Friday, November 15th, 2024

Highlights

isolved People Cloud version 10.19 includes information on a change to the Adaptive release schedule, 2025 minimum wage updates, federal and state tax form changes, and information on Applicant Tracking enhancements, among other exciting updates.

Adaptive Employee Experience (AEE)

- New Adaptive release schedule

Payroll & Tax

- 2025 minimum wage updates for multiple state and local jurisdictions

- Federal and state tax form updates

- Forward your 2025 IRS and state notifications to Insperity – action required!

- Year-end information available on the Help Center

Reporting and Analytics

- NY DBL PFL reports updated with 2025 limits

Applicant Tracking

- Applicant Tracking planned maintenance Friday, November 15th, 10:00 p.m. Eastern

- Enhanced employee search and navigation

- Employee Referral transition to Job Sharer portal

Adaptive Employee Experience (AEE)

New Release Schedule for AEE

Updates will be released on Fridays at 9:00 p.m. Eastern

While new releases for isolved People Cloud and the Adaptive Employee Experience (AEE) will continue to deploy on a 3-week cadence, they will no longer be deployed at the same time.

People Cloud releases will continue to deploy late Thursday evening, and most users will see the new release when they come into work Friday morning. Adaptive updates will now be released Friday at 9:00 p.m. Eastern, the day after People Cloud.

Payroll & Tax

Minimum Wage Updates for 2025

State and local minimum wage updates

A number of 2025 minimum wages have been updated based on information provided by each jurisdiction. The file below shows all the known 2025 minimum wage changes and will continue to be updated as more rates are published.

These minimum wage changes will not automatically update employee salary records. See Reviewing pay information for minimum wage compliance to learn how Workforce Acceleration can help you stay in compliance with minimum wage changes.

State Tax Form and Federal Guided Flow Updates

Federal and State Form Changes

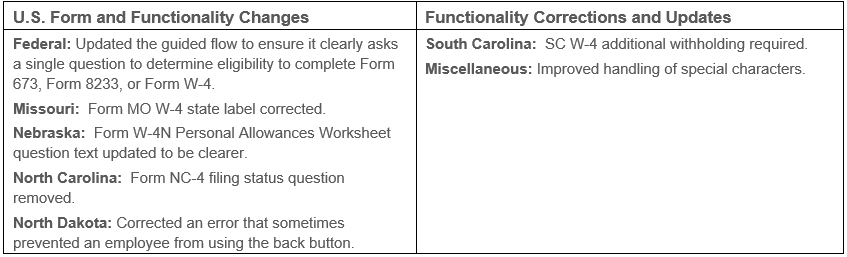

With this release, updates will be made to Federal and State forms and employee withholding forms that are used in onboarding and those using the Tax Updates functionality in self-service. Here is the list of changed forms:

Click here to see additional information about these tax form changes.

2025 IRS and State Notifications

Forward unemployment rate and tax filing frequency notices to Insperity

Unemployment rates and tax filing frequency changes are mailed to the taxpayer, not to Insperity. It is imperative these tax-related communications are forwarded to Insperity immediately.

For those clients in the states of Washington and Wyoming, we also require your 2025 Workers Compensation rates, as those are remitted with tax payments.

We require this information to ensure your taxes are paid accurately and timely in 2025. Please send your information to wx.tax@insperity.com

Year-end Information available in the Help Center

Access important information to help you prepare for the end of year

Look for important 2024 year-end information in our year-end central section of the Insperity® Help Center. This section provides you with critical information to prepare for the end of the year, including:

- Holiday schedules

- Year-end maintenance and guidance for adjustments

- Tax resources and information about W-2s

- ACA compliance deadlines

Reporting and Analytics

NY DBL PFL report updates

Reports updated to reflect 2025 limits

The NY DBL PFL Audit Detail Report and the NY DBL PFL Audit Report have been updated to reflect the 2025 limits:

- PFL Covered Wages: updated the weekly cap to $1,757.19 for 2025

- PFL YTD Capped Wages: updated the capped limit to $91,373.88 for 2025

Applicant Tracking

ATS Planned Maintenance Notification

Maintenance begins Friday, November 15th, at 10:00 p.m. ET

We want to inform you of an upcoming scheduled maintenance update for isolved Applicant Tracking. On Friday, November 15th we will be migrating to a new data storage provider, a change that will enhance security and scalability.

The planned maintenance will begin at 10:00 p.m. ET on November 15th. This update requires a short period of downtime, during which users will not be able to access the system. We anticipate the update will take 1-3 hours.

Enhanced Employee Search and Navigation

Faster load times in the Employee User tab!

This week you’ll get faster load times in the Employee User tab! Whether you’re searching for a specific employee or managing a large list, you’ll now experience quicker load times, along with new pagination for lists of over 250 users. The page is now alphabetically sorted by last name, making it easier to locate employees and access other features seamlessly.

Employee Referral Transition to Job Sharer Portal

Improved platform set to replace legacy Employee Referral Portal

As we continue transitioning clients to our new Job Sharer Portal, we want to remind you that our improved platform is set to fully replace the legacy Employee Referral portal by the end of 2024.

If you haven’t switched yet, our Account Management and Support teams may reach out to guide you through the transition. Want to get started sooner? Just let us know!

Indeed Visibility Tips

Faster Job Posting on Indeed

Big news is on the way! Soon, your jobs will appear on Indeed in just hours—not days. Faster posting means quicker applicant flow and an instant start for Sponsored Jobs. Stay tuned for details!

Pay Range Gets More Visibility

Jobs with a pay range get priority on Indeed because most job seekers say it’s a top concern. Including salary details upfront not only builds trust but also helps attract serious candidates who know they’re aligned with your offer. Learn more about how pay transparency can elevate your job visibility and build a stronger team.

Where Did My Job Go?

Are you feeling confused or concerned about Indeed’s recent visibility updates? The article below will provide the clarity you need!

Navigating Indeed’s Updated Organic Job Visibility Policies

For more information about the changes in the 10.19, please contact your Insperity Payroll Specialist.