Friday, April 5th, 2024

Highlights

isolved People Cloud version 10.06 includes important information about the upcoming Multi-Factor Authentication, Payroll tax changes, CO and CA payroll updates, Adaptive Employee Experience improvements, Client Change log updates, and NXG time clock memory updates.

Payroll & Tax

- Identity Phase 2 security enhancements which among other updates includes forced multi-factor authentication upon login is coming April 25th

Payroll & Tax

- Stay informed of new 2024 tax changes impacting several states and counties

- Colorado Paid Family Leave taxability changes for some deduction types

- Changes to California Pay Data Reporting requirements for employees who were remote in 2023.

REMINDER! Employers with 100 or more employees and at least one in California must submit their 2023 pay data by May 8, 2024 - Salary Percentage Increase Added to Pending Workflow Details for Salary Updates

- Time Card Audit Report Enhancement

Employee Management

- Adaptive Employee Experience – Employee Self Service Personal Updates to match Classic view functionality.

Client Management

- Several enhancements will be added to the Client Change Log screen including the ability to select multiple tables to search at a time.

- The Client Change Log screen been redesigned with the modern grid view

Time & Labor Management

- For companies using NXG time clocks, to better manage time clock memory, only biometric employers with biometric options enabled and more than 2000 employees loaded will be retained

Applicant Tracking

- Get the most out of our integrations with Indeed

Identity & Access Management

Multi-factor authentication has a new release date!

The isolved security enhancements associated with IdentityServer Phase 2 will be released on Thursday, April 25th. Please note this is an off-cycle release.

Watch this quick video overview that shows how logging in to isolved People Cloud will change.

These Phase 2 enhancements provide additional security measures to help prevent fraudsters from accessing your critical employee information, including multi-factor authentication and a reduced inactivity timeout. Cybercriminals have become more sophisticated, so your Insperity Workforce Acceleration™ technology is changing to keep pace.

Please see this Help Center article for additional information about the changes included in this release, including training materials, and FAQAs.

Payroll & Tax

2024 Tax Updates

Idaho Unemployment Tax updates

Idaho has made the following updates to components of their state unemployment insurance (SUI) tax, effective January 1st, 2024:

- Decreased the SUI Administrative Reserve tax rate from 0.55811% to 0.44608%*

- Decreased the SUI Workforce Development tax rate from 0.09849% to 0.07872%*

These updates were deployed with this release of isolved People Cloud. For clients with work locations in Idaho, your Payroll Specialist will process a zero payroll on your behalf that will result in an automatic recalculation of the tax amount due.

*Will be rounded to 0.466% and 0.787% respectively, due to field length restrictions

Pennsylvania Unemployment Tax updates

Pennsylvania changed the taxability of Dependent Care from taxable to exempt for regular and supplemental wages for the following tax types effective January 1st, 2023 and are included with this release of isolved People Cloud:

- State Withholding

- City Withholding

- Local Service Tax

- School District Tax

- City Employer Tax

For clients with work locations in Pennsylvania and employees with dependent care deductions in 2024 payrolls prior to this release, your Payroll Specialist will reach out to you to communicate and review tax and wage updates they will need to process on your behalf.

Georgia added filing status

In releases 10.01, we noted, a filing status of “Married Filing Separately or Married Filing Jointly Both Spouses Working” (Filing Status – 64) has been added to be consistent with the 2024 GA W-4. Georgia does not require all employees to file a new GAW-4 for 2024.

The following filing statuses will be eliminated in this release:

- Married filing separately (Filing Status – 4)

- Married filing jointly both spouses working” (Filing Status – 20)

NOTE: Existing employees using these filing statuses should be recoded to married Filing Separately or Married Filing Jointly Both Spouses Work (Filing Status – 64). If not, it will calculate as if they have a null filing status. For Georgia, all the filing statuses (including null) use the standard deduction with the exception of Married filing jointly 1 spouse working.

Not sure who this impacts? There is report called Employee Profile that shows this information. Make sure to run the one with the “As Of Date” version in Excel. Then scroll over to the columns with Resident State Filing Status and Work State Filing Status to see utilization.

We have created a sample communication you can use to communicate these changes to your employees:

State Tax Changes for Georgia Employees

Please be informed about some critical changes to the state tax withholding for employees in the state of Georgia. These changes are effective from January 1, 2024, and will affect your payroll deductions and tax liability.

Key Takeaways:

- Newly Filing Status Added: Georgia has added a new filing status option for married couples “Married Filing Separately or Married Filing Jointly Both Spouses Working (Filing Status – 64)” to align with the 2024 GA W-4 requirements.

This filing status is consistent with the 2024 GA W-4 and allows married couples who both work to reduce their state income tax withholding.

- Eliminated Filing Statuses: Georgia has also eliminated two filing status options for married couples:

- Married Filing Separately (Filing Status – 4)

- Married Filing Jointly Both Spouses Working (Filing Status – 20)

These options are no longer available and will not be valid for tax year 2024 and beyond.

Action Required:

If you are currently using one of the eliminated filing status options, please update your withholding information as soon as possible. Otherwise, your state income tax withholding may be incorrect. If no action is taken, you will be automatically recoded to Married Filing Separately or Married Filing Jointly Both Spouses Working (Filing Status – 64).

If you have any questions or need assistance with updating your filing status, please reach out to <the HR or Payroll department> for guidance.

Additional 2024 state and local tax updates

Click here to view the details for each state and local tax update on the chart below. All tax changes are effective January 1, 2024, unless otherwise noted.

| State Tax Updates | Local Tax Updates and Additions |

| Georgia (details above) Idaho (details above) Pennsylvania (details above) Minnesota North Dakota | Kentucky Boone County Buckhorn, Perry County Middlesborough, Bell County Paintsville, Johnson County |

| Ohio Berkshire Township JEDD, Delaware County Berkshire Twp JEDD II, Delaware County Shelby, Richland County Washingtonville, Columbiana County Washingtonville, Mahoning County | |

| Pennsylvania Homestead Boro, Allegheny County Wheatland Boro, Mercer County |

Please reach out to your Insperity Payroll Specialist for questions or support.

Colorado Paid Family Leave Taxability Changes

Colorado FAMLI changed the taxability of the following deductions for employees and employers from exempt to taxable for regular and supplemental wages effective January 1st, 2024 and were included in the January 26th release (10.01) of isolved People Cloud:

- Section 125 cafeteria plans deductions

- Dependent Care expense deductions

- Flexible Spending Account (FSA) deductions

- Health Savings Accounts (HSA) deductions under Section 125

- Health Savings Accounts (HSA) catch-up contributions

- Adoption Assistance deductions under Section 125

Payrolls that were processed in January, prior to the January 26th release, included these deductions as exempt and not subject to CO FAMLI tax. Because these deductions are now taxable for CO FAMLI, wage/tax adjustments will be required to correct the subject and taxable wages for the employee as well as the missed tax for those wages.

For clients with work locations in Colorado and employees who had these specific deductions in January payroll runs, your Payroll Specialist will reach out to you to communicate and review tax and wage updates they will need to process on your behalf.

California Pay Data

CA Issues Updated Guidance re: Pay Data Reporting

This state reporting requirement applies to employers with at least 100 employees and at least one working in California. Reporting will be largely the same as last year, the first year this requirement was in effect, but there are some changes recently noted by the Civil Rights Department.

Changes include but are not limited to: (1) new template required for uploading to the portal, (2) new data field requiring reporting of remote worker headcount, (3) requirement to assign all employees a race/ethnicity and gender, and (4) additional guidance on which employees should be counted for the report.

Click here for the full article about CA Pay Data Reporting

Reports are due this year on May 8, 2024. For additional detail, click here.

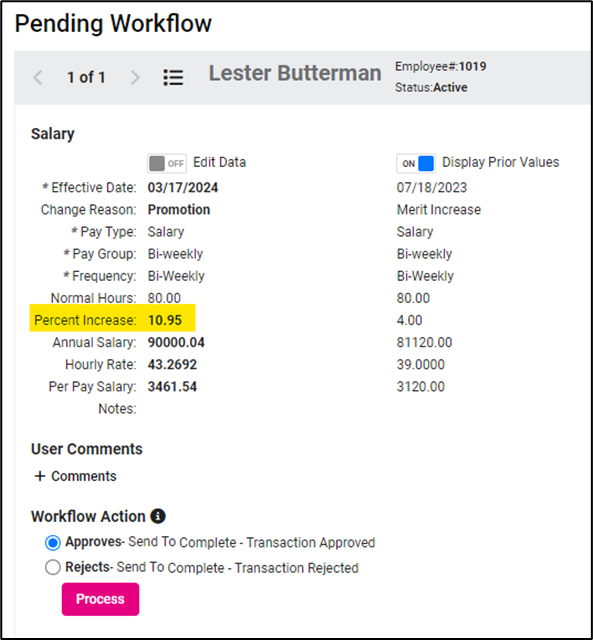

Salary Percentages Added to Workflow

Added Salary Percentage Increase to Pending Workflow Details for Salary Updates

With this release, a percentage increase field will be added on the Pending Workflow details for salary updates. The percentage increase field will be a read-only field that shows when editing the pending workflow record as the approver.

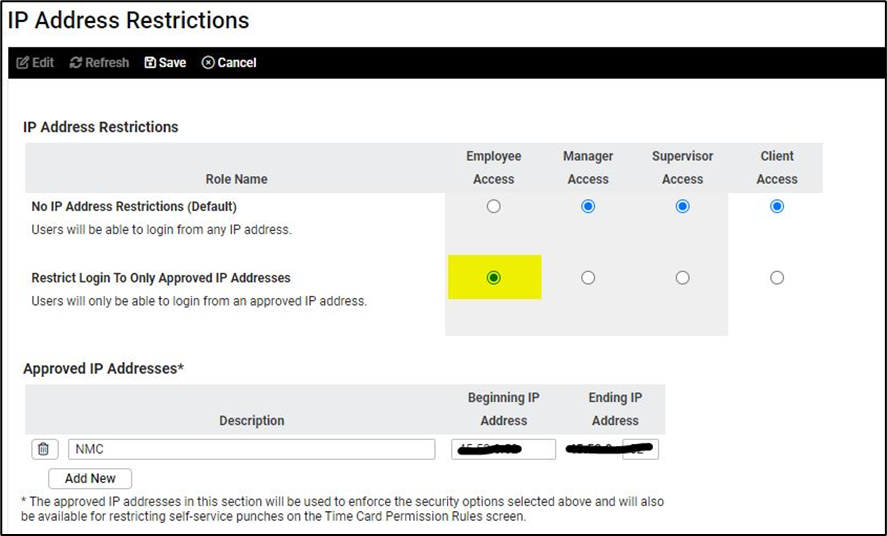

Time Card Audit Report Enhancement

With this release, the “Time Card Audit Report” will be updated to reflect true IP address associated with a punch rather than session IP.

Employee Management

Adaptive Employee Experience (AEE)

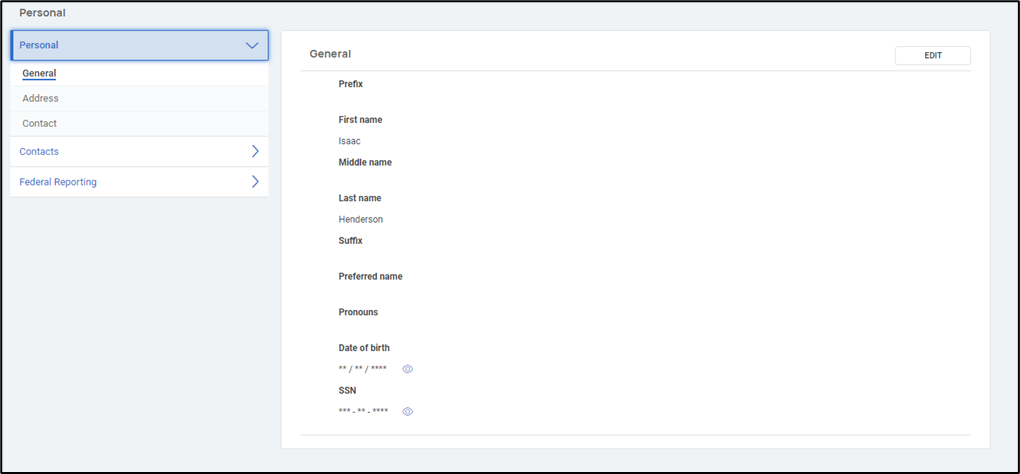

Employee Self Service Personal Updates

To match functionality from the classic experience for employee personal updates, the Profile and Personal Information pages in the AEE experience will be updated to allow for control of the data available to employees to update.

This includes moving the preferred name and pronoun field from the My Profile page to the Personal Updates > General. This is for us to set up the ability to include those fields in workflows that we are working on for a future release.

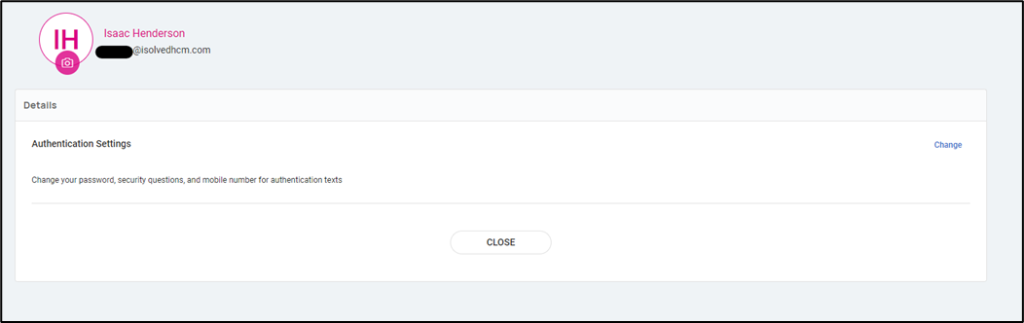

With the Preferred Name and Pronouns fields moved to the other screen, that leaves only the security options.

We’ve streamlined the different authentication settings into one single link that will take the employee to the My Account screen where they can update things such as their mobile phone, passkey settings, etc.

If you would like to update or changes to your setup and access for employees, please reach out to your Insperity Payroll Specialist.

Client Management

Client Change Log Updates

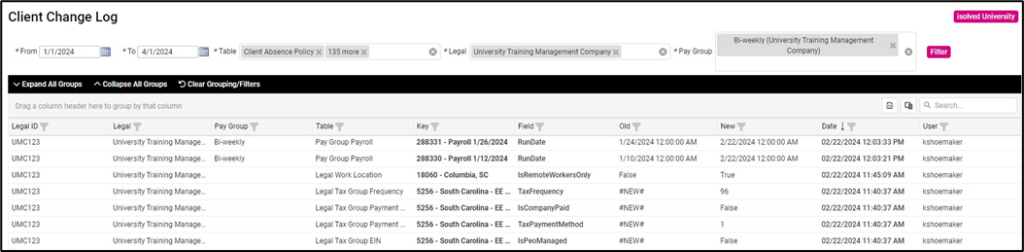

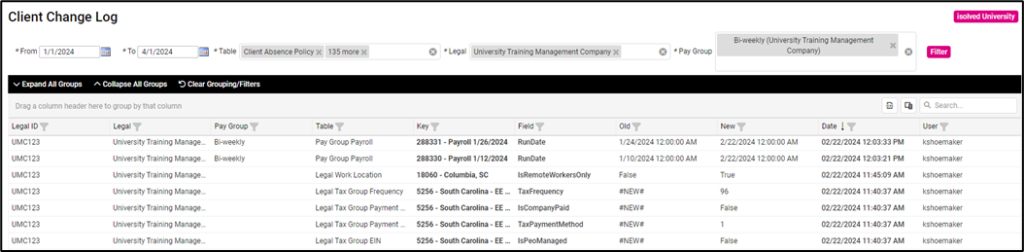

Several Enhancements will be added to the Client Change Log screen with this release:

- When loading the screen, 30-day date range will be auto-populated in From and To dates.

- Users are allowed to select multiple tables to search at a time.

- Optional columns are included for Table, Legal ID, Legal, and Pay Group.

Screen Enhancement

Client Management

The effort continues in this release to modernize the screens in isolved People Cloud. Over the next few months, additional screens will be refreshed using the new grid style that you’ve already seen on other screens. The overall functionality stays the same with some differences noted below.

With this release: Client Management > Client Utilities > Client > Client Change Log:

- Updated grid layout.

- Added export to Excel.

- Added filtering to all columns.

- Added column chooser.

Time & Attendance

NXG Default Eligible Employees

Updates to default eligible employees at for NXG clocks!

We’ve noticed that the existing behavior of isolved when adding a clock has resulted in all employees of a client/legal being associated to the clock, especially if the legal company doesn’t use eligibility rules or manage clocks. This behavior impacts the quantity of employee data loaded to clocks when forcing preloads for identification mode biometric operations. For large companies, this would result in too much data for clock storage capacities.

This update will lessen the amount of employee data associated with a given clock, as well as providing visual feedback to users on the resulting employee/clock data association. The changes include:

- When a clock is attached to a company, by default, only employees associated with the clock’s work location will be associated with the clock, and pushed to the on-demand middleware, as well as to third party middleware systems via APIs.

- Provided a text box on the assigned employee tab of the manage clock screen that displays the number of employee records associated with the clock based on the default settings, as well as any additional employee data that results from selecting additional eligibility rules.

- Display an informational text message ‘By default, only employees whose work location matches clockwork location will be assigned if no eligibility rules are used. If assigned employees exceed 2000, employees may not be able to use identity mode (use verify mode) as templates will be pushed to clock on an as needed basis).

Applicant Tracking

Indeed Integrations

Are you getting the most out of our integrations with Indeed? If not, it’s time!

Our integrations with Indeed, the go-to job site for millions of job seekers worldwide, are a game changer for your hiring process. We’ve got your Indeed workflow covered from A to Z, all directly inside the ATS! Here are just a few highlights:

- Indeed Recruiter Extension (IRX): Connect instantly with Indeed-recommended candidates, gain key market insights, and stay updated with real-time notifications.

- Indeed Apply: Boost your job’s visibility by up to 30% with this seamless, candidate-friendly experience.

- Indeed Sponsored Jobs: Increase your chances of hiring success by 4.5 times with easy job sponsorship direct from the ATS.

- Disposition Sync: Keep everyone in the loop with automatic updates on application statuses between the ATS and Indeed. Psst! Promptly communicating applicant status with Indeed is a great way to boost your chances at Indeed’s Responsive Employer badge!

Interested in adding Applicant Tracking? Contact your Insperity Customer Success Specialist. If you’re already using Applicant Tracking and have questions about new features, reach out to support@isolvedhire.com.

For more information about the changes in the 10.06 release, contact your Insperity Payroll Specialist.