Friday, December 1st, 2023

Highlights

isolved version 9.23 includes important information about minimum wage changes, FUTA tax credit reductions, a new report to provide employee pay stubs, continued improvements in screen design, information about federal, state, and local tax updates coming in the new year, and new features for Applicant Tracking users.

Identity & Access Management

- Reminder: Multi-factor authentication has been postponed until 2024 for desktop and Adaptive Employee Experience (AEX) users

Payroll & Tax

- Action required! Get prepared for year end with our information-packed webinar and Year End Central section in the Insperity Help Center

- Action required! Enter your pay rate changes so you stay compliant with 2024 minimum wage updates for multiple states and local jurisdictions

- 2023 Federal unemployment tax credit reductions will be applied in December 1 payrolls

- Stay informed of 2024 tax changes that will be introduced in the next few releases

- For clients in the New York Metropolitan Commuter Tax District, corrections have been made to tax withholding in additional checks

- You now have more control with arrears withholding deductions

- Provide up to a year of pay history to individual employees with the new Employee Paystub by Date Range report

Benefits

- Employees enrolling in benefits can see the benefit plan year on the confirmation page to easily differentiate current year life event enrollments from open enrollment for the upcoming plan year

- See all of your open enrollment changes in the enhanced report

Client Management & HR

- The Client Management Training and Employment Statuses screens have been redesigned with the modern grid view, along with the Time Entry Templates screen

- You can now use the Enter key to initiate searching in screens with the redesigned grid view

Applicant Tracking

- Career site enhancements make it easier for applicants to review and apply for jobs on mobile devices

- Now you can prompt applicants to enter a date from the calendar when responding to additional application questions with the new Date Selection option

- The redesigned Job Board Push simplifies job board integration and clarifies billing options

- Is your Indeed account connected through our sponsored jobs integration? Streamline job posting to the world’s #1 job site

- Have you seen the new SourcingPower? Ensure every job you post is getting optimal results with actionable tips and KPIs.

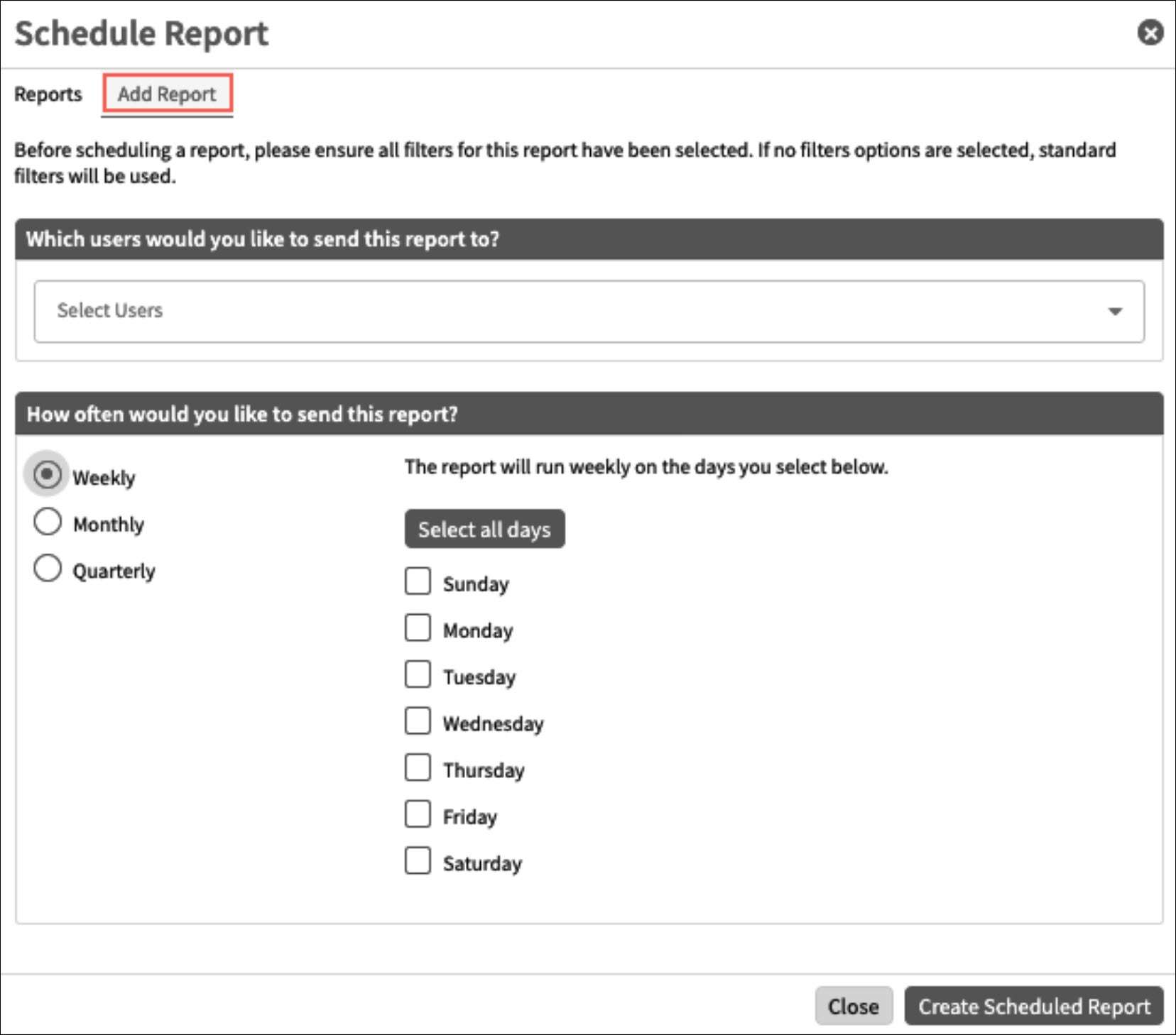

- Send the Jobs Overview report automatically with the new report scheduling feature

- Let the Applicant Tracking experts write your job postings for you with the new Job Ad service

- Register for the Put it on Auto-Pilot: Automating Statuses and Communication webinar to learn how to save time with automation

Identity & Access Management

Multi-factor authentication postponed until 2024

We heard you! At Insperity, we understand year-end is a busy and important time of year. To ensure you can give your company’s year-end the focus and attention it deserves, the Identity Phase 2 – Multi-factor authentication enhancements have been postponed until after the holiday and year-end season.

We will update you on the timing of the release of multi-factor authentication in the first half of January.

Payroll & Tax

Get prepared for year end

Action required!

With the new year approaching, our Preparing for Year End webinar is packed with information that guides you through tasks related to closing out 2023. In addition to our video, the Insperity Year-End Central section has additional videos and guides to help you prepare for the year-end closing.

Additional Minimum Wage Updates for 2024

State and local minimum wage updates for 2024

A number of 2024 minimum wages have been updated based on information provided by each jurisdiction. They will continue to be updated as more rates are published.

The file below shows all the known 2024 minimum wage changes. Please visit the HR Resource Center for the full list of minimum wages and updates on new ones in the states you do business. Don’t have an account? Reach out to your Customer Success Specialist for details and access.

9.23 List of 2024 Minimum Wage Changes

ACTION ITEM – You will need to add new salary records for employees who need pay increases due to minimum wage changes. The system will not automatically increase their rate. Be sure to enter any rate changes before you process the first pay period of the new year to stay in compliance.

- Use the How do I find employees who are being paid below minimum wage? guide in the Insperity Help Center to identify employees who will fall below minimum wage with the changes effective January 1, 2024 so you know who to update.

- Follow the {article about how to add new salary records, since we need to make sure they add new and don’t just edit existing} article for help entering new salary records.

Click here for more information on reviewing pay information for minimum wage compliance.

2024 Tax Changes

Federal, state, and local tax updates coming in 2024

Starting with payrolls processed with a pay date on or after January 1, 2024, the tax changes included in the 2024 Tax Changes document will automatically take effect.

Stay tuned! Additional 2024 tax changes will be announced with upcoming December isolved releases.

New York Metropolitan Commuter Transportation Mobility Tax Zones

Updates for Additional Checks processed in NY MCTMT

In release 9.18 and 9.19, we discuss the NY MCTMT zone updates and available reports. In this release, an update has been made to accumulate MCTMT taxes to the right zone when additional checks are processed. If you processed additional checks for employees working in the New York Metropolitan Commuter Transportation District since the taxation was split into two zones at the start of the third quarter, use the NY MCTMT ZONE REPORT to ensure your wages and taxes are applied correctly.

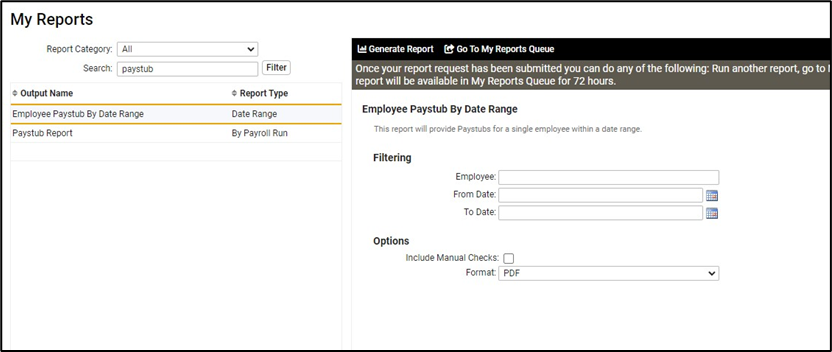

New Paystub Report

Employee Paystub by Date Range Report

With this release, there is a new Employee Paystub by Date Range report that lets you easily provide pay history to individual employees. You can run the report for up to a year by selecting an employee and entering your desired date range. Pay stubs for regular payrolls are included by default, but you can also include manual checks by selecting that option.

The following payment types are not included:

- 3rd Party Sick Pay

- Adjustments

- Voided Checks

- Wage Adjustments

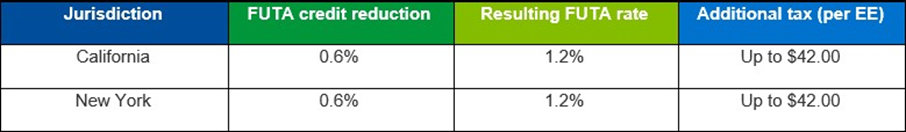

2023 FUTA Credit Reduction updates

2023 Federal unemployment tax credit reductions

If you are an employer with a work location in California or New York, you may be subject to additional federal unemployment tax (FUTA) for 2023.

These states had an outstanding federal loan balance for two consecutive years and failed to pay back the loans by the Nov.10, 2023 deadline, so the FUTA credit will be reduced:

The first payroll with a check date on or after Dec. 1, 2023, will include the additional FUTA payment for employees who work in the affected states.

If you do not plan to process any payrolls on or after Dec. 1, 2023, please contact your payroll specialist or Insperity Tax at IPS.Tax@insperity.com for assistance with the FUTA adjustment to ensure compliance.

For more information about these unemployment tax credit reductions, visit Federal Unemployment Tax Credit Reductions 2023.

Arrears Deduction Updates

You now have more control now when withholding additional deductions for arrears

The system can be configured to automatically capture arrears if an employee doesn’t have enough pay to withhold all of their scheduled deductions. If that happens, instead of trying to withhold the whole amount due in the next check, you can take a smaller portion over multiple checks so there is a smaller impact on the employee’s pay.

The Max Per Check field will now display on the employee deduction if there is an arrears balance so you can specify how much to take in each check. That amount will be deducted until the arrears has been repaid.

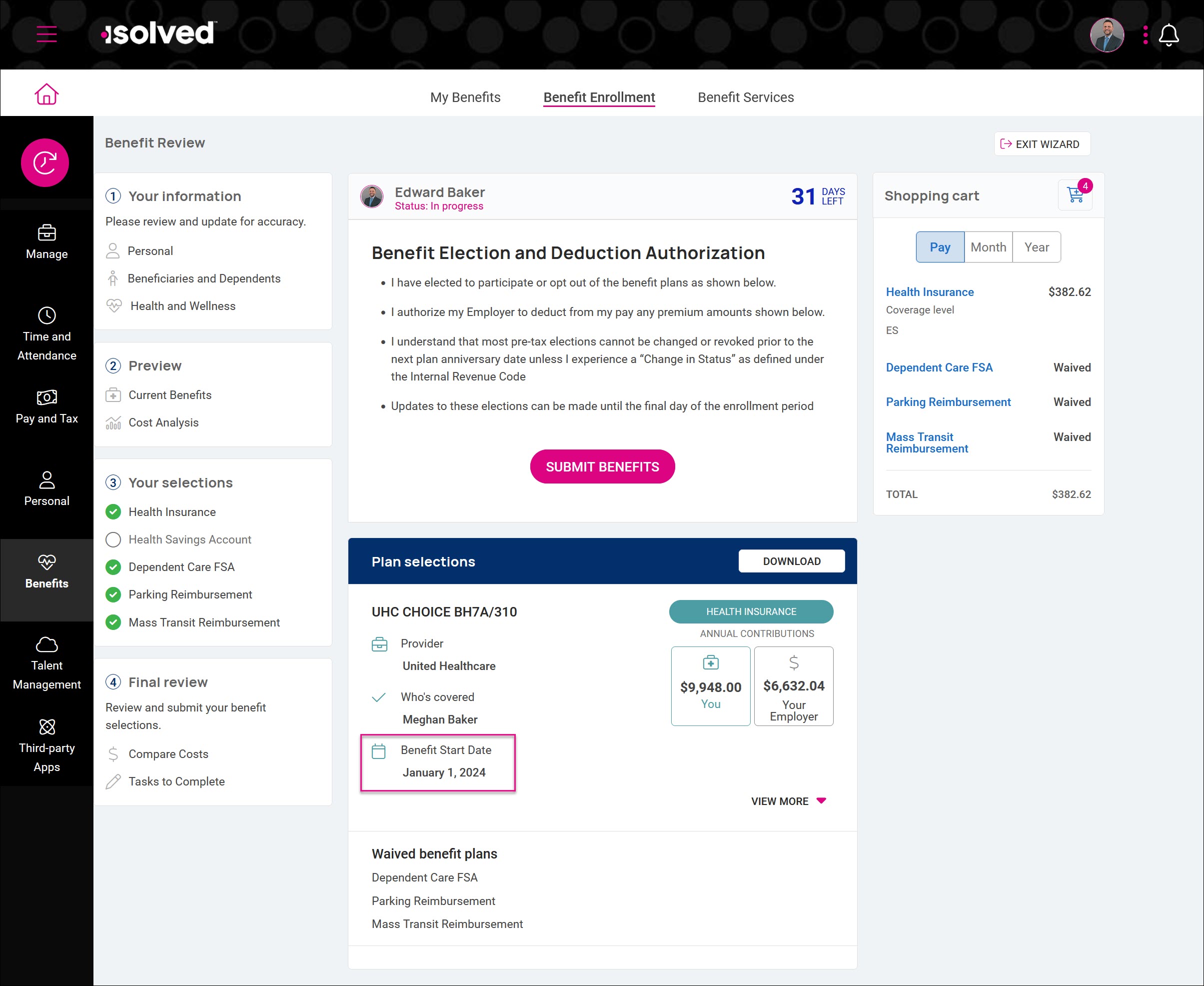

Benefits

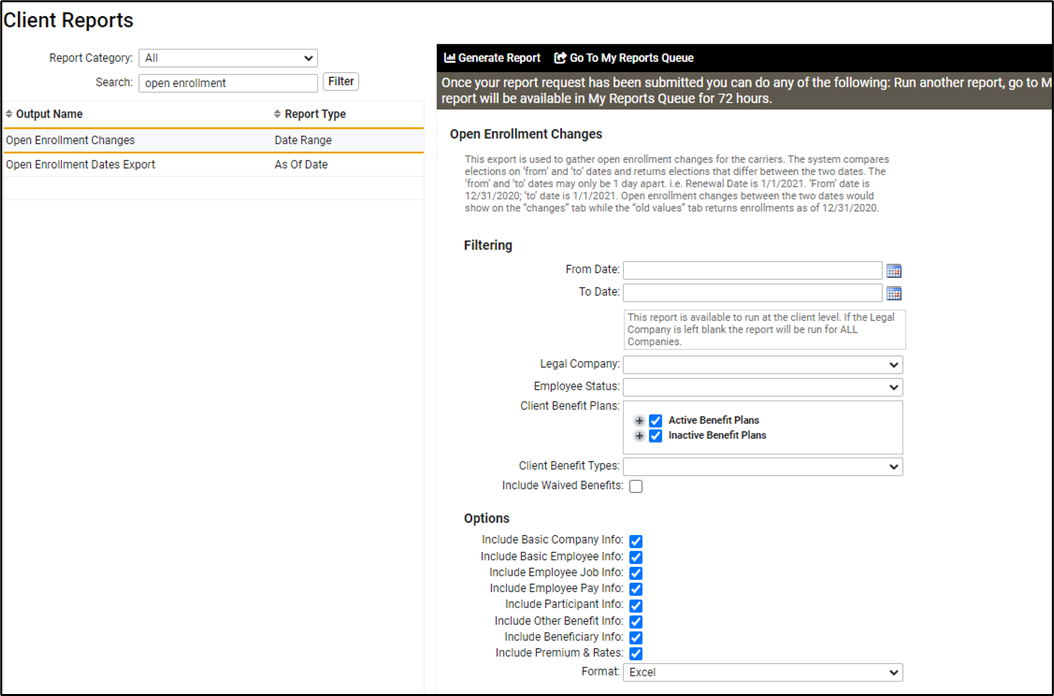

Open Enrollment Changes

Confirm the benefit plan year before submitting benefit elections

The confirmation page now includes the benefit plan year start date so employees can clearly tell when they’re enrolling for the upcoming plan year in open enrollment vs. enrolling in the current plan year for life events.

All open enrollment changes that occurred in the date range are now included on the report

The Open Enrollment Changes report will now include changes that occurred on the From Date of the date range. Prior to this release, the report was only including changes greater than the from date, rather than greater than or equal to the from date.

Client Management & HR

Screen Enhancements

The effort continues in this release to modernize the screens in isolved People Cloud. Over the next few months, additional screens will be refreshed using the new grid style that you’ve already seen on other screens. The overall functionality stays the same with some differences noted below.

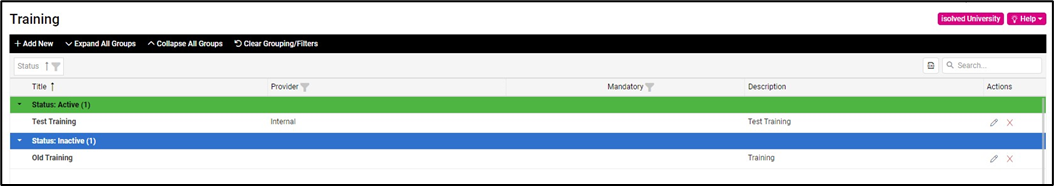

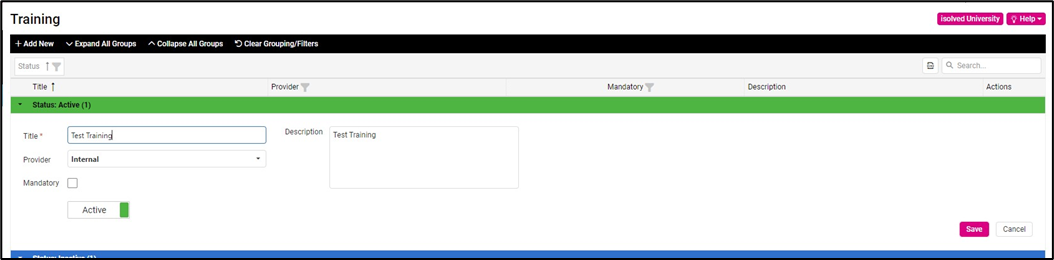

Client Management

Client Management > HR Management > Training and Development > Training:

- Updated grid layout.

- Added export all data to Excel.

- Added filtering to all columns.

- Added edit button.

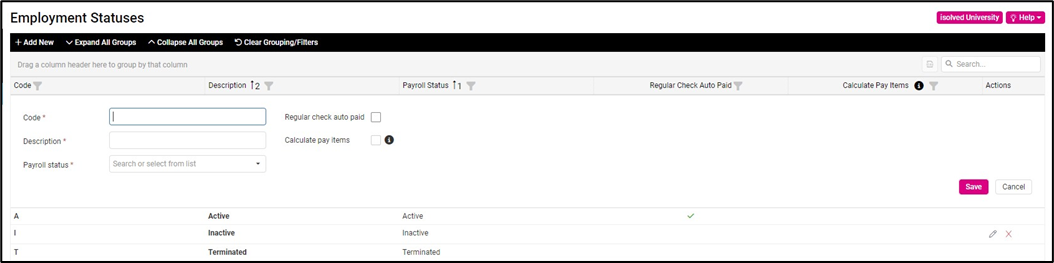

Client Management > Tables > Employment Statuses:

- Updated grid layout.

- Added export all data to Excel.

- Added filtering to all columns.

- Added edit button.

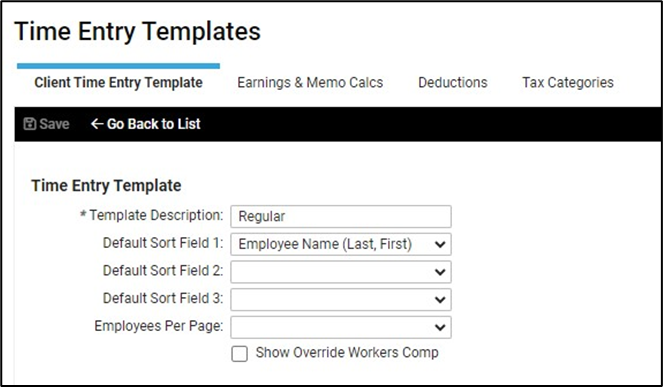

Payroll Processing > Payroll Entry Setup > Time Entry Templates:

- Updated grid layout.

- Added export all data to Excel.

- Client Time Entry Template, Earnings & Memo Calcs, Deductions and Tax Categories all available through added edit button.

Search Box Enhancement

You can now use the Enter key for searches

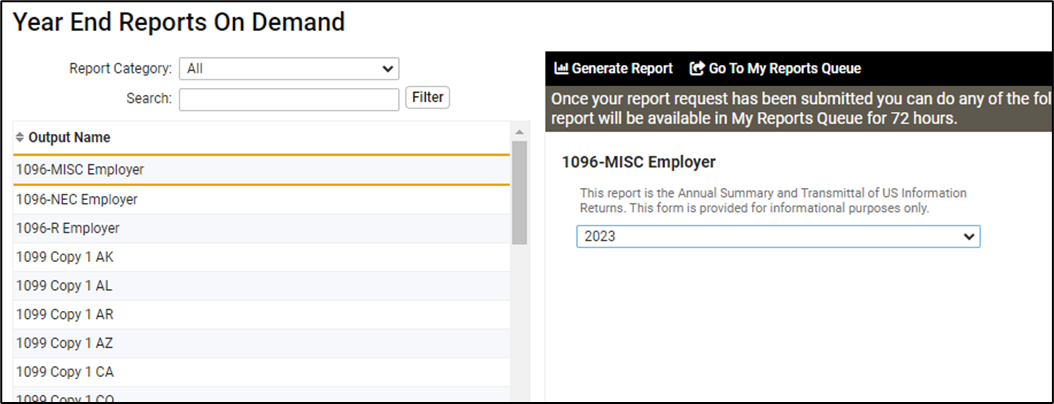

When using the Search box, you can now press the Enter key to initiate the search on screens like Client Reports, My Reports, Year End Reports On Demand, Report Writer, Legal Services.

For more information about the payroll and tax changes in isolved version 9.23, please contact your Payroll Specialist.

Applicant Tracking

Career site and application enhancements

Career sites are easier to navigate on mobile devices with a central hamburger menu (☰) to quickly access job categories, account settings for registered applicants, and company information. You can further customize the mobile experience by using a different page header optimized for small devices.

For applications that include additional questions, you can now prompt employees to select a date from the calendar. When you create your questions, use the Date Selection answer setting to require applicants to respond by choosing a date. For example, you can ask employees when they are available to begin working and they can use the calendar to supply the right date.

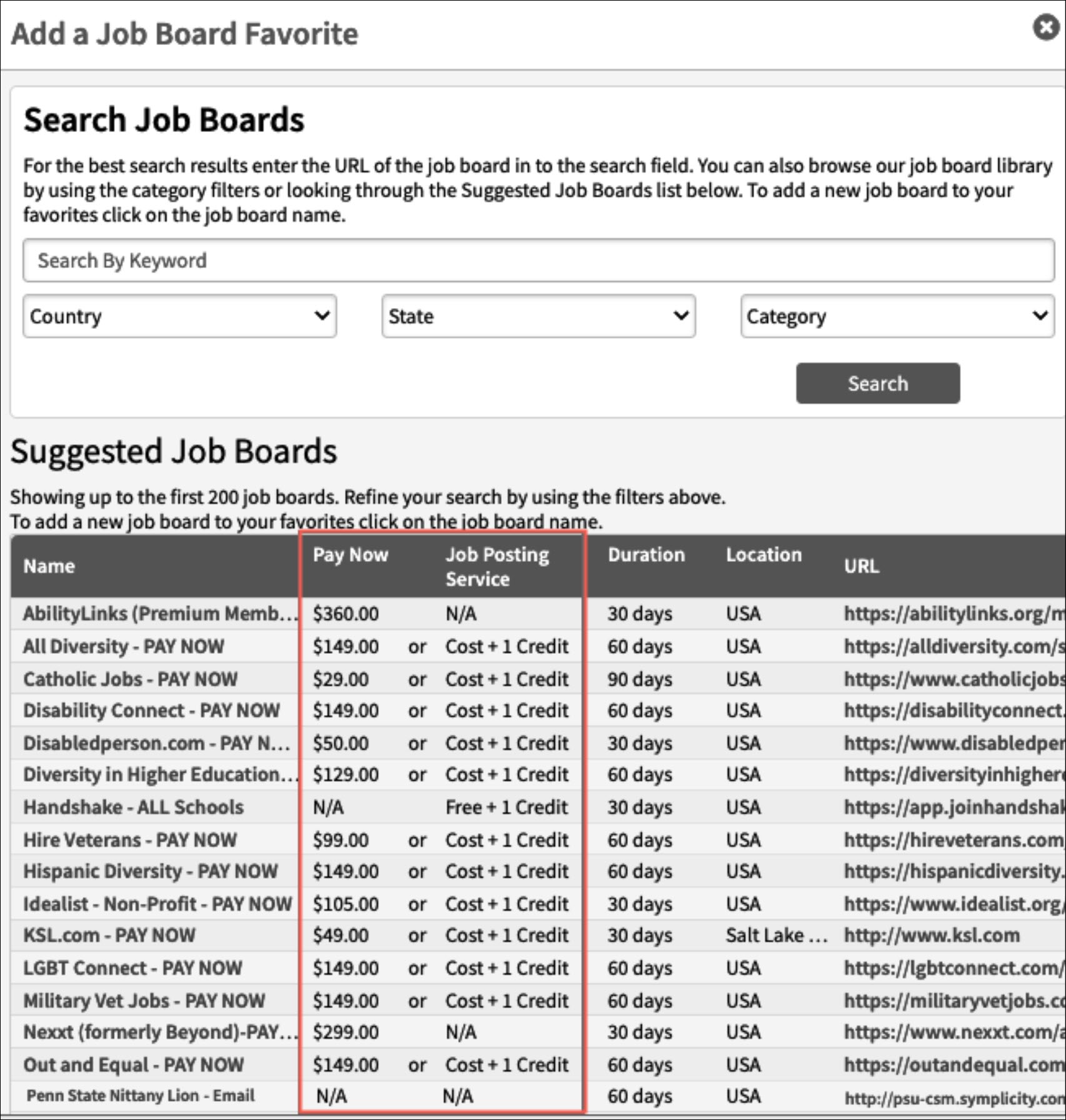

Improved job board integration

The redesigned Job Board Push tab makes it easier to post your job ads on integrated job sites and understand the costs associated with your listings. Select the Job Board Push option from the Job Listings menu to take advantage of these enhancements:

- You will now see three sections that clearly define how posted is done and payment is collected.

- The Direct Charge section is now Pay Now. In this section, you will see the job sites listed that will require a payment by credit card when you post. These boards can be integrated for direct posting.

- The Use Credit section is now titled Job Posting Service. The job sites listed here require a credit to post using the job posting service. It is divided into a Free Job Boards and a Paid Job Boards section so you can easily determine whether you will be charged to use the site.

- The Free section is now called Free Automated Job Boards so you can quickly see which sites allow you to use integration and still post for free.

- The Posting Method is now easier to understand. Choose ATS Job Posting if you want the isolved Applicant Tracking team to post to the job board using their account. Select My Job Board Account if the ads should be posted use the account you have registered with the job site.

- The Cost column has been updated so it’s easier to understand the true cost of posting.

- If a dollar amount is listed in the Pay Now section, that is the total cost for the isolved Applicant Tracking team to post your job.

- If you use Indeed, Upward, or ZipRecruiter, the cost is listed as Custom in the Pay Now section since the price varies based on your budget and other preferences you’ve specified.

- For listings that use the Job Posting Service, the Free + 1 Credit option means the job board does not charge to advertise, but you will use 1 job posting service credit for the isolved Applicant Tracking team to post the job for you.

- The Job Board Cost + 1 Credit option means you will be charged by the job site to advertise your job and you will use 1 job posting service credit for the isolved Applicant Tracking team to post the job for you.

The Job Favorites tab has been updated to use the same categories and cost options as the Job Board Push tab so you can easily understand costs and options for the boards you use most. When searching to add new job boards to your favorites, you can quickly decide which payment method works best for you.

For more details, read the Job Board Push update summary in the Applicant Tracking Help.

The Applicant Tracking team has been working closely with Indeed, the world’s #1 job site, to streamline job posting so you can find the right candidates for your company. The Indeed Sponsored Jobs integration offers the option to set a customized budget or specify how many applicants you wish to receive. To improve security and control over your job campaigns, each user who has permission to post jobs needs to connect their Indeed employer account in the system. You will be automatically prompted through a few simple steps the next time you sponsor a job through the integration. Or you can reach out to the Applicant Tracking support team at (844) 222-3371 for help.

Powerful reporting and analytics

SourcingPower tells you exactly how to improve the quality and visibility of your job ads so every posting delivers optimal results

In Job Listings, you’ll see a graph next to each job ad that measures the sourcing strength so you can identify which posts are working and which need to be improved. Hover over the graph or select Action next to the job listing and then click SourcingPower to view 5 benchmarks with actionable tips for improvement. These benchmarks show:

- Job Ad Quality

- Job Posting

- Employee Referrals

- Social Marketing

- Agency Referrals

Use the SourcingPower key performance indicators to significantly charge the power of your job ads. Watch this video to Learn More!

Report Scheduling comes to Applicant Tracking

Keep hiring managers informed by automatically sending the Jobs Overview report. Click Reports and scroll down to select the Jobs Overview Report, and then click View. You’ll see the new Schedule Report button in the Filter Options. Choose to email the report weekly, monthly or quarterly to the users you select.

Services and expertise at your fingertips

Introducing the Job Ad Writing Service!

Creating a job ad that truly resonates with potential candidates is an art, and the team of professional job ad writers at isolved have mastered it for you. They infuse creativity and expertise into every word, ensuring your ad stands out to potential job seekers. They blend persuasive writing techniques with SEO strategies, harnessing the power of keywords and AI to boost your ad’s visibility. For just $99, let the team craft three tailored variations of your job ad, saving you time and effort.

Register for the webinar on December 6th to learn more about automation

The client success team has been helping clients become better acquainted with isolved Applicant Tracking through monthly webinars. December’s topic is Put it on Auto-Pilot: Automating Statuses and Communication.

Does it feel like your hiring task list just keeps getting longer and longer? Learn how to leverage automation capabilities to knock some of those tasks off your list. Register for the webinar on December 6, 2023 at 11:00 AM Central. Even if you can’t attend live, complete registration to receive a replay link following the webinar.

To take advantage of the services or learn more about new Applicant Tracking features, contact isolved Applicant Tracking at support@isolvedhire.com or call (844) 222-3371.

For more information about the changes in isolved version 9.23, please contact your Payroll Specialist.