360° Retirement Integration automates data transmission to third-party retirement vendors. In order for Insperity HRCore™ clients to take advantage of this seamless integration, client administrators will need to work with their Insperity Payroll Specialist to ensure their isolved People Cloud system is configured to support their deferred compensation plans.

New Clients

For new clients who purchased 360° Retirement Integration with Insperity HRCore, integration is a component in your overall implementation plan.

- Intake

When you meet with your Intake specialist to review your business requirements during implementation, they will confirm you’re working with a third party recordkeeper for 360° Retirement Integration,- Let them know which recordkeeper you’re using so they can document it in the notes for your implementation project team.

- Provide a copy of your retirement summary plan documents, including your Plan ID.

- Let your recordkeeper know that you purchased Insperity HRCore with 360° Retirement Integration, so you will be changing payroll providers and working with an Insperity integration specialist. Be sure to let them know that you’ve purchased Insperity HRCore, an Insperity traditional employment offering, so they know which Insperity integration option to enable.

- Project Management

When you meet with your Project Manager to begin implementation, they’ll review the discovery, configuration, and go live phases of your project.- Your Project Manager will assign an Integration Specialist and help schedule the Integration Kickoff call.

- Implementation

Once your implementation team is assigned, your payroll implementer will discuss your deferred compensation plans in discovery and build them during the configuration phase.- Payroll implementers will use the retirement summary plan documents, pay history, registers, and other documentation you provided in Intake to build your deferred compensation plans and loan employee contributions.

- Your Integration Specialist will hold an Integration Kickoff call in the discovery phase to outline the timelines for your 360° Retirement Integration project, review the deferred compensation setup, and make sure the configuration is complete to begin testing. We recommend inviting your recordkeeper so we can establish contacts and answer any outstanding questions about your setup.

- Your Integration Specialist will configure the integration mappings and work with you to determine when testing will begin. The payroll contribution data we need to begin testing the 180° outbound files is generated when you process payroll, so the earliest we can begin testing is your first live payroll.

- During testing, you’ll receive emails from your Integration Specialist and your recordkeeper asking you to confirm totals, review data, or answer questions. Please respond timely to keep your project on track.

- Recordkeepers don’t use test data to process contributions or fund employee accounts, so make sure you continue to provide reports to the recordkeeper so they have the data they need to make timely account deposits.

- Sometimes everything works perfectly in the first payroll test, but it’s more common to test for a few payroll cycles to ensure everything is working correctly. So you will probably transition to support while you’re in this testing phase. But you’ll continue working with the same Integration Specialist for the whole process.

- Since we test when you process payroll, the length of your test phase will depend on your pay frequencies and how many corrections are needed. Responding to your recordkeeper and Integration Specialist quickly is the best way to keep the project moving.

- Once your recordkeeper confirms that they’re successfully receiving payroll data in the test phase, your Integration Specialist will move you to live processing for 180° outbound files.

- From that point, information will flow seamless each time you process payroll.

- The Insperity TES Integration Team monitors all live integrations for errors, so we’ll reach out if anything comes up.

- Your Insperity Integration Specialist will enable the bidirectional 360° integration once you’re live.

- Since we can only test the inbound data exchange when employees make contribution changes in the recordkeeper’s site or establish new loans, this test phase might not happen right way.

- If you can run reports or get updates from the recordkeeper when employees make contribution or loan changes, provide your Integration Specialist with the names of those employees and what they changed so they can confirm the updates processed successfully.

- You can also confirm by checking the Deferred Compensation tab of the employee benefit records to see contribution election changes. Check the employee Deduction screen for loan updates.

Existing Clients

Existing Insperity HRCore clients can work with their Customer Success Specialist to add 360° Retirement Integration. Once you’ve signed your delivery order to purchase, we’ll begin the implementation.

- Integration Kickoff

- An Integration Specialist will be assigned when you purchase 360° Retirement Integration. They’ll send an introductory email with some times to meet for your Integration Kickoff call. They’ll ask for your current retirement plan documents to confirm your Plan ID and configuration so integration can work successfully.

- Let your recordkeeper know

- Let your recordkeeper know that you purchased 360° Retirement Integration. Be sure to let them know that you’re using Insperity HRCore, an Insperity traditional employment offering, so they know which Insperity integration option to enable.

- Share the contact information for your Insperity Integration Specialist and invite them to the Kickoff call so we can confirm integration timelines and answer any open questions.

- Deferred Compensation Configuration

- Your Integration Specialist will work with you and your Insperity Payroll Specialist to confirm your deferred compensation setup is complete in isolved People Cloud with all of the details needed for integration.

- Integration Configuration

- Your Integration Specialist will work with you and your recordkeeper to setup the integration mappings for your specific plans.

- Integration Testing – 180º outbound – Payroll contributions

- Once the configuration is complete, testing will begin with the next payrolls that are processed for each pay group. Each time you process payroll, the data will be sent to your recordkeeper in Test mode.

- Recordkeepers don’t use test data to process contributions or fund employee accounts, so make sure you continue to provide reports to the recordkeeper so they have the data they need to make timely account deposits.

- During testing, you’ll receive emails from your Integration Specialist and your recordkeeper asking you to confirm totals, review data, or answer questions. Please respond timely to keep your project on track.

- Sometimes everything works perfectly in the first payroll test, but it’s more common to test for a few payroll cycles to ensure everything is working correctly. Since we test when you process payroll, the length of your test phase will depend on your pay frequencies and how many corrections are needed. Responding to your recordkeeper and Integration Specialist quickly is the best way to keep the project moving.

- Once the configuration is complete, testing will begin with the next payrolls that are processed for each pay group. Each time you process payroll, the data will be sent to your recordkeeper in Test mode.

- Live processing – 180° outbound – Payroll contributions

- Once your recordkeeper confirms that they’re successfully receiving payroll data in the test phase, your Integration Specialist will move you to live processing for 180° outbound files.

- From that point, information will flow seamless each time you process payroll.

- The Insperity TES Integration Team monitors all live integrations for errors, so we’ll reach out if anything comes up.

- Testing and live processing – 360° inbound – Employee contribution and loan updates

- Your Insperity Integration Specialist will enable the bidirectional 360° integration once you’re live with the 180° outbound payroll contributions.

- Since we can only test the inbound data exchange when employees make contribution changes in the recordkeeper’s site or establish new loans, this test phase might not happen right way.

- If you can run reports or get updates from the recordkeeper when employees make contribution or loan changes, provide your Integration Specialist with the names of those employees and what they changed so they can confirm the updates processed successfully.

- You can also confirm by checking the Deferred Compensation tab of the employee benefit records to see contribution election changes. Check the employee Deduction screen for loan updates.

Complete Deferred Compensation setup for successful integration

Before data can flow between isolved People Cloud and your supported third-party retirement recordkeeper, your plan configuration and employee assignments must be complete and correct. The following configuration must be in place:

Deferred Compensation Plans

1. A deferred compensation plan needs to be set up by your Insperity Payroll Specialist. Once you provide a copy of your retirement plan documents, they will work with you to complete the plan configuration in isolved People Cloud.

Employee Deferred Compensation Benefits

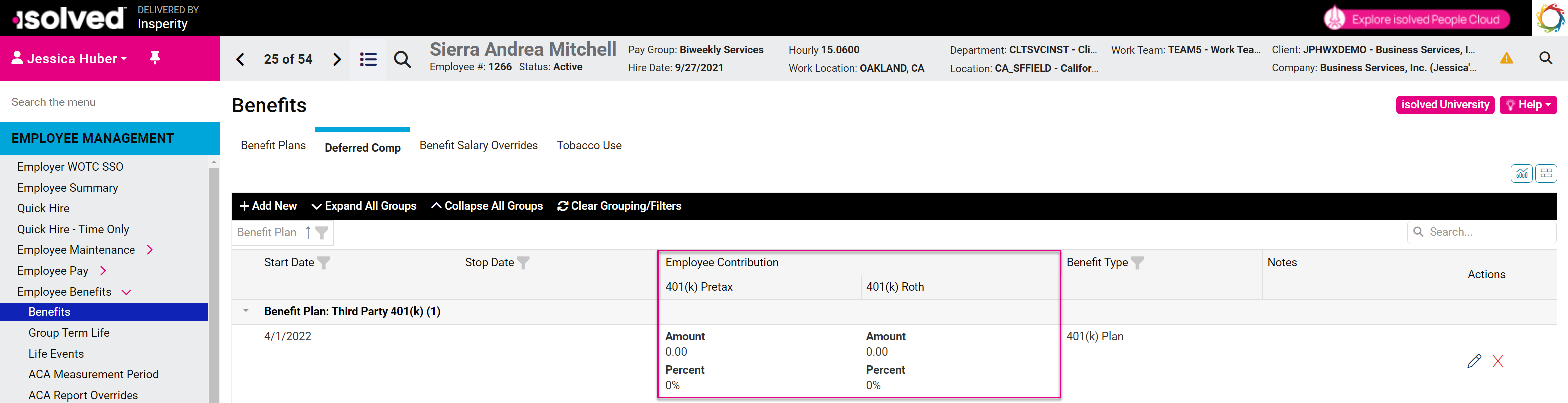

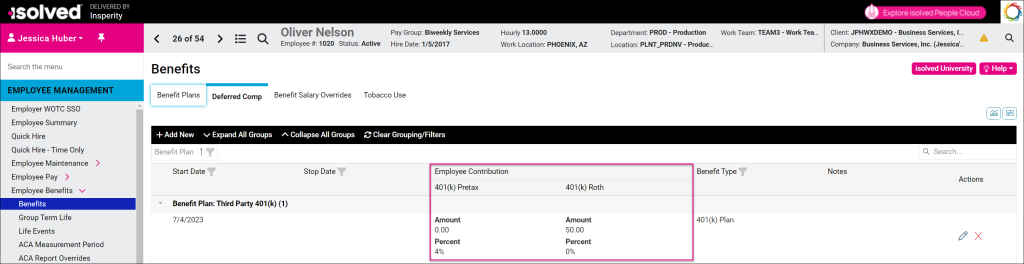

2. All plan-eligible employees should have a deferred compensation benefit plan record on their Employee Management > Employee Benefits > Benefits > Deferred Compensation tab.

Most clients choose to enable the automatic enrollment option that creates employee deferred compensation records for all eligible employees when payrolls are processed. Even if an employee is not currently contributing to the retirement plan, all eligible employees should have a record to ensure seamless integration.

In this example, Sierra has a 401(k) deferred compensation benefit record to indicate she’s eligible for the Third Party 401(k) but is not making contributions.

In this example, Oliver Nelson is participating in the Third Party 401(k) plan with a 4% pretax contribution and a $50.00 Roth contribution.

For more information on assigning employee deferred compensation plans manually, please refer to our article on Benefits Administration.

Employee Retirement Plan Loan Deductions

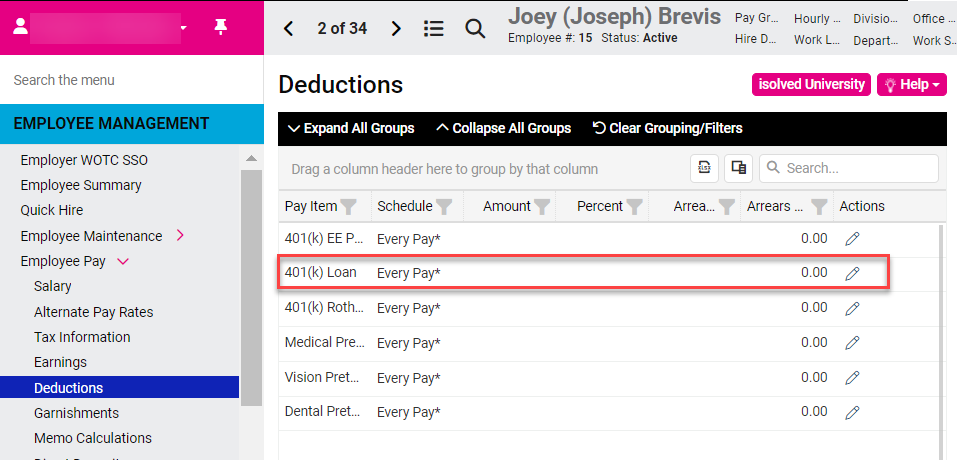

3. Add Reference Numbers to retirement loan deductions in isolved People Cloud.

To ensure successful loan updates with 360° Retirement Integration, the loan number on the employee’s isolved deduction must match the loan number at the third party retirement recordkeeper. For some recordkeepers this may be a unique code such as “383710347” while others may simply use “Loan 1.” Work with your recordkeeper to update any existing loan deductions.

You can enter this on Employee Management > Employee Pay > Deductions, as seen in the below screenshots. Remember to click “Save” when making any changes.

Once 360° Retirement Integration is live, loan numbers will automatically populate in the Reference Information field for any new loans that are added. This step is only required loan deductions that were already in place before the integration was enabled.

Please work with your Insperity Payroll Specialist if you need help with any configuration changes in isolved to prepare for 360° Retirement Integration.

More Information

For more tools to leverage Insperity HRCore for retirement plan administration, see:

* These resources require access to isolved University. You will need to log in to view the content. This article can help if you need to register for the University. If you are having trouble accessing the content, please contact your Benefits Specialist.