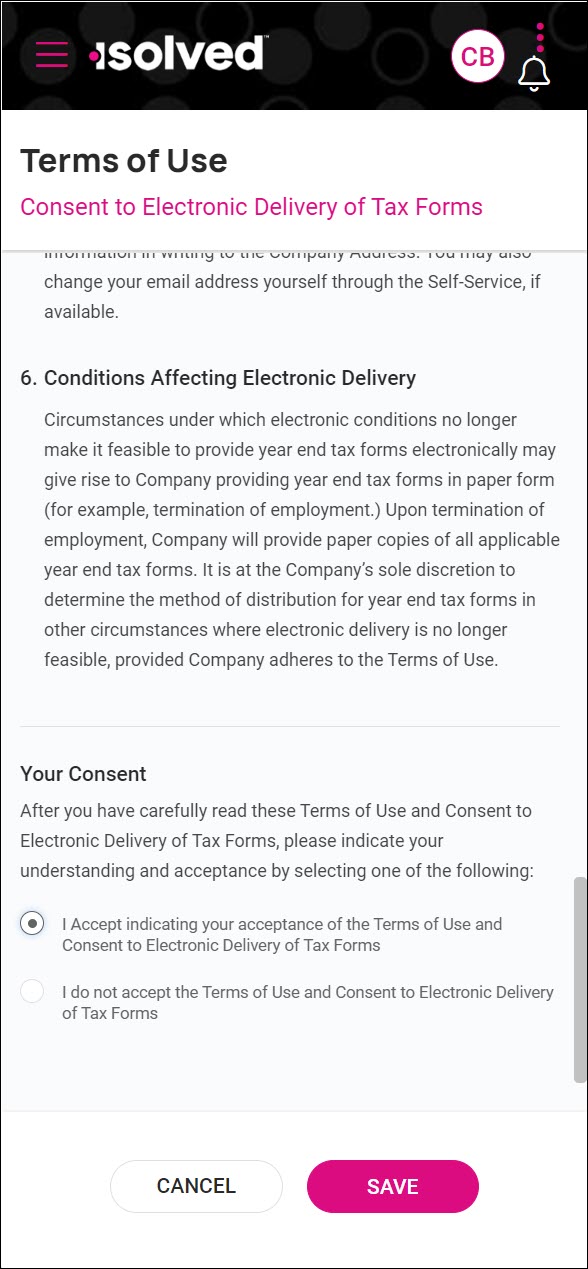

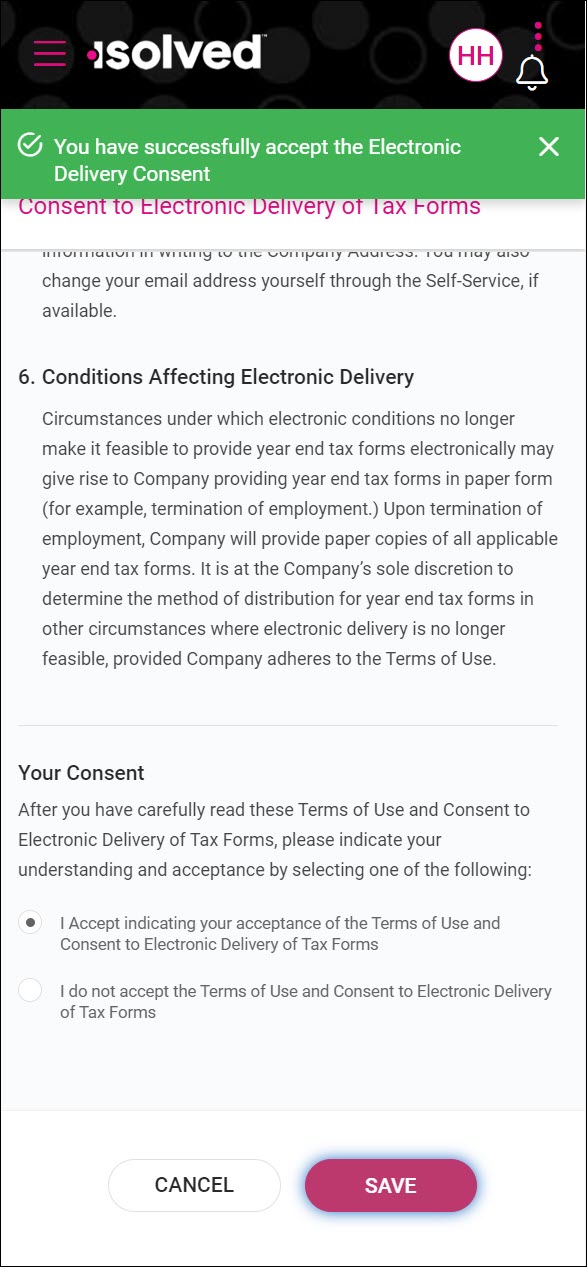

Once your payroll specialist has activated this feature for you, employees will see a pop-up notification the next time they log in to Employee Self Services asking them to provide consent to receive year-end forms electronically.

All new employees will receive the same option to elect online year-end forms when they log into the Adaptive Employee Experience (AEX) or ESS Classic View for the first time.

They will need to scroll to the end of the message and accept or decline consent to electronic delivery of year-end tax forms.

|  |  |

The full text is available here.

For employees who opt-in to receive their tax forms electronically, printed copies of these forms will not be mailed.

How to notify employees that this option is available to them

Here’s a sample email communication we have prepared that you can use to notify your employees if you will be enabling electronic delivery for the first time:

| SUBJECT: Electronic delivery of year-end tax forms is now available The next time you log in to the isolved Adaptive Employee Experience (AEX), a pop-up notification will give you the option to receive year-end tax forms (W-2, 1099-NEC, ACA 1095 form) electronically instead of waiting for them to be mailed. If you accept to give consent for electronic delivery of tax forms, you will see your W-2s and 1099s in the Year-End Tax Forms section of AEX in late January following the end of the tax year, according to IRS guidelines. If you decline, you will receive printed versions of your tax forms in the mail at the address listed in the Personal Information section of AEX. If you consented to electronic delivery of tax forms before December 27, 2023, you will be able to access your W-2 beginning on Friday, January 19, 2024. If you declined, paper copies of your W-2 will be mailed on January 31, 2024. |

Reminder: The option to choose electronic delivery is enabled during implementation for most clients. If so, all employees are offered the option when they initially register for the Adaptive Employee Experience (AEX), so no additional communication is necessary.

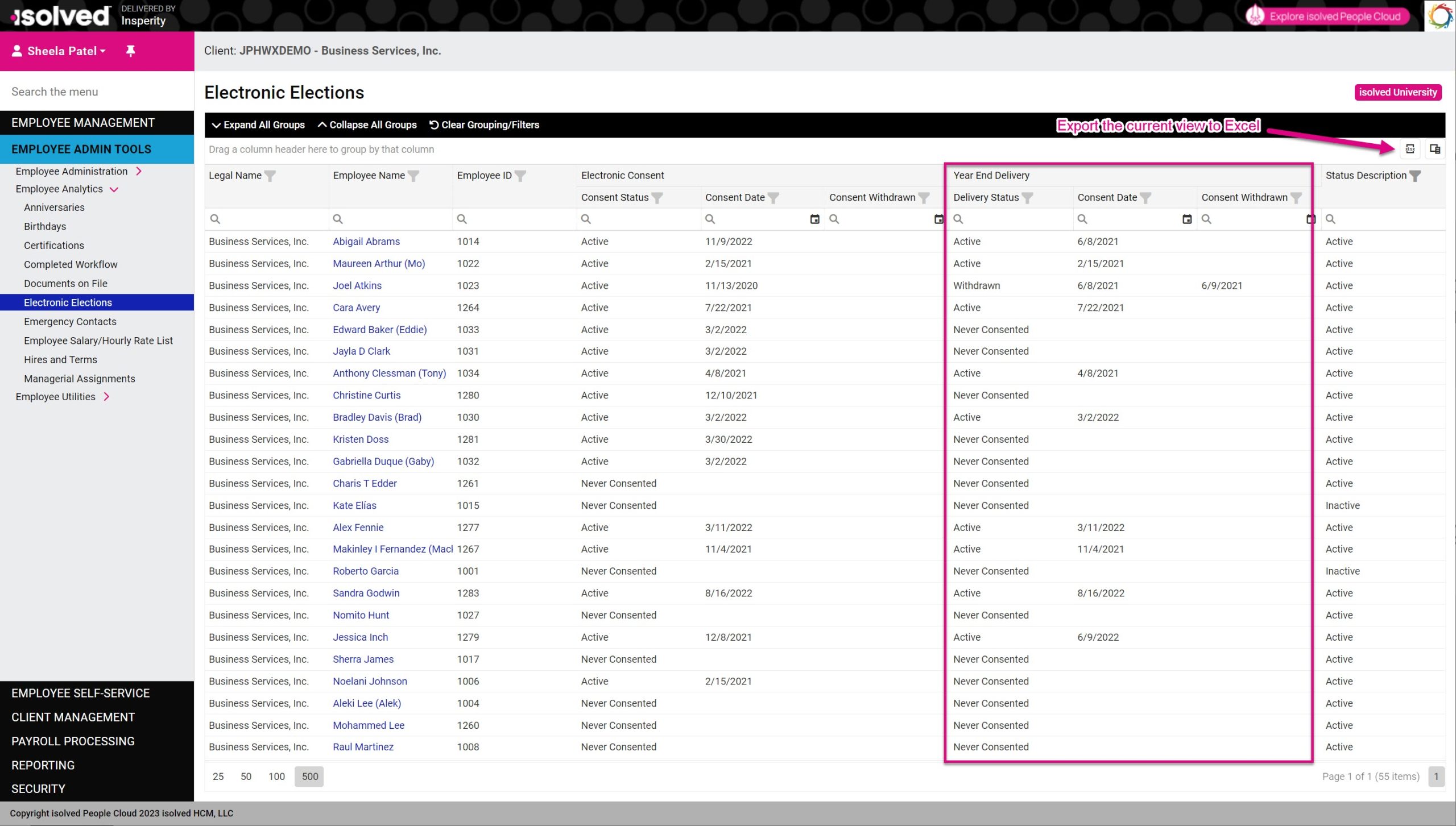

How to see which employees have consented to electronic delivery of their tax forms

The easiest way to review employee elections is by using the Electronic Elections dashboard on the Employee Admin Tools > Employee Analytics menu.

Like the other Analytics dashboards, you can:

- Use the column filters to narrow your view to specific employee populations

- Use the Field Chooser to add additional columns like department and location

- Export your current view to Excel using the XLSX button

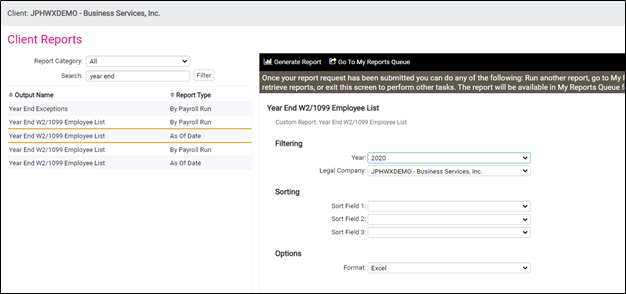

You can also use standard reports to see which employees have consented to electronic delivery of their tax forms. Go to Reporting > Client Reports and run the Year End W2/1099 Employee List report for the tax year you want to review.

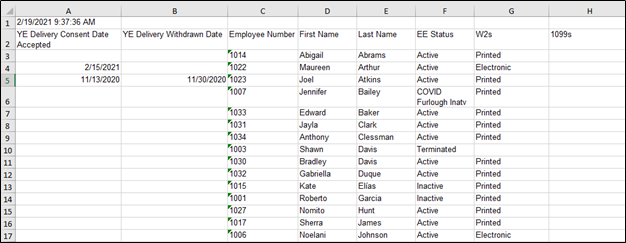

Column A of the report will display when the employee consented to the electronic delivery of tax forms. Column B will display if the employee previously consented to electronic delivery of their tax forms and then later withdrew their consent.

Additional Information

These resources in the isolved University provide more information about electronic year-end forms: