Friday, October 7th, 2022

Highlights

isolved version 8.19 includes information regarding end of life for the isolved GO mobile app, changes to the WOTC Questionnaire, updates to require SOC code for companies with work locations in specific states, and Vertex updates.

isolved GO Mobile Application

- End of Life Announcement

HR

- Work Opportunity Tax Credit (WOTC) Questionnaire update

- Updates to require SOC code when hiring in certain states

Payroll

- Vertex updates for Arkansas and Kentucky

isolved GO Mobile Application

End of Life Announcement

GO functionality disabled effective October 7th

The isolved GO mobile app will no longer be functional, effective Friday, Oct. 7th. When employees attempt to use the isolved GO app, they will receive a message stating “Unable to communicate with server. Please try again.”

If your employees are not yet using the Adaptive Employee Experience (AEX), see it in action here. To switch to the modern AEX that works across all devices visit the Help Center or contact your Customer Success Specialist.

HR

Work Opportunity Tax Credit questionnaire update

WOTC Questionnaire updated to remove outdated information

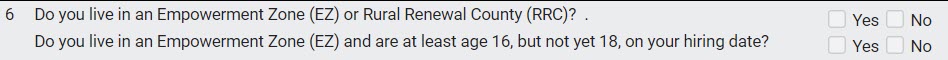

For clients capturing Work Opportunity Tax Credit (WOTC) new hire information during employee Onboarding, the WOTC Questionnaire has been updated to remove an outdated question. Question 6, related to Empowerment Zones (EZ) and Rural Renewal Counties (RRC), has been removed.

WOTC is a federal tax credit incentive Congress provides to employers for hiring individuals from certain target groups who have consistently faced significant barriers to employment. For further information regarding WOTC, click here.

Isolved allows employers to capture the information from newly hired employees necessary to determine whether the employer qualifies for a tax credit for hiring individuals from the target groups and creates the forms for submission to the State Workforce Agency. To easily capture WOTC new hire information during Onboarding, please contact your Payroll Specialist.

For additional information about Onboarding click the link to access a quick video overview. You will be asked to provide your isolved University user email address and password.

Updates to require SOC code when hiring in certain states

SOC code now required when hiring in Washington

Effective October 1st, the Standard Occupational Classification (SOC) code is required for tax reporting for employees that work in Washington state. To support this requirement, updates have been made to the Client New Hire Wizard, Employee Quick Hire and Employee Job screens, and the Employee Import.

You will be required to select the appropriate code from the SOC dropdown to successfully hire an employee associated with a Washington work location. To search for a specific code from within the SOC code field, enter the beginning numbers and select the appropriate code from the list that displays.

For more information on SOC codes and to view a complete list of available codes, click here.

SOC code now required on all hiring screens when an employee is associated with an Indiana work location

The SOC code has been required for tax reporting for employees that work in Indiana and isolved Quick Hire already requires SOC code when hiring for a work location within the state. The New Hire Wizard, Employee Job screen, and the Employee Import have been enhanced to require the code as well.

Payroll

Vertex updates

Arkansas State Tax Changes

Arkansas state income tax withholding calculation changed effective October 1st:

- Increased the standard deduction used in the calculation from $2,200.00 to $2,270.00

- Increased the $50.00 Midrange Income Lookup amount from $90,601.00 to $91,801.00

- Revised the withholding tables

Arkansas also decreased the supplemental withholding tax rate from 5.5% to 4.9%.

Harrodsburg, Mercer County, Kentucky Tax Changes

Effective October 1st, the percentage of the Occupational License Tax increased from 1 to 1.5 percent for the city of Harrodsburg, Mercer County.

For more information about the changes in the version 8.19 release, contact your Payroll Specialist.

Download the release notes

Download the release notes: isolved Product Release v8.19