360° Retirement Integration automates data transmission to third party retirement vendors. In order for Workforce Acceleration clients to take advantage of this seamless integration, client administrators will need to work with their Insperity Payroll Specialist to ensure their isolved People Cloud system is configured to support the integration.

Before data can flow between isolved People Cloud and your supported third party retirement recordkeeper, the following configuration must be in place:

Deferred Compensation Plans

1. A deferred compensation plan needs to be setup by your Insperity Payroll Specialist. Once you provide a copy of your retirement plan documents, they will work with you to complete the plan configuration in isolved People Cloud.

Employee Deferred Compensation Benefits

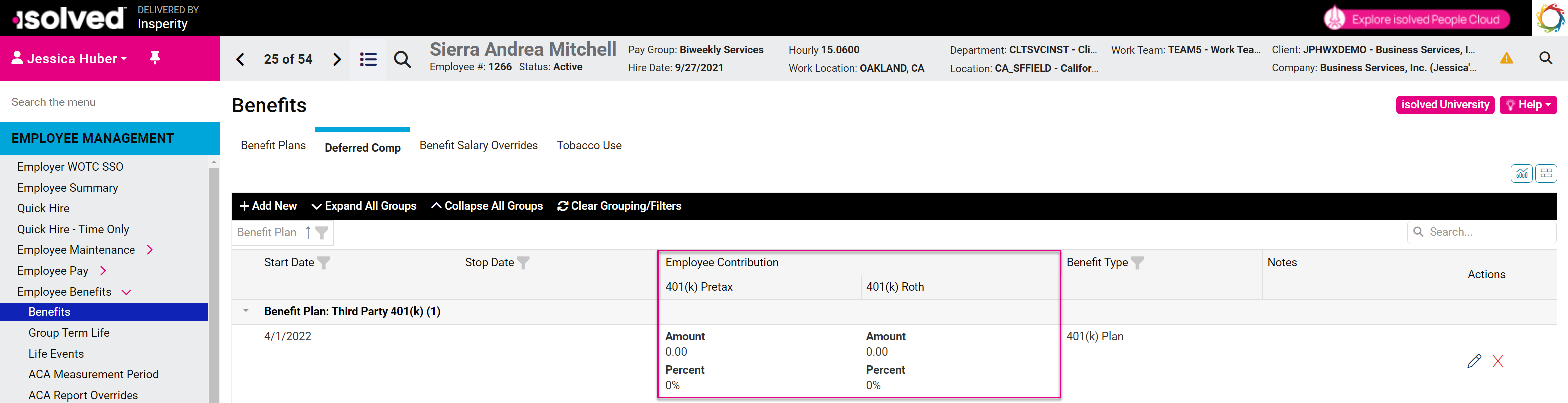

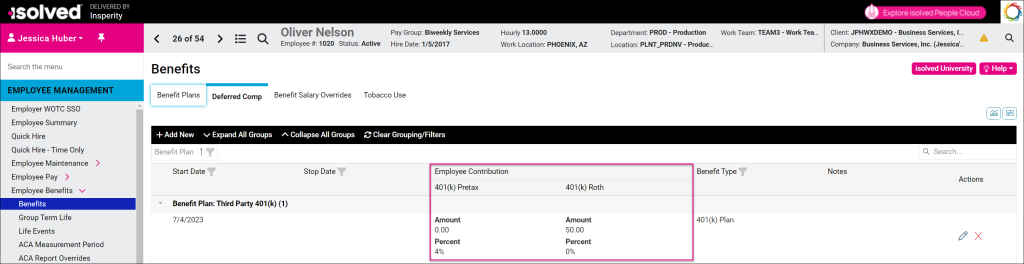

2. All plan-eligible employees should have a deferred compensation benefit plan record on their Employee Management > Employee Benefits > Benefits > Deferred Compensation tab.

Most clients choose to enable the automatic enrollment option that creates employee deferred compensation records for all eligible employees when payrolls are processed. Even if an employee is not currently contributing to the retirement plan, all eligible employees should have a record to ensure seamless integration.

In this example, Sierra has a 401(k) deferred compensation benefit record to indicate she’s eligible for the Third Party 401(k) but is not making contributions.

In this example, Oliver Nelson is participating in the Third Party 401(k) plan with a 4% pretax contribution and a $50.00 Roth contribution.

For more information on assigning employee deferred compensation plans manually, please refer to our article on Benefits Administration.

Employee Retirement Plan Loan Deductions

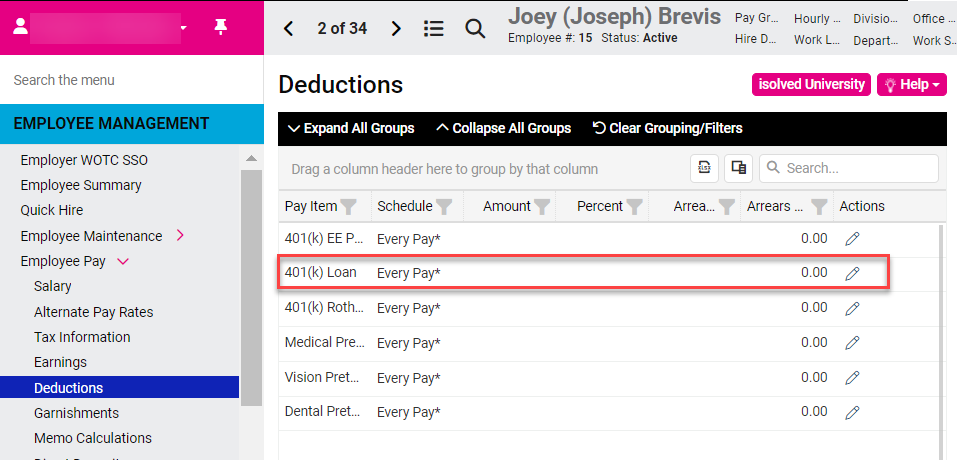

3. Add Reference Numbers to retirement loan deductions in isolved People Cloud.

To ensure successful loan updates with 360° Retirement Integration, the loan number on the employee’s isolved deduction must match the loan number at the third party retirement recordkeeper. For some recordkeepers this may be a unique code such as “383710347” while others may simply use “Loan 1.” Work with your recordkeeper to update any existing loan deductions.

You can enter this on Employee Management > Employee Pay > Deductions, as seen in the below screenshots. Remember to click “Save” when making any changes.

Once 360° Retirement Integration is live, loan numbers will automatically populate in the Reference Information field for any new loans that are added. This step is only required loan deductions that were already in place before the integration was enabled.

Please work with your Insperity Payroll Specialist if you need help with any configuration changes in isolved to prepare for 360° Retirement Plan Information.

More Information

For more tools to leverage Insperity Workforce Acceleration for retirement plan administration, see:

* These resources require access to isolved University. You will need to log in to view the content. This article can help if you need to register for the University. If you are having trouble accessing the content, please contact your Benefits Specialist.