For employers doing business in Colorado, the Colorado FAMLI leave contributions will begin with your January 3, 2023 pay date which may include a pay period that began in December 2022.

Using the Insperity HRCore™ solution to comply with Colorado Paid Family and Medical Leave legislation

- HR services though the HR resource center (requires log in) helps you understand how the new Colorado Paid Family and Medical Leave Insurance impacts your business

- Use the isolved technology to collect and remit Colorado Paid Family and Medical Leave tax.

Understanding the Legislation

In November of 2020, Colorado voters approved Proposition 118, which paved the way for a state-run Paid Family and Medical Leave Insurance program.

- Provides Colorado employees with twelve weeks of paid family and medical leave. Employees who take leave for pregnancy or childbirth complications may receive up to sixteen weeks of FAMLI leave.

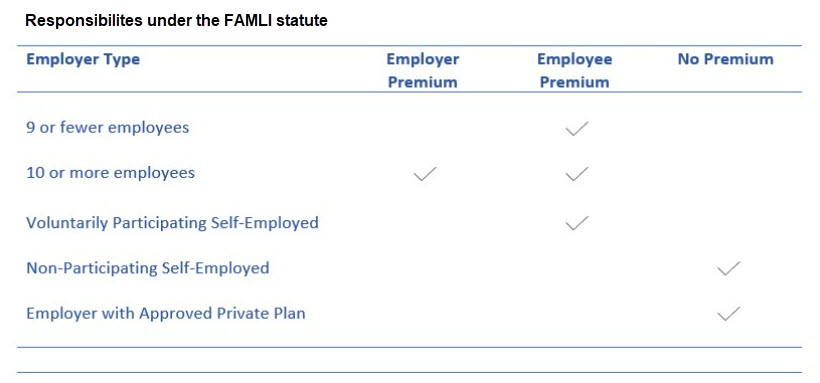

- Employers and their employees are both responsible for funding the program and may split the cost 50/50. The premiums are set to 0.9% of the employee’s wage with 0.45% paid by the employer and 0.45% paid by the employee.

- Businesses that report having ten or more employees who worked during 20 or more weeks in all of 2022 will be responsible for sending the full 0.9% premium for all four quarters of 2023.

- Businesses with nine or fewer employees do not have to contribute to the program but do need to remit their employee’s share (0.45%) of the premium on behalf of the employees each quarter.

- Employers are never required to pay more than 50% of the total premium, however they may choose to cover some or all of their employees’ premium as a company perk.

- Premiums are paid on wages up to the Federal Social Security Wage Cap ($160,200 for earnings in 2023).

- Employers cannot collect missed premiums from employees in later pay periods.

Important Dates

- January 1, 2023 – Date by which employers are required to notify their employees about the FAMLI program.

- January 1, 2023 – Most Colorado businesses will need to begin deducting FAMLI premiums from all employees on their payroll, including full-time, part-time, and seasonal. The new employee and employer taxes will be made available in isolved for all companies who do business in Colorado.

- Prior to April 30, 2023 – All employers, regardless of size, will be required to register with the FAMLI Division before the first premium payment is due at the end of the first quarter of 2023. Registration is now open.

- April 30, 2023 – The first FAMLI premium payments are due. Insperity’s Tax Team take expertly manage this process for you.

- January 2024 – Benefits will become available to workers.

Resources

- The Colorado Department of Labor and Employment Paid Family and Medical Leave Insurance (FAMLI) program

- The Colorado Department of Labor and Employment FAMLI Toolkit for employers that includes several resources to help your employees navigate the upcoming changes, including the 2023 Required Program Notice, the FAMLI Employee Handbook and more.

- Colorado FAMLI Employer FAQs

Legislation FAQ

Employees of the federal government cannot access the state benefit, and therefore will not see any FAMLI-related wage deductions on their pay stubs.

If an individual works for an employer who has chosen to cover their employees’ full portion of the contribution as an added work perk, the employee will not see any FAMLI-related wage deductions.

Employers may apply to opt out of the program only if they already have a privately funded paid family leave program in place that offers benefits comparable to FAMLI. Employees for those employers also won’t see any FAMLI-related wage deductions but may see other deductions depending on how the employer funds its private program.

There is no enrollment period for self-employed workers. You can opt in any time and apply for leave any time once benefits become available in 2024. No action is required until then.

These contributions build the FAMLI fund during 2023. Starting on January 1, 2024, employees may begin to file claims to receive their FAMLI benefits through an online process in development by the Department.

The 2023 premium payment schedule is:

• April 30, 2023 – A 30-day grace period will be offered before the first premium payments and wage reports are considered late.

• July 31, 2023

• October 31, 2023

• January 31, 2004

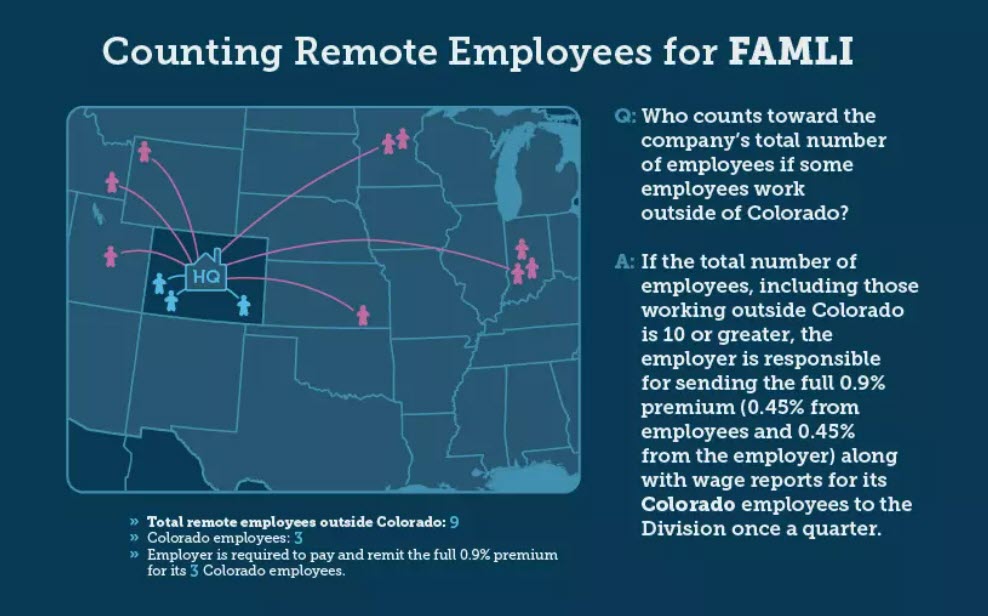

In the example below, this employer has 15 total employees and will be required to remit the full 0.9% premium (0.45% from employees and 0.45% from the employer) for the eight employees who are based in Colorado.

In this example, the employer would be responsible for remitting the 0.45% employee share and the 0.45% employer share for the three employees who work in Colorado because it has 12 total employees.

It’s important to note that employers are responsible for deducting and remitting premiums for every employee as soon as they are hired. This 20-week concept should only be used to determine whether or not your business is categorized as having 10 or more employees and thus responsible for sending in the full 0.9% premium once a quarter.

Employers who are considering offering a private plan (including self-insurance models) are NOT exempt from paying FAMLI premiums until the FAMLI Division has reviewed and approved the private plan or self-insurance documentation in accordance with the Division’s private plan regulations.

All employers must register with the FAMLI program and will be required to pay premiums beginning January 1, 2023. Employers can request a refund for premiums paid in 2023 if they get a private plan approved by the Division with an effective date on or before January 1, 2024.

The FAMLI Division anticipates opening the application for private plan approval in the first quarter of 2023. Instructions on that application process are forthcoming.

1. The employee’s work is performed entirely within Colorado.

2. The employee performs work both within and outside of Colorado, but the work performed outside of Colorado is incidental to the employee’s work within Colorado, or is temporary or transitory and consists of isolated transactions; or

3. Neither the base of operations nor the place from which some part of the work is directed or controlled is not in any state in which part of the employee’s work is performed, but the employee’s individual residence is in Colorado.

Colorado Paid Family and Medical Leave in isolved

Implementing FAMLI deductions

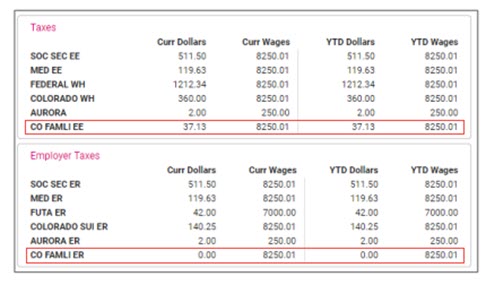

Effective 1/1/2023, the system will automatically add the CO – CO Paid Family and Medical Leave Employee and Employer to each legal company doing business in the state of Colorado. The rates will automatically be added and cannot be edited. Therefore, if an employee receives Gross Wages of $8250.01, it would be multiplied by .9% and then divided appropriately between the employer and employee. See below:

Employers with less than 10 employees

Employers with less than 10 employees are not subject to the employer portion of the tax. Please contact your Insperity Payroll Specialist who will ensure the employer portion of the tax will not be taken.

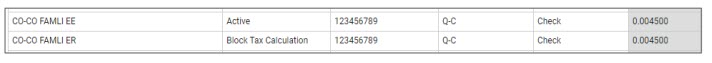

Since the employee must still pay the tax and the wages must still be reported, this will just block the tax calculation for the employer portion of the premium. See below:

Employers with approved private plans

If an employer has a state approved Private Plan, the employer is still required to report the employee wages and hours. Therefore, your Insperity Payroll Specialist will change the Tax Status for both the employee and employer portion to block the tax from calculating. This will stop the withholding, but the wages will still be reported.

The pay stub will still show the taxable wages for both the employee and employer portion of the CO- Paid Family and Medical Leave, but no tax will be withheld.

Block tax for certain employees

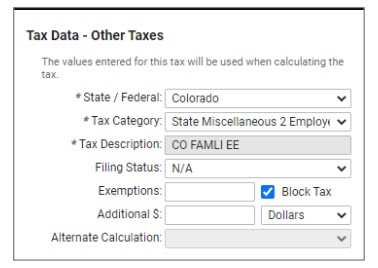

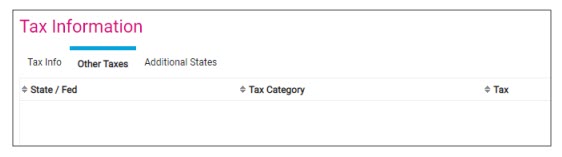

If an employee should not have tax withheld navigate to Employee Management > Employee Pay > Tax Information and click on the Other Taxes tab.

Click on the Add New icon and select the following:

• Select “Colorado” from the State / Federal drop-down menu.

• Select “State Miscellaneous 2 Employee” from the Tax Category drop-down menu.

• Put a check mark in the Block Tax option.