Friday, December 29th, 2023

Highlights

isolved version 9.25 includes important year-end reminder and action items, the ability to define the default work week in the standard attendance scheduler, Employee Management screen updates, enhancements to the Adaptive Employee Experience Pay History screen, and new features for Applicant Tracking users.

Payroll & Tax

- Action required! Before you process your last payroll of the year, make sure you have completed all year-end adjustments

- Action required! Enter your pay rate changes so you can stay compliant with 2024 minimum wage updates in this release for multiple states and local jurisdictions

- Stay informed of 2024 tax changes that will be introduced in the next few releases

- New York Paid Family Leave (PFL) Audit Report updated for 2024 maximum contributions

- Action required! California Sick Leave law updates impacting Wage Notices

- Return Archive reports now have an option to view ALL vs by quarter or month

- Important Reminders!

- 2024 Alabama overtime tax changes – hourly paid employees will not pay state income tax on their overtime pay.

- Reminder! 2023 Federal unemployment tax credit reductions will be applied in payrolls after December 1st

Time & Labor Management

- Manager You can now define the default work week in the standard attendance scheduler

Employee Management

- The Employee Management > Employee Maintenance > Employment screen have been redesigned with the modern grid view, along with the Time Entry Templates screen

Adaptive Employee Experience (AEX)

- Employee Pay History Screen now has a new look and includes additional items

Applicant Tracking

- Job Ad AI Pro is a new, AI-powered job ad writing tool that makes creating job postings easy

- Applicant Tracking has a new modern look that is easier to navigate

Payroll & Tax

Before you process your last payroll of the year, make sure you have completed all year-end adjustments

Action required!

Processing your last payroll of the year automatically initiates the year end closing process, which generates data for year end tax forms including W-2s and 1099-NECs. If you have any adjustments that need to need to be included on these year end tax forms, work with your Payroll Specialist prior to running the last payroll of the year.

If you have already processed your last payroll of the year and need to make adjustments for 2023, they must be processed in isolved People Cloud no longer than today, Friday, December 29th, 2023. Annual tax processing and year-end form generation begins on Tuesday, January 2nd, 2024 and Insperity offices are closed on Monday, January 1st for New Years Day. If you realize adjustments to year-end tax forms are required after the 2023 cutoff date, they will need to be processed as amendments. Your Payroll Specialist can provide a quote based on your requirements. Once you sign and pay for the amendment delivery order, the changes will be processed beginning on February 1, 2024.

For more information about year-end requirements, our Preparing for Year End webinar is packed with information that guides you through tasks related to closing out 2023. In addition to our video, the Insperity Year-End Central section has additional videos and guides to help you prepare for the year-end closing.

Additional Minimum Wage Updates for 2024

State and local minimum wage updates for 2024

A number of 2024 minimum wages have been updated based on information provided by each jurisdiction. They will continue to be updated as more rates are published.

The file below shows all the known 2024 minimum wage changes in this release. Please visit the HR Resource Center for the full list of minimum wages and updates on new ones in the states you do business. Don’t have an account? Reach out to your Customer Success Specialist for details and access.

9.25 List of 2024 Minimum Wage Changes

ACTION ITEM – You will need to add new salary records for employees who need pay increases due to minimum wage changes. The system will not automatically increase their rate. Be sure to enter any rate changes before you process the first pay period of the new year to stay in compliance.

- Use the How do I find employees who are being paid below minimum wage? guide in the Insperity Help Center to identify employees who will fall below minimum wage with the changes effective January 1, 2024 so you know who to update.

- Follow the {article about how to add new salary records, since we need to make sure they add new and don’t just edit existing} article for help entering new salary records.

Click here for more information on reviewing pay information for minimum wage compliance.

2024 Tax Changes

isolved federal, state, and local tax updates

When you process payrolls in isolved with a pay date on or after January 1, 2024, the tax changes included in the 2024 Tax Changes document will automatically take effect.

Stay tuned! Additional 2024 tax changes will be announced in January.

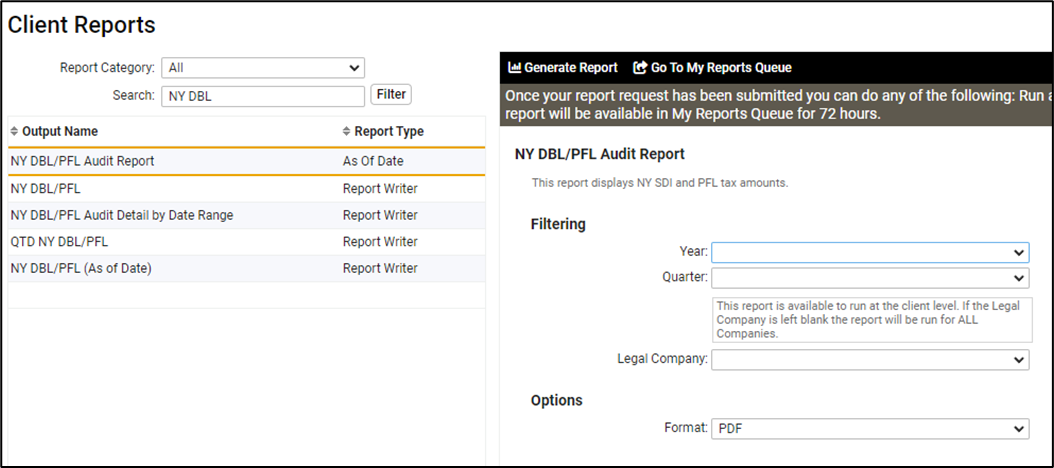

New York Paid Family Leave (PFL)

Audit Report Update

For clients with employees in New York, the NY DBL/PFL Audit Report is a great tool to understand how much the organization needs to pay their disability insurance provider and to remit for Paid Family Leave. If you run the report for a quarter in 2023, it will use the 2023 PFL maximum annual contribution of $399.43, which is based on 0.455% of gross wages up to $87,786.81. If you run the report for a quarter in 2024, it has now been updated to use the 2024 maximum contribution of $333.25, which is based on 0.373% of gross wages up to $89,343.80.

For more information about New York Paid Family Leave rates and wages, refer to How PFL is Funded.

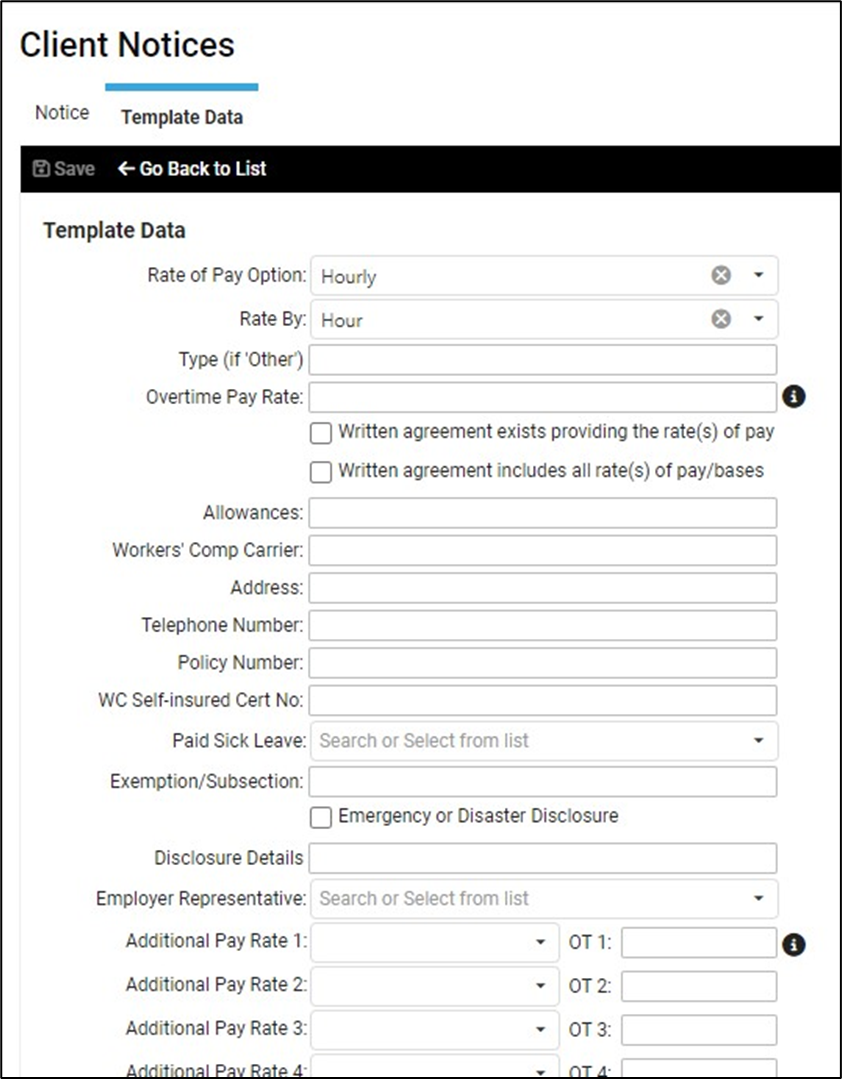

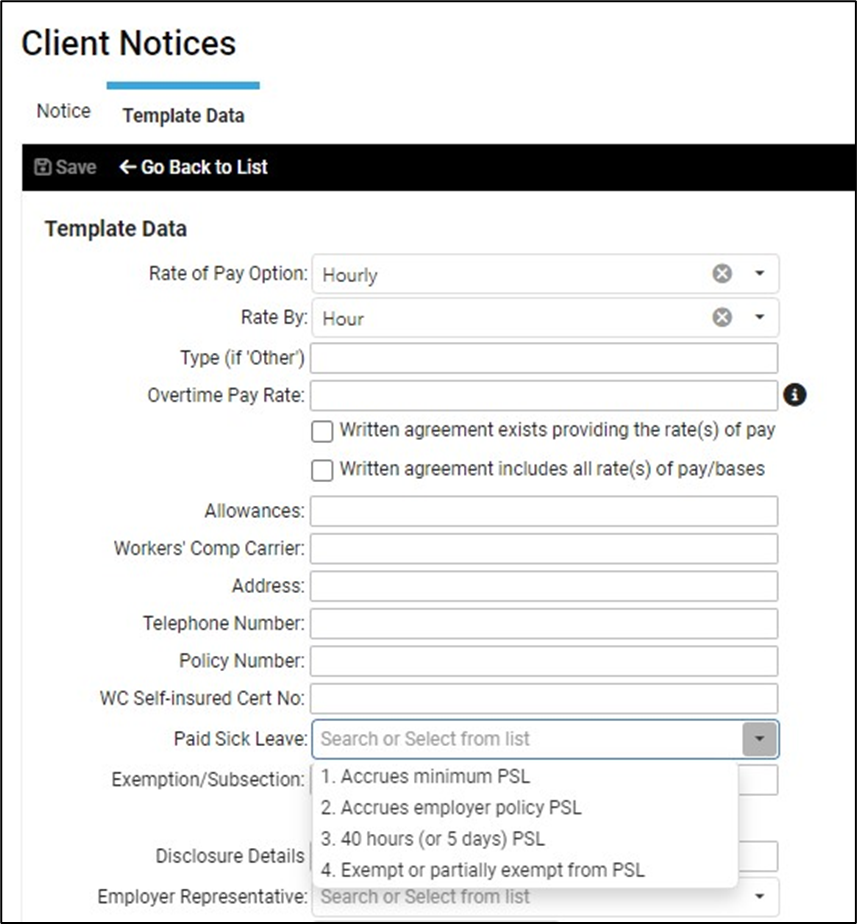

California Pay Notices Updated

CA Sick Leave Law updates affecting Wage Notices

The state of California has updated their sick leave laws and the employee wage notices accordingly. Changes include:

- Two added fields:

- Emergency or Disaster Disclosure checkbox

- Disclosure Details text field

- The language of two drop-down options under ‘Paid Sick Leave’ has been updated:

- 24 hours (or 3 days) PSL > 40 hours (or 5 days) PSL

- Exempt from PSL > Exempt or partially exempt from PSL

Please reach out to your Payroll Specialist for assistance with updating existing notices.

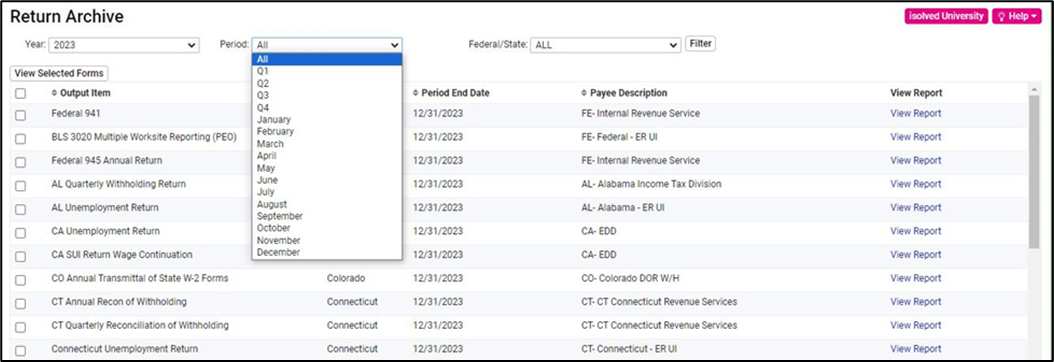

Tax Report Updates

An “ALL” Option is now available under Reporting > Return Archive

An “ALL” option has been added to the Period drop-down filter on Reporting> Return Archive, allowing you to run and view all returns at the same time.

Important Reminders!

2024 Changes – Hourly employees exempt from Alabama state income tax on overtime earnings

If you have employees in Alabama and have not yet contacted your Payroll Specialist or Time Support at WATime@insperity.com, please do so before processing a payroll in 2024.

Visit the 9.24 release article for more information.

2023 Federal unemployment tax credit reductions updates

If you are an employer with a work location in California or New York, FUTA tax credit reductions were taken on the first payroll you posted in December. If you have not posted any payrolls in December, please contact your payroll specialist or Insperity Tax at IPS.Tax@insperity.com for assistance with the FUTA adjustment to ensure compliance.

To confirm your annual Form 940 will be correct, visit the Federal Unemployment Tax Credit Reductions 2023 article for audit report tips.

Visit the 9.24 release article for more information.

Time & Labor Management

Default Weekday Start for Scheduler

You can define the default week start day in scheduler!

For clients using the standard attendance scheduling, when viewing the scheduler, the view will display to what is set rather than the default Sunday-Saturday view as it does currently.

The scheduling options are:

- Sunday-Saturday (Default)

- Monday-Sunday

- Tuesday-Monday

- Wednesday-Tuesday

- Thursday-Wednesday

- Friday-Thursday

- Saturday-Friday

If you would like to change your workday option, please reach out to our Time Support team at WAtime@insperity.com.

Employee Management

Screen Enhancements

The effort continues in this release to modernize the screens in isolved People Cloud. Over the next few months, additional screens will be refreshed using the new grid style that you’ve already seen on other screens. The overall functionality stays the same with some differences noted below.

Employee Management

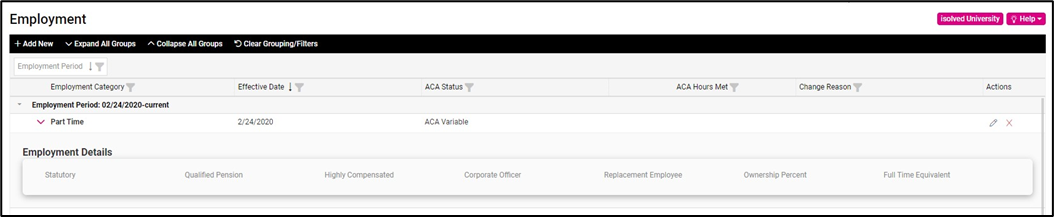

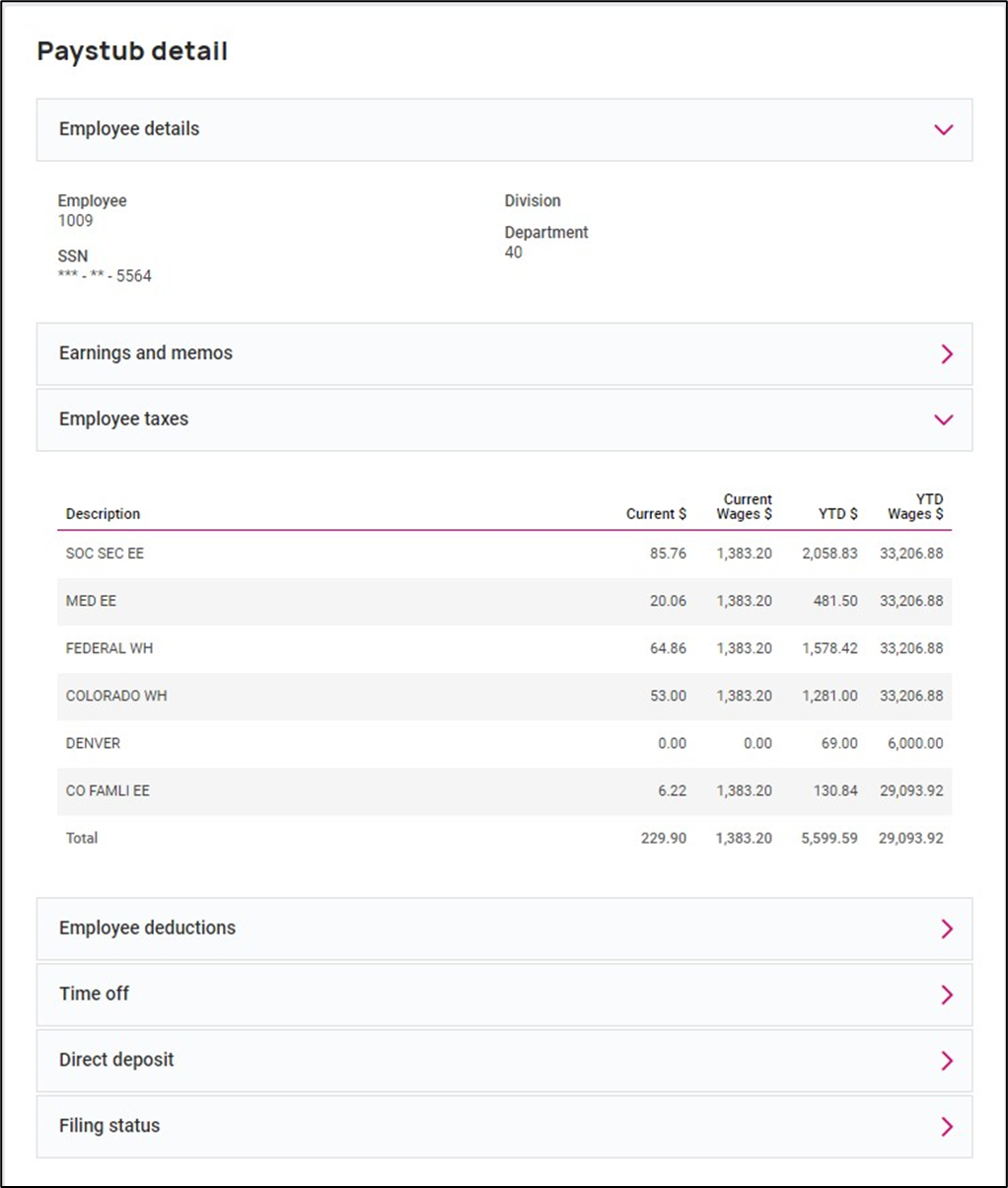

Employee Management > Employee Maintenance > Employment:

- Updated grid layout.

- Added edit button.

- Added filtering to all columns.

Adaptive Employee Experience (AEX)

Employee Pay History Screen Updates

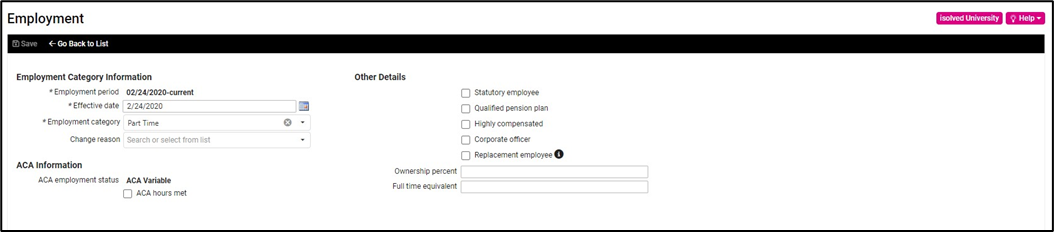

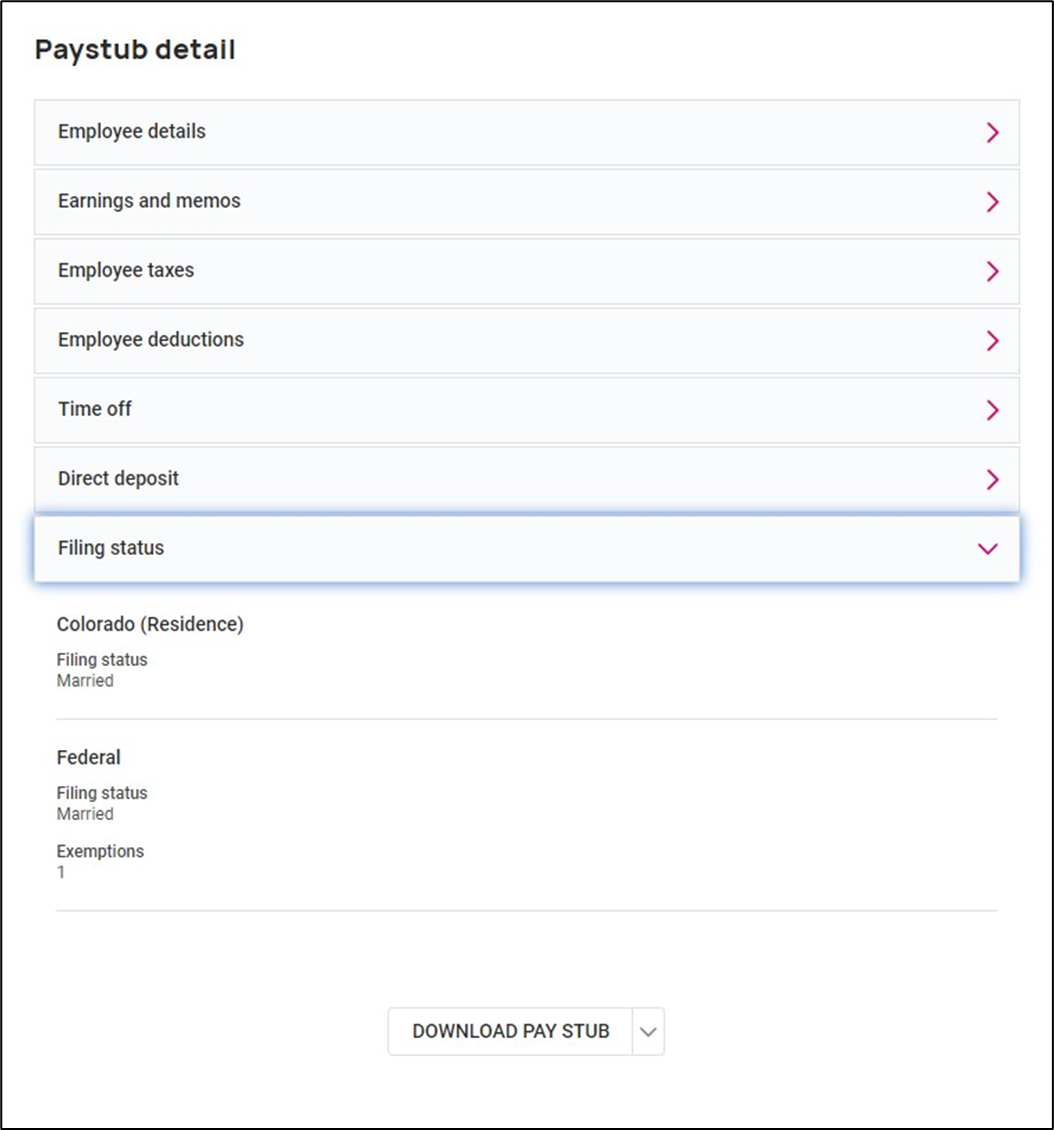

The Pay & Tax > Pay History screen now includes additional items

Updates have been made to the design for Pay & Tax > Pay History include additional items when an employee’s W-4 filing status is for 2020 or later.

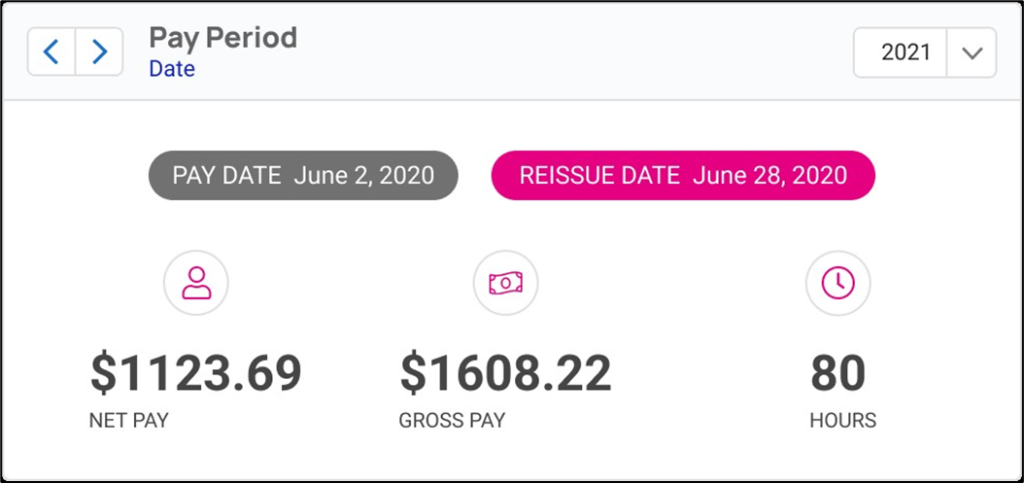

Changes to the UI and functionalities on the Pay Summary screen include:

- Reissue Date displayed when applicable on the summary to the right of the pay date.

- Employee Details: New section for the items below.

- Employee Number

- SSN

- Labor field(s)

- Employee Taxes field includes Current and YTD taxable wages.

- Filing Status: Moved to the bottom of the list and the filing statuses for federal, state, and local taxes are better defined. Please note that the filing statuses for these fields will only show if there is data.

For more information about the changes in isolved version 9.25, please contact your Payroll Specialist.

Applicant Tracking

Create compelling job postings in minutes

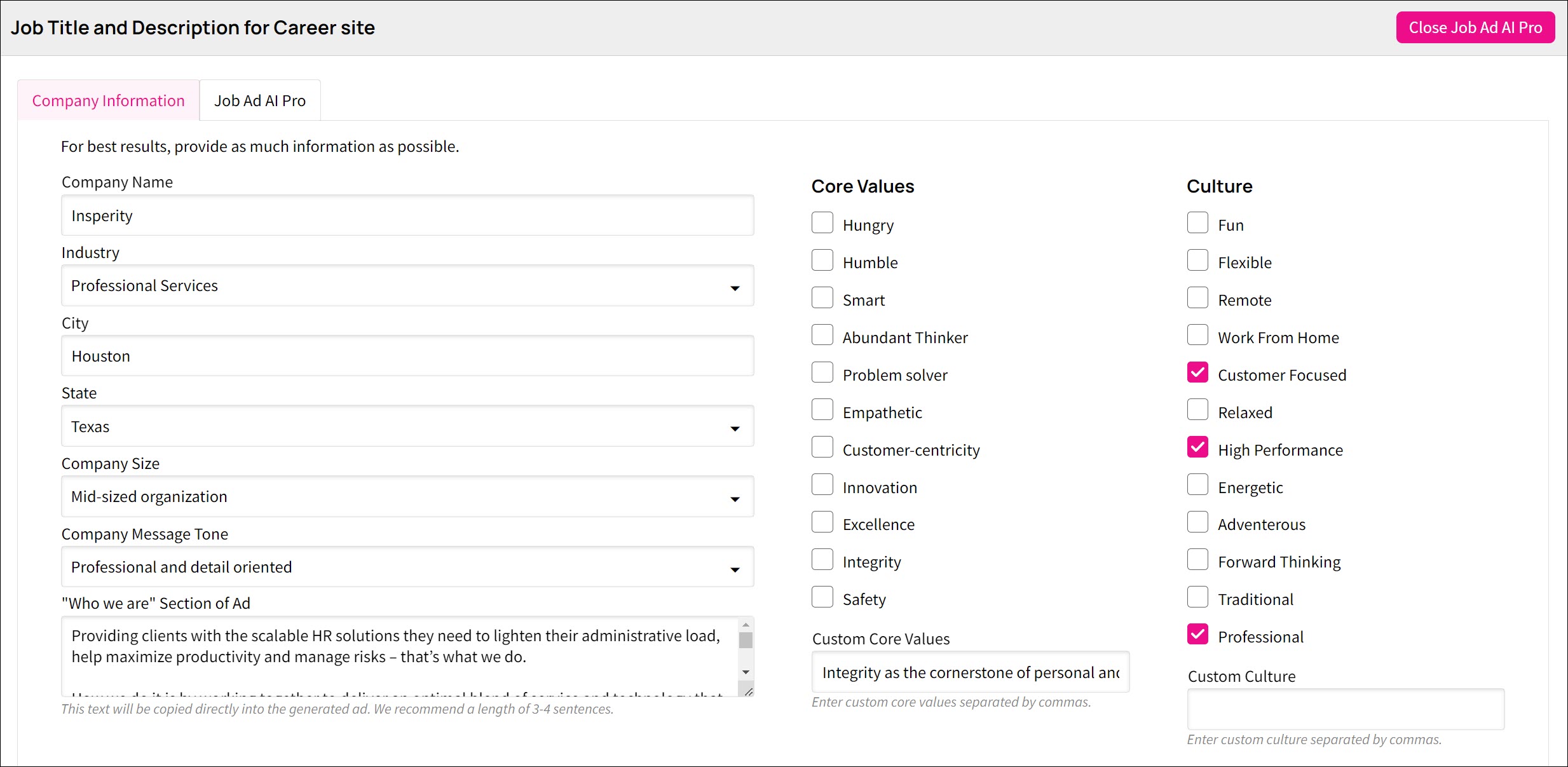

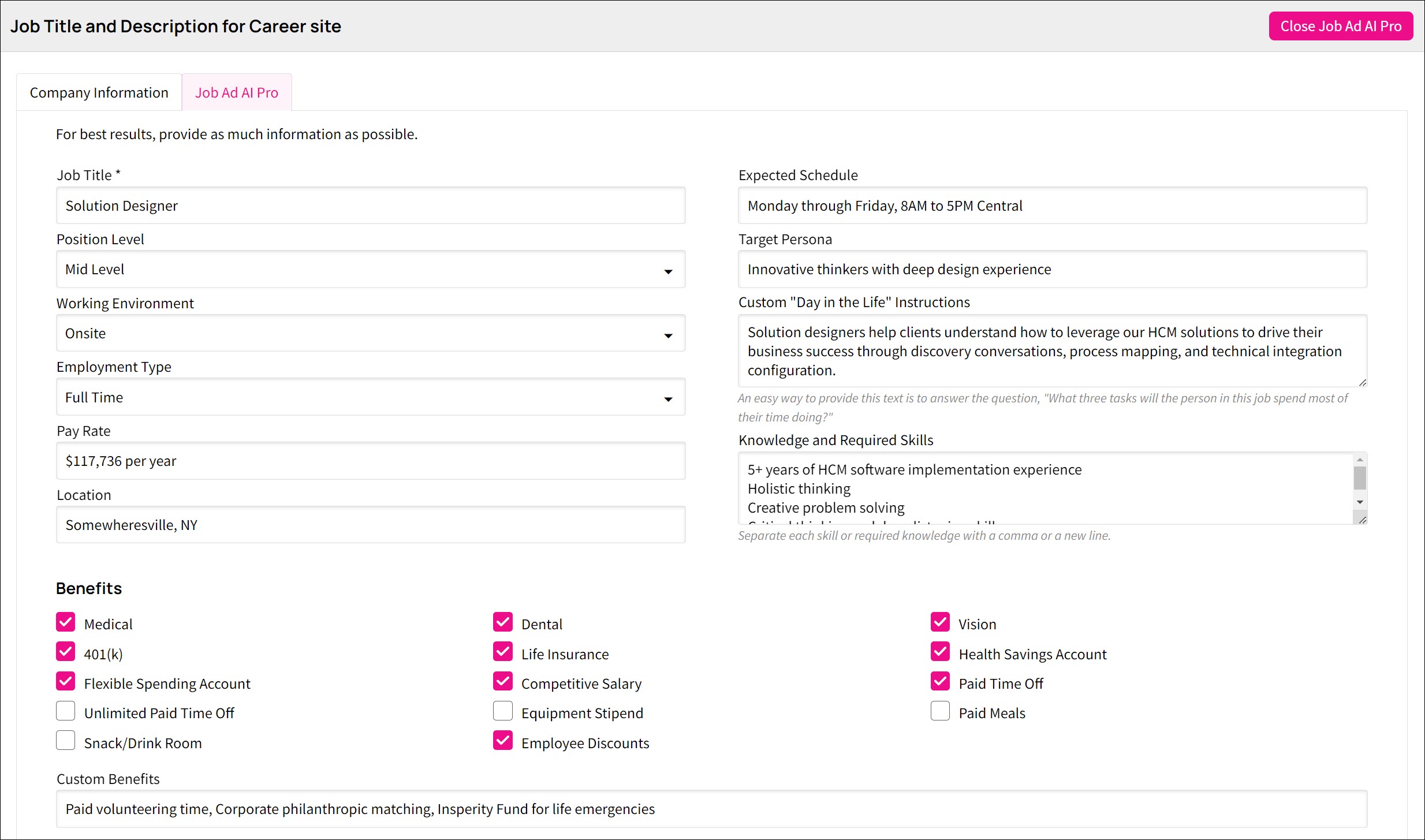

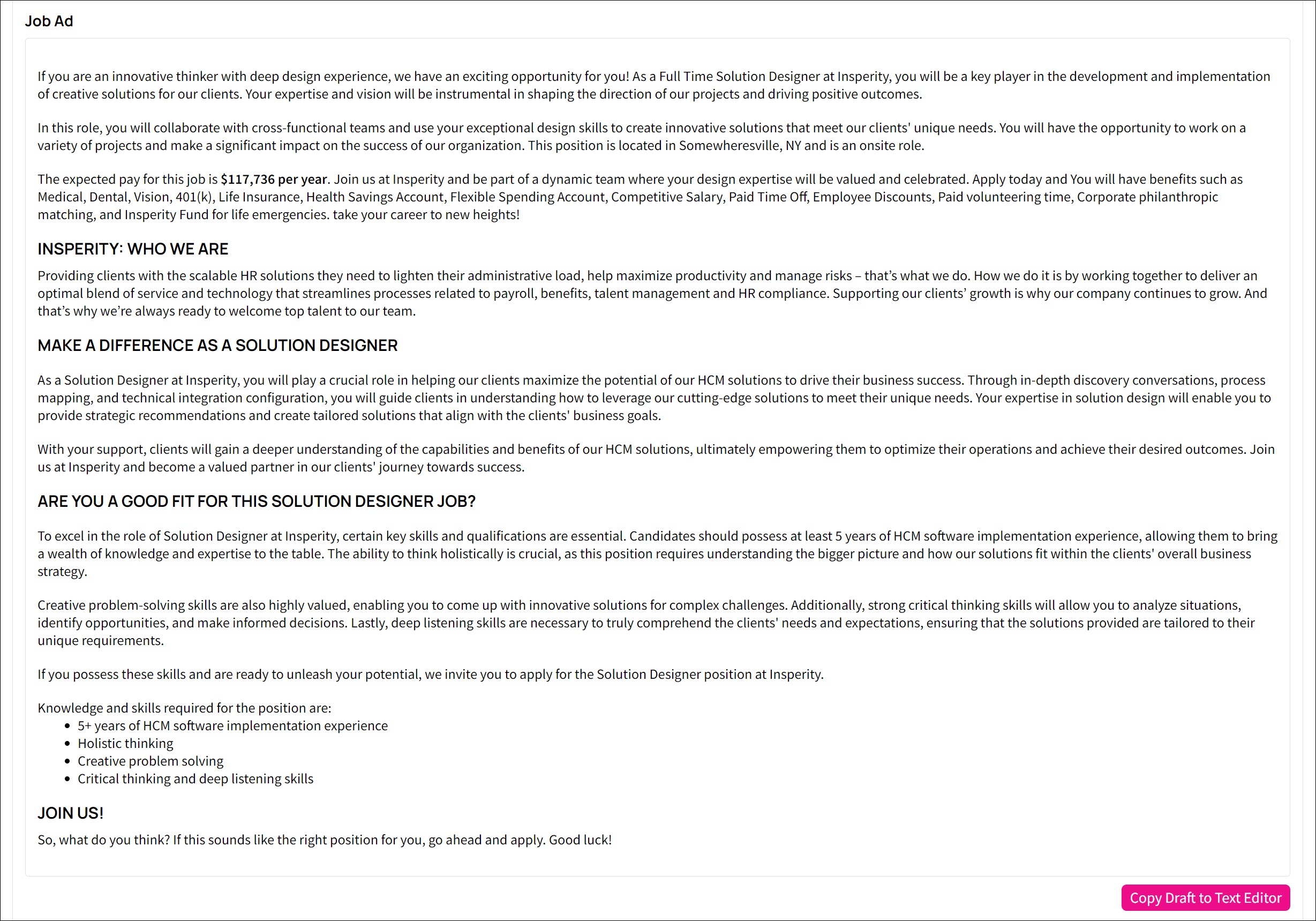

Job Ad AI Pro leverages artificial intelligence to quickly draft new job ads

The innovative Job Ad AI Pro tool lets you breeze through the process of creating new job postings in 3 steps:

1. Help applicants understand your organization and corporate culture by answering a few prompts on the Company Information tab.

2. Then add details about the job requirements, positioning, and company benefits.

3. Click the Generate Job Ad button and the tool creates a polished first draft for you to review and refine.

Job Ad AI Pro is seamlessly integrated into your existing job template workflows and individual listings. Better still, it’s included at no additional charge for existing Applicant Tracking users. Whether you are a high-volume recruiter or a hiring pro managing individual roles, this tool is designed to drastically reduce your time spent drafting new ads and make your life easier.

Learn more about this time-saving feature in Applicant Tracking Help.

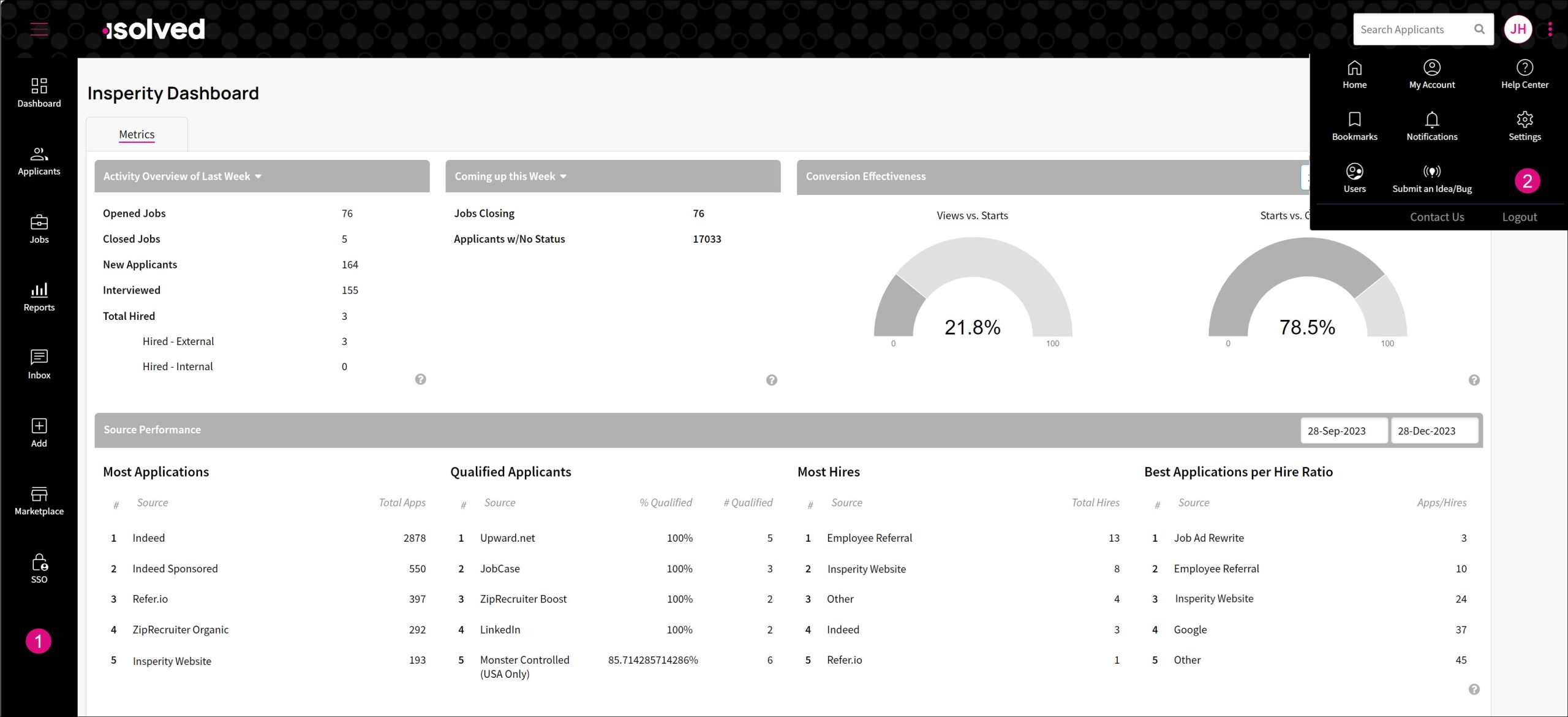

Applicant Tracking has a new look

A refreshed overall appearance brings a modern and polished feel to isolved Applicant Tracking

Applicant Tracking has an updated user interface that is consistent with the latest isolved People Cloud features, like the Adaptive Employee Experience (AEX).

- Easily find the sections you need from the streamlined menu on the left or click the ☰ icon at the top to hide the menu and view the full screen.

- Utilities and settings are available from the ⁝ menu on the right for a cleaner look and simplified navigation.

While the menus have been updated, all the recruiting functionality you use every day is still available. For more information, view the User Experience Updates Summary in Applicant Tracking Help.