For clients who empowered employees and contractors to receive their year-end tax forms online, they were automatically prompted to make their consent choice during initial registration or when they logged in for the first time after the electronic delivery option was enabled. Their choice controls online access to their W-2, 1099-NEC, and ACA forms.

Employees who have consented to electronic delivery

Employees who have already agreed to electronic delivery can view their consent in their preferences in AEE and the isolved People Cloud mobile app.

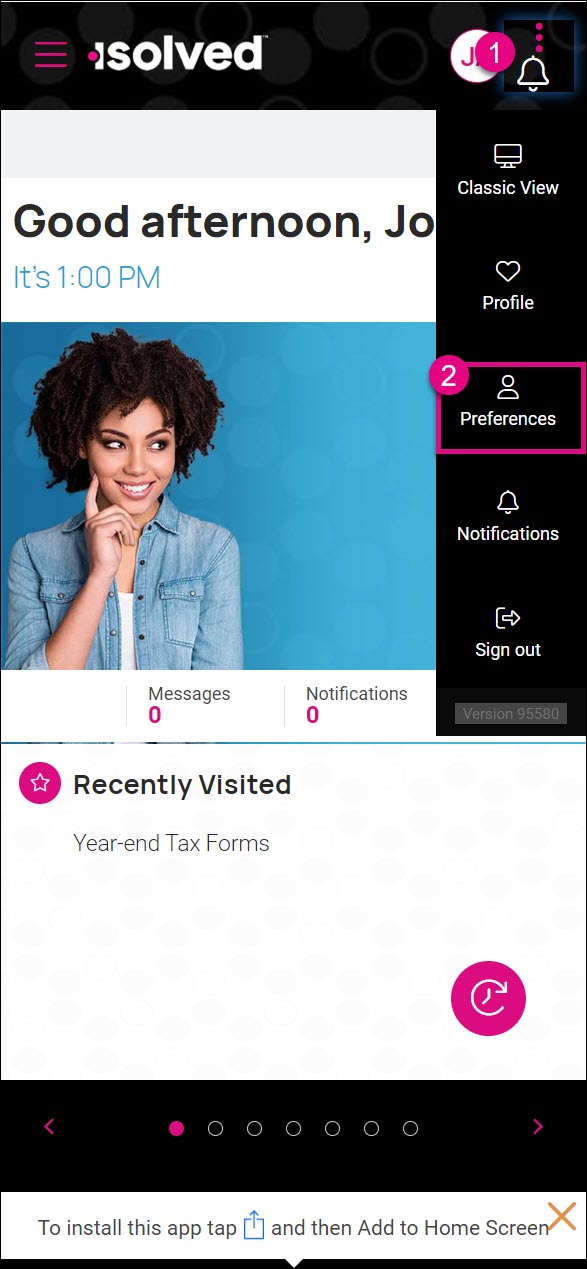

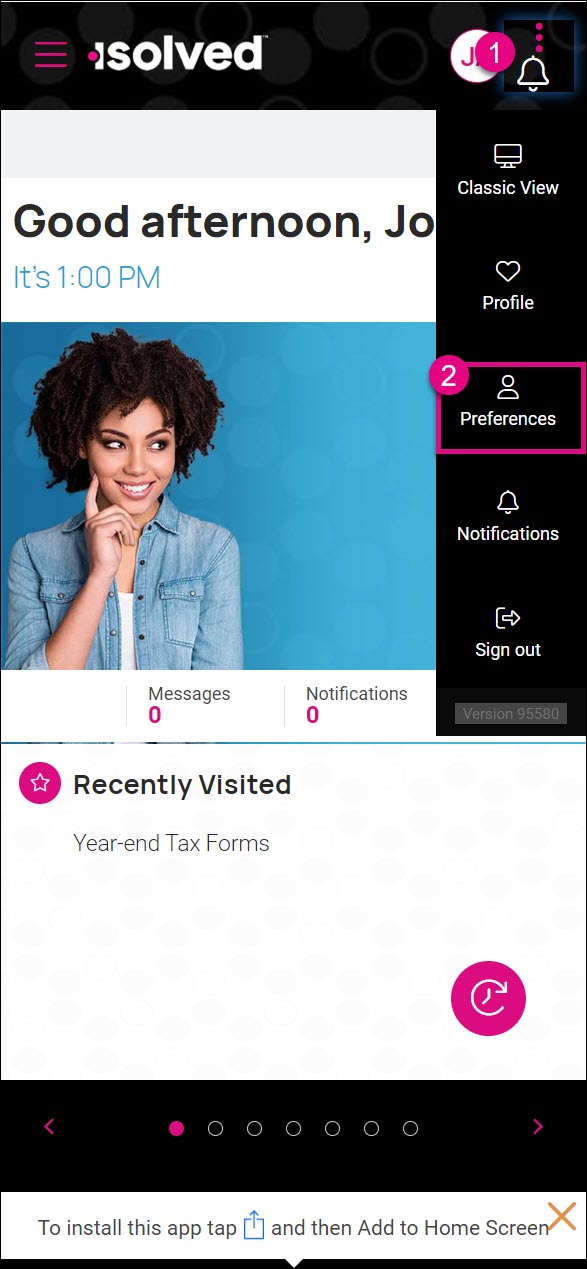

- Click the ⋮ menu icon to access the user menu.

- Select Preferences.

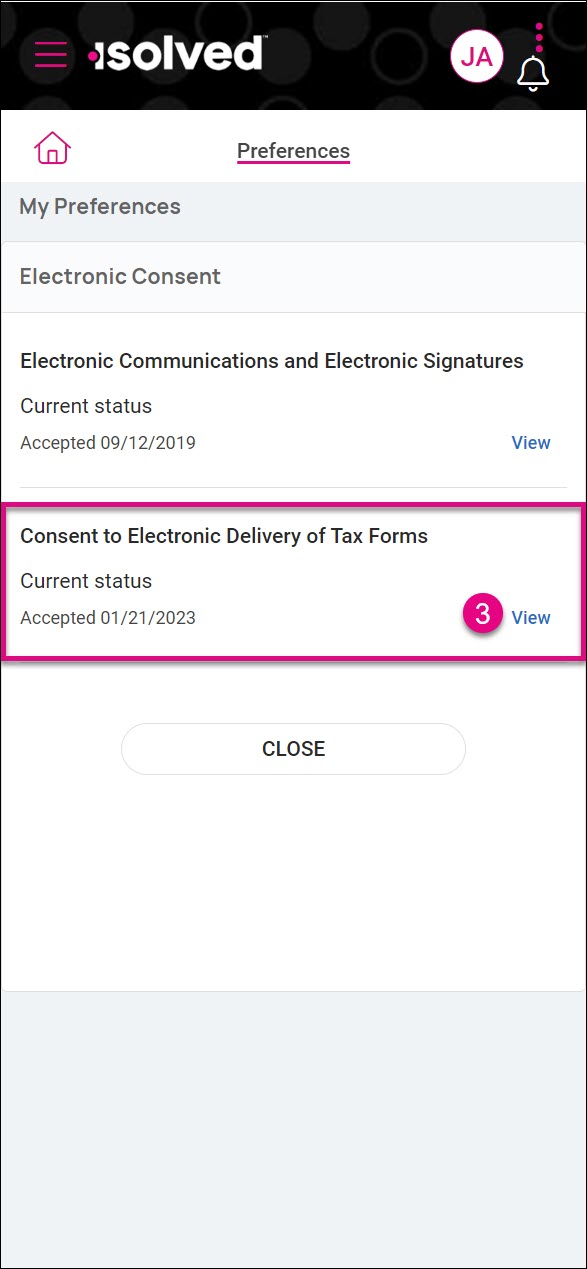

- In the Consent to Electronic Delivery of Tax Forms section, click View.

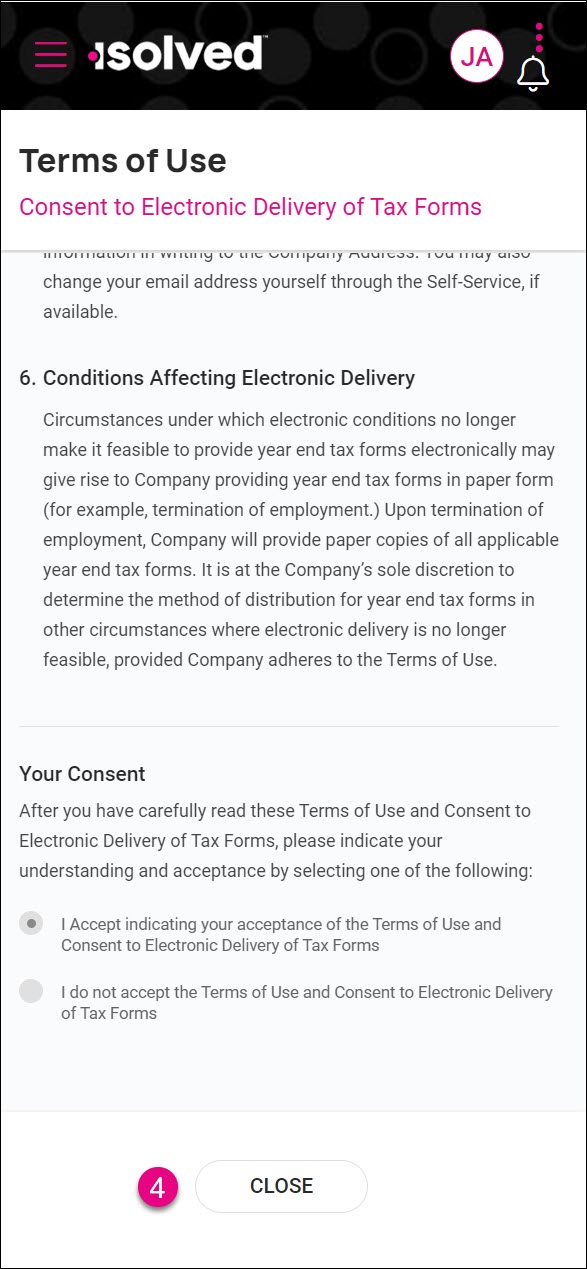

- Read the terms of the consent and view your acceptance status. Click Close to return to My Preferences.

|  |  |

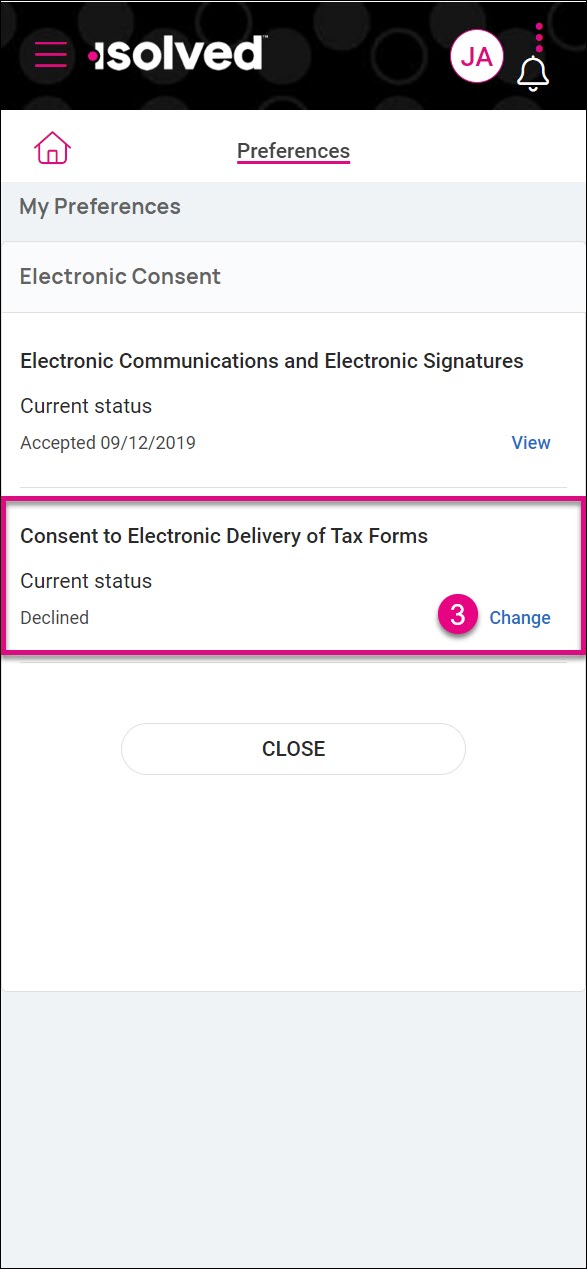

Employees who have declined electronic delivery

Employees who declined electronic delivery of year-end tax forms can change their election in their preferences in AEE and the isolved People Cloud mobile app.

- Click the ⋮ menu icon to access the user menu.

- Select Preferences.

- In the Consent to Electronic Delivery of Tax Forms section, click Change.

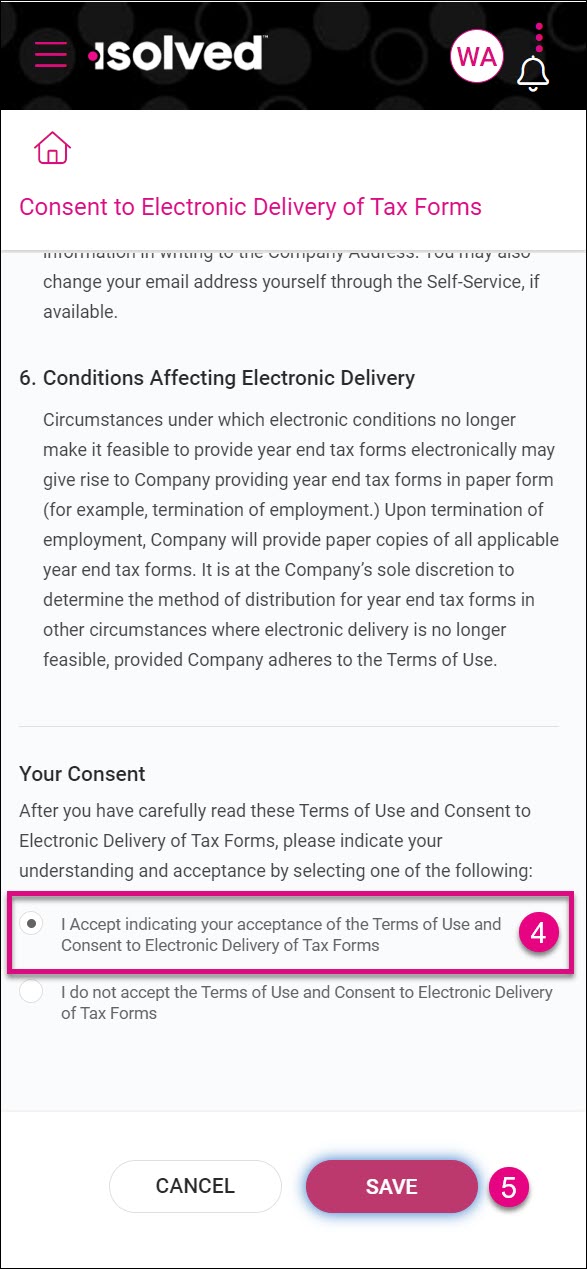

- Read the terms of the consent. Scroll to the bottom and choose I Accept indicating your acceptance of the Terms of Use and Consent to Electronic Delivery of Tax Forms. Click Save.

Note: Employees will need to log out and log back in to see their updated status in Preferences.

|  |  |

Removing consent to electronic delivery

If employees previously consented to electronic delivery of year-end tax forms and want to remove that consent, they will need to contact their isolved People Cloud administrator for assistance. See How can I withdraw the consent for electronic delivery of year-end tax forms for an employee? for more information.

Employees who have consented to electronic delivery will no longer receive a printed copy of their year-end tax forms. They will be able to access them electronically on-demand on any device using the Adaptive Employee Experience or isolved People Cloud mobile app.