Friday, January 12th, 2024

Highlights

isolved version 10.00 includes important 2024 tax changes, Federal and State Tax Form updates, a Time Card absence enhancement, and screen updates using the new modern grid style

Payroll & Tax

- Stay on top of 2024 tax changes

- 2024 federal and state tax form updates

Time & Labor Management

- Absences now remain verified after uncommitting Time Cards

Employee and Client Management

- Several screens have been redesigned with the modern grid view including Employee Training, Employee Audit, and Earnings

Applicant Tracking

- Keep your hiring team aligned with the new Share a Copy feature so they’re included when you send eForms to applicants

Payroll & Tax

2024 Tax Changes

2024 federal, state, and local tax changes

Starting with payrolls processed with a pay date on or after January 1, 2024, the tax changes included in the 2024 Tax Changes document will automatically take effect (unless otherwise noted).

2024 Tax Form Updates

With this release, we have made updates to the federal and several state employee withholding forms.

Federal Form W-4

In addition to verbiage updates throughout Form W-4, the following changes have been made:

- Page 3 – the dollar amounts in Step 4(b), Line 2 have been updated for all three filing statuses:

- Married filing jointly or qualifying surviving spouse was updated from $27,700 to $29,200

- Head of Household was updated from $20,800 to $21,900

- Single or married filing separately was updated from $13,850 to $14,600

- `Page 4 – values in all three tables have been updated.

Arizona Form Employee Withholding Certificate

The following changes have been made for Form A-4:

- The header year and revision date were updated from 2023 to 2023

- The banner calling out the 2023 Arizona tax rate decrease was removed

Colorado Form Employee Withholding Certificate

In addition to verbiage updates throughout Form DR 0004, the following changes have been made:

- Table 1: Standard Allowance amounts have been updated

- Under Step 2 of Worksheet 1, the standard allowance amounts have been updated as follows:

- Single or married filing separately was updated from $11,500 to $12,500

- Head of Household was updated from $18,500 to $19,500

- Filing jointly or qualifying surviving spouse was updated from $25,500 to $27,000

- Table 2: Child Tax Credit Allowance amounts have been updated.

Connecticut Employee Withholding Certificate

The following changes have been made to Form CT-W4:

- The header year and revision date were updated from 2023 to 2023

- Various updates to form instructions

Idaho Employee Withholding Certificate

The following changes have been made for Form ID-W4:

- The year and revision date were updated from 2023 to 2023 throughout the form

- Page 2 – the Pay Period Table has been updated:

- Biweekly updated from $30 to $31

- Semimonthly updated from $32 to $33

- Monthly updated from $65 to $67

- Page 2 – the values in Section 2 have been updated:

- Line 2 has been updated from $12,950 to $13,850

- Line 6 has been updated from $3,417 to $3,534

- Line 8 has been updated from 6% to 5.8%

Iowa Employee Withholding Certificate

The following changes have been made for Form IA-W4:

- The effective year and revision dates were updated from 2023 to 2023 throughout the form

- Page 1:

- Verbiage and formatting changes throughout

- Marital Status options have changed to:

- Other

- Head of Household

- Married filing jointly (which also includes a checkbox for “if so, does your spouse also have earned income?”)

- Page 2:

- Line 1 – Personal Allowances now has dollar value amounts rather than the number of allowances

- Line 3 – Allowances for Itemized Deductions dollar values have been updated

- Line 5 – Allowances for child and dependent care credit dollar values have been updated

Minnesota Employee Withholding Allowance/Exemption Certificate

The following changes have been made for Form W-4MN:

- The year has been updated from 2023 to 2023 throughout the form

- Page 3 – Itemized Deductions and Additional Income Worksheet has been updated:

- Step 1 has been updated from $220,650 ($110,325 for Married Filing Separately) to $232,500 ($116,250 for Married Filing Separately)

- Married Filing Jointly has been updated from $27,650 to $29,150

- Head of Household has been updated from $13,825 to $14,575

- The amount in Step 8 was updated from $4,800 to $5,050

Montana Employee Withholding Certificate

Effective January 1, 2024, legislation passed in Montana will result in significant changes to their withholding tax formula. As a result, several changes have been made to Form MW-4 and employees are encouraged to file a new withholding form for 2024 to ensure their withholding is correct. The changes to the form are as follows:

- The year has been updated from 2023 to 2023 throughout the form

- Section 1: Montana Allowances has been removed. Allowances are no longer used in 2024

- Line 1 – Federal Filing Status has been added with three filing status options

- Line 2 – “Married Filing Jointly with Both Spouses Working” has been added

- Line 3 – “Extra Withholding” has been added

- Line 4 – “Reduced Withholding” has been added

- Exemptions are now found on Line 5

- The form has been extended from 3 pages to 6 since there is now a Multiple Jobs Worksheet and Tables, in addition to instructions on pages 2-6.

New Mexico Employee Withholding Certificate

In addition to verbiage updates throughout New Mexico Form W-4, the following changes have been made:

- Page 3 – the dollar amounts in Step 4(b), Line 2 have been updated for all three filing statuses:

- Married filing jointly or qualifying surviving spouse was updated from $27,700 to $29,200

- Head of Household was updated from $20,800 to $21,900

- Single or married filing separately was updated from $13,850 to $14,600

- `Page 4 – values in all three tables have been updated

South Carolina Withholding Certificate

The following changes have been made to Form SC W-4:

- The year has been updated from 2023 to 2023 throughout the form

- Page 3 – In Step 8, $4,400 has been updated to $4,700

Time & Labor Management

Time Cards

Absences remain verified after uncommitting Time Cards

Previously, when Time Cards were verified, locked, and committed in Process Payroll, uncommitting the Time Cards would cause all verified absences in the pay period to become unverified.

With this release, previously verified absences will remain verified when Time Cards are uncommitted.

Employee and Client Management

Screen Enhancements

Employee Management

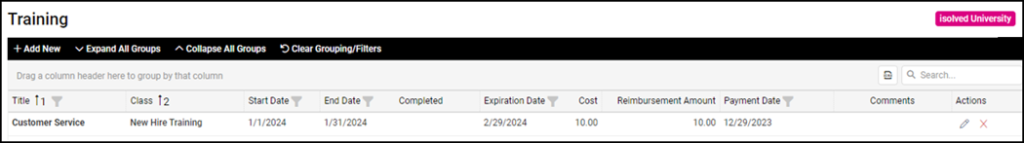

Employee Management > Human Resources > Training and Development > Training:

- Updated grid layout

- Added filtering to each column

- Added edit button

- Added export to Excel

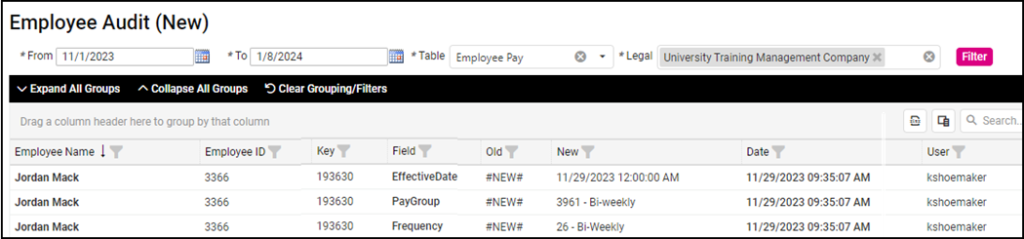

Employee Admin Tools > Employee Utilities > Employee Audit:

- Updated grid layout

- Added filtering to each column

- Added column chooser

- Added export to Excel

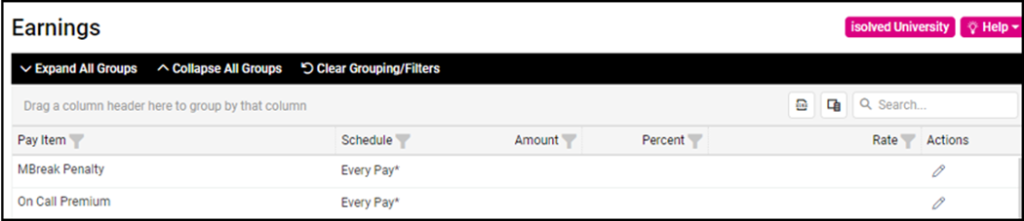

Employee Management > Employee Pay > Earnings:

- Updated grid layout

- Added filtering to each column

- Added edit button

- Added column chooser

- Added export to Excel

Client Management

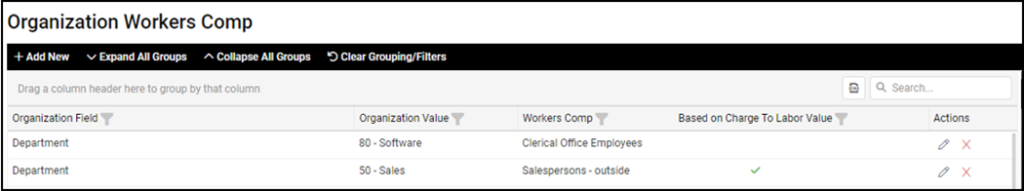

Client Management > Tables > Organization Workers Comp:

- Updated grid layout

- Added filtering to each column

- Added Edit button

- Added export to Excel

Applicant Tracking

Share eForms with your team with the new copy feature

Use the Share a Copy option to CC your hiring team when you send offer letters and other eForms to candidates

You are now able to Share a Copy when sending an eForm to your applicants. This new option keeps your team members aligned in the hiring process.

See the eForms article in Applicant Tracking Help for more information.

For more information about the changes in the 10.00 release, contact your Payroll Specialist.