Friday, March 22nd, 2024

Highlights

isolved People Cloud version 10.05 includes important information about minimum wage changes, ACA affordability reports, upcoming updates to components of the Idaho unemployment tax, changes made to Colorado FAMLI related to the taxability of certain deductions, and Applicant Tracking enhancements.

Payroll & Tax

- Colorado Paid Family Leave taxability changes for some deduction types

- Idaho Unemployment tax updates – coming soon

- Employee Paystub by Date Range update

- Updates have been made to the tip credit rate in Santa Fe County, New Mexico that took effect on March 1, 2024.

- New minimum wage rates have been added for fast food workers in California that take effect on April 1, 2024.

- REMINDER Assign Standard Occupational Classification (SOC) codes to employees who are subject to unemployment in South Carolina and West Virginia no later than March 31, 2024. For more information, review the isolved People Cloud version 10.03 release notes.

Benefits

- Affordable Care Act reports updated for 2024

Applicant Tracking

- Employee Referral Program Updates

Payroll & Tax

2024 Tax Updates

Colorado Paid Family leave taxability changes

Colorado FAMLI changed the taxability of the following deductions for employees and employers from exempt to taxable for regular and supplemental wages effective January 1st, 2024 and were included in the January 26th release of isolved People Cloud:

- Section 125 cafeteria plans deductions

- Dependent Care expense deductions

- Flexible Spending Account (FSA) deductions

- Health Savings Accounts (HSA) deductions under Section 125

- Health Savings Accounts (HSA) catch-up contributions

- Adoption Assistance deductions under Section 125

Payrolls that were processed in January, prior to the January 26th release, included these deductions as exempt and not subject to CO FAMLI tax. Because these deductions are now taxable for CO FAMLI, wage/tax adjustments will be required to correct the subject and taxable wages for the employee as well as the missed tax for those wages.

For clients with work locations in Colorado and employees who had these specific deductions in January payroll runs, your Payroll Specialist will reach out to you to communicate and review tax and wage updates they will need to process on your behalf.

Idaho Unemployment Tax updates – coming soon

Idaho has made the following updates to components of their state unemployment insurance (SUI) tax effective January 1st, 2024:

- Decreased the SUI Administrative Reserve tax rate from 0.55811% to 0.44608%*

- Decreased the SUI Workforce Development tax rate from 0.09849% to 0.07872%*

These updates will be deployed with isolved People Cloud v10.06 which will be available on April 5th, 2024. After the release, Insperity will run a special payroll for clients with work locations in Idaho that will auto-adjust the tax collected/due for the quarter ahead of filing /paying Q1 2024 Idaho SUI.

*Will be rounded to 0.466% and 0.787% respectively, due to field length restrictions

Minimum/Living Wage Updates

Minimum wage changes for tipped employees in Santa Fe County, NM may require additional makeup pay

The system minimum wage tables will be updated to include new rates in this release. The rate changes for tipped employees included in the isolved People Cloud version 10.03 release on February 25th, 2024 for Santa Fe County, New Mexico have been updated. While the base minimum wage effective March 1, 2024 remains at $14.60, the tip credit has been updated from $10.24 to $10.22 with this release. If you paid tipped employees for days worked in March at the tipped minimum rate of $14.60 – $10.24 = $4.36 for straight time pay or ($14.60 * 1.5) – $10.24 = $11.66 for overtime, those employees were underpaid by $0.02 due to the tip credit rate included with the version 10.03 release. It is recommended that you pay the additional $0.02 per hour in their next regular payroll. For all payrolls processed after this version 10.05 release on March 22, 2024, the correct tip credit of $10.22 will be applied.

For more information about Santa Fe County minimum wage rates, see the Living Wage Ordinance.

Updated minimum wage rates for fast food workers in California

On September 28, 2023, Governor Newsom signed AB 1228 into law which added 3 sections to the California Labor Code and does two main things:

Effective April 1, 2024, fast food workers in California should be paid a base minimum wage of $20.00 with no allowed tip credit. This updated rate will automatically apply to pay periods on or after April 1, 2024 if your tipped earnings are configured to use the system minimum wage rates and your California work locations have been configured as California – Fast Food. California work locations that use the California standard or California Small employer wage rules will not be affected.

If you employ California fast food workers but use employee hourly rates from their salary record, be sure to add a new salary record effective 4/1 before you process any payrolls for hours worked in April.

For more information about California wage rates, refer to the California Department of Industrial Relations minimum wage FAQ.

Please contact your Payroll Specialist if you have any questions about your earning, work location, or wage configuration.

Employee Paystub by Date Range report

Deleted direct deposits no longer cause an error to generate

This release resolves an issue some clients experienced with the Employee Paystub by Date Range report generating an error if a previously used direct deposit for an employee had been deleted. To take advantage of the Employee Paystub by Date Range report, navigate to Reporting > Client Reports and select “Payroll” from the Report Category filter at the top of the screen.

Benefits

Affordable Care Act (ACA)

ACA Affordability Client Reports updated

The following ACA Affordability client reports have been updated to reflect 2024 values:

- ACA Safe Harbor Affordability-FPL

- ACA Safe Harbor Affordability-Rate of Pay

- ACA Safe Harbor Affordability-W-2 Wages

To access the ACA Affordability reports, navigate to Reporting > Client Reports and select ”Benefits-Affordable Care Act” from the Report Category filter at the top of the screen.Q1 2024 Unemployment tax filing changes in South Carolina and West Virginia

Applicant Tracking

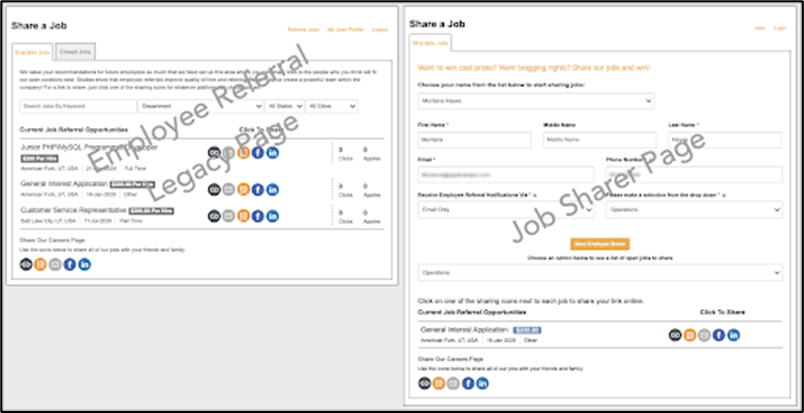

Employee Referral Program Updates

New Benefits

It’s time to share some exciting updates regarding our Employee Referral program! We’ve been working diligently to enhance your experience and provide even more value to your recruitment efforts.

Referrals are a cornerstone of effective sourcing, driving high conversion rates while minimizing recruitment costs. With Employee Referrals, you have the power to tap into your greatest asset – your employees. With this in mind, we asked ourselves: How can we enhance the quality and quantity of referrals for our clients? We’re excited to introduce several new benefits and features designed to do just that.

- No Login Required! Say goodbye to the hassle of login credentials or email addresses. We’ve streamlined portal access making it easier than ever. (Don’t worry, notifications will still be sent via email.)

- Efficient Verification: Our updated system verifies users through their phone numbers and remembers a unique ‘token,’ ensuring a seamless and secure experience.

- Expanded Referral Networks! Get ready to broaden your referral networks beyond just employees. Ever considered tapping into your loyal customers and the raving fans of your team? Now you can! Set up a referral network that perfectly suits your organization’s needs.

But we’re not stopping there! We have additional features in the pipeline, so stay tuned!

In our efforts to refine and improve the job referral program, we will be phasing out the Employee Referral Contest feature effective June 10, 2024. If you have been using this feature, we’re here to assist you in transitioning to the new and improved functionalities.

We understand that change can be both exciting and challenging, and our dedicated support team is here to help you every step of the way.

Interested in adding Applicant Tracking? Contact your Insperity Customer Success Specialist. If you’re already using Applicant Tracking and have questions about new features, reach out to support@isolvedhire.com.

For more information about the changes in the 10.05 release, contact your Insperity Payroll Specialist.