Friday, March 8th, 2024

Highlights

isolved version 10.04 includes important information about enhancements to the Tax Wizard in Onboarding and Tax Update in the Adaptive Employee Experience and the isolved People Cloud mobile app, updates to the re-verification and correction features for I-9 forms, and update to the Alert Occurence Count Report, additional 2024 tax changes and state tax form updates, and Applicant Tracking enhancements.

Payroll & Tax

- Enhancements to the Tax Wizard in Onboarding and Tax Update in the Adaptive Employee Experience and the isolved People Cloud mobile app

- Stay informed of new 2024 tax changes impacting several states and counties

- 2024 state tax form updates

Employee Management

- Enhancements to I-9 re-verification and correction features

- The Onboarding Client New Hire Wizard has been updated to require SOC codes for employees with work locations in South Carolina and West Virginia

- Several screens have been redesigned with the modern grid view including Location Distribution and OSHA Incidents

Time & Labor Management

- Enhancement to the Alert Occurrence Count Report will enable occurrence tracking points to display along with the alerts

- Admin Calendar updates to properly display absences

Applicant Tracking

- SourcingPower is now called Job Advertising

- New ability to send out Applicant Questionnaire

Payroll & Tax

Adaptive Employee Experience (AEE) Tax Wizard Updates

Tax Updates Wizard enhancements in Adaptive Employee Experience

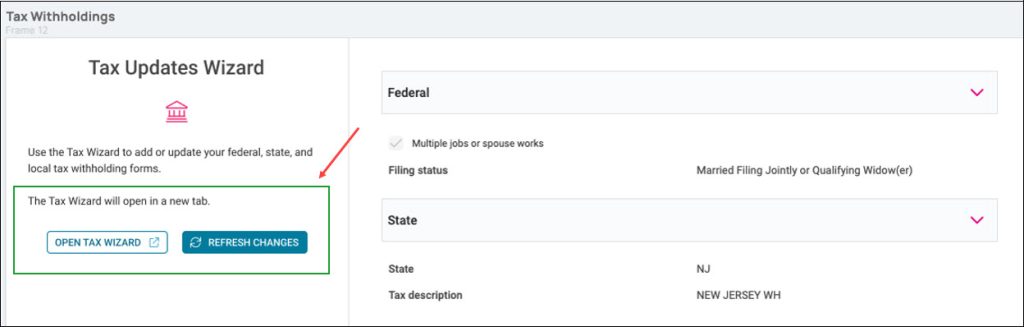

Employees can update tax forms in AEE by navigating to Pay and Tax > Tax Updates. As part of this enhancement, the button to start the Tax Updates Wizard in Adaptive has been renamed to Open Tax Wizard, and when selected, it will open the Tax Updates Wizard in a new browser window. To ensure users have the most up-to-date information on the Tax Updates screen, they can click the new Refresh Changes button. This button allows users to refresh the page and view any recent updates made in the Tax Updates Wizard.

Tax Wizard enhancements in Onboarding in the Adaptive Employee Experience

As part of this enhancement, the button that initiates the Tax Wizard in Adaptive Onboarding has been renamed to Open Tax Wizard. When selected, it will open the Tax Wizard in a new browser window. Employees can be sure they have the most up-to-date information on the Tax Updates screen by clicking the new Refresh Changes button. This button refreshes the page with any recent updates made in the Tax Wizard.

Once a user has opened the Tax Wizard, an additional button will display, allowing them to confirm the wizard’s completion and providing users with a clear way to indicate they have finished updating their tax forms.

Additional messaging guides users through the tax form update process:

- Success message: “Tax Form updates confirmed. Click ‘Next’ to continue onboarding”

- Warning message: If users have not completed the Tax Wizard a warning appears, “Tax information not completed. All tax forms must be complete and submitted to save your informatoin. Any partial updates will be lost.”

2024 Tax Changes

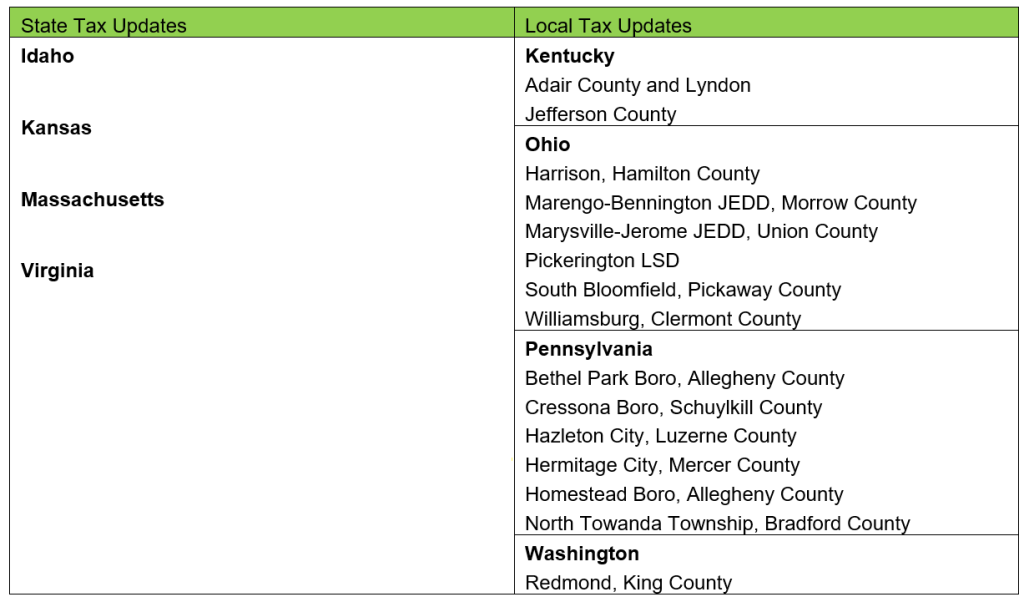

Additional 2024 state and local tax updates

Click here to view the details for each state and local tax update on the chart below. All tax changes are effective January 1, 2024, unless otherwise noted.

This document will show all the 2024 Tax Changes.

Tax Form Updates

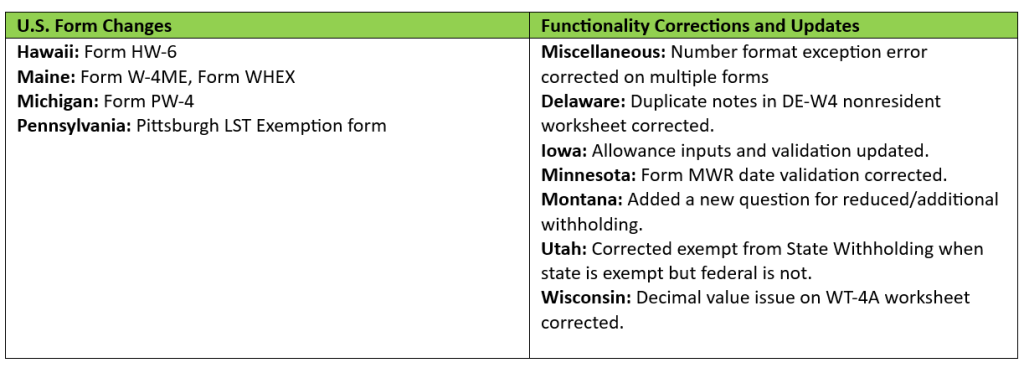

With this release updates will be made to State withholding forms, employee withholding forms that are used in onboarding, and those using the Tax Updates functionality in self-service.

State Tax Form changes

The chart below lists the changes and updates, please view the State Tax Form Changes – Release 10.04 for details on what has changed on the forms and in self-service.

Here is the list of changed forms:

Employee Management

I-9 Enhancements

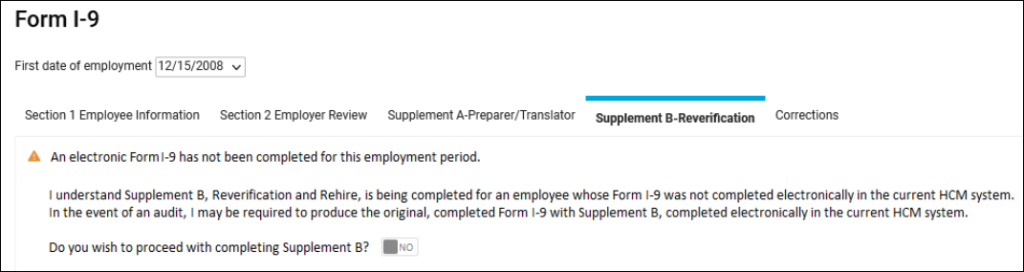

I-9 Reverification and corrections

With this release, you get several great enhancements related to I-9 forms. To reverify or make corrections to an employee I-9, navigate to Employee Administration > I-9 Management > Form I-9 and take advantage of the Supplement B-Reverification and Corrections tabs. Now you can:

- Reverify an I-9 even when the employee’s original I-9 was not completed within People Cloud

- Make corrections to complete the preparer section of the I-9 after making corrections to Section 1 on behalf of the employee

Q1 2024 Unemployment tax filing changes in South Carolina and West Virginia

Client New Hire Wizard enhanced to require SOC code

This release brings an enhancement to the Client New Hire Wizard in the Onboarding workflow that requires Standard Occupational Classification (SOC) codes on job records for employees with work locations in South Carolina or West Virginia.

Both states have begun requiring the SOC codes on the quarterly unemployment wage return that will be filed for this quarter, so employees must have accurate SOC code assignments by March 31, 2024.

Be sure to monitor the Payroll Exception Report where you will see missing SOC code exceptions when previewing payrolls. For more information about how to review and update SOC code assignments, read Including SOC codes on unemployment tax returns.

Screen Enhancements

Employee Management

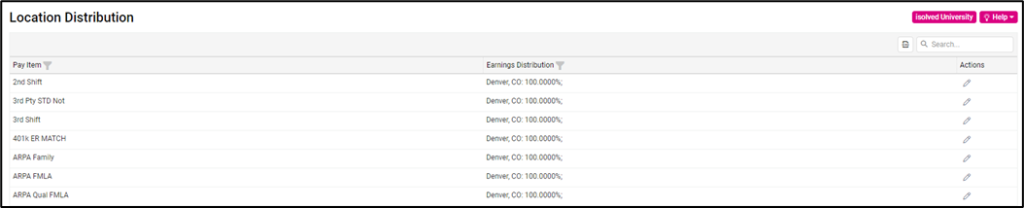

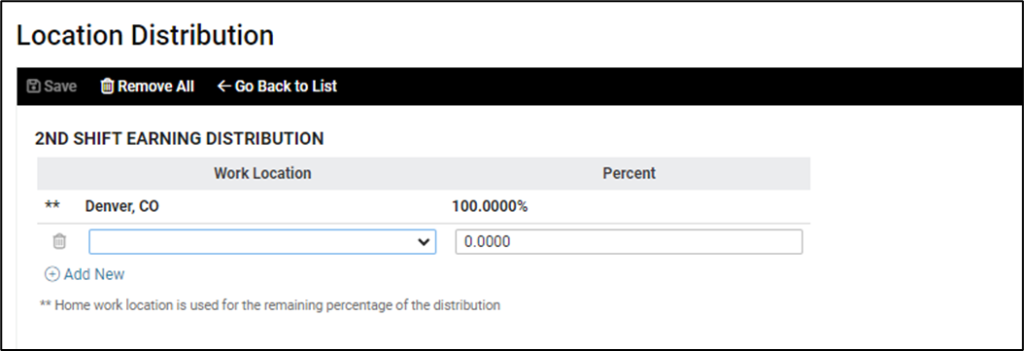

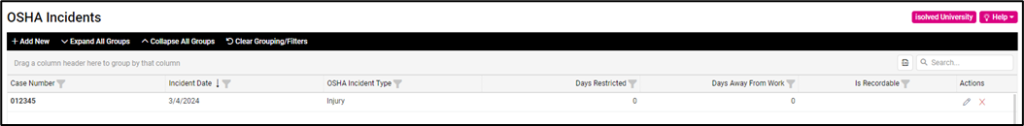

The effort to modernize the screens in isolved People Cloud continues with this release. Over the next few months, additional screens will be refreshed using the new grid style that you’ve already seen on other screens. The overall functionality stays the same with some differences noted below.

Employee Management > Employee Maintenance > Location Distribution:

- Updated grid layout

- Added Export to Excel

- Added filtering to all columns

- Added edit button

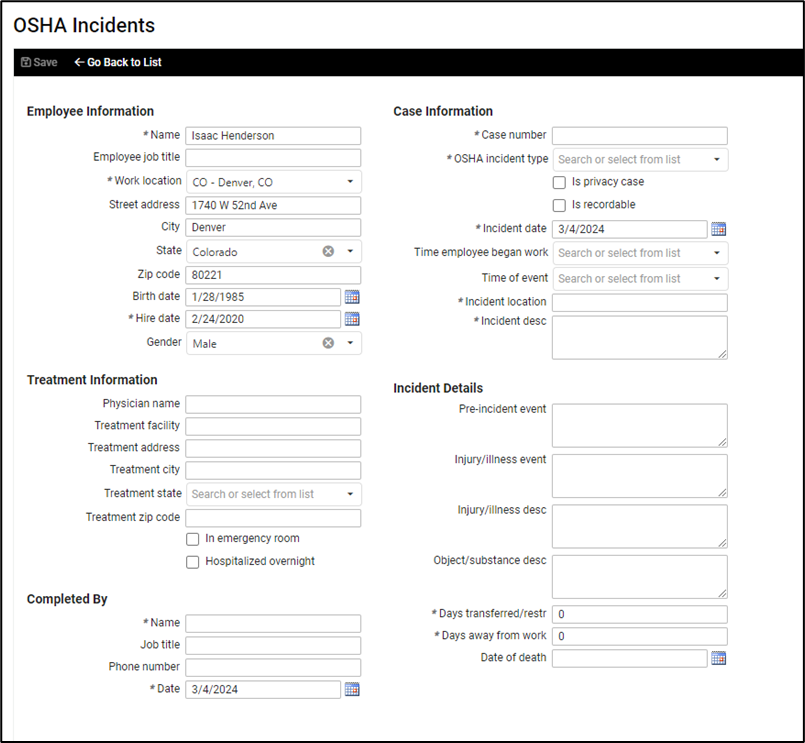

Employee Management > Human Resources > Regulatory > OSHA Incidents:

- Updated grid layout

- Added Export to Excel

- Added filtering to all columns

- Added edit button

- Added delete button

Time & Labor Management

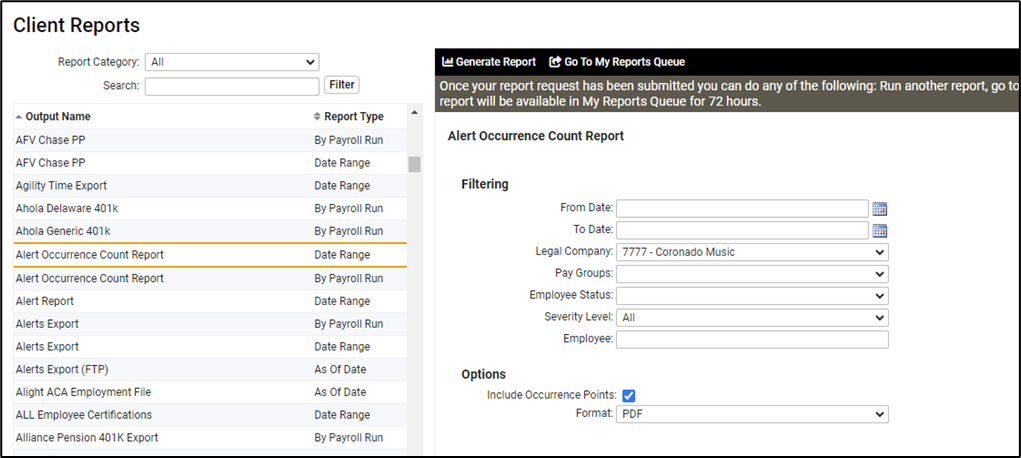

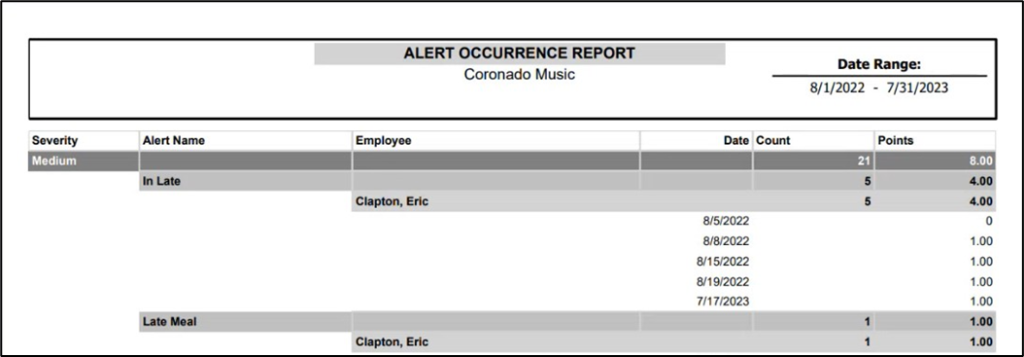

Occurrence Count Alert Report

Report Enhancement

With this release, we have updated the “Alert Occurrence Count Report – Date Range” to have an option to enable occurrence tracking point amounts to be displayed along with the alerts!

Note: The report will not give employee balance totals, only point amounts per alert and the corresponding point totals for the date range selected.

Time Admin Calendar

Calendar Enhancement

Today, if absences with more than two absence types (“approved”, “pending”, “processed”) are present on the same date, the admin calendar does not display all the absences. With this release, the event limit has been lowered to ensure the More button displays before too many events are cut off from the page.

Applicant Tracking

SourcingPower Transitioning to Job Advertising

Job Board Push

Based on feedback and requests, SourcingPower will now be called Job Advertising.

For clarity, we’ll be updating the naming conventions in two key ways:

- Job Advertising: the name of the whole area where you find the SourcingPower tool will be called Job Advertising. This way it is clearer what the tool is for – helping you advertise your job ads better.

- SourcingPower is a reference to how strong your job ads are at finding the right candidates. So we’re ensuring that Sourcing Power will refer to exactly that – the scoring of your job ads and the tips to make them better.

Applicant Questionnaire

Job Question Enhancement

There is now the ability to send out surveys to applicants after they have applied for a job. Easily create and email your own survey templates to get additional information from your applicants quickly and efficiently.

For more information about the changes in the 10.04 release, contact your Insperity Payroll Specialist.