Friday, June 21st, 2024

Highlights

isolved People Cloud version 10.11 includes information about the new Vermont Child Care Contribution tax and changes to the FSLA standard overtime salary threshold that are both effective July 1st, minimum wage and tax form updates, an update that extends the multi-factor verification window, and a new way of logging into Applicant tracking, as well as other small enhancements and fixes.

Payroll & Tax

- Minimum wage updates for Berkeley, California, Chicago, and Cook County in Illinois

- Fair Labor Standards Act (FLSA) changes to standard overtime salary threshold for “white-collar” exemptions

- Tax form updates for Colorado, Oregon, Michigan, and Pennsylvania

- California Pay Notice enhancement

- Vermont Child Care Contribution

Identity & Access Management

- “Remember this device” setting for multi-factor authentication extended from 12 to 26 hours

Time & Attendance

- Fix for occasional “orphan” time off requests

Applicant Tracking

- Logging into Applicant Tracking just got easier!

Payroll & Tax

Minimum Wage Updates

New minimum wage for Berkeley, CA, Chicago, and Cook County, IL

| State | Jurisdiction | Effective Date | Minimum Wage | Tipped Minimum Wage | Overtime Tip Credit | Notes |

| CA | Berkeley | 7/1/2024 | $18.67 | $18.67 | ||

| IL | Chicago | 7/1/2024 | $16.20 | $11.02 | $5.18 | Applies to any employer with 4 or more employees |

| IL | Cook County | 7/1/2024 | $14.05 | $8.40 | $5.65 |

These minimum wage rate changes will not automatically update employee salary records. See Reviewing pay information for minimum wage compliance to learn how Workforce Acceleration can help you stay in compliance with minimum wage changes.

FLSA Exemption Threshold Update

Minimum salary threshold for exempt employees effective July 1, 2024

On July 1st, 2024, the new minimum salary threshold for exempt employees set by the US Department of Labor Wage and Hour Division goes into effect and will increase to $844 per week ($43,888 annually).

To support this change, the “FLSA Exemption Threshold Report” has been enhanced to use the $43,888 annual value. Navigate to this Client Report and run it with an effective date of July 1st or later to determine which employees meet the new exemption requirements.

For further information about this change, including how to change an employee’s salary or exempt status in People Cloud, please see the White Collar Exemption FAQs article in the Insperity Help Center.

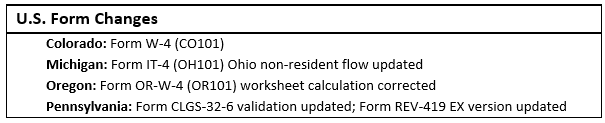

Tax Form Updates

Form updates for Colorado, Michigan, Oregon, and Pennsylvania

With this release, we’ve made updates to tax forms that are used in Onboarding and the Tax Updates screen in self-service. Here is the list of changed forms:

Please view this article for additional information about these changes.

California Pay Notice Enhancement

Regular Pay Day information captured for all pay schedules

The “CA Notice to Employee” and “CA Notice to Employee (Staffing Agency)” pay notices have been enhanced to capture the Regular Pay Day for all pay schedules. Previously, the Regular Pay Day field was blank for payrolls with a frequency other than “Weekly” or “Biweekly”.

Vermont Child Care Contribution Tax

New tax effective July 1, 2024

Vermont’s new Child Care Contribution (CCC) tax goes into effect on July 1st, 2024. All employers required to remit Vermont Income Tax are subject to the CCC tax.

Key provisions:

- Employers are required to pay a 0.44% payroll tax on their employees’ wages paid on or after 7/1/24.

- Employers are required to pay the child care tax on all employee wages, whether full- or part-time.

- All wages subject to VT income tax withholding are also subject to this tax.

- Employees are not required to file or pay this tax, but employers may choose to deduct and withhold up to 1/4 of the contribution from employee wages (not more than .11% of any employee’s wages). The employer may also choose to withhold a smaller portion or not to withhold any amount from employees. There is no requirement for employers to withhold the same amount from every employee.

- If an employer chooses to deduct and withhold a portion of the tax from an employee, the amount withheld for the tax year will be reported in Box 14 of the employee’s W-2.

- Form WHT436, Quarterly Withholding Reconciliation will be updated to include the child care contributions and payments will be remitted in the same manner and frequency as Vermont income tax withholding.

For additional information, please see this article provided by the Vermont Department of Taxes.

Identity & Access Management

Update to the Multi-factor Authentication (MFA) Policy

MFA verification window extended to 26 hours

We are committed to continually improving your experience and security when accessing isolved People Cloud. Based on valuable feedback and ongoing efforts to optimize processes, an important update has been made to the Multi-Factor Authentication (MFA) policy:

The MFA verification window has been extended from 12 to 26 hours for users who choose the “remember this device” option.

Why This Change?

- Reduced Frequency: By extending the MFA window, you will need to authenticate less frequently, thus reducing the interruptions to your and your employees’ workday.

- User Convenience: A slightly longer MFA window provides more flexibility, especially for those working across varying schedules.

What You Need to Do

This change has been implemented automatically and you do not need to take any action.

Time & Labor Management

Time Off Requests submitted by not approved before a pay period is processed

Resolution for occasional “orphan” time off requests

This release resolves an issue that occasionally occurred when an employee initiated a time off request and the pay period was processed before the absence was approved. When this happened, the approved absence displayed in Employee Absences and on both the employee and admin calendars. However, when subsequent pay periods were processed, the approved absence was not deducted from the employee’s balance as anticipated, nor was it marked as “Processed.” Going forward, the approved absence from the previously processed pay period will be marked as “Processed,” and the corresponding amount will deducted from the employee’s balance during the subsequent payroll processing.

Applicant Tracking

Logging into Applicant Tracking just got easier!

Enhanced security and streamlined experience

We’re excited to announce an important update to our login process that will enhance your security and streamline your experience. We are consolidating the login credentials for both isolved Applicant Tracking and isolved People Cloud, making it easier to manage HR processes within a single, unified system.

Starting June 25th, you’ll be logging into isolved Applicant Tracking using your isolved People Cloud credentials. Here’s everything you need to know:

What is the Applicant Tracking/isolved People Cloud integration?

With this integration, you’ll log into Applicant Tracking using your isolved People Cloud account. This means that you can move seamlessly between the isolved People Cloud system and Applicant Tracking.

What You Need to Do

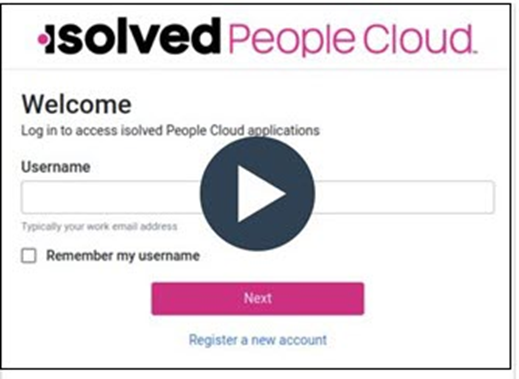

1. Logging In

If you already have an isolved People Cloud Account that matches the email address you use to log into Applicant Tracking, simply log into Applicant Tracking using your isolved People Cloud credentials starting June 25th. The Applicant Tracking login link remains the same but will look a little different.

Check out the brief video below for a sneak peek at the new look!

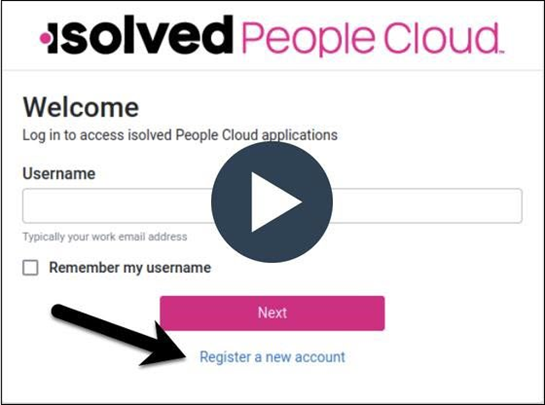

2. Connecting Your Account

If you do not have an isolved People Cloud account that matches the email address used to log into isolved Attract & Hire, you will need to register a new account with People Cloud.

Select Register a new account then follow the instructions to set up your People Cloud account.

Check out the video below to see the process in action!

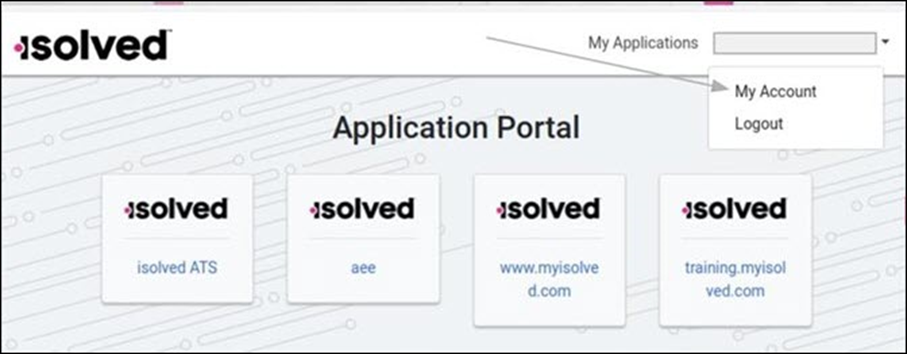

3. Managing Your Login Credentials

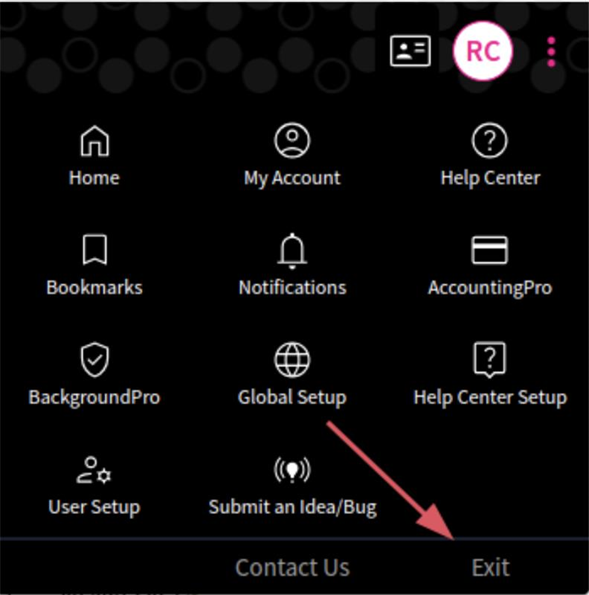

After you have registered and connected your Applicant Tracking account to People Cloud, your login credentials, name, and contact information will be managed by People Cloud. To manage this information:

- Go to the utility menu and click My Account.

- Click the Manage isolved People Cloud Login button to go to the isolved Application Portal.

- Click My Account in the Application Portal to make your changes.

Your changes will not take effect until you have logged out of both Applicant Tracking and People Cloud.

4. Exiting Applicant Tracking

From the utility menu, you will now see Exit instead of Logout. When you click Exit, you will leave Applicant Tracking, but you are not logged out of isolved People Cloud. When you return to Applicant Tracking while your isolved People Cloud session is still active, you will automatically be logged in. If your People Cloud session is no longer active when you return to Applicant Tracking, you’ll need to log in again.

For more information about the changes in the 10.11 release, contact your Insperity Payroll Specialist.