Some accrual plans are configured to forecast accruals, meaning they will show all scheduled accruals for the current accrual year (e.g., calendar, anniversary, or fiscal) in advance, while others are configured to simply populate the employees’ accrual transactions as they go.

Accrual year definitions

An accrual year is the timeframe in which an employee’s accruals populate and taken time is calculated before carrying over or expiring into the next accrual year. Some examples of accrual years include:

- Calendar year – Jan. 1-Dec. 31

- Anniversary year – Custom for each employee based on their hire date

- An employee hired on Aug. 15 will have an accrual year of Aug. 15-Aug. 14

- Fiscal year – Custom based on your company’s setting, such as July 1-June 30

- Other – Additional customizations may be relevant depending on your setup

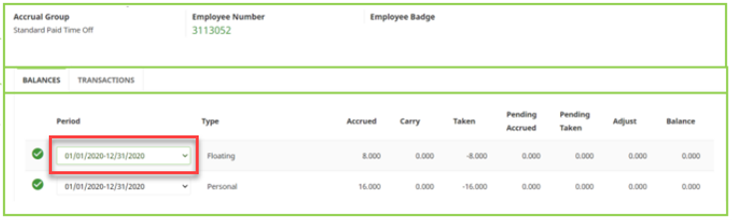

You can review a plan’s accrual year by navigating to Employee Maintenance > Employee Information > Accrual Summary > Balances. The period listed there reflects the accrual year for each plan.

Forecasting – Accrual summary

When an accrual plan is forecasting, the employee will see a larger Pending Accrued amount toward the beginning of the accrual year. You can learn more about the Accrual Summary page here: Accruals – viewing your accruals.

A non-forecasting plan will display only the current pay period’s projected accruals in the Pending Accrued column. Once the pay period is closed, those accruals will move to the Accrued column, and the Pending Accrued column will reflect the new pay period’s projections.

A forecasting plan will display accruals for the current and all future pay periods within the selected period (accrual year) in the Pending Accrued column. Once the pay period is closed, the accruals from the closed pay period will move to the Accrued column, and the Pending column will reflect the reduced amount for the remainder of the accrual year.

Requesting into next accrual year

Systems that are configured to not forecast accruals will not recognize accrued balances in the next accrual year until the current pay period reflects those dates. This is because no eligible unused time from the previous accrual year (if applicable) has carried over and no new accruals have populated in the new accrual year.

For example, a non-forecasting plan with an accrual year of Jan. 1-Dec. 31 will not allow for requests in the next calendar year until the current pay period reflects dates within the new year. At that time, employees will be able to request time off in the new year as expected.

Accrual balance display

The accrual balance display is the remaining balance displayed when submitting a time-off request and/or manually adding time off to an employee’s timesheet. Assuming the plan being considered is forecasting, there are three balance display options.

- The first option determines the available balance based on the employee’s accrual year balance (the balance shown on the Accrual Summary Balances tab in your system).

- For example, if you are forecasting accruals, this means an employee could potentially request time off in January even if they will not fully accrue the time until December.

- If your accrual plans are set to allow a minimum balance threshold of zero, employees would not be able to request into the negative in terms of the balance shown on the Balances tab, but they would potentially be able to request into the negative in terms of the running balance shown on the Transactions tab.

- The second option determines the available balance based on the current accrued balance, meaning the running balance as of the last closed pay period.

- Since accruals in the current and future pay periods will not be considered, this can make it difficult for employees to request time off early in the year or well in advance.

- This option will also not consider scheduled time off in the current or future pay periods. It will look specifically at the balance as of the last closed pay period to determine the amount of time available to request, regardless of any transactions in the current or future periods. For example, if an employee has a balance of 8 hours in the most recent closed pay period, they could potentially request multiple days off in the current and future pay periods – all referencing that same 8 hours. As the pay period is moved forward, this could result in unintended negative balances. It would be particularly important for the supervisor to review future transactions before approving a request in this scenario.

- The third option determines the available balance based on the projected balance as of the requested date.

- For example, if an employee is requesting time off in July, it would look at their scheduled accruals and take transactions up to that date to determine if they have enough time available. It would not consider any scheduled accruals or transactions beyond that date.

- While this does ensure employees aren’t using the time before they fully accrue it, there is the possibility that an employee could request a week off in December and have that approved, then request a week off in November and have that approved, then request a week off in October and have that approved, and so forth since the system does not consider future transactions. It would be particularly important for the supervisor to review future transactions before approving a request in this scenario.

Please note this is a system-wide setting and cannot be changed on a per-plan basis. If you would like to confirm your current system setting, change this setting, or have questions about any of these options, please contact Time and Attendance Support.