Friday, June 2nd, 2023

Highlights

isolved version 9.10 includes tips and updates for Applicant Tracking, employee withholding tax form updates in the Tax Wizard, and updates to isolved People Cloud and ESS Classic View as part of the modernization effort.

Applicant Tracking

- Understand the Twilio fee changes for the Text-to-Hire service

- Make sure your job postings are compliant with new posting requirements on Indeed and ZipRecruiter

- Learn tips and tricks for generating more applicants in the upcoming Job Posting 101 webinar on June 7

Tax

- The Federal Filing Status options have changed on the employee tax screen to phase out the W-4 options that were in effect prior to 2020

- Tax rates, geocodes, and filing statuses have been updated for state and local taxes to ensure compliance

Usability

- More screens get a refreshed look to make it easier than ever to manage employees

Self-Service

- Better screen design makes it easier for employees, managers, and supervisors to update HR items in ESS Classic View

- Review the tax compliance updates to employee withholding forms in the Tax Wizard in Onboarding, ESS Classic View, and the Adaptive Employee Experience (AEE)

Security

- Make sure you’re ready for the changes coming to the isolved login process on June 30th

Onboarding & HR

- Are your I-9 verification processes ready to return to pre-COVID standards? Temporary accommodations are expiring July 31, so learn how to stay compliant with WX

Applicant Tracking

Understand the fee changes for the Text-to-Hire option

Twilio has announced billing changes for clients using the Text-to-Hire feature in isolved Applicant Tracking

In our modern world, applicants use their phones for everything. The Text-to-Hire feature lets them apply for jobs by sending text messages. This add-on feature for isolved Applicant Tracking is powered by Twilio, who sends text messages from businesses to applicants.

You may have received an email from Twilio already about changes to their text messaging fee structure, but we want to be sure there are no surprises about this future change.

- Twilio will be charging a $19 fee to clients who are currently subscribed to a texting plan

- New clients will receive 25 free texts per month. Free texts are meant to allow companies to test the feature with their applicant pool. They are not intended for long-term use.

- Existing clients who have already purchased the Text-to-Hire feature will retain 50 free texts per month

If you are currently using free text messages but want to take advantage of a full plan, or you would like to learn more about the Text-to-Hire option, contact your Project Manager or Customer Success Specialist to complete the business registration process.

Ensure your job postings are compliant with new rules on Indeed and ZipRecruiter

Don’t request personal information on Indeed

Indeed now penalizes job posts that request personal information by limiting their visibility, which reduces your applicant pool. Make sure you’re not asking for any of these items in your initial job applications:

- Driver’s License Information

- Social Security Number or the last 4 digits of the SSN

- Bank account information

If this information is pertinent to your application, we recommend requesting it in Phase 2 of the two-step application process, so it does not connect back to Indeed.

Indeed and ZipRecruiter now require salary and pay information in job descriptions

To stay compliant with state and local laws that require pay transparency in job postings, Indeed and ZipRecruiter will estimate salary and pay information based on averages for similar positions. To make sure your postings are accurate, include the salary or hourly rate in your Job Listings in isolved Applicant Tracking so they post correctly with the automated job board integration.

Attend free webinars from our recruiting specialists to learn how to get noticed on career sites

- If you missed the Job Posting Habits You Need webinar in May, you can watch it here:

Job Posting Habits You Need | Login to this event (webinarjam.com) - Attend the June webinar, Job Posting 101, on June 7, 2023 at 10 AM MST to dive into job posting. Register here by clicking the button in the blue bar at the bottom of the page:

Job Posting 101: Featuring Our Job Posting Team! (webinarjam.com)

Tax

Automated tax updates ensure you stay in compliance

Federal filing status options have been phased out that are no longer in use on the current W-4

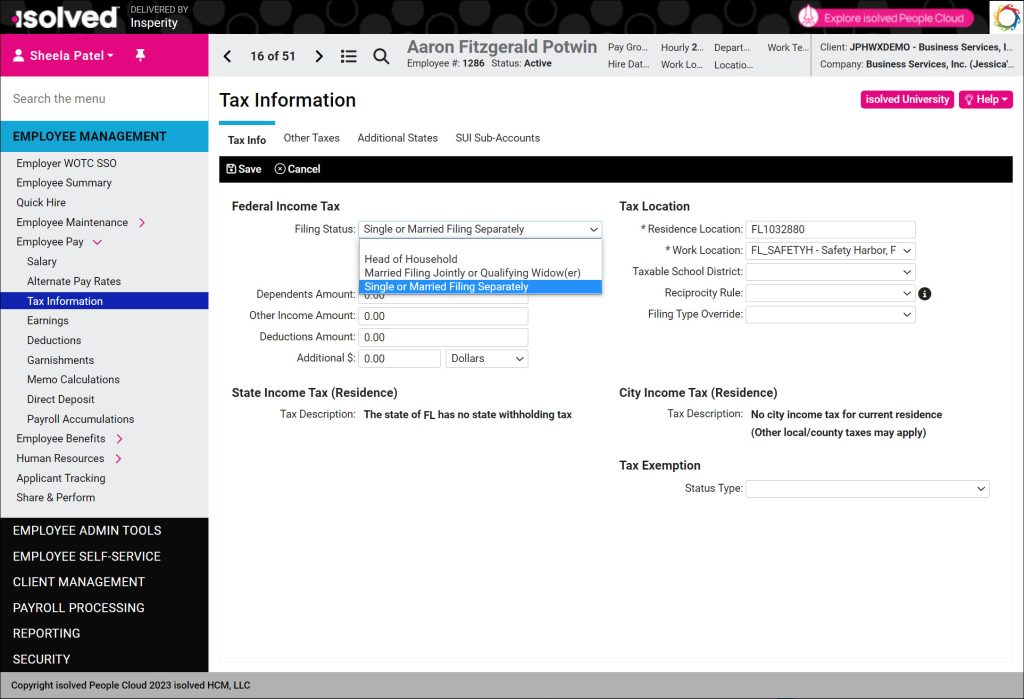

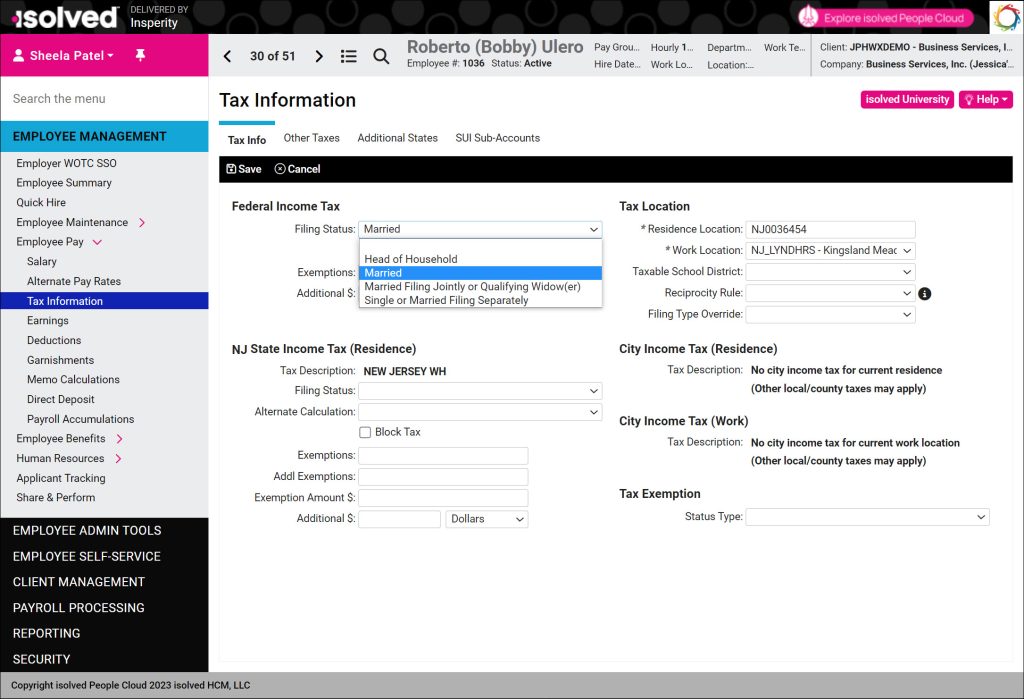

Since all employees completing the Tax Update Wizard through Onboarding and self-service since 2020 have been using the new federal filing statuses, the old Single and Married options have been removed. If you are manually entering or updating employee federal tax withholdings in Quick Hire or on the Employee Management > Employee Pay > Tax Information screen, you will notice the Single and Married options are no longer available to select.

If you have employees who were hired prior to the Federal W-4 update in 2020 who have not submitted updated information, their old filing information is still saved. But you will not be able to assign those old values to any employees who already have up-to-date withholding information.

For compliance, it is recommended that you reach out to any employees who are still listed with the Single or Married filing statuses so they can update their federal tax withholding forms. Employee Messages are a great way to send this request through self-service in the Adaptive Employee Experience (AEE) or ESS Classic View.

Employees may notice changes to withholding amounts in some states and local jurisdictions

Insperity works with isolved to ensure your tax rates, standard deductions, exemptions, and tax location codes are always in compliance so you don’t have to worry about it.

The following changes were included in the version 9.10 release on Friday, June 2, 2023, so employees will see these updates reflected in all payments processed after that date:

- Utah state income tax changes were effective 6/1/2023 and may result in lower tax withholding amounts:

- The Utah state tax withholding rates changed from 4.85% to 4.65%

- Standard deductions increased from $390.00 to $415.00 for single filers and from $780.00 to $830.00 for married filers.

- The withholding allowance credit changed from $7,774.00 to $8,371.00 for single filers and from $15,548.00 to $16,742.00 for married filers

- Mason County, Kentucky added a county occupational license fee of 1% effective 5/1/2023. If you have work locations in Mason County, you will see this additional Occupational License Fee tax on payments processed after the 9.10 release. For more information about the tax, see this presentation provided by Mason County.

- Ohio local tax rates have changed for some jurisdictions effective 1/1/2023:

- Berkshire Township JEDD II, Delaware County, now has a 1.85% withholding rate. Employees who qualify as a military spouse under the Military Spouses Residency Relief Act (MSRRA) can be exempt from this tax.

- Burton Village/Township JEDD, Geauga County, now has a 1% withholding rate. Employees who qualify as a military spouse under the Military Spouses Residency Relief Act (MSRRA) can be exempt from this tax.

- Indian Hill in Hamilton County decreased their withholding tax rate from 0.525% to 0.475%

- The name of the Joint Economic Development District in Clermont County changed from Union Twp-Milford JEDD to Union Twp-Milford JEDD V.

- The taxability of certain benefit deductions for the Community Safety Payroll Tax in Eugene County, Oregon changed effective 1/1/2023:

- 401(k) catch up contributions for employees aged 50 and older in the calendar year are now exempt.

- 403(b) catch up contributions for employees aged 50 and older in the calendar year are now exempt.

- 457 plan catch up contributions for employees aged 50 and older in the calendar year are now exempt.

- Long term disability payments under a section 125 plan are now taxable

- Short term disability payments under a section 125 plan that are made by a third party agent are now exempt.

- Johnson City in Cambria County, Pennsylvania changed withholding tax rates effective 4/29/2023:

- The Local Services Tax (LST) rate decreased $156.00 to $52.00 annually. There will be a separate communication on how this should be updated and how employee YTD taxes are impacted.

- The low income exemption for the LST tax decreased from $21,000 to $12,000

- The Herrings, New York geocode (NY0455932 / 33-045-5932) is no longer valid for work locations and tax processing. This unincorporated hamlet in Jefferson County should be reassigned to the unincorporated Jefferson County geocode of NY0450000 (33-045-0000).

- Payroll Specialists contacted all Workforce Acceleration clients with work locations using this geocode in May, so everyone should be reconfigured correctly.

The following changes were included in the version 9.10 release on Friday, June 2, 2023 but will not take effect until pay periods including or after July 1, 2023:

- Ohio local tax rates will change for some jurisdictions effective 7/1/2023:

- Lordstown in Trumbull County has a withholding tax rate increase, from 1% to 1.5%

- The Village of Stockport in Morgan County introduced a municipal tax at the rate of 1% that will be administered by the Ohio Regional Income Tax Agency (RITA). Employees who qualify as a military spouse under the Military Spouses Residency Relief Act (MSRRA) can be exempt from this tax. For more information, read the tax ordinance.

- Warsaw in Coshocton County introduced a municipal tax at the rate of 1% that will be administered by the Ohio Regional Income Tax Agency (RITA). Employees who qualify as a military spouse under the Military Spouses Residency Relief Act (MSRRA) can be exempt from this tax. For more information, read the Warsaw member page on the RITA website.

Correction: These tax changes were not included in the original release notes published on Friday, June 2, 2023. Based on updated information from isolved, these changes have been added to the release notes on June 5, 2023 to ensure you have accurate information about what was included in the version 9.10 release.

Usability

More employee screens get the modern look and grid style

As a continuation of the isolved screen design refresh, more screens have been updated with the modern look and new grid style. The overall functionality remains the same but they’re easier to navigate. The new screen designs include:

- Columns you can drag to reorganize and click to sort

- Filters on each column so you can group records or limit your view to find just the information you need

- A Search field to easily find specific records

- An XLSX button to quickly export your current view to Microsoft Excel

- Employee grid views include a Field Chooser to add additional columns of information to review your employee populations at a glance

- Employee grid views include Actions buttons or menus on each record that let you add, edit, or delete without having to scroll

Leave Management screen updates

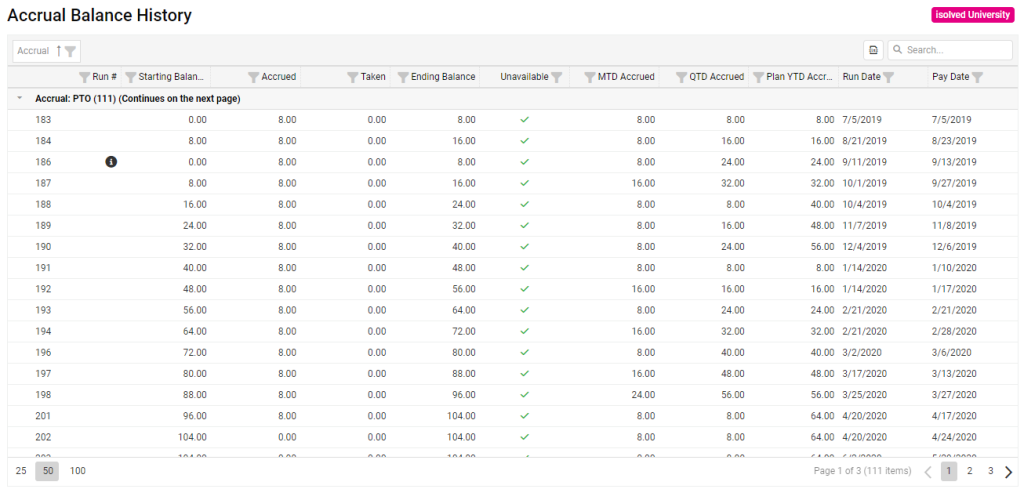

The Accrual Balance History screen has been updated to a new modern look. Navigate to Employee Management > Employee Benefits > Accruals > Accrual Balance History to check out the new design. You can now sort, filter, and group the information displayed on the screen and easily export to Excel.

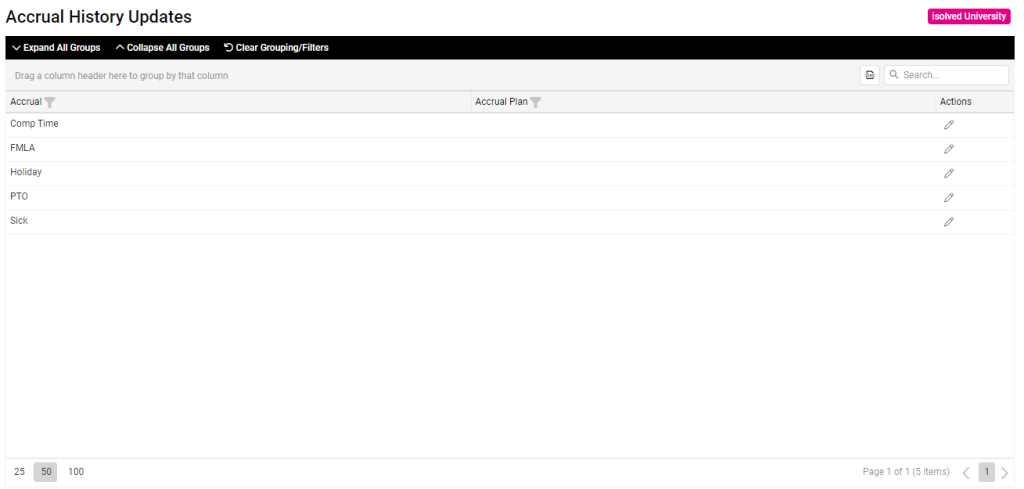

The Accrual History Updates screen has also been updated to use the employee gird view. Navigate to Employee Management > Employee Benefits > Accruals > Accrual History Updates to use the redesigned screen. To view more details about a specific plan or edit and save changes to accrual balances, use the new pencil icon in the Actions column on the right.

Human Resources screen updates

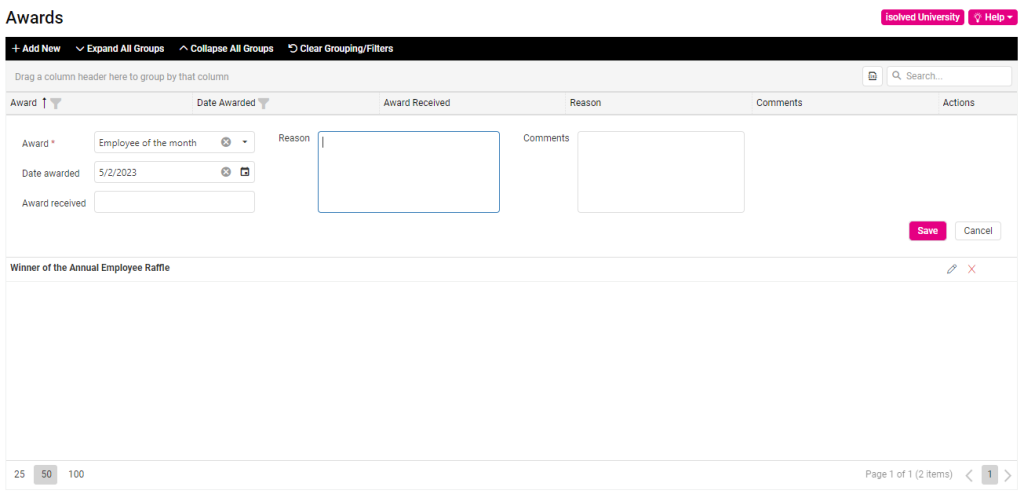

The Awards screen in the Employee Management > Human Resources > Performance section has been refreshed. Now you can sort, filter, and group employee award records and edit using the pencil icon in the Actions column on the right. Use the Search box to find specific records quickly.

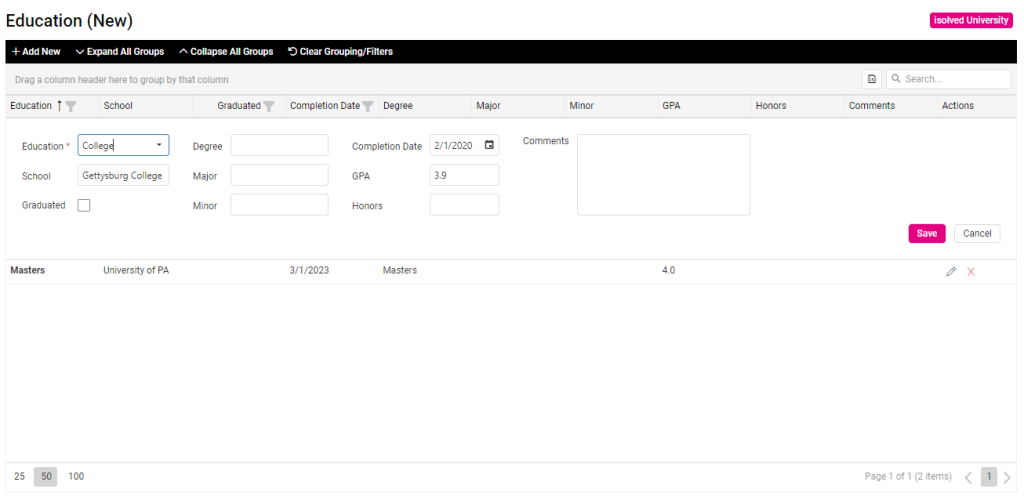

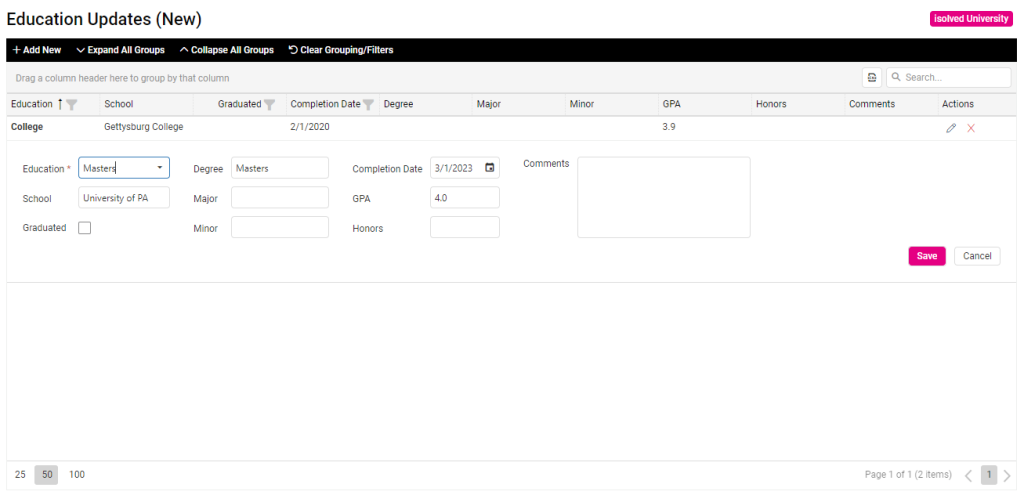

You can sort, filter, and search through multiple employee records on the Education screen now. Navigate to Employee Management > Human Resources > Training and Development > Education to test the new features.

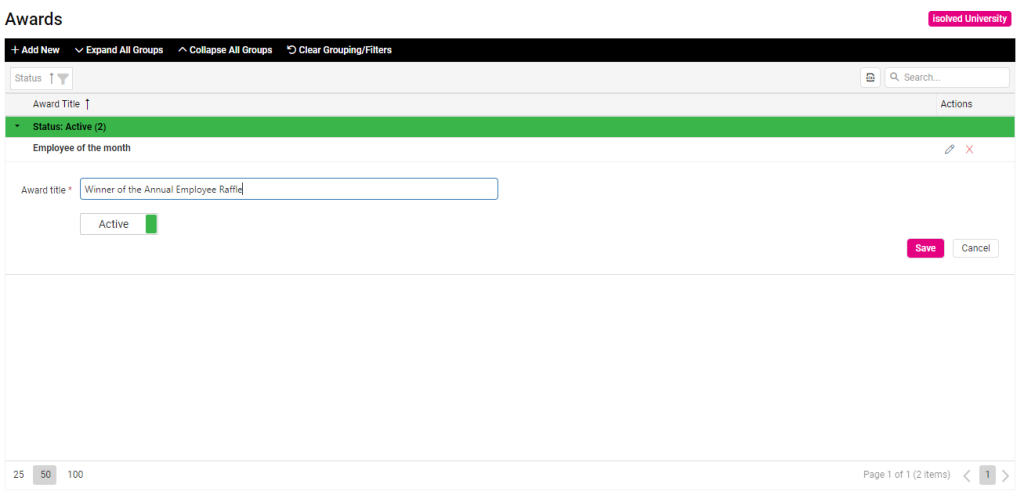

Adding new Award Types is easier too with the updated Client Management screen design

Navigate to Client Management > HR Management > Performance to use the revamped Awards screen to view, add, edit, and delete new award types. You can tell at a glance which award types are active since they are separated into categories in the new design.

Correction: The Client Management > HR Management > Training and Development > Skills screen was not updated with this release. Previous versions of this article listed it as already complete. It will be redesigned with the new grid view in the upcoming 9.11 release on Friday, June 16, 2023.

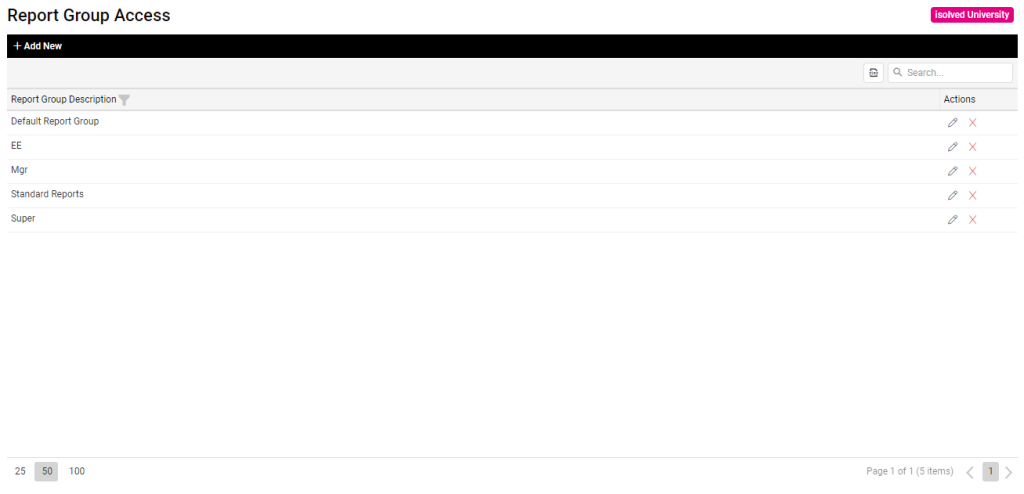

Report Group Access gets a redesign too

Control which reports your administrators, managers, and supervisors can see more easily with the updated Report Groups screen. Navigate to Client Management > Tables > Report Group Access to see the report groups that are defined. Use the pencil in the Actions menu on the right to edit the report group name or quickly delete unused groups with the X.

Employee Self-Service

It’s easier than ever for employees to update their awards, education, and skills in ESS Classic View

Awards, Education, and Skills Updates have a new look

ESS Classic View screens get the same great features as their employee management counterparts. Employees, managers, and supervisors can Search, Sort, Filter, and Group to quickly locate the right records. The Actions column on the right makes it easy to understand which record you’re editing or deleting. Add new records with the + Add New button in the black bar at the top of the screen.

The Awards Updates and Skills Updates screens in ESS Classic View and the Employee Self-Service menu in isolved People Cloud get the same modern, intuitive design updates as the Education Updates screen.

Compliance changes to employee withholding forms in the Tax Wizard

Guided Mode and Choose Mode for Colorado Form W-4

The Colorado Form W-4, Employee’s Withholding Certificate uses employee federal withholding information. If employees have previously completed their Federal Form W-4, Employee Withholding Certificate, the Guided Mode automatically populates the Colorado form with the information from the Federal version. If they are using Choose Mode to complete both the Federal W-4 and Colorado W-4, the updates will change both forms.

In Guided Mode, employees will be prompted with the question:

If you want to make adjustments from your Federal withholding, you must complete the Colorado DR 0004 form. Otherwise, if not completing the Colorado DR 0004 form, employer must use a copy of your IRS form W-4. Do you want to continue with the Federal W-4 for Colorado purposes?

Saying yes will bring in the Federal W-4 information for Colorado State Income Tax Withholding in isolved.

Corrections to other state withholding forms

Small corrections were made to some state withholding forms to ensure they are compliant with the latest rules.

- California Form DE-4(SP), Certificado de Retenciones del Empleado, was updated to align with the English version

- The PDF version of the Colorado Form DR 1059, Affidavit of Exemption for the Nonresident Spouse of a U.S. Servicemember has been corrected. The attestation by the servicemember’s spouse initials were transposed with the service member’s initials in the previous finalized PDF version.

- The New York Resident Guided flow survey question, “Would you like to opt out of paid family leave benefits?” has updated responses:

- I would like to opt out of paid family leave benefits

- I would NOT like to opt out of paid family leave benefits

Previously, this option said None of the above

Security

isolved account migration – June 30th

Have you marked your calendar yet?

On Friday, June 30th, the new login experience will be live for all users. Read Logging in to isolved is getting easier! to make sure you’re ready. Keep your eye out for important information regarding this migration in future editions of the HUB, your biweekly isolved release notes, and emails.

Onboarding & HR

Temporary COVID-19 Form I-9 accommodations are set to expire

Bring your I-9 processes into compliance before July 31, 2023

Read the Temporary COVID-19 Form I-9 Accommodations Set to Expire article to get ready for the changes to your I-9 verification process.

- U.S. Immigration and Customs Enforcement (ICE) has announced that employers must return to physically inspecting I-9 documents in person by July 31, 2023

- For employees hired between March 20, 2022 and July 31, 2023 when the relaxed inspection requirements were in effect, employers need to go back and physically inspect their documents.

- Learn how to leverage isolved to determine which employees need reinspection and to annotate their I-9s when the inspection is complete

For more information about the changes in the version 9.10 release, contact your Payroll Specialist.