(updated 10/23/2024)

For employees who declined electronic delivery of year-end tax forms, they will be mailed to the employee’s year-end tax form address in isolved for these forms:

Employee Home Address

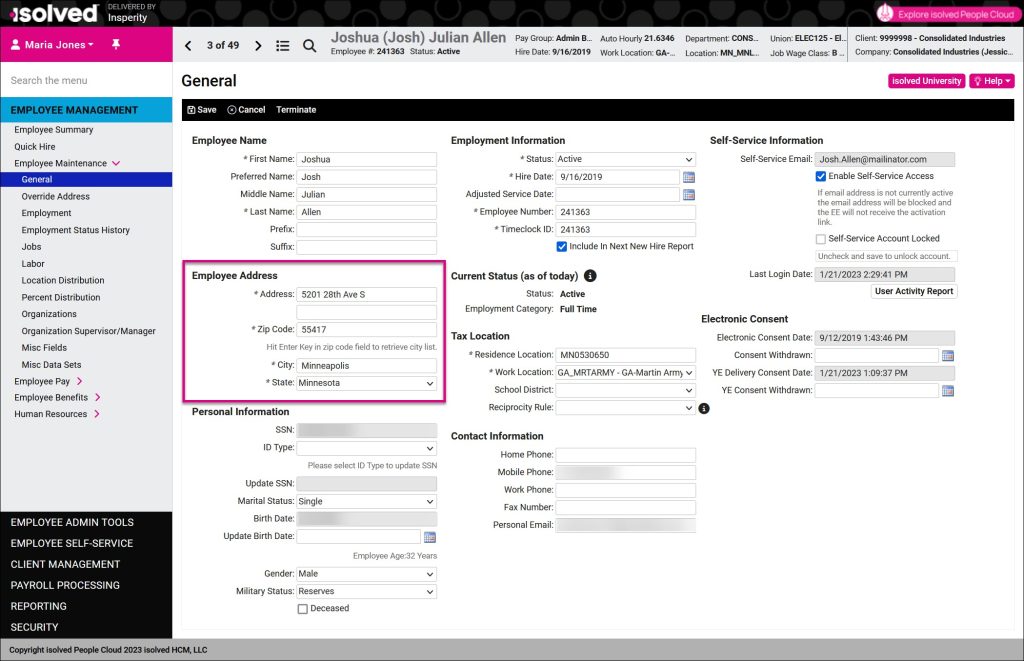

Most employees have only one address on file in isolved: their home address. Client administrators can view their employee’s home address from the General screen on the Employee Management > Employee Maintenance menu in isolved People Cloud:

Year-end tax forms will be mailed to the employee’s home address unless they have an override address designated for tax forms.

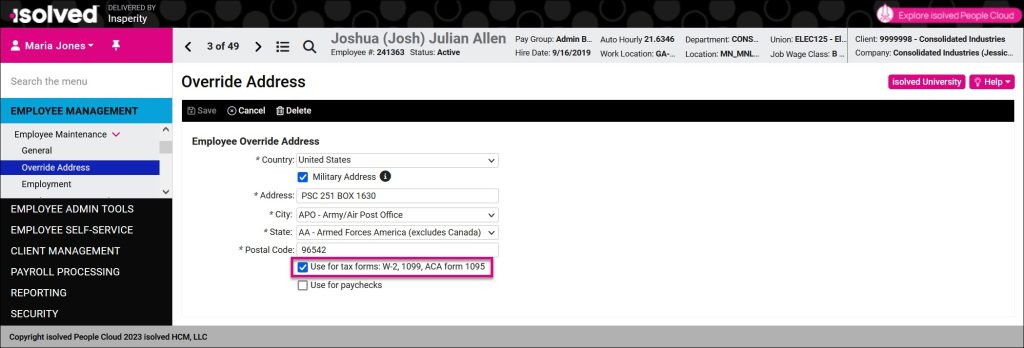

Override Address designated for Tax Forms

Some employees may be temporarily located at a different address when they need to receive their year-end tax forms. Since changing their home address would also impact resident taxes, they can specify an alternate address just for delivery of mailed pay stubs and year-end tax forms.

Employees with an APO address who are temporarily stationed in another military location are the most common users of the override address.

For the 2024 tax year, employees will need to update their home address or specify an override address for tax forms no later than Friday, December 27, 2024, to ensure delivery to the correct address.

Note: Mailed tax forms will be returned to the employer if an employee’s address is invalid. If that occurs, please correct the address in isolved and contact your HCM payroll specialist for a reprint, if necessary.