Friday, September 3rd, 2021

Highlights

isolved version 7.16 includes a modernized Employee Profile; a new attestation feature for isolved Time that prompts employees to answer questions before they punch to certify their health, waive meals, or acknowledge important company information; and new evaluations for benefit administrators. It also requires a secure internet connection when you log in on Friday, September 3rd, 2021.

Employee Administration

- The Employee Summary and Employee Profile have been modernized to show key information at a glance while securing protected personal information

Benefit Administration

- The Benefit Evaluation Utility includes new tools to find employees who still need to enter their HSA bank account information or add missing beneficiary or dependent details

Reporting

- Employee Profile reports have been updated to include 2020 W-4 tax details

Time

- The new Time Card Notes feature supports California attestation requirements and helps employees return to work safely by prompting employees before they punch

- Rounding logic has been updated so individual blocks of time shown on the employee Time Card sum to the same cumulative total in payroll

Browser and Operating System Support

- For enhanced security, isolved will no longer support TLS 1.0 and 1.1 protocols with the isolved version 7.16 release. If you’re using an operating system or browser that is not compliant with TLS 1.2 or higher, you will need to upgrade before you can log in

Employee Administration

The Employee Summary and Employee Profile have been updated

See a streamlined employee overview and access protected information with a click

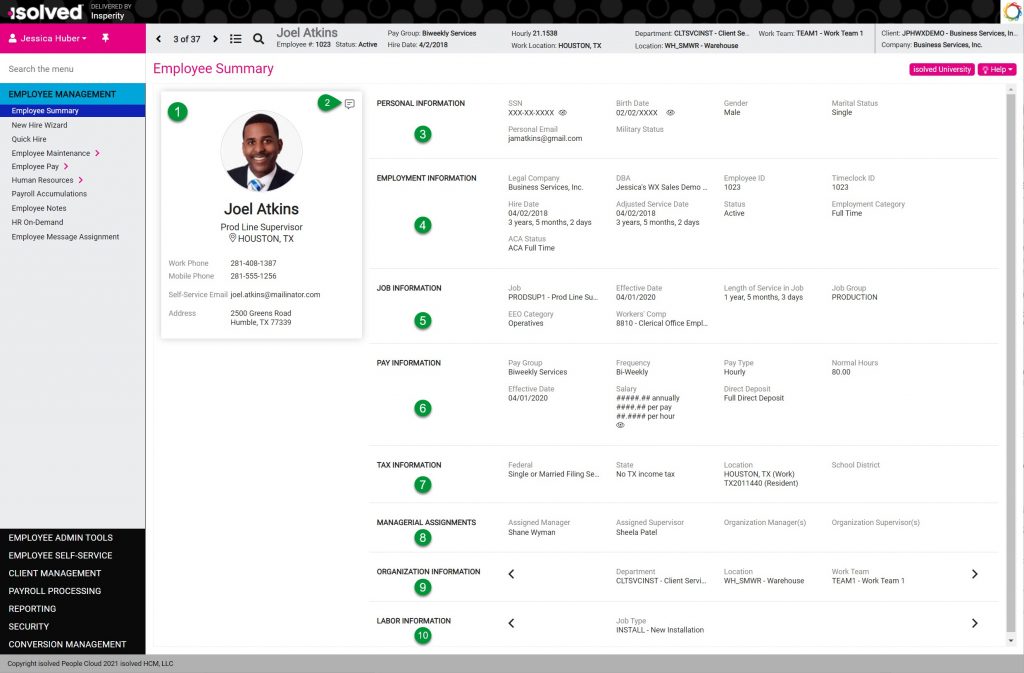

The Employee Summary for administrators and Employee Profile for managers, supervisors, and employees now provide the most relevant employee details at a glance while protecting sensitive data.

Review employee information in these sections:

- The Employee Contact Card shows the employee photo and their primary contact information, along with their job title and work location. The employee’s work email address is displayed here.

- If notes have been entered for this employee and the user has permission to view them, the Notes icon provides a shortcut to the Employee Notes screen.

- The Personal Information section includes protected employee information, so the Social Security Number and birth year are hidden by default. Users with permission to view the unmasked information can click and hold the eye icon to show the full details.

- View details of the employee’s current employment period in the Employment Information section. Their seniority is automatically calculated for both their current hire date and the adjusted seniority date, if that field is being used to track a secondary seniority date for PTO, benefit, deferred compensation, or other eligibility. For terminated employees, the Employment Category field will not be shown. Instead, the Termination Date and Termination Reason will be displayed.

- View details of the employee’s current job in the Job Information section. The employee’s length of service in their current position is automatically calculated.

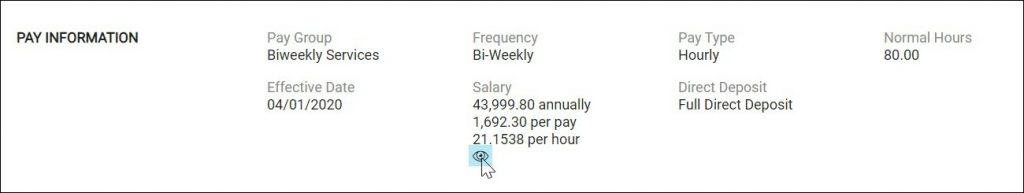

- The employee’s current salary details are shown in the Pay Information section. The annual, pay period, and hourly rates are hidden by default. Users with permission to view salaries can click and hold the eye icon to show the full details. If the employee is receiving a printed check instead of full direct deposit, the Printed Check field will also be shown.

- The Tax Information section shows an overview of the employee’s current federal W-4, state, and local elections along with their resident and primary work states.

- Managerial Assignments shows the employee’s current supervisors and managers.

- View the employee’s current organizational assignments in the Organization Information section. If you track a lot of organization levels, use the arrows on the left and right to scroll through them.

- View the employee’s current labor assignments in the Labor Information section. If you track a lot of default labor levels, use the arrows on the left and right to scroll through them.

- To comply with diversity, equity & inclusion initiatives and federal and state laws, ethnicity information is no longer shown. This information is still viewable on the EEO tab of the Federal Reporting Data screen for administrators with access, or on the EEO Self-Identification screen in Employee Self-Service (ESS) for employees, supervisors, and managers with access.

Benefit Administration

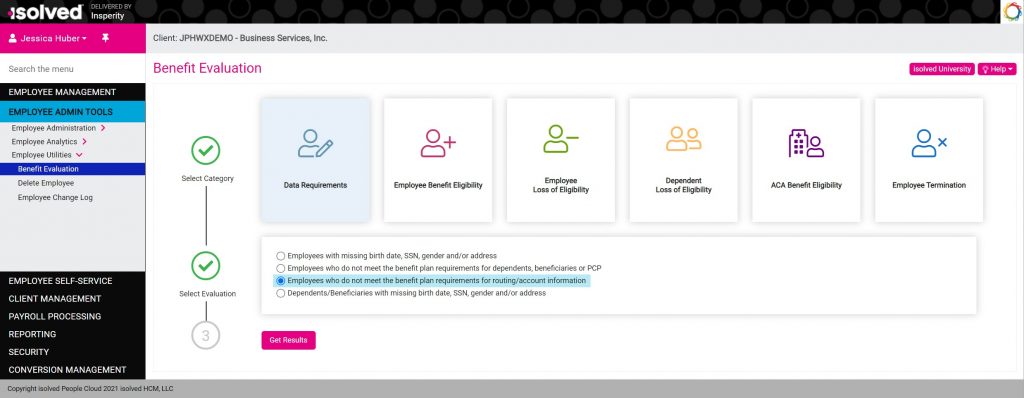

New tools are available in the Benefit Evaluation Utility

Find employees missing HSA bank accounts

The Data Requirements benefit evaluation has been updated to include a new option. Find employees who did not submit their Health Savings Account (HSA) bank account or routing information during open enrollment. If your plans are configured to automatically fund employee accounts, HSA contributions will not begin until that information is entered, so use this tool to locate and notify employees.

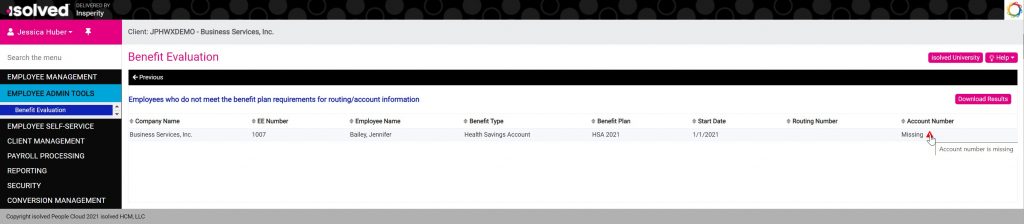

Running the Employees who do not meet the benefit plan requirements for routing/account information evaluation will locate employees who have enrolled in an HSA plan but are missing required banking details.

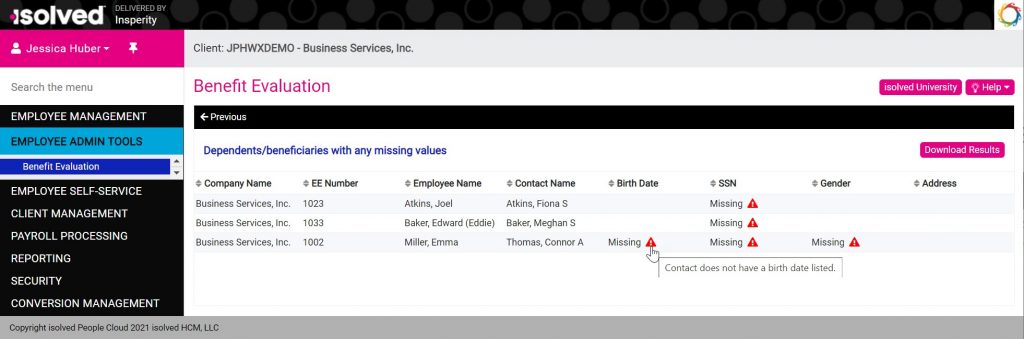

The column will say Missing for each missing value. If you hover over the red triangle, a tooltip will give more information. Click Download Results to export the evaluation results to Excel.

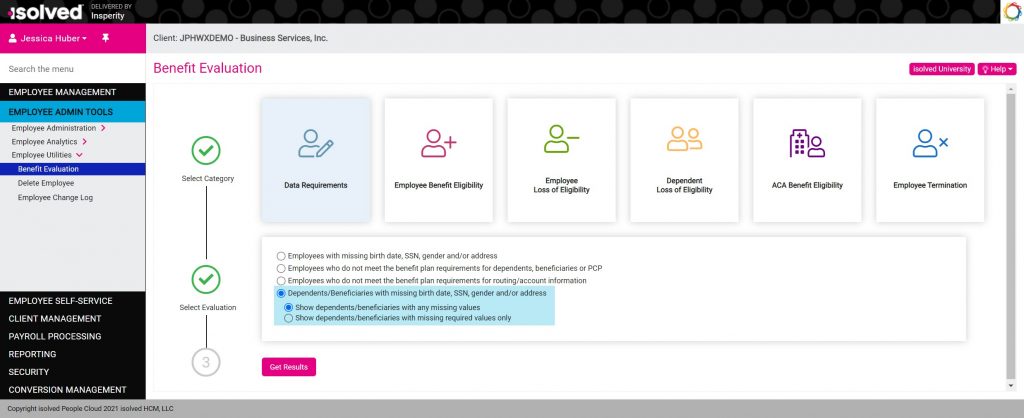

Find dependents and beneficiaries missing required information

The new Dependents/Beneficiaries with missing birth date, SSN, gender and/or address option in the Data Requirements benefit evaluation reviews employee contact records to find dependents or beneficiaries who do not have those required details.

Two options are available when evaluating dependent and beneficiary records:

- Show dependents/beneficiaries with any missing values will search for employee contact records marked as dependents and/or beneficiaries who are missing their birthdate, Social Security Number, gender, or contact address

- Show dependents/beneficiaries with missing required values only will search for missing information based on the dependent and beneficiary requirements you specified during implementation. You can choose to require the following information:

| Type | Fields you can require: |

| Dependent | – Birthdate – Gender – Social Security Number |

| Beneficiary | – Birthdate – Social Security Number |

Contact your Payroll Specialist if you would like to change your required information.

Once you select your preferred option and click Get Results, the evaluation will indicate Missing for each required data element that is missing. If you hover over the red triangle, a tooltip will give more information. Click Download Results to export the evaluation results to Excel.

Reporting

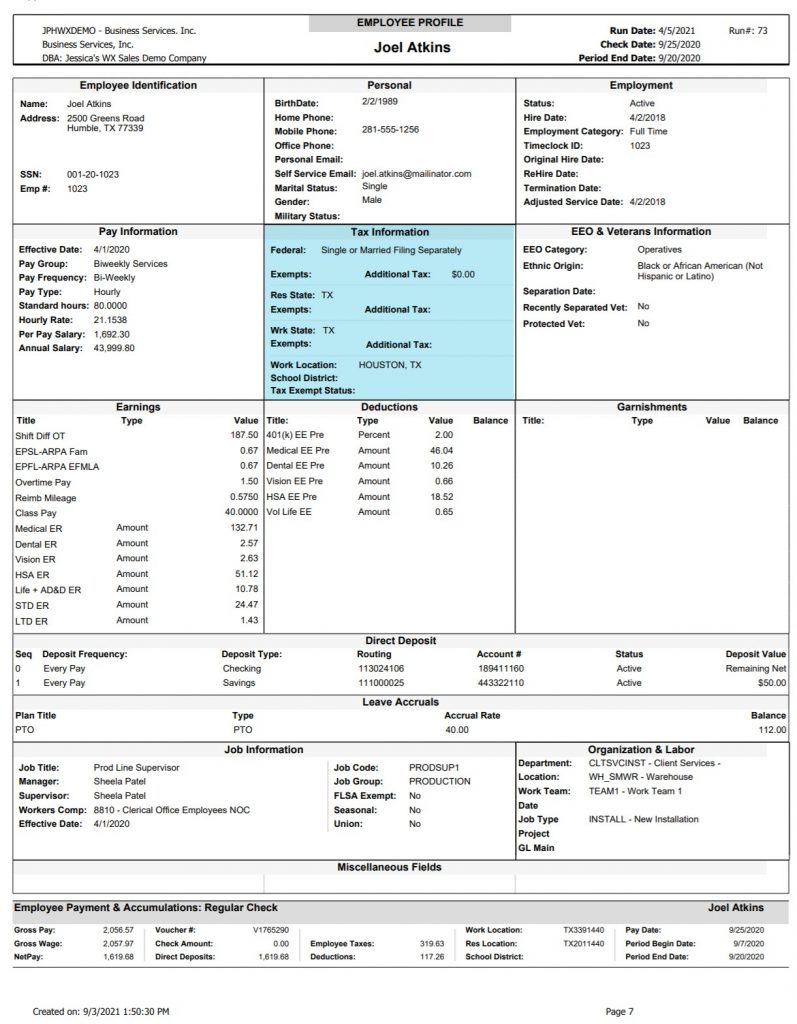

Employee Profile reports show current federal W-4 tax elections

All employee profile reports have been updated to match the enhanced screens

All Employee Profile reports will now show the 2020 W-4 tax election options in the Tax Information section.

The following reports have been updated:

- Employee Profile By Payroll Run

- Employee Profile As of Date

- Employee Profile with Check Accumulations By Payroll Run

- Employee Profile with Check Accumulators As Of Date

Time

The new Time Card Notes feature lets you prompt employees when they punch and save their responses automatically

Help employees return safely to work and ensure compliance by having them attest to their health, meals, breaks, and other company requirements

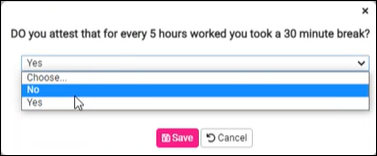

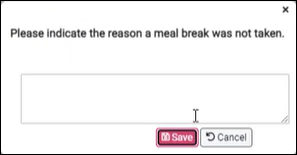

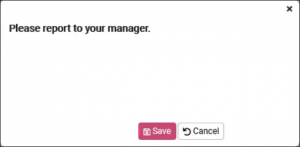

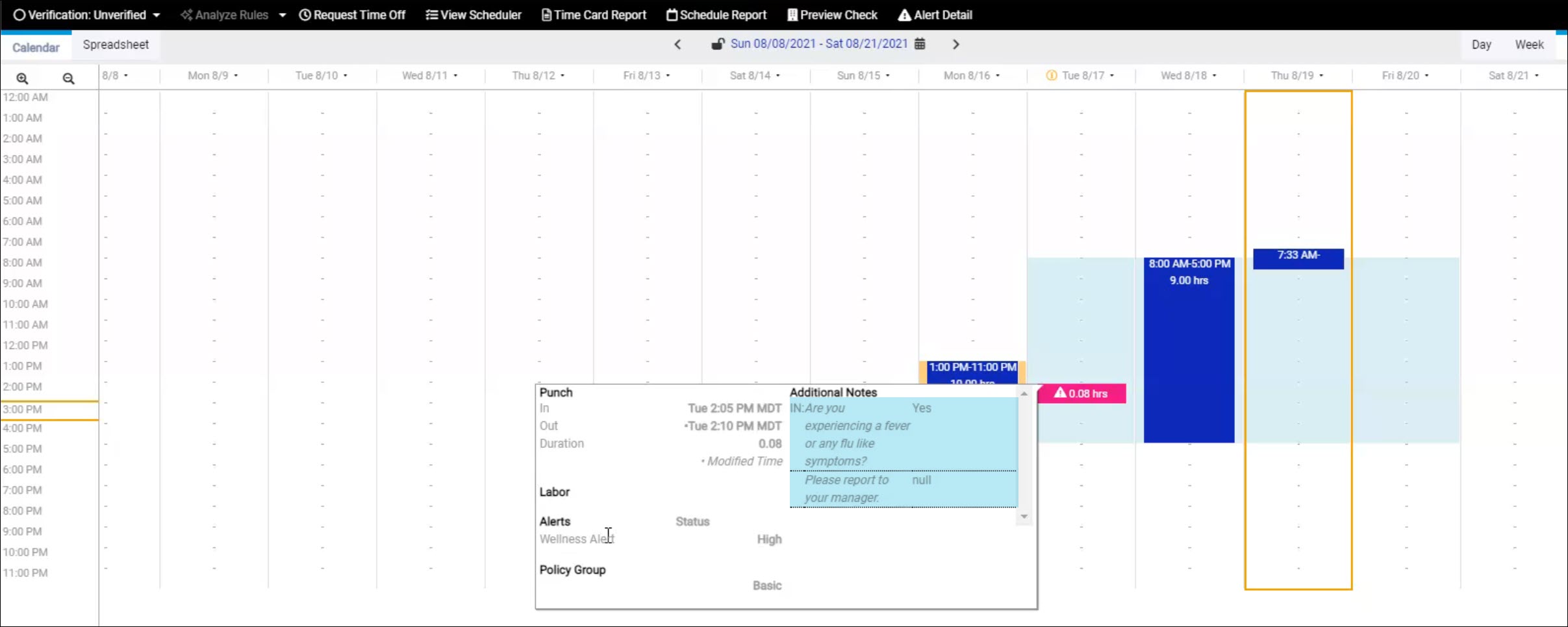

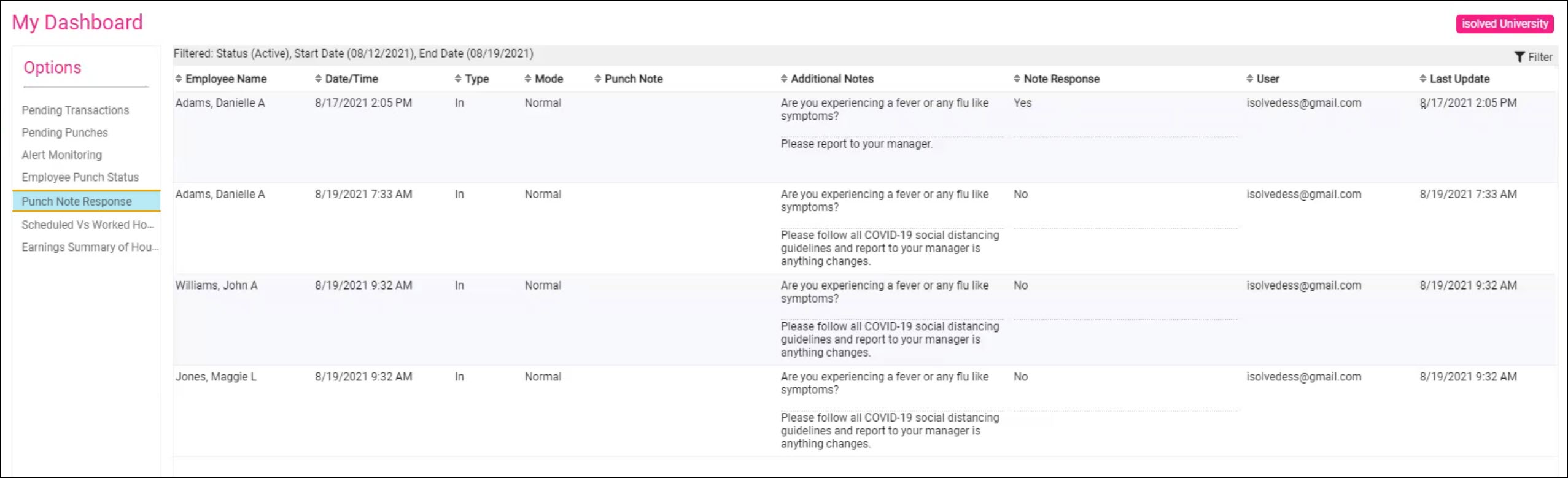

Attestation is simply asking your employees to confirm a statement is true, and then storing that confirmation to document compliance. The new Time Card Notes feature allows you to prompt employees before they punch and capture their responses as notes in their Time Card in isolved Time. This meets attestation requirements in states like California that require employees to confirm they received all mandated rest periods, or chose to waive them instead. This feature takes it a step further and lets you ask follow-up questions or prevent the employee from punching based on their answers. With this tool, you can:

- Prompt employees to certify information before they punch, and allow them to choose their answers from a list or enter freeform text

- Ask follow-up questions based on their answers

- Prevent employees from punching based on their answers

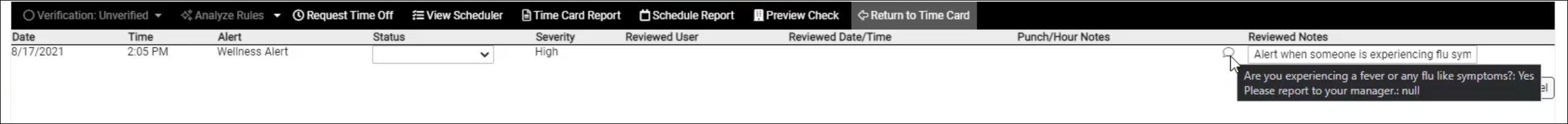

- Automatically trigger alerts based on specific responses

- Save the question with the employee’s answer automatically in a note on the employee Time Card

- Control who can view or edit the notes on the employee Time Card

- Review and excuse attestation alerts on the employee Time Card

- Use the new My Dashboard Punch Note Response view in Employee Self-Service to quickly review prompts and answers for multiple employees

This powerful new option helps businesses:

- Help employees return to work safely. For example, you can:

- Require employees to take their temperature when they arrive at the office and then enter the result before they punch in. If it is too high, you can prevent them from punching and trigger a notification to the site supervisor so they understand why the employee cannot work.

- Ask employees to certify they have received COVID-19 vaccinations and automatically document their response

- Meet compliance requirements. For example, you can:

- Before they leave at the end of the day, prompt employees working in California to specify how many rest and meal breaks they took. If they took less than required, follow up by asking if they chose to waive their first meal of the day and worked less than 6 hours. If so, clear any missed meal alerts so no penalties are triggered.

- Give employees a voice. For example, you can:

- Ask a survey question about a policy change you’re considering and capture the employee’s feedback before they leave for the day

- Remind employees to pick up their new uniforms before they punch out and capture their acknowledgment

- Enforce corporate policies. For example, you can:

- Require employees to confirm they met job safety protocols for their work that day

Contact time.support@insperity.com if you would like to enable Time Card Notes for employees who punch using Employee Self-Service in their browser.

isolved rounds differently now when calculating hours from punches

For clients who capture time by day in payroll, these rounding changes improve precision for accurate Certified Payroll Reporting

When time in hours and minutes is converted to employee pay in dollars and cents, you must first convert the hours to a decimal number to multiply by the employee’s hourly rate. Rounding occurs in this step. This chart shows how each minute converts to a decimal, so you can see it’s rarely precise at 2 or even 4 decimal places:

| Minutes | Decimal | Minutes | Decimal | Minutes | Decimal | Minutes | Decimal | Minutes | Decimal | Minutes | Decimal |

| 1 | 0.0166… | 11 | 0.1833… | 21 | 0.35 | 31 | 0.5166… | 41 | 0.6833… | 51 | 0.85 |

| 2 | 0.0333… | 12 | 0.2 | 22 | 0.3666… | 32 | 0.5333… | 42 | 0.7 | 52 | 0.8666… |

| 3 | 0.05 | 13 | 0.2166… | 23 | 0.3833… | 33 | 0.55 | 43 | 0.7166… | 53 | 0.8833… |

| 4 | 0.0666… | 14 | 0.2333… | 24 | 0.4 | 34 | 0.5666… | 44 | 0.7333… | 54 | 0.9 |

| 5 | 0.0833… | 15 | 0.25 | 25 | 0.4166… | 35 | 0.5833… | 45 | 0.75 | 55 | 0.9166… |

| 6 | 0.1 | 16 | 0.2666… | 26 | 0.4333… | 36 | 0.6 | 46 | 0.7666… | 56 | 0.9333… |

| 7 | 0.1166… | 17 | 0.2833… | 27 | 0.45 | 37 | 0.6166… | 47 | 0.7833… | 57 | 0.95 |

| 8 | 0.1333… | 18 | 0.3 | 28 | 0.4666… | 38 | 0.6333… | 48 | 0.8 | 58 | 0.9666… |

| 9 | 0.15 | 19 | 0.3166… | 29 | 0.4833… | 39 | 0.65 | 49 | 0.8166… | 59 | 0.9833… |

| 10 | 0.1666… | 20 | 0.3333… | 30 | 0.5 | 40 | 0.6666… | 50 | 0.8333… | 60 | 1 |

When you look at time on the employee Time Card, isolved calculates the hours for each individual shift. If you add up the hours for each shift, it doesn’t always reflect the same total on the employee’s paycheck. This occurs because time is summed and converted from minutes to decimal differently when you commit time cards in the payroll process.

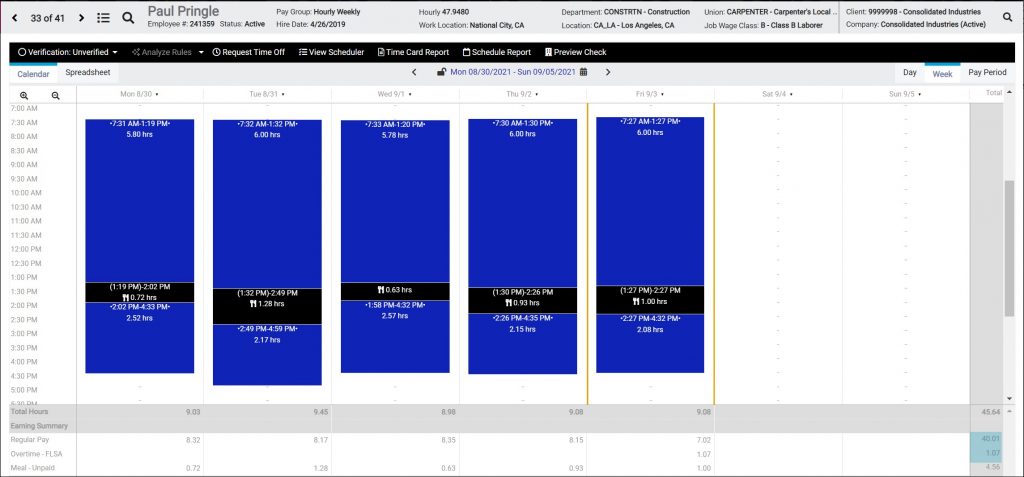

To understand how this works, consider the following Time Card:

If you look at his time in hours and minutes, you can see that he worked a total of 41 hours and 4 minutes in the week. If you convert that total to a decimal, he worked 41.0666… hours, which rounds to 41.07 weekly hours. When it’s converted to pay with regular and overtime earnings applied, he should receive 40.00 hours of regular pay and 1.07 hours of overtime.

But if you convert each individual shift from minutes to decimal and then sum the weekly total, he would receive 40.01 regular hours and 1.07 overtime hours. It looks like he’s being underpaid for overtime, since he should begin receiving overtime after working 40 hours. But it looks like he’s gained an extra 0.01 hours of time somewhere, since 40.01 regular hours + 1.07 overtime hours = 41.08, a hundredth more than the 41.07 he actually worked. This chart shows how it happened:

| Shift | Day | In Punch | Out Punch | Hours Worked per Shift (hh:mm) | Regular Hours (hh:mm) | Overtime Hours (hh:mm) | Regular Hours (decimal, converted per shift) | Overtime Hours (decimal, converted per shift) |

| 1 | Mon 8/30 | 7:31 AM | 1:19 PM | 5:48 | 5:48 | 0:00 | 5.80 | 0.00 |

| 2 | Mon 8/30 | 2:02 PM | 4:33 PM | 2:31 | 2:31 | 0:00 | 2.52 | 0.00 |

| 3 | Tues 8/31 | 7:32 AM | 1:32 PM | 6:00 | 6:00 | 0:00 | 6.00 | 0.00 |

| 4 | Tues 8/31 | 2:49 PM | 4:59 PM | 2:10 | 2:10 | 0:00 | 2.17 | 0.00 |

| 5 | Wed 9/1 | 7:33 AM | 1:20 PM | 5:47 | 5:47 | 0:00 | 5.78 | 0.00 |

| 6 | Wed 9/1 | 1:58 PM | 4:32 PM | 2:34 | 2:34 | 0:00 | 2.57 | 0.00 |

| 7 | Thurs 9/2 | 7:30 AM | 1:30 PM | 6:00 | 6:00 | 0:00 | 6.00 | 0.00 |

| 8 | Thurs 9/2 | 2:26 PM | 4:35 PM | 2:09 | 2:09 | 0:00 | 2.15 | 0.00 |

| 9 | Fri 9/3 | 7:27 AM | 1:27 PM | 6:00 | 6:00 | 0:00 | 6.00 | 0.00 |

| 10 | Fri 9/3 | 2:27 PM | 4:32 PM | 2:05 | 1:01 | 1:04 | 1.02 | 0.00 |

| Totals | 41:04 | 40:00 | 1:04 | 40.01 | 1.07 |

When you commit time cards, isolved keeps the time in hours and minutes until it needs to be summarized by earning, labor value, or work week. So most of the time, you’re not rounding every shift. Instead, you’re rounding totals, so this issue rarely arises. If you need to keep the hours broken down by day to support Certified Payroll reporting, the issue occurs more frequently since you’re rounding more often.

With this release, isolved is doing additional math to ensure the daily breakdown in payroll matches the totals on the employee Time Card in isolved Time.

Browser & Operating System Support

isolved now requires TLS version 1.2 or higher to log in

To secure your employee information, ensure your browser and operating system are compliant

When you use isolved, information travels across the internet from their server to your browser. The data is encrypted using a transport layer security (TLS) protocol to ensure it can’t be seen along the way. The most secure version of TLS is 1.3, although TLS 1.2 meets compliance standards for protecting sensitive employee information. Older browsers and operating systems use earlier versions of the TLS protocol, 1.0 or 1.1, that are no longer secure against modern internet threats. With this release, isolved will check to ensure information is being requested using TLS 1.2 or higher each time you log in from a browser to make sure your data is safe. isolved GO access is not affected by this change.

If you receive HTTP Error 503 or an Unable to connect error, then you will need to upgrade to a browser version that uses the TLS 1.2 protocol on your operating system.

To ensure compliance, make sure you’re using one of these supported operating system and browser combinations for isolved:

| Device Type | Provider | Operating System | Supported OS Version (TLS 1.2 or higher) | Supported Browser Version (TLS 1.2 or higher) |

| Mobile | Android | Android 5.0, Lollipop or newer | Google Chrome | |

| Mobile | Apple | iOS | iOS 9 or newer | Safari 9 or newer |

| Mobile | Microsoft | Windows Phone | Windows 8.1 | Internet Explorer 11 |

| Mobile | Microsoft | Windows Phone | Windows 10 | Microsoft Edge |

| Desktop / Laptop | Microsoft | Windows | Windows XP, Vista, or earlier versions | Internet Explorer 11 |

| Desktop / Laptop | Microsoft | Windows | Windows 7 & 8 (must enable TLS 1.2 manually) | Internet Explorer 11 |

| Desktop / Laptop | Microsoft | Windows | Windows 8.1 | Internet Explorer 11, or the latest version of Google Chrome, Mozilla Firefox, or Microsoft Edge |

| Desktop / Laptop | Microsoft | Windows | Windows 10 | The latest version of Google Chrome, Mozilla Firefox, or Microsoft Edge (Safari is not TLS 1.2 compliant for Windows) |

| Desktop / Laptop | Apple | Mac | OS X Yosemite 10.10 or earlier versions | The latest version of Google Chrome or Mozilla Firefox (Safari is not TLS 1.2 compliant with this OS) |

| Desktop / Laptop | Apple | Mac | OS X El Capitan 10.11 or newer versions | Safari 7 or newer, or the latest version of Google Chrome or Mozilla Firefox |

isolved University

For more information, review these updated articles in isolved University:

- Employee Summary – https://learning.myisolved.com/library/articles/159

- Benefit Evaluation Utility – https://learning.myisolved.com/library/articles/988

Download the release notes

Download the release notes: isolved Product Release v7.16