Friday, December 15th, 2023

Highlights

isolved version 9.24 includes important information about minimum wage changes, changes to Alabama overtime taxation in 2024, and enhancements to the Adaptive Employee Experience Preferences.

Identity & Access Management

- Reminder: Multi-factor authentication has been postponed until 2024 for desktop and Adaptive Employee Experience (AEX) users

Payroll & Tax

- Action required! Get prepared for year end with our information-packed webinar and Year End Central section in the Insperity Help Center

- Action required! Enter your pay rate changes so you stay compliant with 2024 minimum wage updates in this release for multiple states and local jurisdictions

- 2024 Alabama overtime tax changes – hourly paid employees will not pay state income tax on their overtime pay.

- Several state tax form changes including Kentucky and North Carolina

- For clients in the New York Metropolitan Commuter Tax District, you can now enable the system to calculate on the first payroll without meeting the wage requirements

- Reminder! 2023 Federal unemployment tax credit reductions will be applied in payrolls after December 1st

- Updated Balance – Forecast Accrual Report

- 2024 tax updates

Adaptive Employee Experience (AEX)

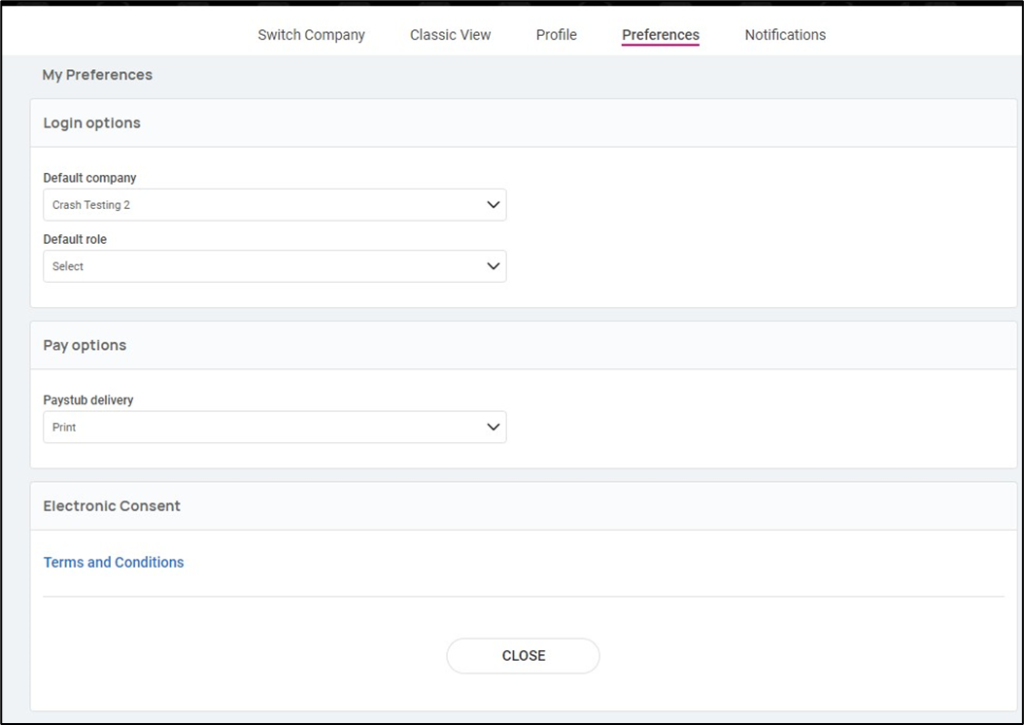

- Manager and Supervisors can now set their own default Legal Company and Role (Manager/Supervisor) in the Preferences user interface

- Users can now use preferences to set pay stub delivery option to Print or Electronic formats

Identity & Access Management

Multi-factor authentication postponed until 2024

We heard you! At Insperity, we understand year-end is a busy and important time of year. To ensure you can give your company’s year-end the focus and attention it deserves, the Identity Phase 2 – Multi-factor authentication enhancements have been postponed until after the holiday and year-end season.

We will update you on the timing of the release of multi-factor authentication in the first half of January.

Payroll & Tax

Get prepared for year end

Action required!

With the new year approaching, our Preparing for Year End webinar is packed with information that guides you through tasks related to closing out 2023. In addition to our video, the Insperity Year-End Central section has additional videos and guides to help you prepare for the year-end closing.

Additional Minimum Wage Updates for 2024

State and local minimum wage updates for 2024

A number of 2024 minimum wages have been updated based on information provided by each jurisdiction. They will continue to be updated as more rates are published.

The file below shows all the known 2024 minimum wage changes in this release. Please visit the HR Resource Center for the full list of minimum wages and updates on new ones in the states you do business. Don’t have an account? Reach out to your Customer Success Specialist for details and access.

9.24 List of 2024 Minimum Wage Changes

ACTION ITEM – You will need to add new salary records for employees who need pay increases due to minimum wage changes. The system will not automatically increase their rate. Be sure to enter any rate changes before you process the first pay period of the new year to stay in compliance.

- Use the How do I find employees who are being paid below minimum wage? guide in the Insperity Help Center to identify employees who will fall below minimum wage with the changes effective January 1, 2024 so you know who to update.

- Follow the {article about how to add new salary records, since we need to make sure they add new and don’t just edit existing} article for help entering new salary records.

Click here for more information on reviewing pay information for minimum wage compliance.

2024 Changes to Alabama Overtime

Hourly employees exempt from Alabama state income tax on overtime earnings

Effective January 1, 2024, overtime pay received by full-time hourly paid employees for hours worked above 40 in any given week are excluded from gross income and therefore exempt from Alabama state income tax. Alabama passed Act 2023-421 in June 2023 with the intent of providing Alabama hourly workers with tax relief while inflation rates remain high. This new law applies to overtime paid before June 30, 2025, unless the state takes action to extend the law prior to that date. This new exemption only applies to Alabama state withholding tax. Alabama overtime earnings will still be subject to SUI and federal taxes.

It is important to note that this exemption applies to any hourly workers who received overtime wages that are subject to Alabama state withholding, regardless of their resident or work location, if all the hours the employee worked to reach the 40-hour threshold are also subject to Alabama state withholding.

Tied with this exemption, the law also imposes mandatory reporting obligations on Alabama employers. The first requirement is a one-time report for the tax year beginning January 1, 2023. Employers are required to report the following information to the Alabama Department of Revenue (ALDOR) no later than January 1, 2024:

- Aggregate amount of overtime paid

- Number of hourly employees who received the overtime pay

More information about the one-time 2023 report will be included in isolved v9.25 which will be released on December 29th.

In addition to the one-time report of 2023 overtime information, the same information will also be reported to the ALDOR monthly on Form A-6 – Employer’s Monthly Return of Income Tax Withheld and quarterly on Form A-1- Employer’s Quarterly Return of Income Tax Withheld starting in January of 2024.

More information about the one-time 2023 report will be included in isolved v9.25 on December 29, 2023.

For additional information about Alabama’s new overtime pay exemption, including FAQs, see this article on the ALDOR website.

ACTION ITEM – Please contact your Payroll Specialist for assistance with getting this new earning set up if you have employees who are subject to this exemption. It is important to have this configured prior to your first payroll with a 2024 pay date.

2024 Tax Changes

isolved federal, state, and local tax updates

When you process payrolls in isolved with a pay date on or after January 1, 2024, the tax changes included in the 2023 Tax Changes document will automatically take effect.

Stay tuned for additional tax updates in isolved v9.25 which will be available on Friday, December 29th.

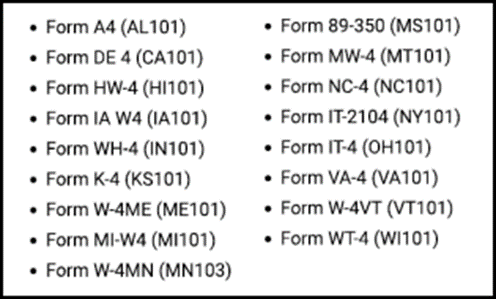

State Tax Form changes

Tax withholding field requirements updated

To align to the form instructions, additional state tax withholding fields are now required for the forms listed below. Previously, this was not a required field, allowing employees to skip it without entering any dollar amount. Many states require that a dollar value be entered, even if it’s $0.

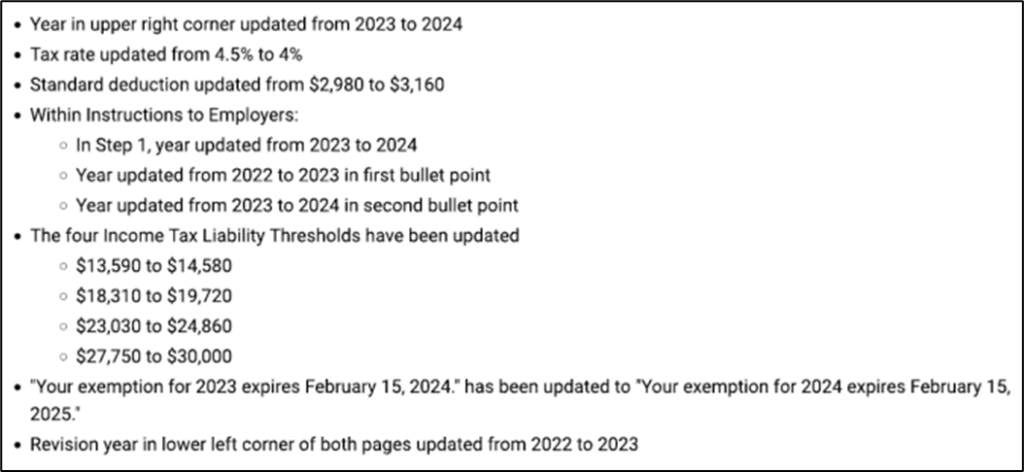

Kentucky Form K-4 update

Effective November 1st, 2023, Form K-4 has been updated with the following changes:

North Carolina Form NC-4 Nonresident Alien (NRA) Update

A question has been added to the NC-4 NRA survey, asking the employee if they are a nonresident student or business apprentice from India. If they select “yes”, the form will populate line 2 on the form with a $0.

If an employee responds “no”, the form will populate line 2 based on their pay period selection.

New York Metropolitan Commuter Transportation Mobility Tax Zones

NY MCTMT Zone Taxes Force Calculation

In Release 9.18, 9.19, and 9.23, we discussed the zone updates for employers in the Metropolitan Commuter Transit District and reports available. Prior to this release, the system would not withhold any New York Metropolitan Commuter Transportation Mobility Taxes until the employer had accrued wage liability of $312,500 for a quarter. This liability covers employees who work in Zone 1 and Zone 2 combined. For employers who know they will likely reach that wage limit, it is recommended to begin withholding this tax in the first payroll of the quarter. With this release, you can request to withhold the NY MCTMT immediately without waiting to meet the wage requirements wages.

If you have questions or would like this enabled, please reach out to your Payroll Specialist.

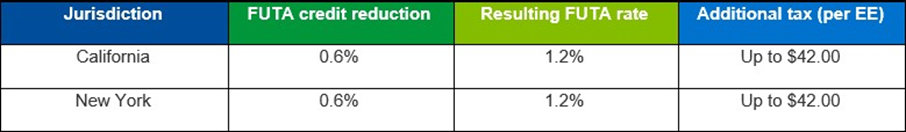

Reminder! 2023 FUTA Credit Reduction updates

2023 Federal unemployment tax credit reductions

If you are an employer with a work location in California or New York, you may be subject to additional federal unemployment tax (FUTA) for 2023.

These states had an outstanding federal loan balance for two consecutive years and failed to pay back the loans by the Nov.10, 2023 deadline, so the FUTA credit will be reduced:

The first payroll with a check date on or after Dec. 1, 2023, will include the additional FUTA payment for employees who work in the affected states.

If you do not plan to process any payrolls on or after Dec. 1, 2023, please contact your payroll specialist or Insperity Tax at IPS.Tax@insperity.com for assistance with the FUTA adjustment to ensure compliance.

For more information about these unemployment tax credit reductions, visit Federal Unemployment Tax Credit Reductions 2023.

Adaptive Employee Experience (AEX)

Updates to Preferences

Manager and Supervisors

For client using AEX, Managers and Supervisors will now be able to set their user preferences just as they can in the Classic view! This means users will be able to set their own default Legal Company and Role (Manager/Supervisor) under My Preferences.

Pay Stub delivery format

Provided Legal Pay Groups are configured properly, employee users can now use preferences options to set receipt of their ESS Pay Stub to either Print or Electronic formats. Preferences set up in Classic will carry over to AEX and the mobile app.

For more information about the changes in isolved version 9.24, please contact your Payroll Specialist.