There might be several reasons why an employee does not see the direct deposit to their account on the morning of the check date. Sometimes, banks have processing delays that impact the timing of direct deposit transactions. There may be a reason that the bank has locked the account or put a hold on it. Also, the employee may have closed their account and forgotten to update their payroll records.

If an employee has not received their direct deposit, the first thing that you should do is to confirm that the payment and account is on the payroll register. To pull the payroll register, follow the steps below.

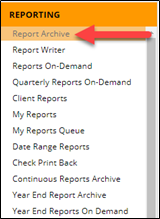

- Go to Reporting > Report Archive.

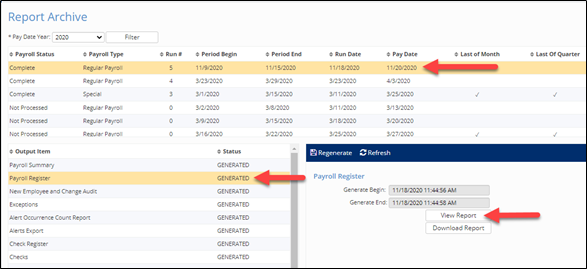

2. Select the payroll, then select the Payroll Register from the list of Output Items and click View Report.

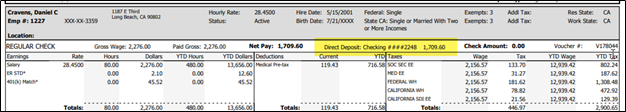

3. Verify that the employee did receive the payment as direct deposit and that the last 4 digits of the account number shown are correct.

Once you have confirmed that the payment is on the register, you can reach out to your payroll specialist to research further. Our payroll specialists can work with our banking team to determine if there are any issues with the deposit.

If an employee direct deposit is rejected, our banking team will usually receive notice from the bank within five business days. Your payroll specialist will then reach out to you to determine how you would like to handle. The funds can be sent to a different account or reissued as a live check. You will need to work with your payroll specialist to complete the reissue.