Friday, March 11th, 2022

Highlights

isolved version 8.04 brings new functionality to support businesses who pay employees based on miles, days, pieces, or other unit types. Dashboards are now easier to read with the improved design in this release, and there is better support for leave plans that accrue each fiscal year. These enhancements will be available when you log into isolved on Friday, March 11th, 2022.

Employee Administration

- Dashboards now have a grid view that is easier to read

Employee Communication

- Mass emails can contain attachments, but make sure they total 3MB or less in total size for successful email transmission

Payroll Reporting

- Now you can keep hours and other units of pay separate in the totals that display on pay stubs and payroll reports

Leave Management

- It’s easier now to define exactly when your fiscal year starts for leave plans that accrue based on a fiscal plan year

Employee Administration

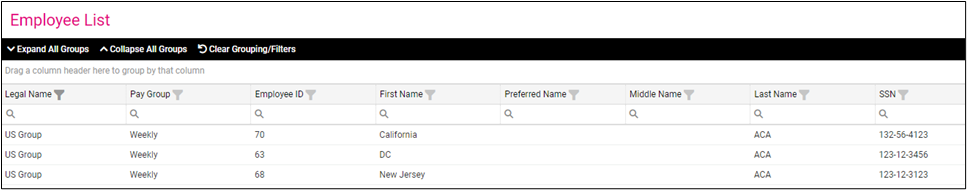

Enhanced Employee Summary and Employee Analytics Dashboards

The updated view makes employee dashboards easier to read

Improvements have been made so dashboards are easier to read.

- Column heading borders have been added to make it easier to see which filter button to use for each column

- Lines have been added between rows to make it easier to scan across with your eyes

- Text is aligned visually across the row so it’s easier to read

- Style changes make it easier to view empty columns

These changes will be applied automatically with the isolved 8.04 release.

Employee Communication

Review the size of your mass email attachments

To ensure mass emails transmit successfully, limit the total attachment size to 3MB

When creating new email templates, a new message will display to remind you about the maximum message size.

If you need to share information with employees that would exceed the attachment limit, consider storing the documents on an internal company website and including a link in the email instead. Another option is to skip email altogether and use Company Information or Employee Messages in isolved to share the information.

Payroll Reporting

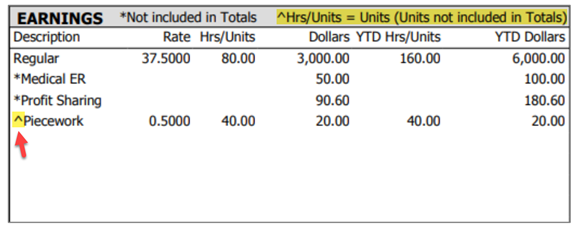

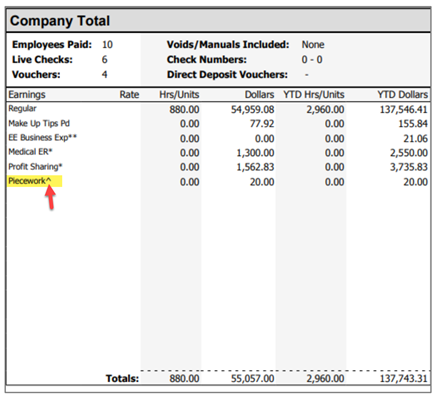

Separate hours and units in report totals

Pay stubs, payroll reports, and Report Writer have been enhanced so units are not included in hours totals

Before this enhancement, there was no way to specify whether your earning was paid based on hours or a unit like miles or piecework. In version 8.04, each earning can be defined as hourly or unit pay. When an earning is used for unit pay, a carat (^) will indicate that the amount in the Hours/Units columns is units, not hours. Units will not be included in the hours totals that are displayed at the bottom of the earnings sections. These changes help California employers meet pay stub requirements to display hours totals.

You will see these changes on:

Pay Stubs

Payroll reports

Report Writer updates as well

If you have earnings that should be marked as unit pay, contact your Payroll Specialist.

Leave Management

Enhanced support for fiscal plan years

Specify your fiscal year start day in company setup to ensure absences are applied to the right fiscal plan years

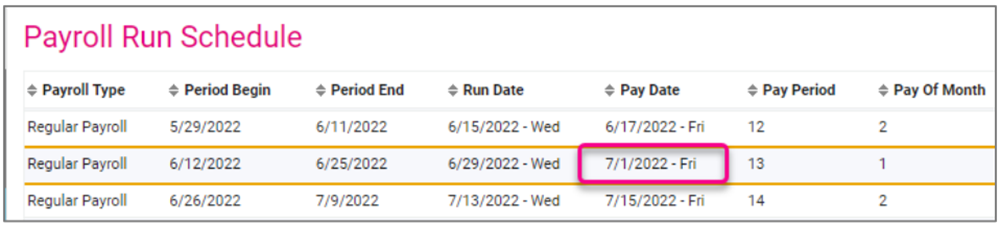

Fiscal years can cover any 12-month period and may not match the standard 12-month calendar of January 1st through December 31st. isolved now has the ability to easily set up a fiscal year for leave accruals. Prior to this release, if leave plans were configured to reset at the end of the fiscal year, the system looked at the pay date to determine when the carryover should occur. Now you have the flexibility to look at pay period dates or pay dates when determining how to apply your fiscal plan year to ensure that absences are applied to the correct plan year.

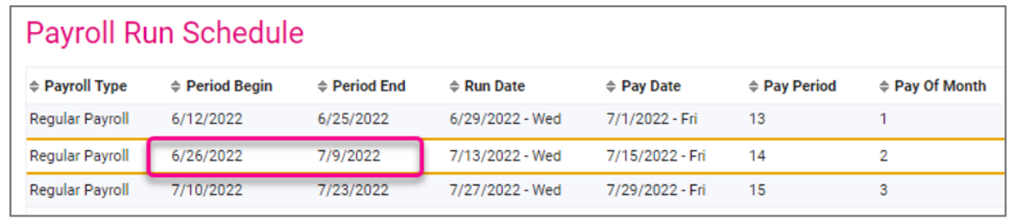

Let’s walk through the new options for a fiscal year that starts on 7/1:

Leave plans that are configured to use a fiscal plan year will automatically default to the Based on Pay Date option to continue existing functionality. When this option is selected, the carryover will occur in the first payroll whose pay date falls on or after 7/1 of the current year. Using the sample pay schedule shown below, the carryover would occur in payroll # 13, whose pay period runs from 6/12/2022 – 6/25/2022 but is paid on 7/1/2022.

The new Based on Period End Date option gives you the flexibility to look at pay period dates instead when determining when the new fiscal plan year begins. With this option selected, the plan year will not reset until payroll # 14 since 7/1 falls within the pay period of 6/26/2022 – 7/9/2022.

To change your carryover option for fiscal year leave plans, contact Insperity Time Support at time.support@insperity.com

Contact your Payroll Specialist if you have any questions about the updates in isolved version 8.04

Download the release notes

Download the release notes: isolved Product Release v8.04