Friday, December 20th, 2024

Highlights

isolved People Cloud version 10.21 includes new menu options for self-service users to access features in ESS Classic View that have not been redesigned yet for mobile. Year-end changes to taxes and new paid leave plans that take effect in January are also included. Lots of exciting new features for Applicant Tracking are in this release as well.

Employee & Manager Self-Service

Adaptive Employee Experience (AEE), isolved People Cloud mobile app, and ESS Classic View

- Menu links are now available in the Adaptive Employee Experience (AEE) and isolved People Cloud mobile app to desktop-friendly features in ESS Classic View

- Tax Wizard updates for 2025 form changes in DC, Missouri, and South Carolina

- Performance has been improved for managers and supervisors when loading Pending punches

Payroll & Tax

- Additional minimum wages updates that start in the new year

- Federal withholding has been updated for nonresident aliens effective January 1, 2025

- State tax changes that take effect for payrolls processed after 1/1/2025 in: Alaska, Arkansas, California, Connecticut, Guam, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Maine, Michigan, Minnesota, Missouri, Northern Mariana Islands, Nebraska, New Mexico, Ohio, Oregon, South Carolina, Utah, US Virgin Islands, Virginia and Wyoming.

- Local tax changes that take effect for payrolls processed after 1/1/2025 for localities in: Kentucky, Ohio, and Pennsylvania.

- Status of Louisiana withholding rate changes for 2025

- Reminder! You must provide all additional payments and benefit updates that need to be reflected on 2024 W-2s to your Payroll Specialist immediately. They must be entered by December 31, 2024.

- Reminder! Unemployment and worker’s compensation rate changes must be provided to Insperity Tax Services.

Leave Management

- Delaware and Maine Paid Family Leave can be enabled now so you’re ready for the new year.

Benefits

- You can now import ACA employee overrides for ICHRA coverage using code 1S.

People Heroes University

- Access the current isolved System Status from the University.

Reporting and Analytics

- The FLSA Exemption Threshold report has been updated with minimum salary changes.

Applicant Tracking

- Product Updates educate users on product enhancements and integrations from the Career page within the platform.

- Non-Employee Job Sharers have been removed from internal jobs emails.

- Reminder! The legacy Employee Referral Portal will be retired on December 31.

- Do you want to beta test the new tailored hiring workflows?

- Font and typography changes in Applicant Tracking screens

- Apply Connect LinkedIn integration

Employee & Manager Self-Service

Access ESS Classic View features from the Adaptive Employee Experience (AEE) and isolved People Cloud mobile app

Menu links can now be enabled to access features that have not been redesigned yet for mobile

Adding menu links for all features into the Adaptive Employee Experience (AEE) makes it easier for managers, supervisors, and employees to move between the mobile-friendly versions and the desktop-friendly ESS Classic View. When menu links are enabled for legacy features, they will launch in a new browser tab on the user’s device, including mobile. While these menu links will be available in all platforms when they’re enabled, they’re still not optimized for mobile, so they may require additional scrolling on smaller screens.

The following features are now available as menu links that will launch ESS Classic View:

For employees:

- Personal

- Documents

- COBRA Documents – Employees can view their COBRA notices and other isolved Benefit Services COBRA Administration documents.

- Personal info

- Company Assets – Employees can view their assigned company property

- Misc Fields – Employees can update miscellaneous fields that have been configured for your organization

- Occurrences – Employees can view disciplinary infractions

- Prior Employment – Employees can view and update their work history

- Training & Development

- Awards – Employees can view or update the awards they have received.

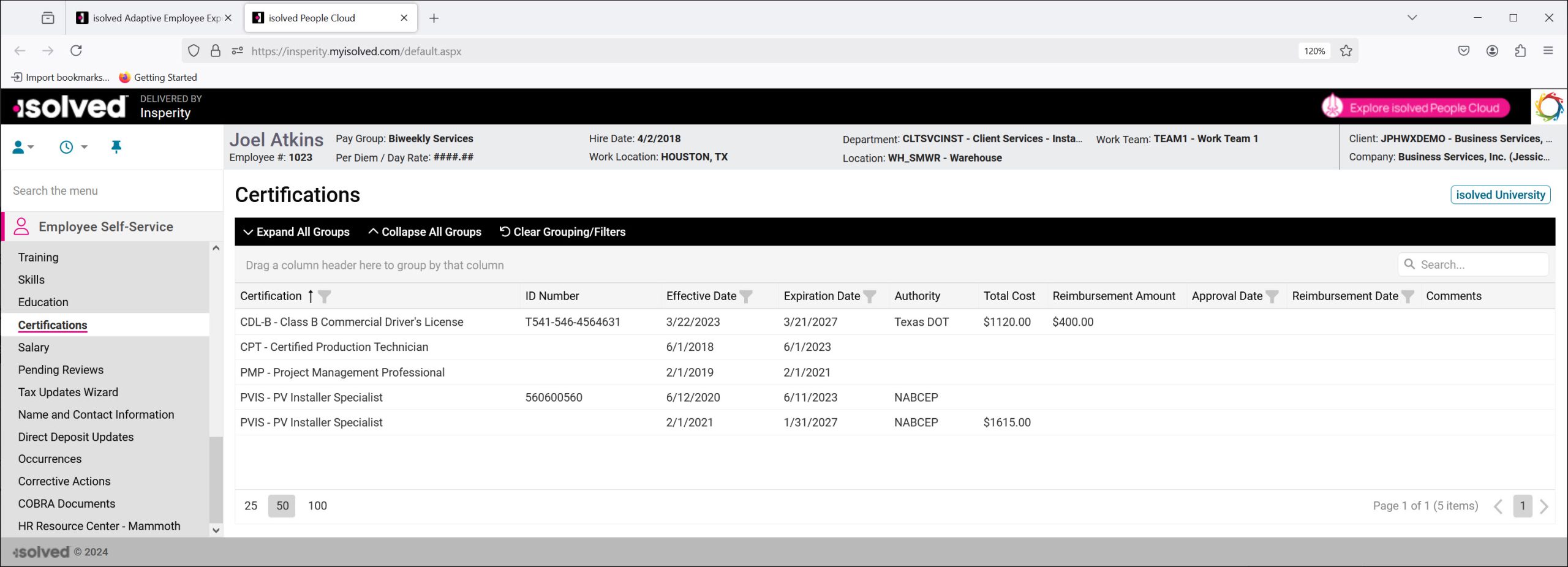

- Certifications – Employees can view or update their certifications and licenses.

- Corrective Actions – Employees can view disciplinary infractions and corrective actions taken in response.

- Education – Employees can view or update their education history.

- Skills – Employees can view or update work-related skills.

- Training – Employees can view or update their training history.

Note: This Training screen is not integrated with Insperity Training & Development powered by Absorb, so employees should continue to view their course history directly in the Insperity Training & Development platform. We don’t recommend enabling this option since it can create confusion for employees.

- Documents

- Pay and Tax

- Salary – Employees can view their current salary record details.

- Time and Attendance

- Time Card Spreadsheet View – Employees, supervisors, or managers can quickly enter enter new time records manually, including start times, end times, and labor values in a spreadsheet view.

- Team calendar – Employees can view holidays and absences for other members of their team.

- Coverage requests – For clients using Scheduling with collaborative features, employees can submit requests for coworkers to cover their shift or respond to coverage requests to pick up shifts.

- My Dashboard – Employees can access My Dashboard to review workflows including pending shift and schedule coverage requests, monitor time card alerts, review attestations, view a graph of scheduled vs. worked hours, or view a time card earning summary.

- Benefits

- Qualifying life events – Employees can submit qualifying life events like birth and marriage that allow changes to benefit elections.

- Benefit updates – Employees can submit changes to benefit contributions for plan types that do not require a qualifying event for updates, like HSA.

For managers and supervisors:

- Manage

- Tasks

- Pending Workflow – Managers and supervisors can view the status of pending employee transaction workflows that require their approval.

- Pending Employees – Managers and supervisors can initiate onboarding or perform their assigned tasks within the hiring workflow for their new direct reports.

- Pending Terminations – Managers and supervisors can initiate terminations or perform their assigned tasks within the offboarding workflow for their direct reports.

- Employees

- Employer

- Employment > More Details – Managers and supervisors can view and edit the current employment categories (i.e., FT, PT, etc.) or request employment category changes for their direct reports.

- Occurrences – Managers and supervisors can enter occurrences for disciplinary infractions.

- Salary Updates – Managers and supervisors can request salary changes.

- Position

- Job > More Details – Managers and supervisors can request employee job changes or updates to their existing job records.

- Organization and labor > More Details – Managers and supervisors can request updates to employee home organization and labor assignments, like department changes.

- Alternate Pay Rates – Managers and supervisors can add or update alternate pay rates for their employees.

- Absences

- History – Managers and supervisors can view the absence history for their direct reports.

- Accrual balance history – Managers and supervisorss can view the accrual transaction history for their direct reports.

- Comp time balance history – Managers and supervisors can view the history of accruals and balance updates to compensatory time for their direct reports.

- HR

- Company assets – Managers and supervisors and add, update, or delete employee company asset records for things like laptops, company-issued cell phones, etc.

- Employee notes – Managers and supervisors can view and add notes to their employee’s records.

- Employment status history – Managers and supervisors can view prior employment periods for employees who have been rehired.

- Misc data sets – Managers and supervisors can review, edit, and add new records to employee miscellaneous data sets.

- Misc fields – Managers and supervisors can review, edit, and update employee miscellaneous fields.

- Prior employment – Managers and supervisors can view and add prior employment history for their direct reports.

- Training & Development

- Awards – Managers and supervisors can view or assign awards to their direct reports.

- Certifications – Managers and supervisors can view or update their employee’s certifications and licenses.

- Corrective Actions – Managers and supervisors can view disciplinary infractions and record corrective actions taken in response.

- Education – Managers and supervisors can view or update their education history for their direct reports.

- Skills – Managers and supervisors can view or update work-related skills for their employees.

- Training – Managers and supervisors can view or update training courses their employees have taken.

Note: This Training screen is not integrated with Insperity Training & Development powered by Absorb, so managers and supervisors should continue to view their employee’s course history directly in the Insperity Training & Development platform. We don’t recommend enabling this option since it can create confusion for employees.

- Employer

- Tasks

- My Reports

- Managers and supervisors can run reports that have been enabled for their report group.

- Schedule

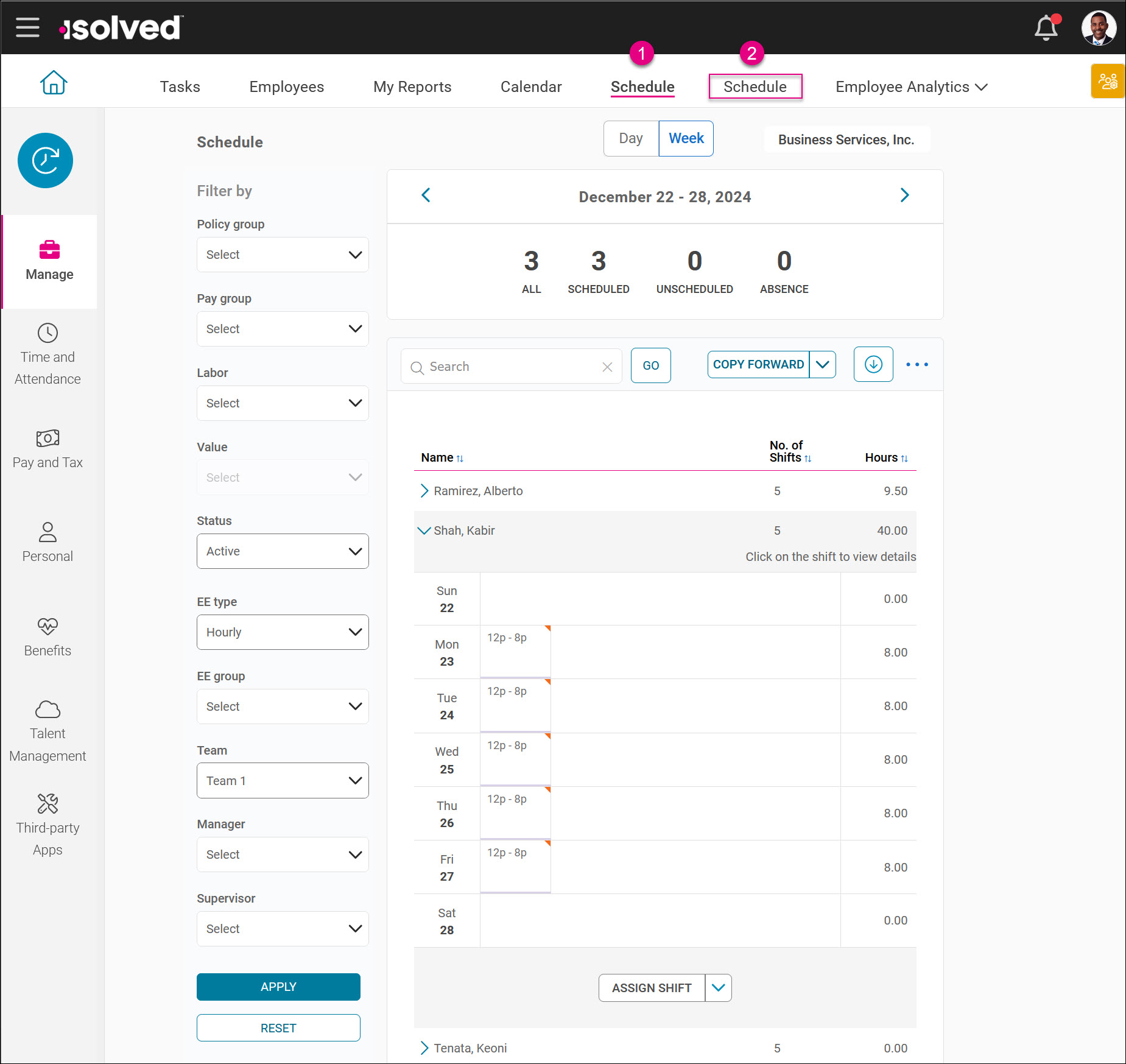

- Advanced collaborative and resource scheduling features – For clients using Scheduling, managers and supervisors can draft schedules that are waiting to be published, submit open shifts for employees to fill, Schedule by shift, or use the Staff Summary scheduling view to see if they’re under- or overstaffed for a particular shift.

Note: When this functionality is enabled, Supervisors and Managers will see two Schedule options in their Manage view. The first one provides access to the mobile-friendly options to add or edit schedules by employee. The second will launch the advanced scheduling features in ESS Classic View.

- Advanced collaborative and resource scheduling features – For clients using Scheduling, managers and supervisors can draft schedules that are waiting to be published, submit open shifts for employees to fill, Schedule by shift, or use the Staff Summary scheduling view to see if they’re under- or overstaffed for a particular shift.

- Employee Analytics – Managers and supervisors can access the Employee Admin Tools with links to ESS Classic View

- Anniversaries – Lists employee anniversaries by month.

- Birthdays – Lists employee birthdays by month.

- Certifications – Provides a holistic view of employee certifications with views for active and expired licenses and certifications.

- Completed Workflow – Provides the steps and details for all completed employee workflows.

- Documents on File – Search employee documents by category and subcategory.

- Electronic Elections – View employees who have consented to electronic signatures and year-end forms.

- Emergency Contacts – Provides a dashboard view of emergency contacts.

- Employee Salary/hourly Rate List – Review employee pay and find employees who are making below the minimum wage.

- Hires and Terms – Review employees hired or terminated within the selected date range.

- Managerial Assignments – Review manager and supervisor assignments for direct reports.

- Training – Review completed training for employees.

Note: This Training dashboard does not include courses completed in Insperity Training & Development powered by Absorb. It is not recommended to enable this analytics option since it can create confusion. Instead, review completed training in Insperity Training & Development.

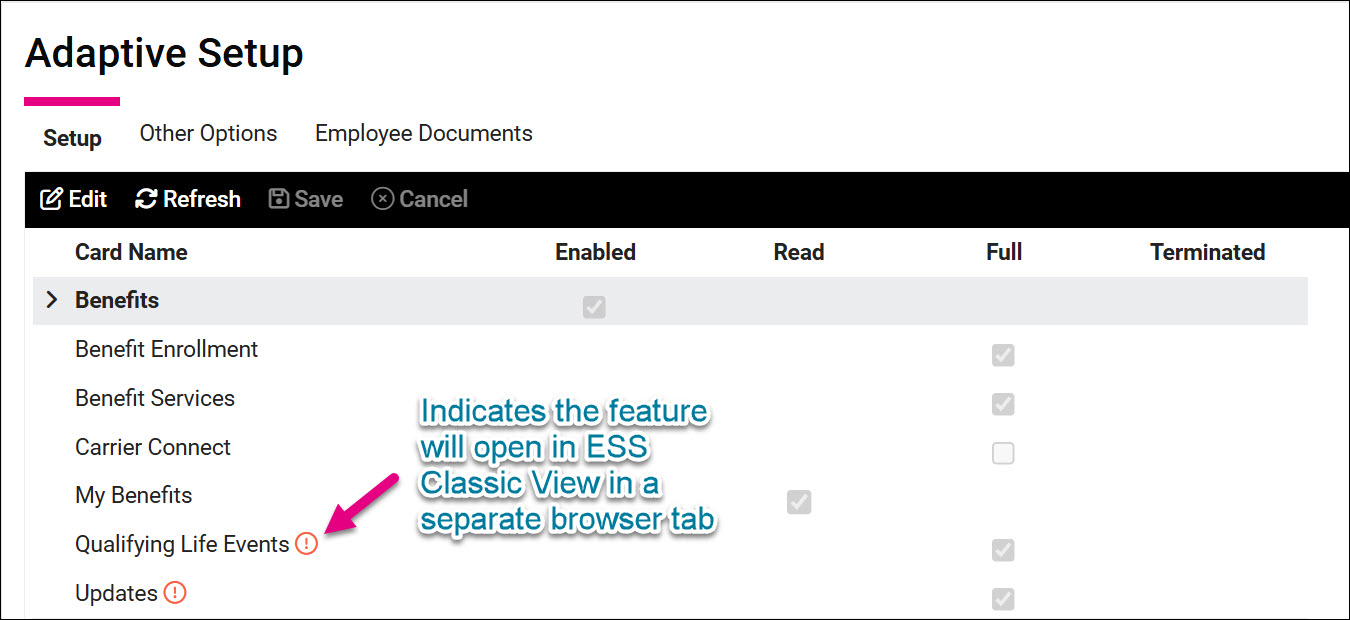

These features must be enabled on the Adaptive Setup screen before employees, supervisors, or managers can use them. An additional information indicator on the Adaptive Setup screen makes it easy to tell which features will open in ESS Classic View. When you hover over the red exclamation point, the feature will indicate Platform linking from AEE if it will launch in a separate browser tab.

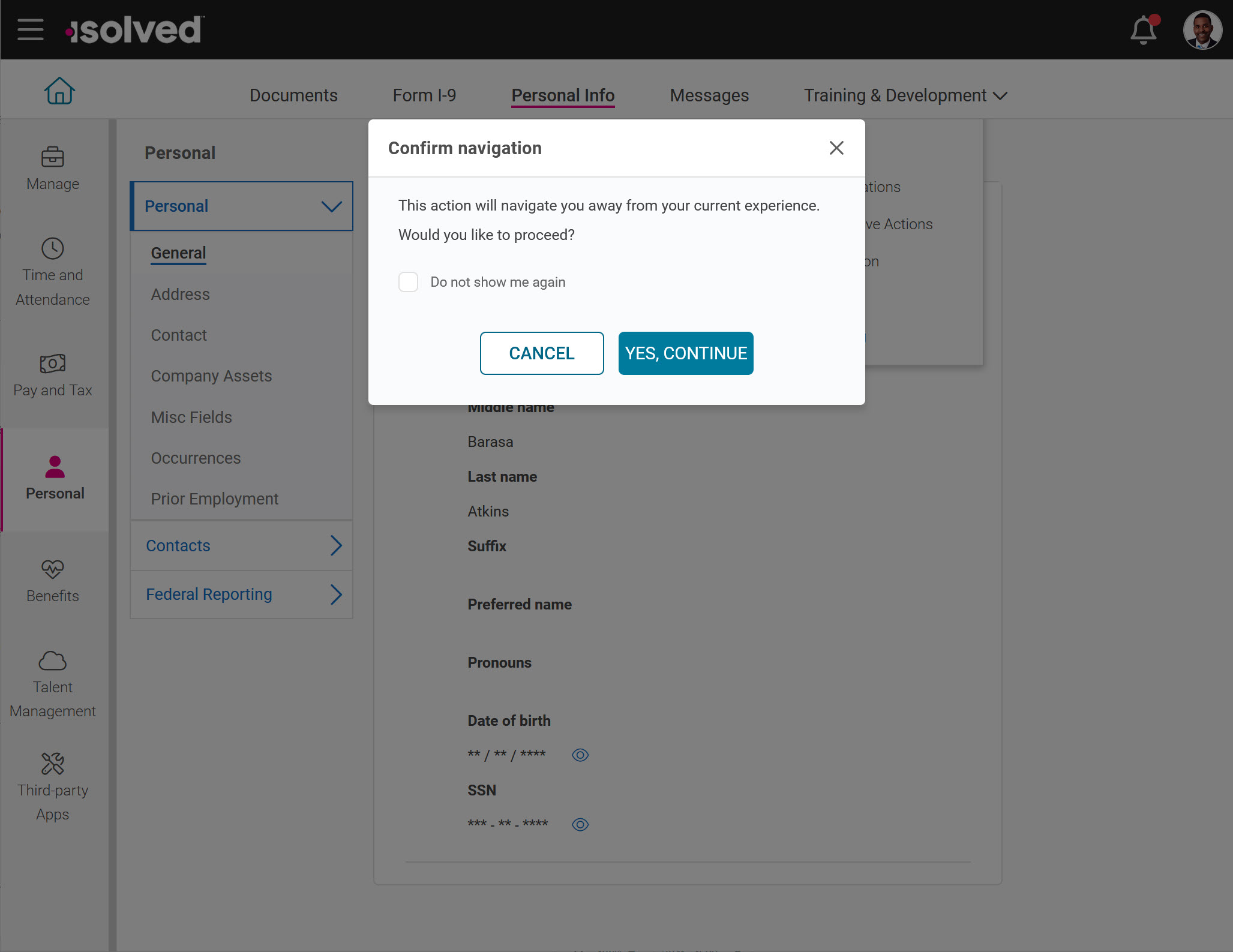

Once enabled, self-service users will be prompted to confirm they want to leave the Adaptive Employee Experience and access the feature in ESS Classic View.

When they click YES, CONTINUE, a new tab will open showing the option in Classic View.

In a desktop or mobile browser, users can close the tab to get back to the Adaptive Employee Experience. In the isolved People Cloud mobile app, they can click the X in the top left corner to close the current tab and return.

While the Classic View options will open on mobile devices, smaller phone screens may be more difficult to use and require scrolling or turning the phone to read and update.

Work will continue in 2025 and beyond to redesign all self-service features so they are fully optimized for mobile devices. These platform links are an interim solution to make it easier for managers and employees to access ESS Classic View.

Tax Wizard updates for 2025 form changes

Employees in the District of Columbia, Missouri, and South Carolina can complete updated tax withholding certificates for 2025

The Tax Wizard in the Adaptive Employee Experience (AEE), isolved People Cloud mobile app, and ESS Classic View has been updated to support required changes that take effect in 2025 for these tax forms:

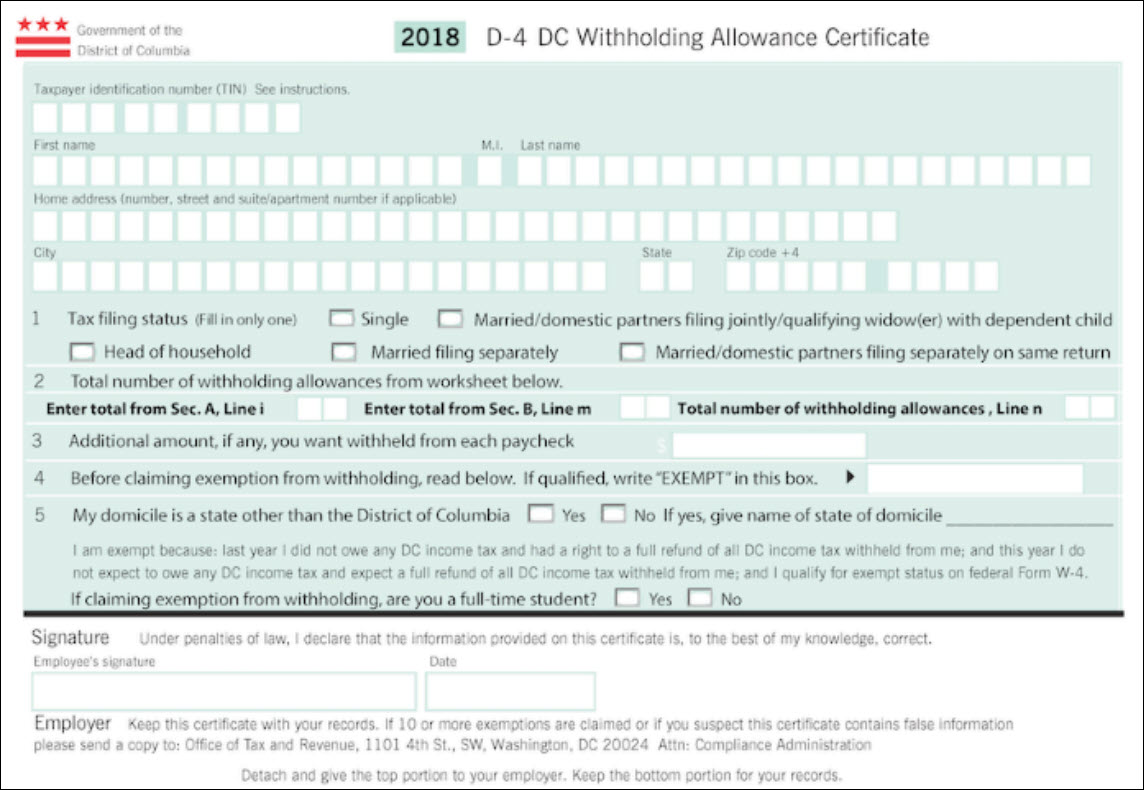

District of Columbia: Form D-4, DC Withholding Allowance Certificate

To address an issue where the text boxes occasionally cut off data on the form when

the total characters exceeded the available boxes for a field), the Tax Wizard will now use the fillable version of this form. This change was confirmed with the District of Columbia Office of Tax and Revenue.

Missouri: MO W-4, Employee’s Withholding Certificate

Effective January 1, 2025, the following changes have been made to the Missouri tax withholding certificate:

- The fields on the form are no longer fillable, although users of the online Tax Wizard will still be able to complete the form electronically

- The form revision was updated from Form MO W-4 (Revised 12-2023) to Form MO W-4 (Revised 12-2024) to reflect the version changes. Additionally, the text has been moved up one line so it now appears in the instruction section.

- A page number 15 has been added to the bottom of the form.

- Text updates have been made to the question: Ever served on active duty in the United States Armed Forces?

- Old text: If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible military individuals. A list of all state agency resources and benefits can be found at veteranbenefits.mo.gov/state-benefits/.

- New text: If yes, visit dor.mo.gov/military/ to see the services and benefits DOR offers to all eligible military individuals, or complete the survey at mvc.dps.mo.gov/MoVeteransInformation/Survey/DOR to receive information from the Missouri Veterans Commission. A list of all state agency resources and benefits can be found at veteranbenefits.mo.gov/state-benefits/.

For more information about Missouri withholding and tax form changes, review the updated State of Missouri Employer’s Tax Guide.

South Carolina: SC W-4, South Carolina Employee’s Withholding Allowance Certificate

Effective January 1, 2025, the following changes have been made to the South Carolina Employee’s Withholding Allowance Certificate:

- Page 1

- The revision date has been updated from (Rev. 11/30/23) to (Rev. 11/21/24) to reflect the updated version.

- The tax form year has been updated from 2024 to 2025 on upper right corner of the form.

- Under Step 7:

- 2023 has been updated to 2024.

- 2024 has been updated to 2025.

- Language for box 2 has been updated:

- Old text: I elect to use the same state of residence for tax purposes as my military servicemember spouse. I have provided my employer with a copy of my current military ID card and a copy of my spouse’s latest Leave and Earning Statement (LES).

- New text: For tax year 2025. I am a military servicemember or the spouse of a military servicemember and elect to use another state as my state of domicile. See instructions.

- The Exemptions section in the instructions have been updated to reflect updated years and instructions.

- Page 2

- Year updated from 2024 to 2025 in the upper left-hand corner and throughout the instructions.

- The employer instructions have been updated.

- Page 3

- Year updated from 2024 to 2025 in the upper left-hand corner and throughout the worksheet.

- The amount in step 8 of the Deductions, Adjustments, and Additional Income Worksheet was updated from $4,700 to $5,050.

Complete instructions are included on the revised South Carolina Employee’s Withholding Allowance Certificate from the SC Department of Revenue.

Pending punches load faster for managers and supervisors

The Pending punches option on the Tasks dashboard has been optimized for better performance

For clients using Time and Labor Management with the option for employees to submit missed punches, logic updates have been applied to reduce latency and improve the time it takes to load. The employee pending punch approval requests from the Tasks menu in the Adaptive Employee Experience (AEE) and isolved People Cloud mobile app will load pending requests faster. Managers and supervisors with a lot of direct reports will notice the performance enhancements most.

Payroll & Tax

Minimum Wage Updates for 2025

State and local minimum wage updates

Additional 2025 minimum wage updates have been included in this release. The file below includes all minimum wage changes taking effect in 2025 that have been provided by each jurisdiction.

2025 Minimum Wage Changes through version 10.21

These minimum wage changes will not automatically update employee salary records. See Reviewing pay information for minimum wage compliance to learn how Workforce Acceleration can help you stay in compliance with minimum wage changes.

Federal, State, and Local Tax Changes effective January 1, 2025

Federal tax changes

Additional Federal Income Tax (FIT) withholding amounts for nonresident aliens are updated to:

- $15,000.00 for employees who have filed a 2020 form W-4.

- $10,700.00 for employees who have not filed a 2020 form W-4 and have a prior

version on file.

The Federal withholding tables have also been updated with 2025 rate changes. To review the 2025 rates, refer to IRS publication 15-T, Federal Income Tax Withholding Methods for use in 2025.

State and local tax changes by jurisdiction

The following changes have been made to taxes effective January 1, 2025 (unless otherwise noted):

Alaska

- State Unemployment

- Increased the employee and employer SUI wage base from $49,700.00 to $51,700.00.

Arkansas

- State Unemployment

- Decreased the maximum employer SUI tax rate from 10.125% to 10.1%.

- Decreased minimum employer SUI tax rate from .225% to .2%.

- Decreased the new employer SUI tax rate from 2.025% to 2%.

- Decreased the administrative assessment tax rate from .125% to .1%.

California

- State Income Tax

- Reciprocity: Changed calculation to eliminate the resident tax credit for certain multi-state combinations. Previously, resident taxes were credited by the work taxes withheld. This change only affects California residents working in the following states: Virginia, Oregon, Arizona.

Connecticut

- State Unemployment

- Increased the SUI wage base from $25,000.00 to $26,100.00.

- Increased the maximum employer SUI tax rate from 7.8% to 8.9%.

- Decreased the new employer SUI tax rate from 2.5% to 2.2%.

- Added a solvency fund tax rate of 1%.

Guam *

- Guam Wage Tax: Guam income tax withholding has been revised to match the Federal Income Tax changes for nonresident aliens.

- $15,000.00 for employees who have filed a 2020 form W-4.

- $10,700.00 for employees who have not filed a 2020 form W-4 and have a prior version on file.

- Guam withholding tables have been revised.

* Insperity does not offer tax filing or tax payment services in Guam.

Hawaii

- State Income Tax

- Revised the withholding tables.

On December 19, 2024, Hawaii passed HB 2404 which significantly reduced income tax brackets in 2025. Starting January 1, employees across the state should notice less tax is being withheld from their paychecks, resulting in an immediate increase in take-home pay. The lowest rate of 1.4 percent will apply to single filer income below $9,600 (up from $2,400 in 2024), and the highest rate of 11 percent will apply to income exceeding $325,000 (up from $200,000).

For additional details about the 2025 Hawaii income tax rate changes, refer to Booklet A, Employer’s Tax Guide (Rev 2024). - Added Extra Lump Sum withholding allowance amount of $1,650.

- Revised the withholding tables.

- State Disability Insurance

- Increased the maximum weekly employee SDI contribution from $6.87 to $7.21.

Idaho

- State Unemployment

- Decreased the SUI Administrative Reserve tax rate from .44608% to .35717%.

- Decreased the SUI Workforce Development tax rate from .07872% to .06303%.

- Decreased the minimum employer SUI tax rate from .2248% to 0.18%.

Note: Due to field length restrictions, the SUI Administrative Reserve tax rate of .35717% was rounded to .3572% and the Workforce Development SUI tax rate of .06303% was rounded to .0630%.

Illinois

- State Unemployment

- Increased the SUI wage base from $13,590.00 to $13,916.00.

- Decreased the maximum employer SUI tax rate from 8.65% to 7.85%.

- Decreased the minimum employer SUI tax rate from .85% to .75%.

- Decreased the new employer SUI tax rate from 3.95% to 3.65%.

Indiana

- State Income Tax

- Reciprocity: Changed calculation to eliminate the resident tax credit for certain multi-state combinations. Previously, resident taxes were credited by the work taxes withheld. This change only affects Indiana residents working in the following states: Oregon, Arizona, District of Columbia.

Iowa

- State Income Tax

- Changed withholding tax to calculate a flat tax rate of 3.8%.

- Removed the following withholding tax calculation methods:

- Concurrent Aggregation

- Previous Aggregation

- The valid default withholding calculation methods are:

- Annualized for regular only wages

- Flat Rate Combined for regular and supplement wages

- Flat Rate for supplemental only wages

- Decreased the supplemental withholding tax rate from 5.7% to 3.8%.

- Standard deduction amounts are now based on filing status instead of the number of exemptions claimed on pre-2024 and post-2024 Iowa W-4 forms. The following standard deduction amounts were added:

- Pre-2024 IA W-4:

- $12,000.00 for filing status Single

- $24,050.00 for filing status Married

- Post-2024 IA W-4:

- $18,050.00 for filing status Head of Household

- $12,000.00 for filing status Other

- $24,050.00 for filing status Married Filing Jointly 1 Spouse Working

- $12,000.00 for filing status Married Filing Jointly 2 Spouse Working

- Pre-2024 IA W-4:

Kansas

- State Income Tax

- The withholding tax calculations have been changed to compute the appropriate total allowance amount.

Prior to this release, taxable wages were reduced by a standard deduction and then allowed $2,320 for each allowance claimed, effective 7/1/2024.

This release will change the withholding allowances to be based on:- Allowance values for employees selecting Single in Box 3 (Allowance Rates) on the K-4:

- Single and zero allowances. There is no allowance amount to apply to the calculation.

- Single and one allowance. The first allowance amount will be $9,160.

- Single and two or more allowances. The first allowance will be $9,160, plus $2,320 for all subsequent allowances.

- Allowance values for employees selecting Joint in Box 3 (Allowance Rates) on the K-4:

- Joint and zero allowances. There is no allowance amount to apply to the calculation.

- Joint and one allowance. The first allowance amount will be $9,160.

- Joint and two allowances. The first and second allowance will each be $9,160, for a total allowance of $18,320.

- Joint with three or more allowances. The first and second allowance will each be $9,160, for a total allowance of $18,320, plus $2,320 for all subsequent allowances.

- There are two options that you can use to offset the under withholding of state tax for 2024:

- Reduce the number of allowances claimed on the K4 form.

- Request an additional withholding amount.

- Allowance values for employees selecting Single in Box 3 (Allowance Rates) on the K-4:

- The withholding tax calculations have been changed to compute the appropriate total allowance amount.

Kentucky

- Local Tax Changes

- Hickman, Fulton County (18-075-1040)

- Removed the annual maximum tax of $750.00, effective 1-1-24. It was inadvertently included in the June update.

- Jackson, Breathitt County (18-025-1296)

- Decreased the Occupational License Fee from 2% to 1.5%.

- Decreased the annual maximum tax from $3,372 to $2,641.50.

- Hickman, Fulton County (18-075-1040)

Maine

- State Unemployment

- Increased the maximum employer SUI tax rate from 5.75% to 5.97%.

- Increased the new employer SUI tax rate from 2.04% to 2.11%.

- Increased the SUI Competitive Skills Scholarship Fund tax rate from .13% to .14%.

- Increased the SUI Unemployment Program Administrative Fund tax rate from .15% to .16%.

- Paid Family Medical Leave

- Added Maine Paid Family and Medical Leave (PFML) with an employee default tax rate of 0% and employer default tax rate of 1%.

Note: Contact your Insperity Payroll Specialist if you prefer to have the employee pay half of Maine PFML - The Maine PFML wage base limit follows the Social Security limit established annually by the Social Security Administration.

- Added Maine Paid Family and Medical Leave (PFML) with an employee default tax rate of 0% and employer default tax rate of 1%.

Michigan

- State Income Tax

- Increased the personal exemption from $5,600.00 to $5,800.00

Minnesota

- State Income Tax

- Increased the withholding allowance amount from $5,050.00 to $5,200.00.

- Increased the additional withholding amount for Nonresident Aliens from $10,300.00 to $10,700.00.

- Revised the withholding tables. Refer to the MN DOL news release for more information: Minnesota income tax brackets, standard deduction and dependent exemption amounts for 2025

Missouri

- State Income Tax

- Decreased the supplemental withholding tax rate from 4.8% to 4.7%.

- Increased the standard deduction amount for Single, Married and Spouse Works, and Married Filing Separate filers from $14,600.00 to $15,000.00.

- Increased the standard deduction amount for Married and Spouse Does Not Work filers from $29,200.00 to $30,000.00.

- Increased the standard deduction amount for Head of Household filers from $21,900.00 to $22,500.00.

- Revised the withholding tables. Refer to the 2025 Missouri Income Tax Withholding Table for more information.

N. Mariana Islands *

- Withholding

- The additional withholding amounts for Nonresident Aliens are as follows:

- $15,000.00 for employees who have filed a 2020 form W-4.

- $10,700.00 for employees who have not filed a 2020 form W-4 and have a prior version on file.

- Revised the withholding tables.

- The additional withholding amounts for Nonresident Aliens are as follows:

* Insperity does not offer tax filing or tax payment services for the Northern Mariana Islands.

Nebraska

- State Income Tax

- Increased the withholding allowance from $2,250.00 to $2,360.00.

- Revised the withholding tables. For the full list of changes, refer to Circular EN, Nebraska Income Tax Withholding for Wages, Pensions, Annuities, and Gambling Winnings Paid on or after January 1, 2025.

New Mexico

- State Income Tax

- Revised the withholding tables. Refer to FYI-104 from the New Mexico Taxation and Revenue Department for full details.

Ohio

- State Unemployment

- Decreased the maximum employer SUI tax rate from 10.6% to 10.2%.

- Decreased the minimum employer SUI tax rate from .9% to .5%.

- Local Tax Changes

- The following Traditional Method school districts with a personal exemption of $650.00 were added to these JEDDs:

- Toledo Express Airport JEDD (36-095-7444), Swanton LSD (02606) – .75%.

- Etna Township-Pataskala JEDZ-I (36-089-1522), Southwest Licking LSD (04510) – .75%.

Note: School district tax is now returned for residents within a JEDD/JEDZ. Previously, no school district tax was returned. School districts will be added to the remaining JEDD/JEDZ in a future update

- The following Traditional Method school districts with a personal exemption of $650.00 were added to these JEDDs:

- Circleville, Pickaway County (36-129-0500)

- Decreased the tax rate from 2.5% to 2%.

- Decreased the credit limit from 2.5% to 2%.

- Circleville-Pickaway JEDD, Pickaway County (36-129-7441)

- Decreased the tax rate from 2.5% to 2%.

- Clinton Massie LSD (1402)

- Eliminated the school district tax of .5%.

The following jurisdictions are affected:- Adams Township, Clinton County 36-027-1027

- Chester Township, Clinton County 36-027-0519

- Clarksville, Clinton County 36-027-4937

- Harlan Township, Warren County 36-165-0161

- Harveysburg, Warren County 36-165-5827

- Liberty Township, Clinton County 36-027-0524

- Massie Township, Warren County 36-165-1481

- Spring Valley Township, Greene County 36-057-0593

- Vernon Township, Clinton County 36-027-1029

- Washington Township, Warren County 36-165-0073

- Wayne Township, Warren County 36-165-0866

- Eliminated the school district tax of .5%.

- Danville LSD (4202)

- Increased the tax rate from 1.5% to 1.75%.

The following jurisdictions are affected:- Brown Township, Knox County 36-083-0334

- Danville, Knox County 36-083-5296

- Gann, Knox County 36-083-5294

- Howard Township, Knox County 36-083-0341

- Jefferson Township, Knox County 36-083-0343

- Richland Township, Holmes County 36-075-0775

- Union Township, Knox County 36-083-0351

- Increased the tax rate from 1.5% to 1.75%.

- Fayette, Fulton County (36-051-5097)

- Decreased the credit percentage from 100% to 50%.

- Mingo Junction, Jefferson County (36-081-1640)

- ncreased the tax rate from 1% to 2%.

- Increased the credit limit from 1% to 2%

- New Concord, Muskingum County (36-119-3260)

- Taxes will be collected by the Regional Income Tax Agency (RITA).

- Allows an exemption from New Concord Municipal Income Tax under the Military Spouse Residency Act (MSRRA).

- Rushville, Fairfield County (36-045-5066)

- Added Rushville with a tax rate of 1%.

- Taxes will be collected by the Regional Income Tax Agency (RITA).

- Allows an exemption from Rushville Municipal Income Tax under the Military Spouse Residency Relief Act (MSRRA).

- Sidney, Shelby County (36-149-2300)

- Decreased the tax rate from 1.65% to 1.5%.

- Decreased the credit limit from 1.65% to 1.5%.

- Waynesfield, Auglaize County (36-011-4824)

- Taxes will be collected by the Regional Income Tax Agency (RITA).

- Allows an exemption from Waynesfield Municipal Income Tax under the Military Spouse Residency Act (MSRRA).

Oregon

- State Unemployment

- Increased the wage base from $52,800.00 to $54,300.00 for the following:

- SUI

- SUI Special Payroll Tax Offset

- Increased the SUI Special Payroll Tax Offset tax rate from .109% to .139%.

- Decreased the minimum employer SUI tax rate from .791% to .761%.

- Decreased the new employer SUI tax rate from 2.291% to 2.261%.

- Increased the wage base from $52,800.00 to $54,300.00 for the following:

Pennsylvania

- Local Tax Changes

- Clearfield Township, Butler County (39-019-0939)

- Increased the Local Services Tax from $5.00 to $52.00.

- Jackson Township, Lycoming County (39-081-2607)

- Eliminated the resident rate of .5%, effective 1/1/2024. Resident employees will continue to be liable for the Southern Tioga school district tax of 1.2%.

- Eliminated the non-resident rate of .5%, effective 1/1/2024.

- McKean Township, Erie County (39-049-3241)

- Increased the Local Services Tax from $10.00 to $52.00.

- Phoenixville ASD (15720)

- Increased the school district tax rate from .5% to .6%.

The following jurisdictions are affected:- East Pikeland Township, Chester County 39-029-1504

- Phoenixville Boro, Chester County 39-029-3020

- Schuylkill Township, Chester County 39-029-4773

- Rice Township, Luzerne County (39-079-4491)

- Increased the Local Services Tax from $10.00 to $52.00.

- Tidioute Boro, Warren County (39-123-8867)

- Increased the Local Services Tax from $5.00 to $52.00.

- Increased the school district tax rate from .5% to .6%.

- Clearfield Township, Butler County (39-019-0939)

South Carolina

- State Income Tax

- Increased the personal allowance from $4,610.00 to $4,860.00.

- Increased the maximum standard deduction amount from $6,925.00 to $7,300.00.

- Decreased the supplemental withholding tax rate from 6.4% to 6.2%.

- Revised the withholding tables. Refer to the 2025 South Carolina Income Tax Withholding Tables for more information.

- State Unemployment

- Decreased the new employer SUI tax rate from .35% to .29%.

Utah

- State Unemployment

- Increased the SUI wage base from $47,000.00 to $48,900.00.

- Decreased the maximum employer SUI tax rate from 7.3% to 7.2%.

- Decreased minimum employer SUI tax rate from .3% to .2%.

US Virgin Islands *

- Withholding

- The additional withholding amounts for Nonresident Aliens are as follows:

- $15,000.00 for employees who have filed a 2020 form W-4.

- $10,700.00 for employees who have not filed a 2020 form W-4 and have a prior version on file.

- Revised the withholding tables.

- The additional withholding amounts for Nonresident Aliens are as follows:

* Insperity does not offer tax filing or tax payment services for the Virgin Islands.

Virginia

- State Income Tax

- Reciprocity: Changed calculation to eliminate the resident tax credit for certain multi-state combinations. Previously, resident taxes were credited by the work taxes withheld. This change only affects Virginia residents working in the following states: California, Oregon, Arizona.

Wyoming

- State Unemployment

- Increased the wage base from $30,900.00 to 32,400.00 for the following:

- SUI

- SUI Employment Support Fund Factor

- Increased the wage base from $30,900.00 to 32,400.00 for the following:

Emergency announcement of Louisiana withholding rate changes

New Louisiana income tax rates effective January 1, 2025

On Dec. 4, 2024, Louisiana Gov. Jeff Landry signed multiple legislative bills enacting changes to several state taxes. While most of the changes affect corporate taxes, House Bill 10 imposes a flat personal income tax rate of 3.09% effective January 1, 2025, replacing the tiered-rate system where earnings were taxed from 1.85% to 4.25%. To prevent higher tax bills for those previously in the 1.85% bracket, the standard deduction nearly tripled from $4,500 to $12,500.

The Tax Policy and Planning Division of the Louisiana Department of Revenue declared an emergency to prevent undue delay in notifying employers of the updated withholding requirements to ensure they stay in compliance. Under this declaration, the state secretary sent notices to Louisiana employers of the requirement to withhold at 3.09% starting on January 1, 2025. The emergency declaration also provides emergency instructions on how to administer the tax changes for 180 days or until the final rules are written. Read the Emergency Declaration for more details.

These income tax rate changes were not announced in time for inclusion in this isolved version 10.21 release. isolved is reviewing the legislation and will be updating the system to automate the new Louisiana 3.09% flat income tax rate. When these updates are applied, they will be included in future Release Notes.

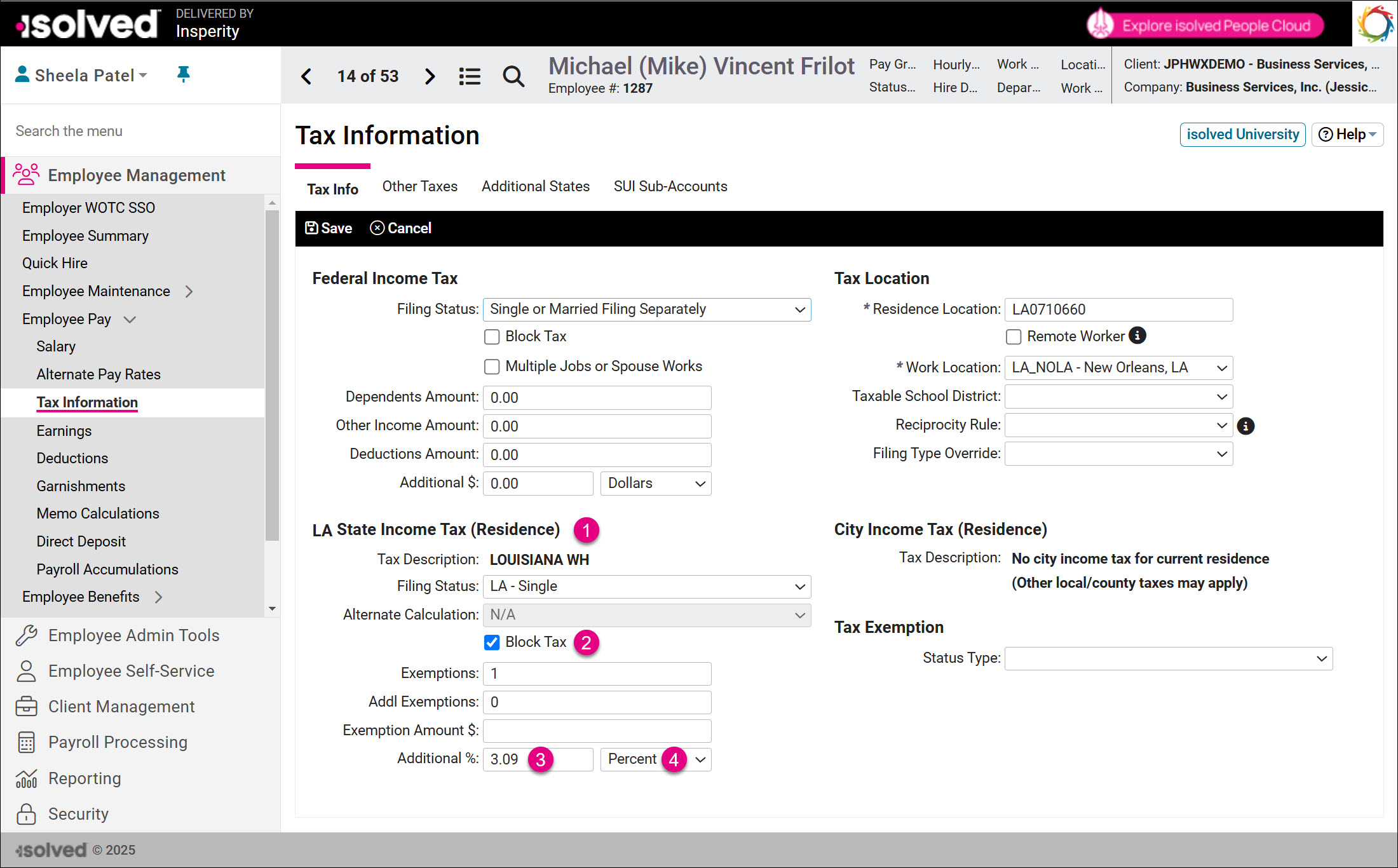

Since the tax rate is a flat 3.09% for payments starting in January, you can override the existing tiered rate calculations now on the Employee Tax screen. To override the withholding rate for a specific employee:

- Go to Employee Management > Payroll > Employee Tax and locate the LA State Income Tax section. It may be listed as Residence or Work, depending on whether the employee lives or works in the state.

- Check Block Tax to block the standard Louisiana income tax withholding calculations.

- In the Additional line, enter 3.09 in the amount/rate field.

- Change the default setting from Dollars to Percent.

Submit your updates now for accurate W-2s

Be sure to process all additional payments and benefit updates before year-end

The Year-end Central section of the Insperity® Help Center provides critical information for accurate employee tax forms. The Insperity HR Resource Center can help you understand what information needs to be reported on W-2s for the 2024 tax year. Be sure you have processed adjustment or supplemental payrolls to add payments, deduction updates, or memos for employer contributions to reflect all pay and benefit items that need to be included.

Some common items that need to be added before year-end are:

- Third party sick pay, often payments under a Short Term Disability (STD) plan

- Premium costs for employer-provided health insurance, including employer contributions and pre- and post-tax employee contributions

- Employer contributions to Employee Assistance Programs (EAP)

- Premiums for hospital indemnity or specified illness like cancer, critical illness or hospital intensive care if the employer contributes or the employee pays the premium with pretax dollars, even if these benefits are part of a Section 125 plan

- Imputed income for wellness benefits or programs, including employer-paid athletic club memberships for offsite facilities

- Imputed income for domestic partner health insurance coverage

- Employer-sponsored premium reimbursements in a QSEHRA when you’re covered under your spouse’s MEC health insurance plan and they paid for coverage with pretax dollars

- Imputed income for the personal use of an employer-provided vehicle

- Imputed income for gift cards

- Employer 401(k) contributions, if they are not calculated automatically with payroll

These changes must be entered by December 31, 2024. Since many of these W-2 reportable items generate additional taxes for employees, they should be processed with regular wages so there are earnings to withhold the taxes from. Contact your Payroll Specialist immediately if you still need to make changes that will impact employee W-2s.

2025 Tax Rate and Deposit Frequency Changes

Forward unemployment rate and tax filing frequency notices to Insperity

Unemployment rates and tax filing frequency changes are mailed to the taxpayer, not to Insperity. It is imperative these tax-related communications are forwarded to Insperity immediately.

For those clients in the states of Washington and Wyoming, we also require your 2025 Workers Compensation rates, as those are remitted with tax payments.

We require this information to ensure your taxes are paid accurately and timely in 2025. Please send your information to wx.tax@insperity.com.

Leave Management

Support for new Paid Family Leave plans

Delaware and Maine Paid Family and Medical Leave has been added to Tax Maintenance

To support the new Paid Family Leave plan requirements in Delaware and Maine that take effect on January 1, 2025, the Tax Maintenance screen has been updated.

Both leave plans require an employer contribution, with a rate that varies based on employee count. Employers may choose to have employees pay up to half of the required contribution.

For more information about these plans, see:

If you have work locations in Delaware or Maine, contact your Insperity Payroll Specialist for assistance enabling these new options. Please let them know what rate tier you qualify for based on your size, and what percentage your employees will be contributing, if any.

Benefits

ACA 1095 support for ICHRAs

Import employee ACA form overrides for line 14 using code 1S

The ACA Form Import has been updated to support the Line 14 Offer of Coverage code 1S – Individual coverage HRA offered to an employee who was not a full-time worker. Use this new code to import coverage overrides for months when variable hour employees weren’t offered employer-provided health insurance but were reimbursed for health insurance premiums under an Individual Coverage HRA.

Reporting and Analytics

FLSA exemption threshold updates

Report update to support DOL changes

The FLSA Exemption Threshold report in the Payroll category of Client Reporting helps to review exempt employees to make sure their salaries meet minimum requirements to be exempt from the overtime provisions of the Fair Labor Standards Act.

On November 15, 2024 a U.S. Circuit Court for the Eastern District in Texas issued a ruling blocking the US Department of Labor’s proposed increase to the federal salary threshold for exempt employees, which was set to take effect in January. The court also reversed the salary increase that took place in July and struck down the provision requiring automatic updates every three years. As a result, the standard salary threshold of $35,568 and HCE threshold of $107,432, in effect prior to July, will remain unchanged.

The report was updated to roll back the changes that had been previously applied, so it will now use the $35,568 threshold for white collar workers and $107,432 for highly compensated employees.

People Heroes University

View system uptime from the University

System Status shows the current status of all isolved platforms

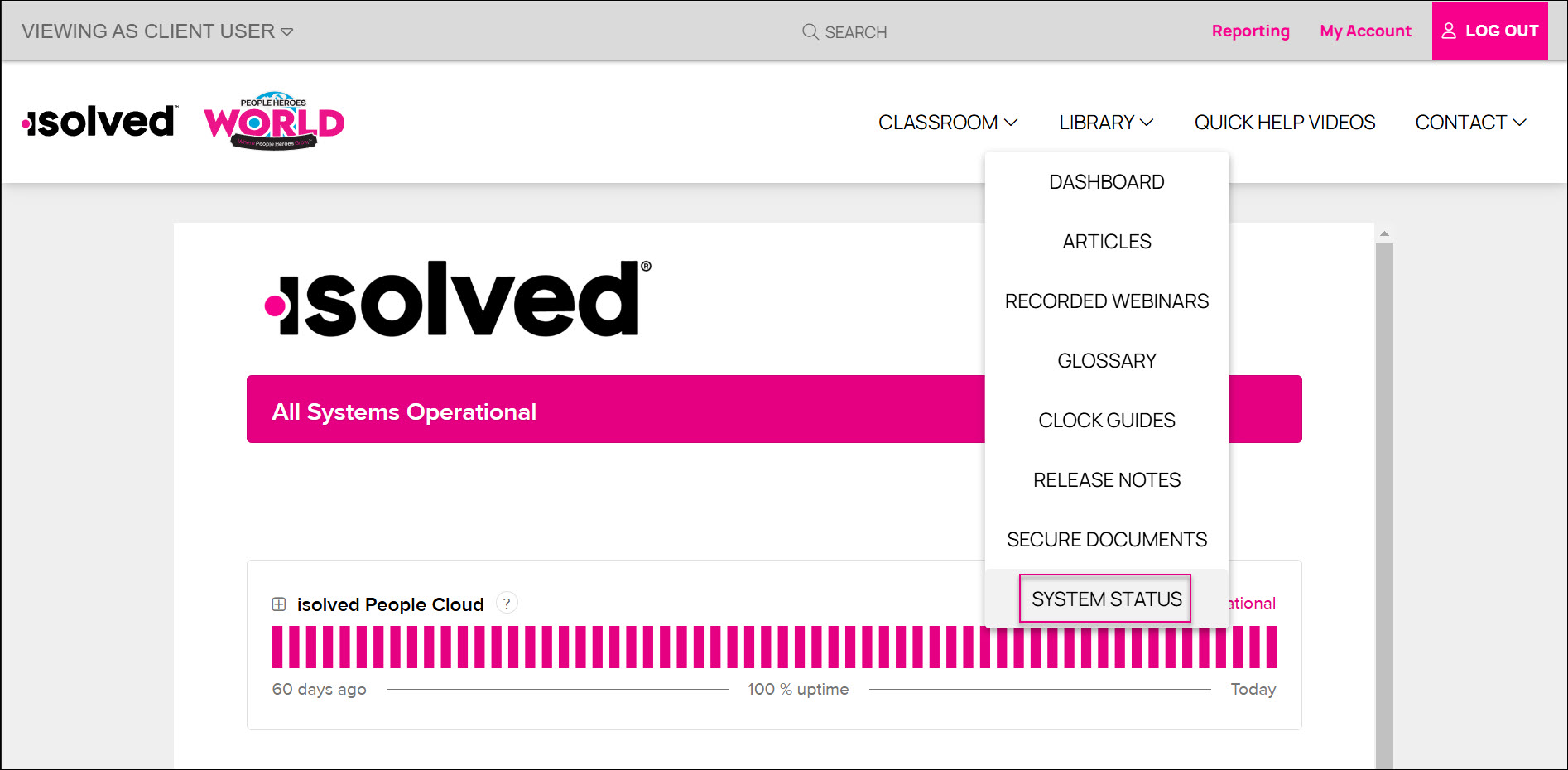

Client administrators can view the current online status for the isolved platform from the System Status option on the Library menu in the People Heroes University.

For more information about the HCM changes in isolved version 10.21, please contact your Insperity Payroll Specialist.

Applicant Tracking

Review release changes and product enhancements in the platform

New Product Update tabs in Applicant Tracking

Product Updates pages help users stay informed on new product enhancements and integrations that aid clients in making their hiring and application processes efficient and successful.

A monthly Applicant Tracking newsletter will still be emailed, but it will now be more informational. It may highlight product releases, but releases will no longer be the primary focus.

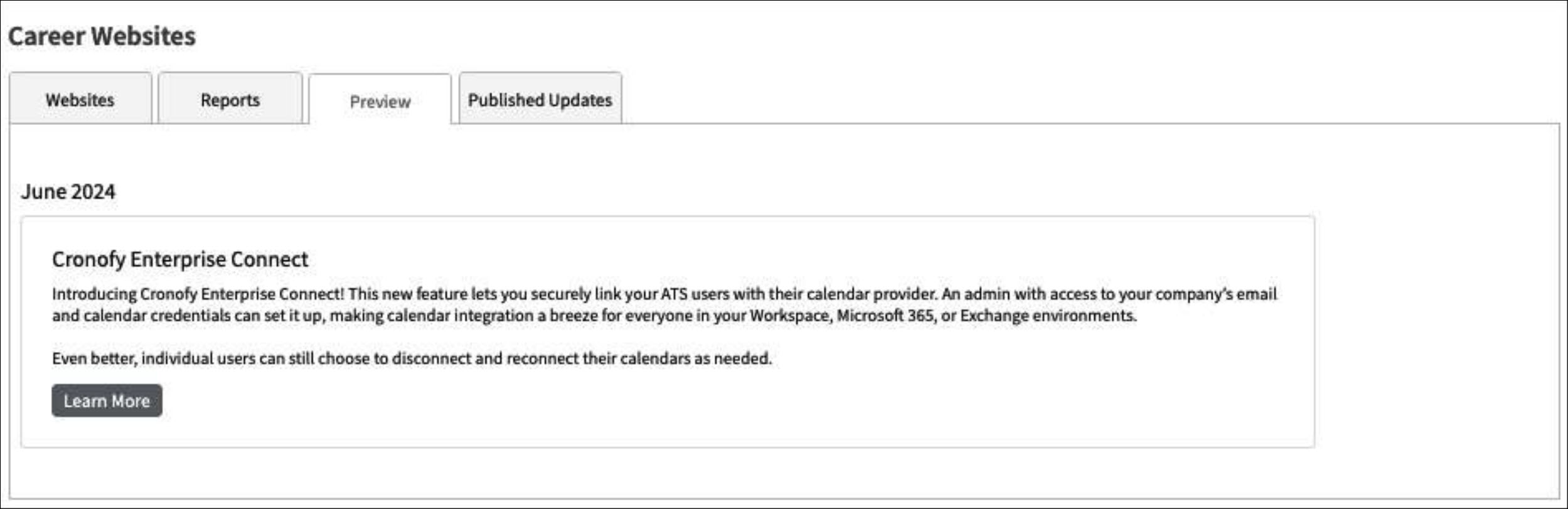

Applicant Tracking administrators can access product updates from the Career Websites page.

- The Preview tab is updated every Tuesday with items that will be released the following Tuesday, so client administrators have time to inform their teams of the upcoming changes. A Learn More button links to Help Center articles that dive deeper into the new features.

- The Published Updates tab lists functionality that has been released in previous months. Release history is shown for a rolling year period.

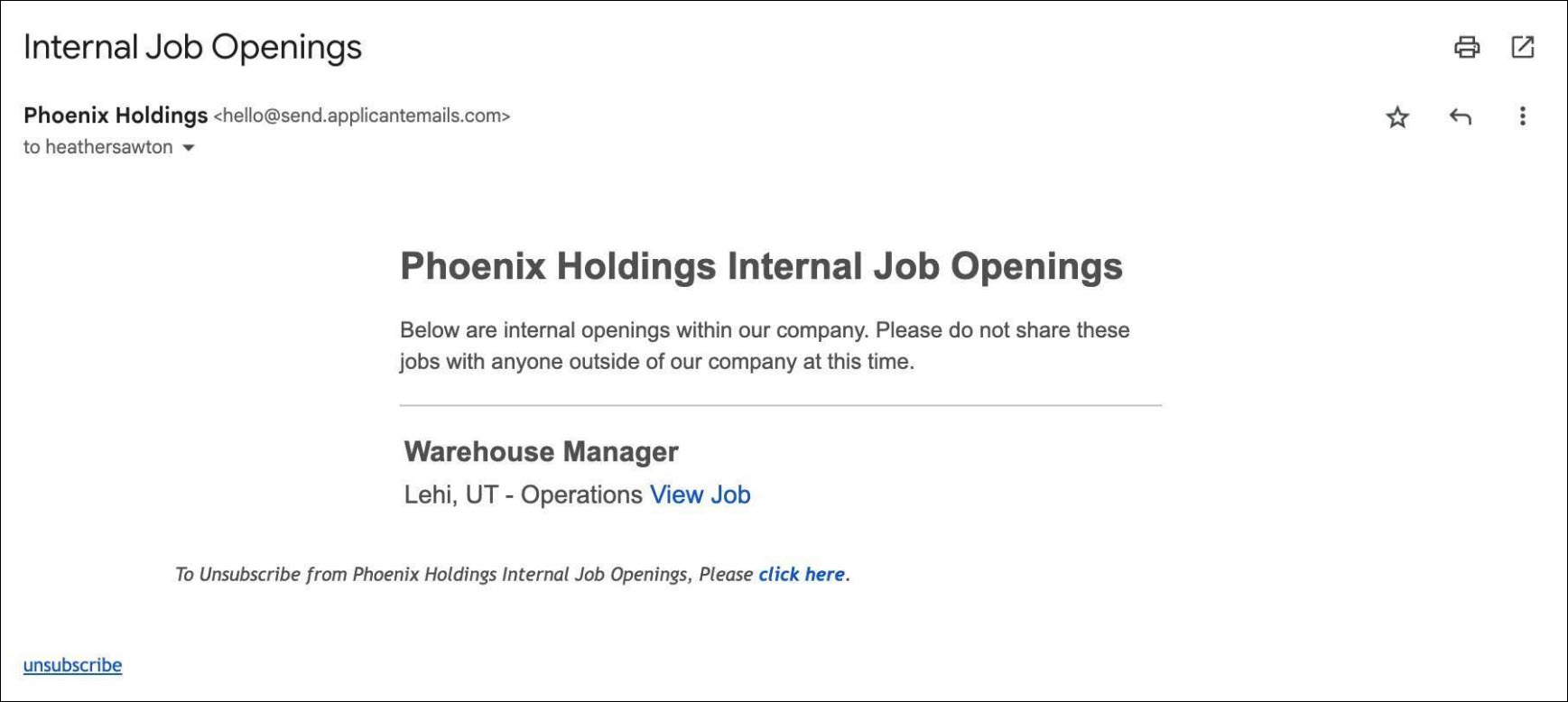

Non-employee Job Sharers were removed from internal jobs emails

This update ensures internal job openings are offered exclusively to employees

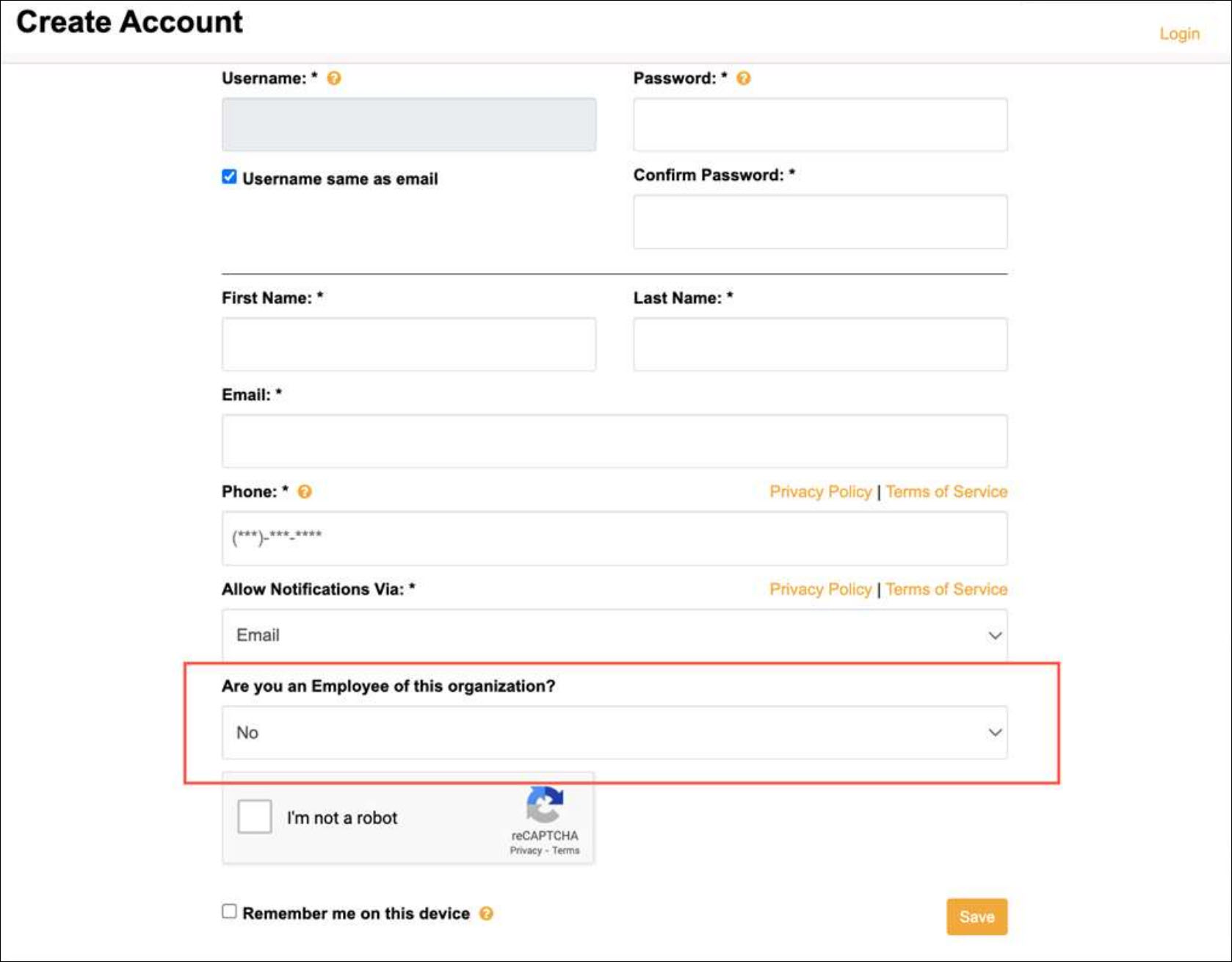

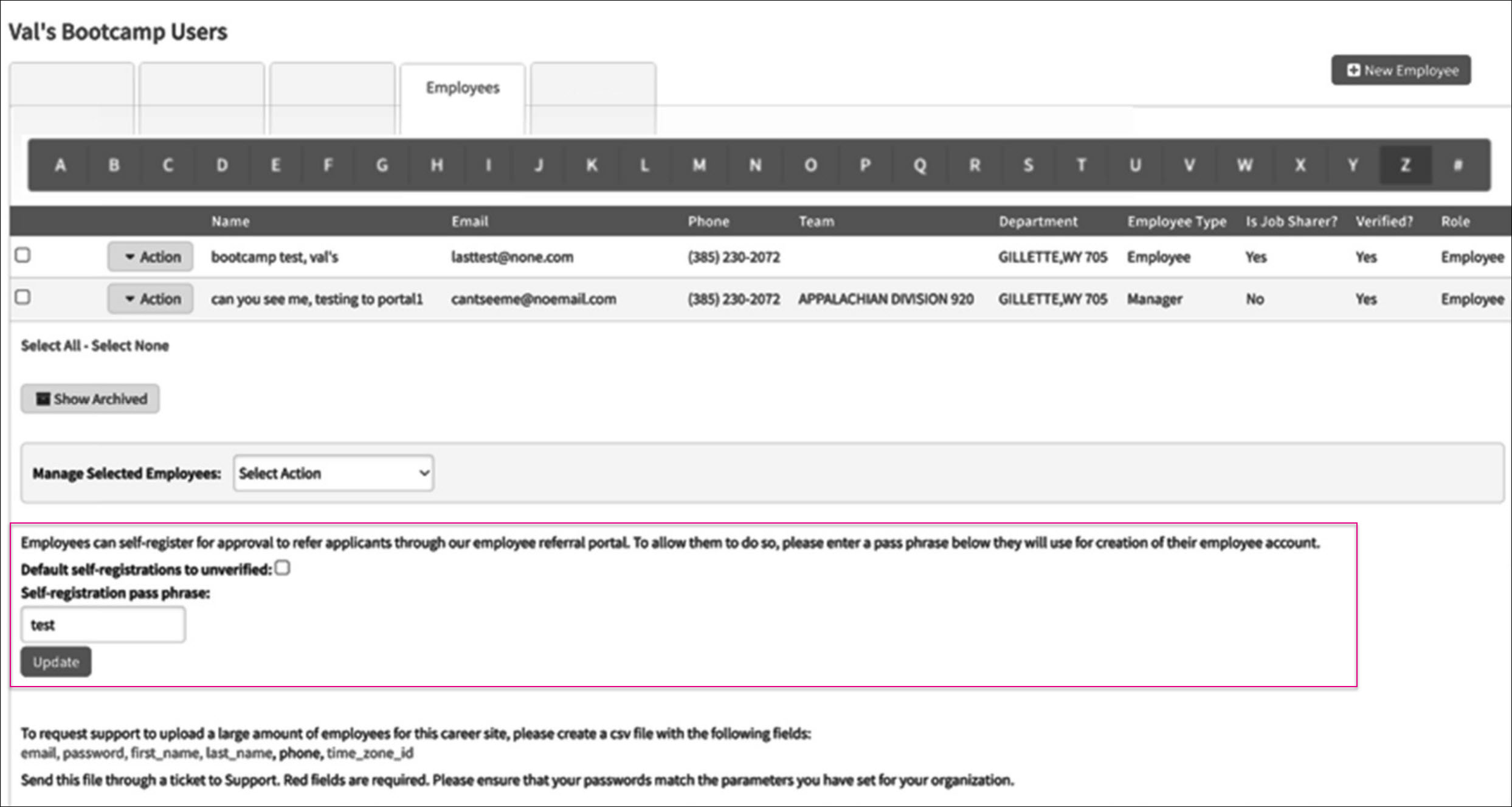

Clients have the opportunity to expand their referral program outside of their internal employees to their clients and social networks. To help support this, a simple question has been added to the Job Sharer Portal:

“Are you an employee of this organization?”

- Non-employees will be identified in the system and excluded from internal job opening emails (if this feature is enabled).

- Admins can easily update a Job Sharer’s status in the Employee User Tab to reflect their role as an employee, manager, or non-employee.

You can approve employees to refer applicants if you create a security passphrase and share it with them when they create their Applicant Tracking account.

This change to remove external users from internal job emails was applied on 12/3/2024. Employees can still choose to opt out of these emails by clicking the unsubscribe button at the bottom of the posting announcement emails.

Employee Referral Portal is sunsetting at year-end

The Job Sharer Portal provides enhanced functionality instead

The legacy Employee Referral portal will be retired on Dec 31st. All clients with active employee referrals should be migrated to the new Job Sharer portal by then. The improved platform makes it easier than ever to expand your referral program beyond employees while keeping internal job openings secure.

Check out the Job Sharer Portal Overview to learn how it helps everyone socialize your job ads to expand your reach.

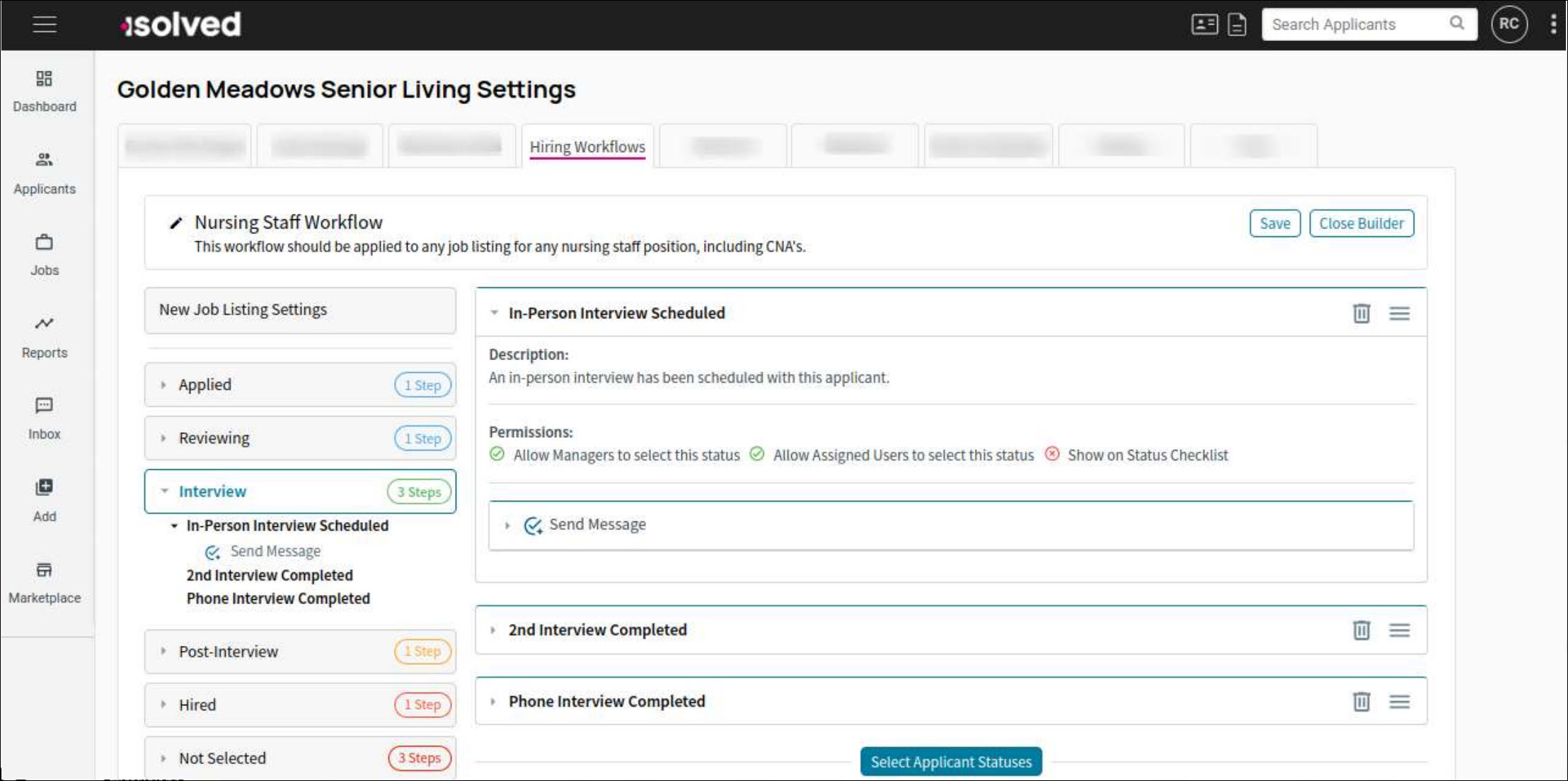

Pilot in progress for tailored hiring workflows

Additional beta testers are being actively accepted to provide feedback on this new functionality

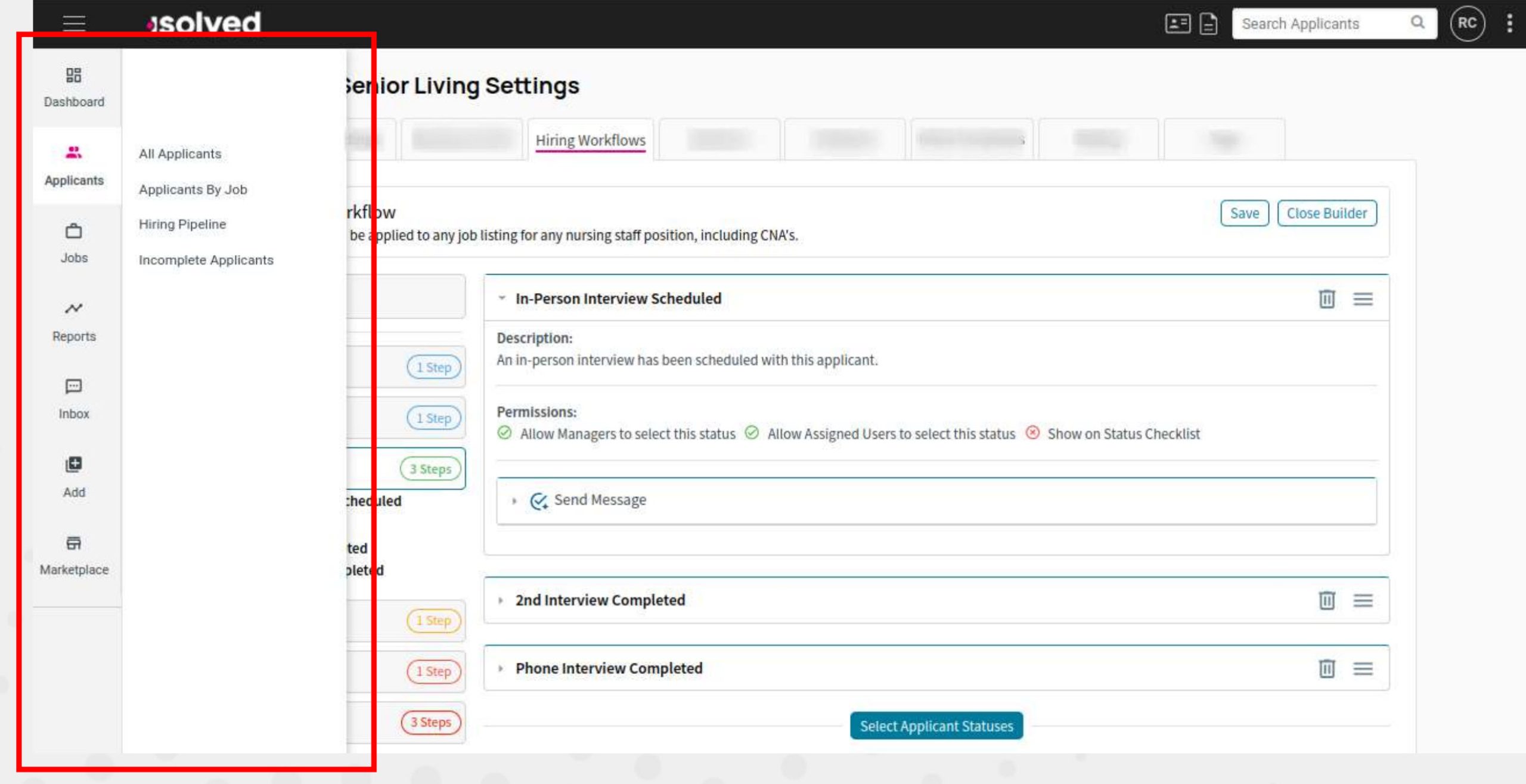

This new feature allows you to customize hiring workflows for different job types, enabling seamless automation of the hiring processes and enhancing efficiency and consistency in recruitment efforts. These features are currently included in the release we’re testing:

- Ability to create hiring workflows tailored to Job Type

- Ability to assign workflows to Job

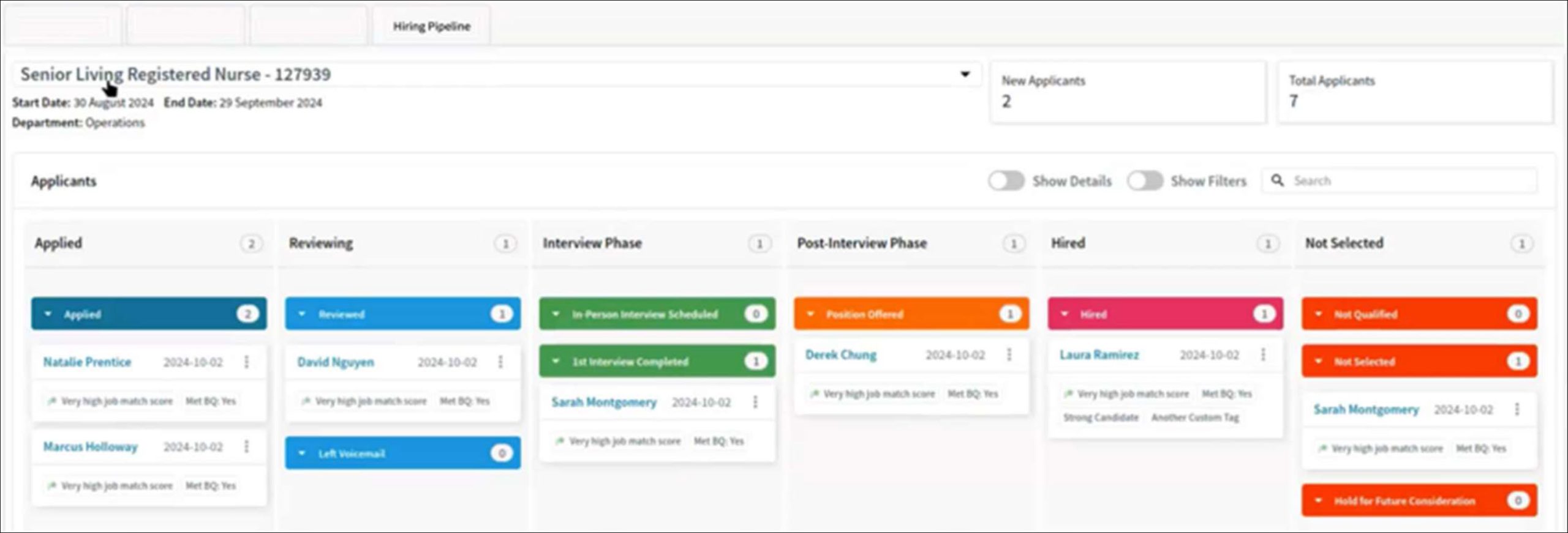

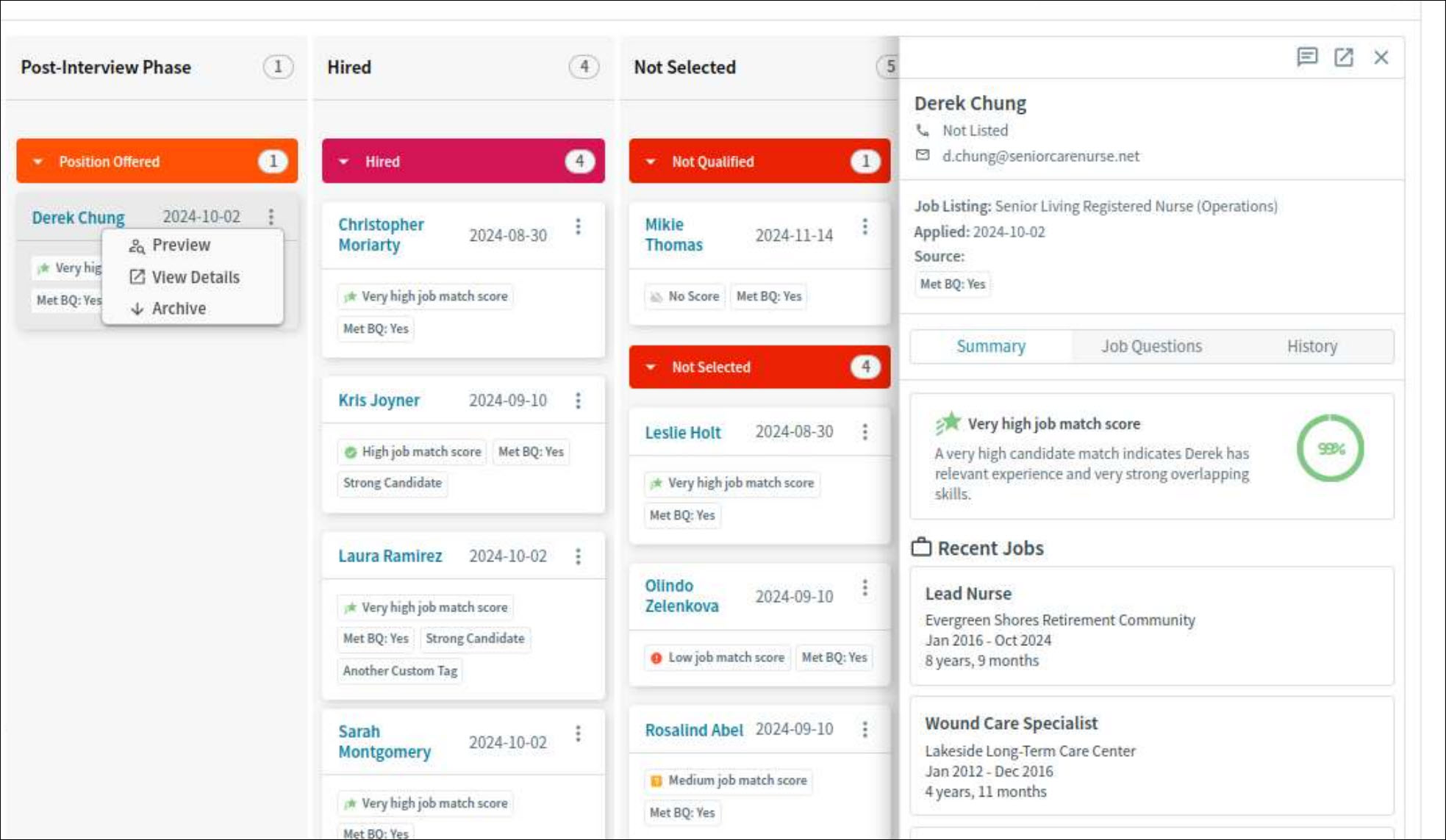

- New pipeline view of applicants

- Infrastructure for custom user-defined workflow actions, such as auto-archive, soft

stops, and more.

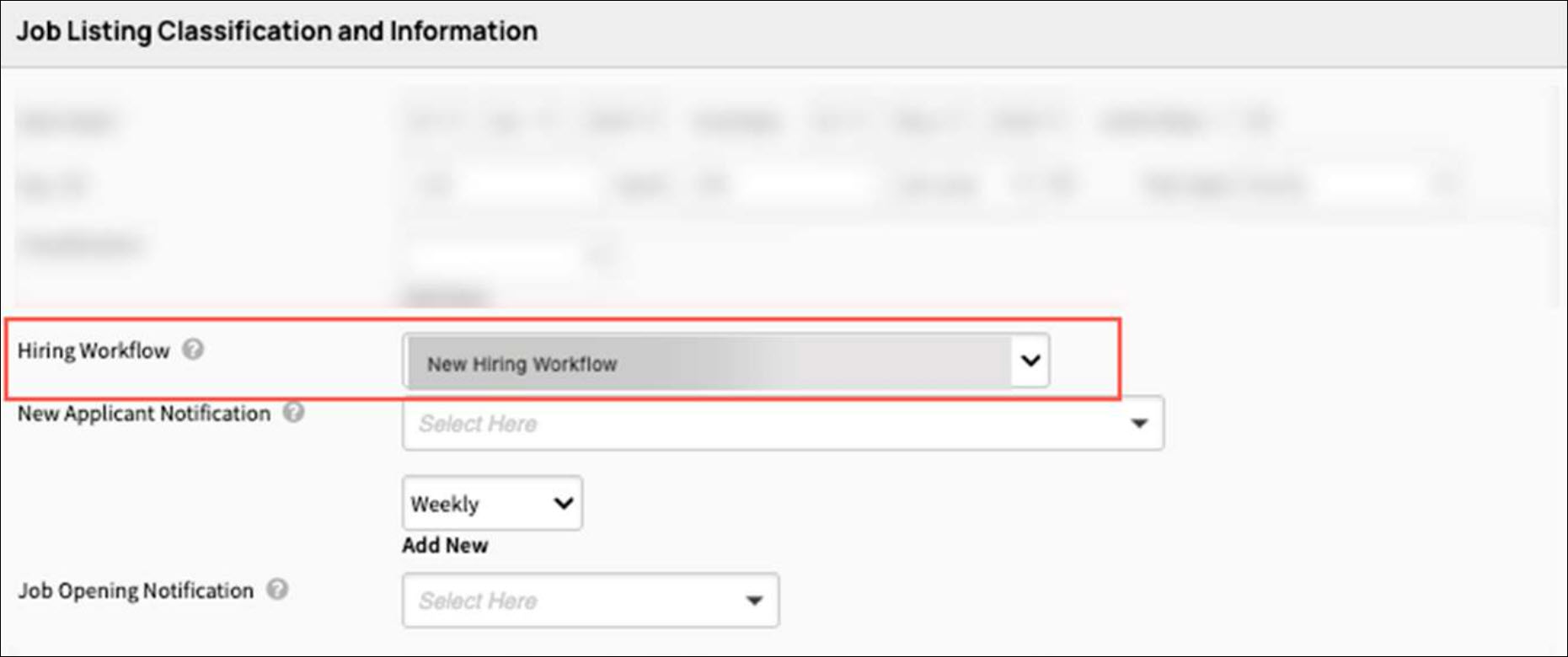

There are 3 steps to setting up Hiring Workflows:

- Configure a hiring workflow in Settings to control which application statuses are included in each tailored workflow.

- Attach a workflow to each Job Listing.

- Manage applicants from the Hiring Pipeline.

- Visual representations show the applicant’s hiring journey.

- Drag and drop applicant tiles to a different lane or status to quickly change the application status

- Preview each applicant’s record.

- Click on the tile to view additional details like Job Match score, job history, and preview the resume.

- Complete additional actions like sending the applicant a message or viewing the full application profile.

Beta testing feedback started on 12/9/2024 but additional testers are welcome in this pilot phase. Final release dates for this new feature will be determined later based on testing feedback.

Color and font changes improve the Applicant Tracking screens

Subtle changes provide a fresh look and feel

Small updates to the Applicant Tracking interface were released on 12/19/2024. This fresh look includes updated colors and subtle design enhancements — all aimed at

improving usability while maintaining a consistent user experience.

Access LinkedIn data directly in Applicant Tracking

Send job information faster and receive more applicant data using Apply Connect

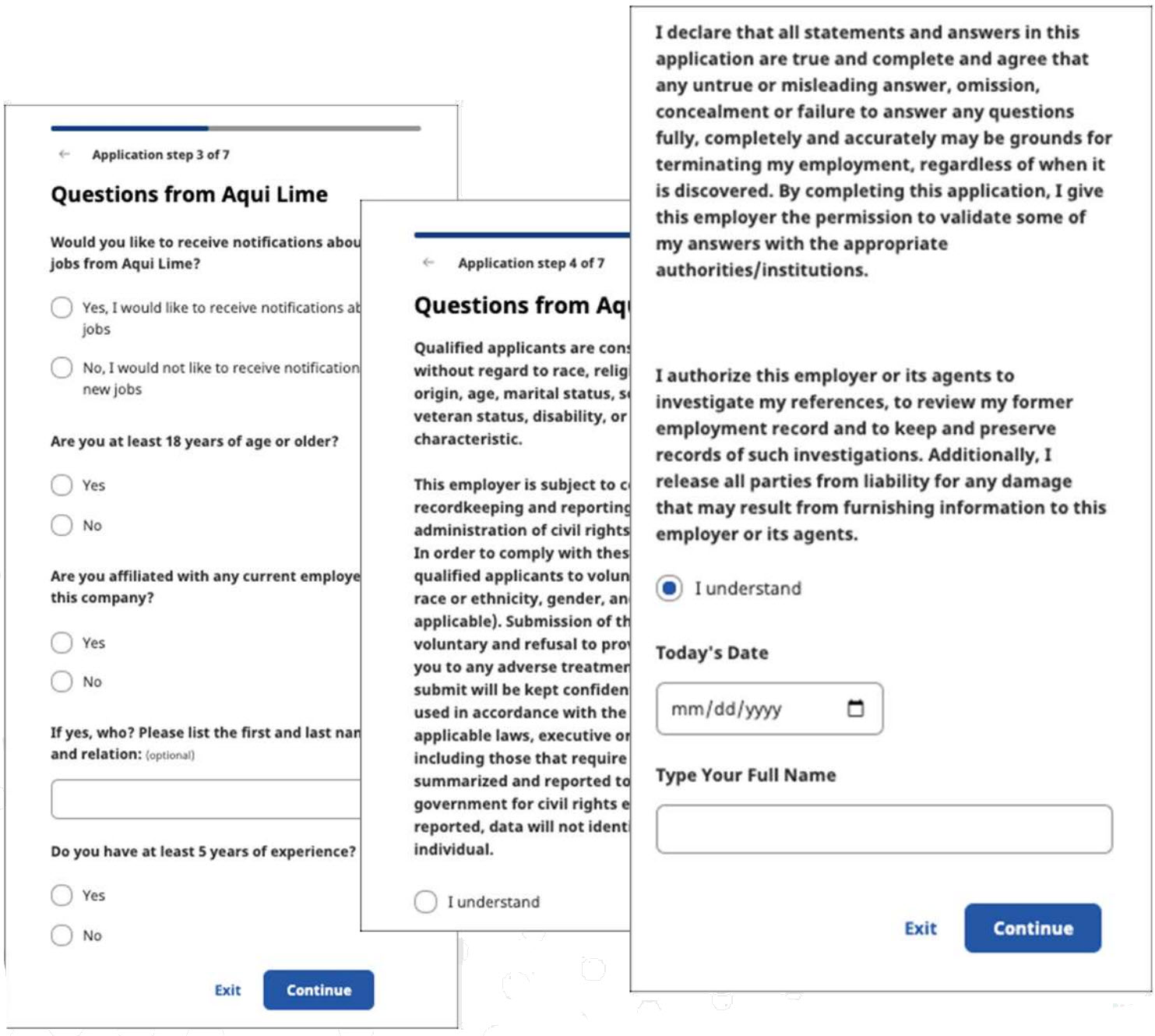

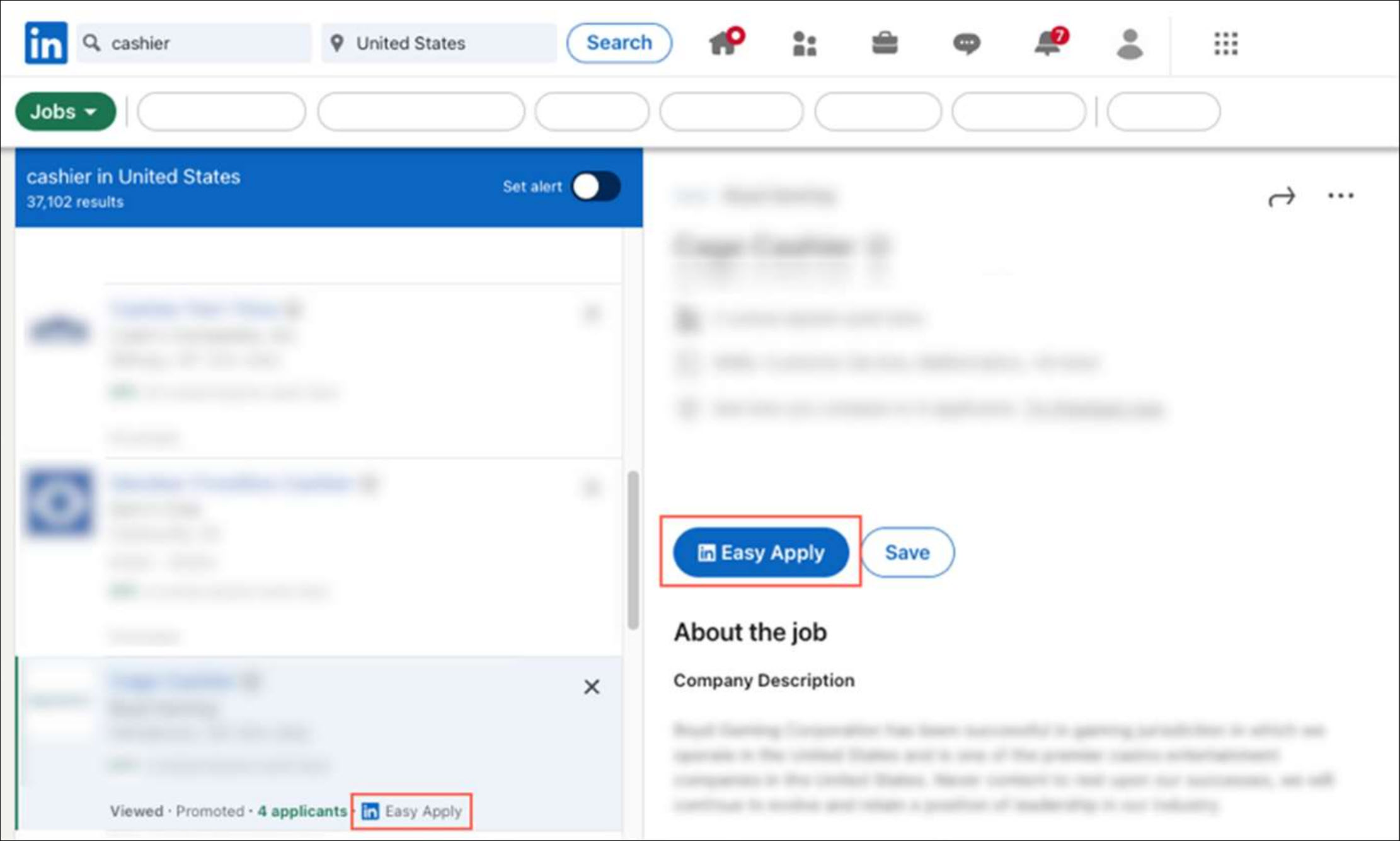

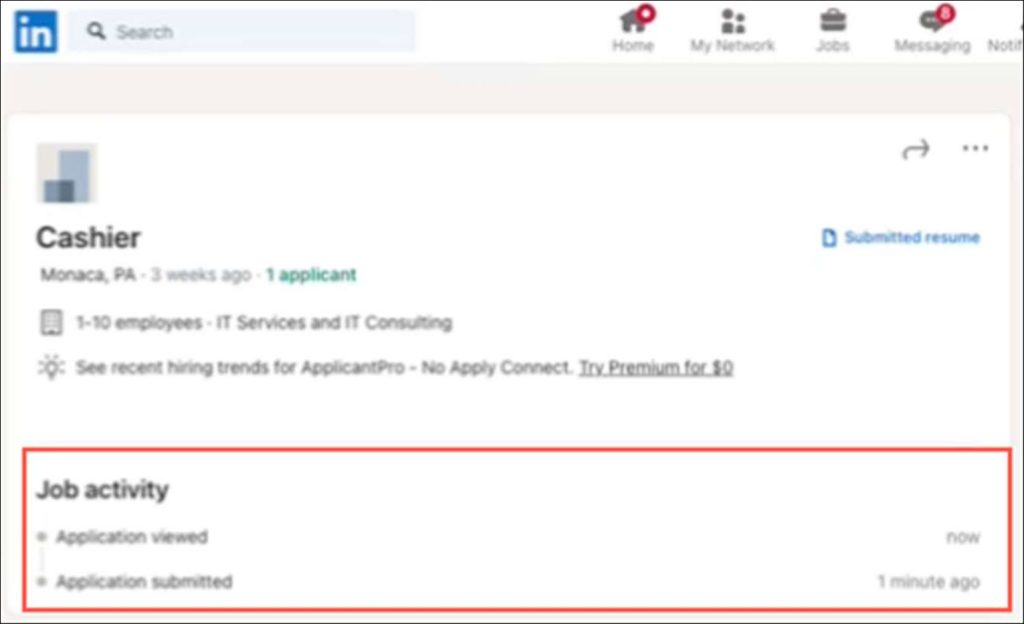

Apply Connect is an integration from LinkedIn that improves the candidate experience by allowing job seekers to apply for jobs without leaving LinkedIn. Statistically, this means that clients will receive more completed applications from LinkedIn.

This option provides more effficient applicant processing because you can:

- Receive job applications and skills match

data from LinkedIn applicants in near realtime. - Collect more information from applicants. The application can include additional information like screening questions and EEO information.

Your job listing performance will also improve because:

- Jobs posted to LinkedIn will appear more quickly on LinkedIn’s website, usually within a few hours, rather than 1 – 2 business days.

- Jobs will appear as a free listing on LinkedIn’s Job Marketplace and under the Jobs tab on your Company page in Applicant Tracking.

- The Easy Apply buttons appear on these job listings. This improves the candidate experience by allowing job seekers to apply for customer jobs without leaving LinkedIn. Statistically, this also drives far more applicant traffic.

Special features for admins with LinkedIn Recruiter accounts

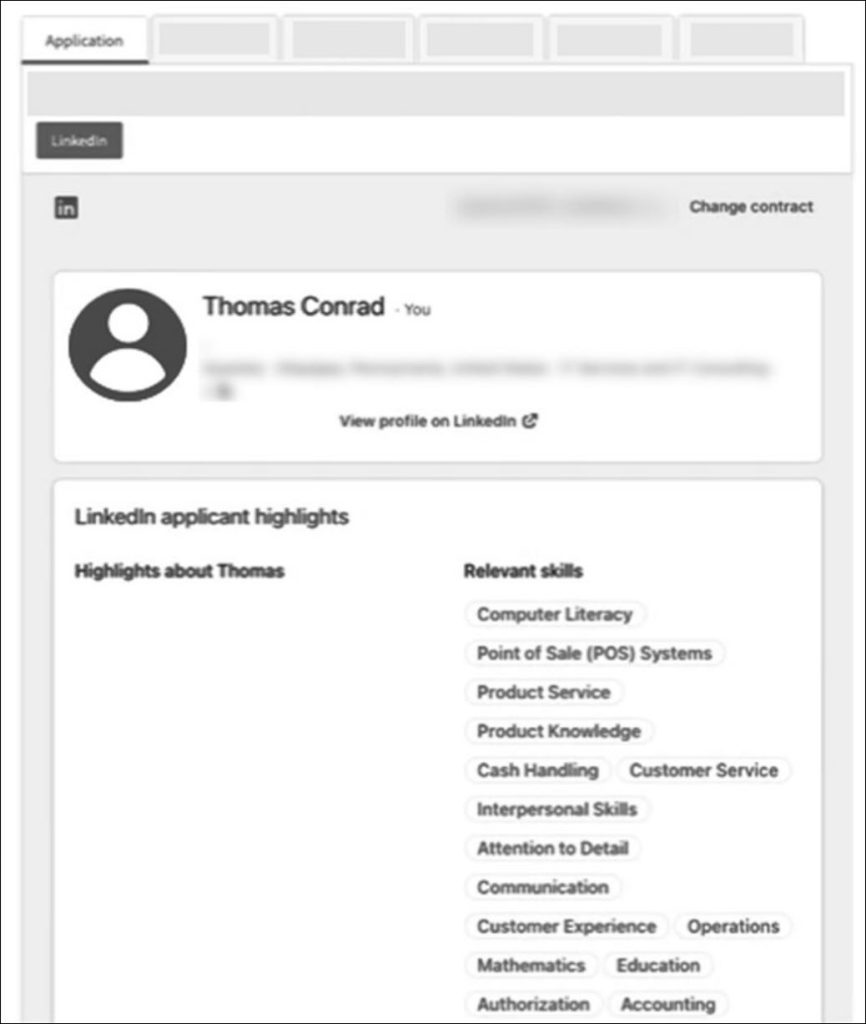

For clients with LinkedIn Recruiter accounts, Apply Connect enhances the applicant management process by providing access to real-time LinkedIn data directly in Applicant Tracking to more efficiently evaluate applicants based on their fit for the job.

For applicant data imported directly from LinkedIn, the LinkedIn source will display on the Applicant List. Hover over the source to display highlights from the applicant’s LinkedIn profile.

In their application record, a new LinkedIn tab shows a more detailed view of their resume highlights and relevant skills from their LinkedIn profile that match the job. A View profile link quickly lets you see their full profile on LinkedIn.

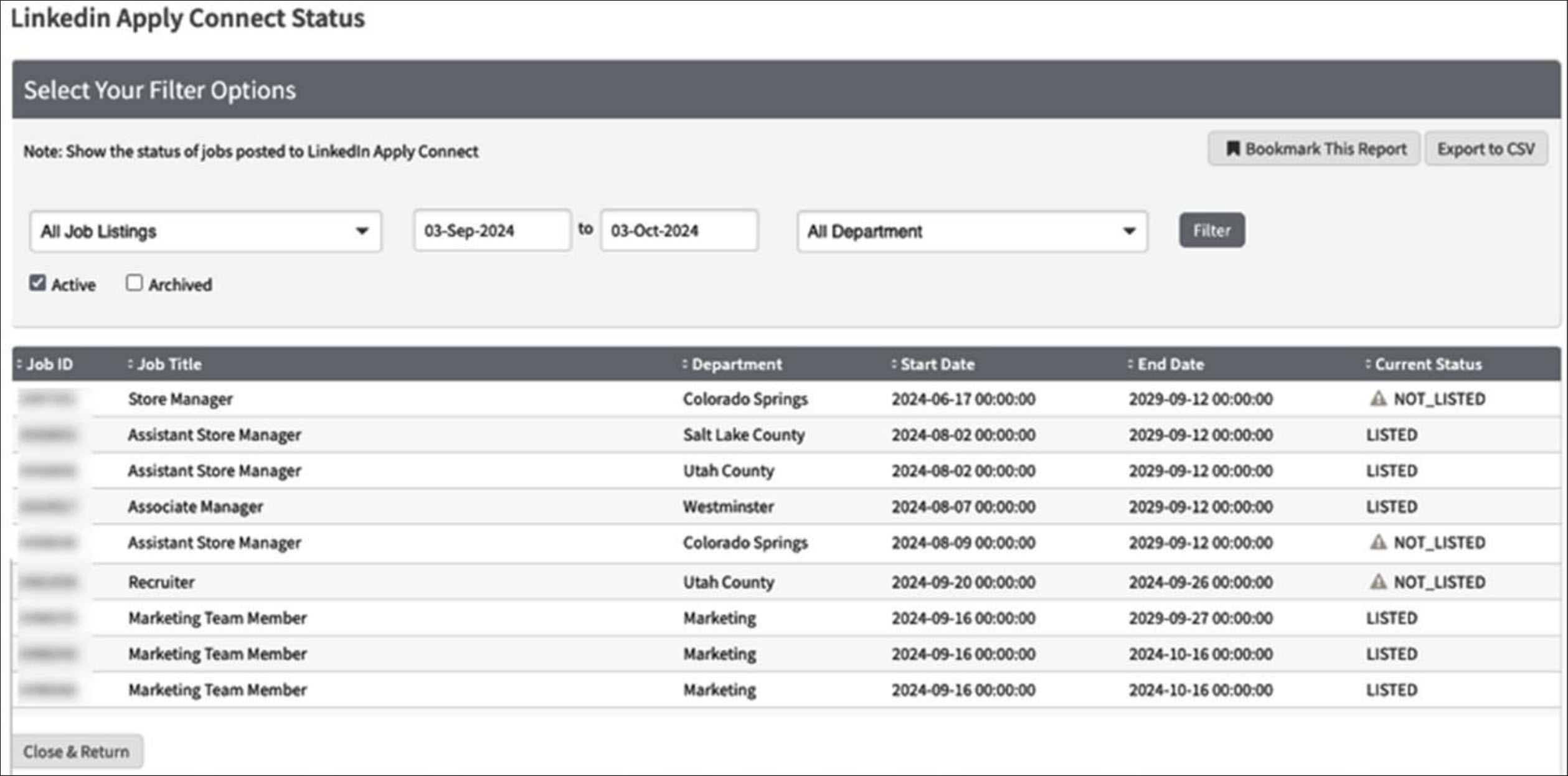

Admins with Recruiter accounts can also view the posting status of jobs for accounts that are using Apply Connect from the Job Status Report.

LinkedIn disposition signals inform applicants of their progess by providing the Status Type, which indicates the stage within your candidate workflow. Sending progress feedback to candidate’s LinkedIn accounts is optional.

Connect your LinkedIn Recruiter account now to take advantage of this integration

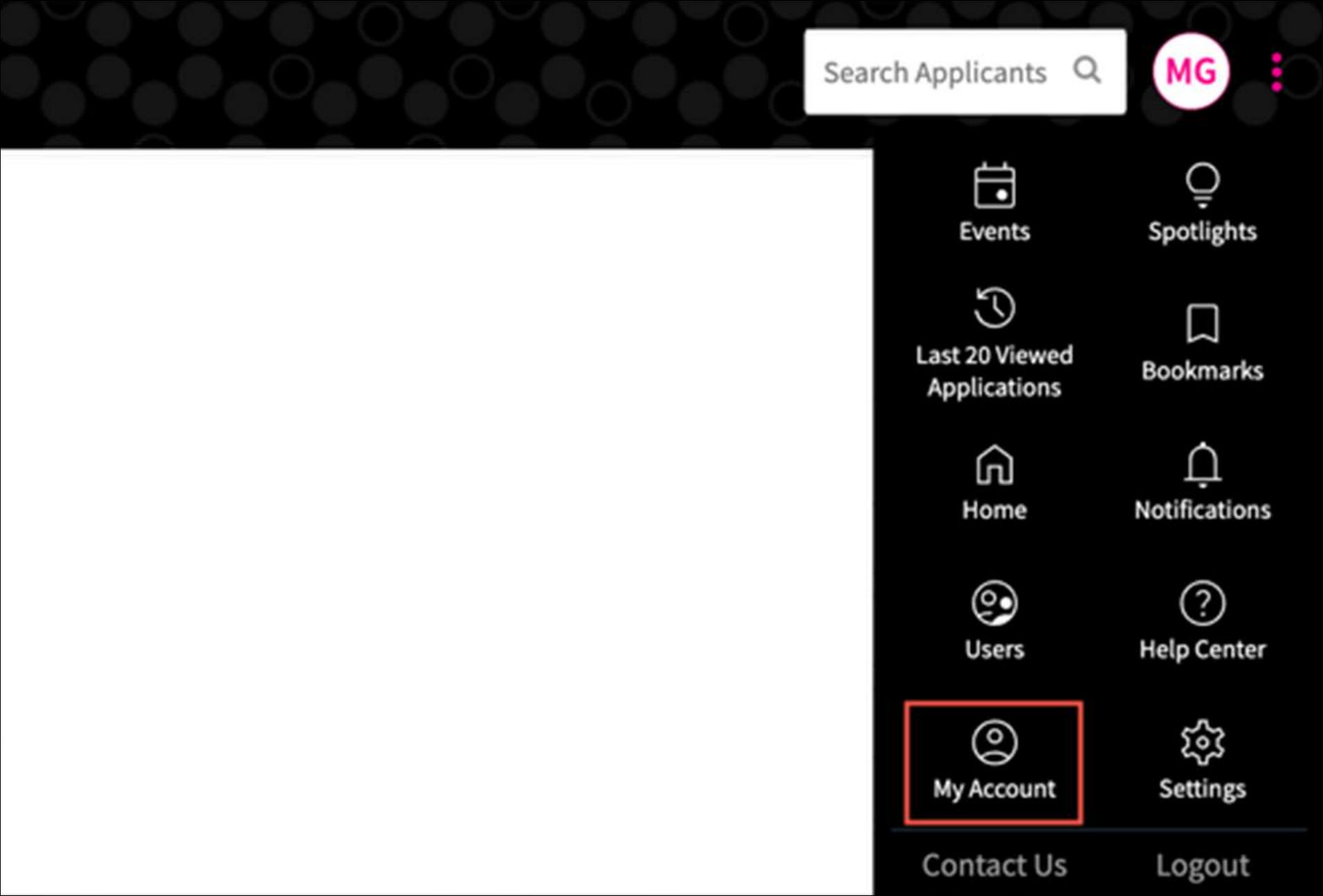

The Apply Connect integration was released on 12/17/24 to all Applicant Tracking administrators. To enable it, follow these steps:

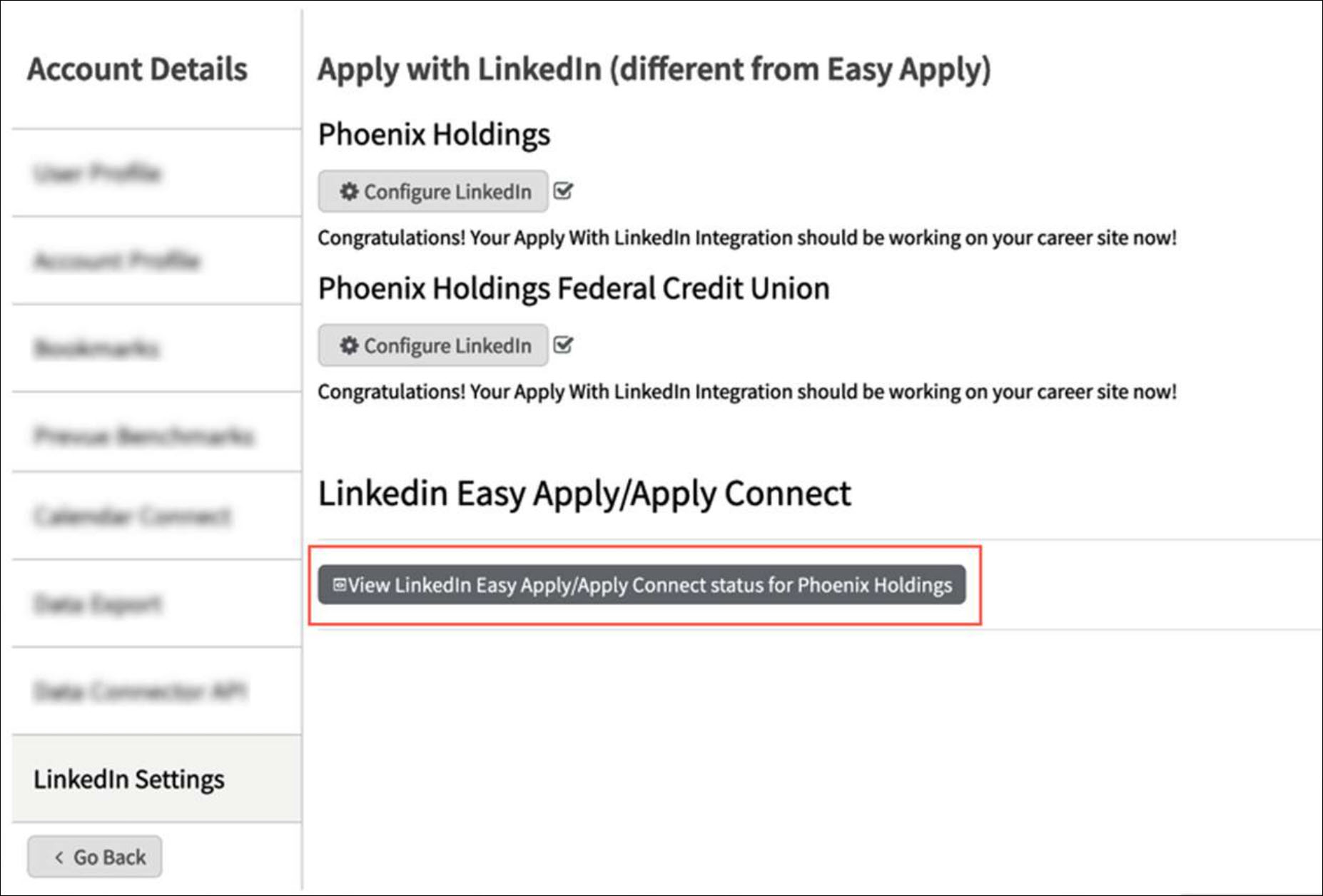

1. Select My Account from the menu in the top right.

2. On the Account Details menu, click LinkedIn Settings.

3. Click the button in the Linkedin Easy Apply/Apply Connect section.

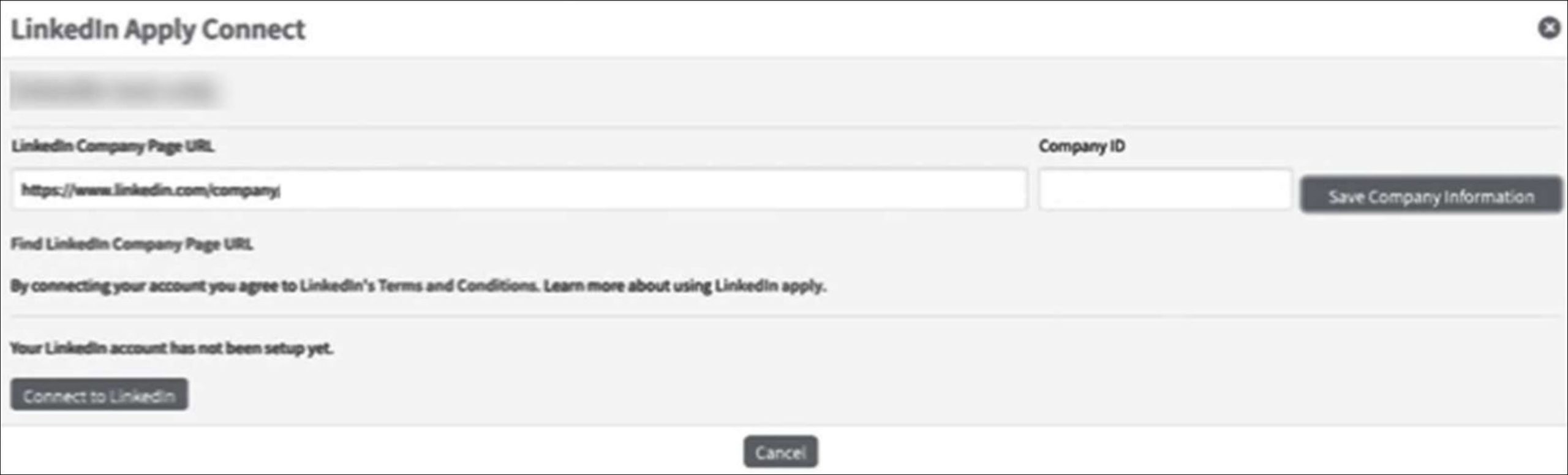

4. Copy and paste your LinkedIn Company Page URL and Company ID into the corresponding fields.

5. Click the Save Company Information button.

6. Click the Connect to LinkedIn button.

There is one additional step to integrate with your LinkedIn Recruiter account.

To take advantage of these Applicant Tracking enhancements or sign up to participate in the beta, contact Applicant Tracking support at support@isolvedhire.com.