Friday, May 17th, 2024

Highlights

isolved People Cloud version 10.09 includes minimum wage updates that take effect in June and July, additional 2024 federal and state tax form updates and enhanced manager access to Applicant Tracking reports.

Payroll & Tax

- 2024 Federal and State tax form updates

- Minimum wage updates for Seattle, Washington and multiple jurisdictions in California

Applicant Tracking

- Enhanced manager access to standard reports and report builder

- Training Webinar – Unlocking the Power of your Applicant Tracking-Indeed Integrations

Payroll & Tax

Minimum Wage Updates

New minimum wage rates for Seattle, Washington and multiple jurisdictions in California

This release will update the system minimum wage tables to include new rates. The rate change in Seattle, WA, takes effect June 1st, 2024. The other minimum wage increases included in this release take effect in July 2024. These tables are used to display the Work Location Minimum Wage on the Employee Salary / Hourly Rate List and for earnings that are configured to use the minimum wage rate.

Minimum wage changes in these jurisdictions are included in the version 10.09 release:

| State | Jurisdiction | Effective Date | Minimum Wage | Tipped Minimum Wage | Overtime Tip Credit | Notes |

| CA | Alameda | 7/1/2024 | $17.00 | $17.00 | ||

| CA | Emeryville | 7/1/2024 | $19.36 | $19.36 | ||

| CA | Fremont | 7/1/2024 | $17.30 | $17.30 | ||

| CA | San Francisco | 7/1/2024 | $18.67 | $18.67 | ||

| CA | West Hollywood | 7/1/2024 | $19.08 | $19.08 | ||

| CA | Seattle | 6/1/2024 | $19.97* | $17.25 | *$17.25/hr if the employer pays $2.72/hr towards medical benefits |

These minimum wage rate changes will not automatically update employee salary records. See Reviewing pay information for minimum wage compliance to learn how Workforce Acceleration can help you stay in compliance with minimum wage changes.

Federal and state tax form updates

Updates to tax forms used in Onboarding and Tax Updates within self-service

With this release, we’ve made updates to federal and state tax forms that are used in Onboarding and the Tax Updates functionality within self-service.

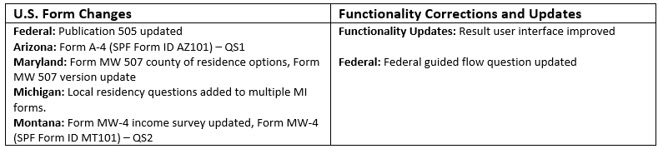

Here is the list of changed forms:

For additional information, click here to see the details about these form changes.

Applicant Tracking

Manager Access to Reports

It’s here! Enhanced manager access to Standard Reports and Report Builder!

Admins are now able to grant user access to career site reports to managers who you determine need it. By ensuring they have a comprehensive view of data within Applicant Tracking, managers will gain valuable insights that will foster better decision-making and drive success across departments.

Important Note: When a manager is granted access to a report, they’ll have full visibility into all data within the career site, regardless of departmental or job listing settings. Which reports are accessible will be consistent across all managers; however, you’ll have the flexibility to customize which managers have access based on your team’s needs.

Training Webinar

Unlocking the Power of Your Applicant Tracking-Indeed Integrations

Join our June webinar to unlock the secrets to turbocharging your recruitment on Indeed, the powerhouse behind 350 million monthly visitors.

We’ll explore our suite of Indeed integrations, which are designed to accelerate hiring, lower costs, and streamline workflows, saving you valuable time and effort.

Whether you’re a hiring pro or just getting started, this webinar will equip you with expert insights and best practices for maximizing your ATS-Indeed integrations.

If you can’t attend the webinar live but would like the information, we’ll send all registrants a replay link after the webinar.

For more information about the changes in the 10.09 release, contact your Insperity Payroll Specialist.