Friday, January 27th, 2023

Highlights

isolved version 9.01 includes 2023 tax changes, information for clients with work locations in Louisiana, new reports for Connecticut’s MyCTSavings program, an update to Arizona withholding tax rates, plus a sneak peak of a few upcoming updates.

Benefits

- Open Enrollment menu options changing to Benefit Enrollment coming soon

- New Benefit Reconciliation Utility is coming soon

Payroll

- Clients with Louisiana work locations should verify employees’ state withholding elections

- 2023 Tax Changes

- New Connecticut MyCTSavings client reports

- Expired Arizona state withholding tax rates removed from Quick Hire

Time and Labor Management

- Time card objections are coming soon

Benefits

Benefit Menu Option Changes – coming soon

Open Enrollment renamed Benefit Enrollment

The Menu item that is located under Client Management > Benefits > Open Enrollment Setup will be renamed to Benefit Enrollment Setup.

The Menu item in Employee Self-Service Class View for Open Enrollment will also be renamed to Benefit Enrollment.

Benefit Reconciliation Utility – coming soon

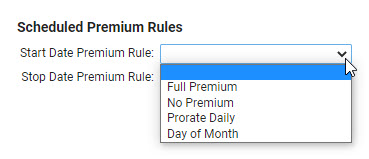

Scheduled Premium Rules

The Benefit Reconciliation Utility will assist in determining any variances between schedule premiums and payroll contributions each month. With upcoming releases, we will include additional sneak peaks into the functionality that will be included in this new employee utility.

With this release you will see several new fields on the Payees tab of Client Management > Benefits > Benefits Plans. Schedule Premium Rules will allow you to update how the amounts are displayed in the Schedule Allocation field of the Employee Benefits Allocation Table. These fields will not be functional until the entire Benefit Reconciliation Utility is released.

It is important to note that the values in these fields do not change how the benefit deductions are calculated in payroll; it only changes the display on the Benefits Allocation Table. There are four options for each of the Schedule Premium Rules and they work the same way for both, except for the “Day of Month” option.

- Full Premium: if the employee is covered any day in the month, calculate the full monthly premium to display on the allocation table

- No Premium: if the employee is covered any other day than the first day of the month, calculate 0.00 to display on the table

- Prorate Daily: if the employee is covered any day of the month, calculate the full scheduled monthly premium, then divide by number of days in the month and multiply by number of days covered in the month to display on the allocation table.

- Day of Month: if the employee is covered any day of the month, the system will look at the day of month entered in this section to determine what will display.

- Start Date Premium Rule: If, for example, 15 is entered, and if the employee is covered before the 15th of the month, the full monthly premium is displayed. If the employee’s coverage starts after the 15th of the month, 0.00 is calculated for the monthly premium of that month.

- Stop Date Premium Rule: If 15 is entered for the stop date and coverage ends before the 15th of the month, 0.00 is displayed as the scheduled allocation for the month. If the coverage ends after the 15th of the month, the full monthly premium is displayed.

Payroll

Action required for clients with Louisiana work locations

Employees’ state withholding elections require verification

Clients who have work locations in Louisiana and hired employees between October 2022 and January 26, 2023, or have employees who updated their Form L-4 Employee’s Withholding Allowance Certificate in isolved during that timeframe will need to work with those employees to update their tax information. While the employee’s Form L-4 found in Employee Self-Service > Documents reflect the elections the employee made, those elections did not map to the Employee Tax screen.

There are two options to update this information. You can have the employee access the Tax Update Wizard in employee self-service in either the Adaptive Employee Experience (AEX) or Classic View and create a new Louisiana state withholding form so their information will map to the Employee Tax screen. As an alternative, you can work directly with the employee and update the information on their behalf within Employee Management > Employee Pay > Tax Information.

2023 Tax Changes

When you process payrolls in isolved with a pay date on or after January 1, 2023, the tax changes included in the 2023 Tax Changes document will automatically take effect.

Connecticut MyCTSavings program

New Client Reports available to support MyCTSavings

The following Client Reports have been added to allow the export of MyCTSavings data from isolved:

- Ct Retirement Savings – Contributions FTP

- CT Retirement Savings – Initial Census

- CT Retirement Savings – Ongoing Census

These reports will provide you with the information you need to provide the state with your original employee information during registration (CT Retirement Savings – Initial Census) as well as the ongoing requirement to provide employee information (CT Retirement Savings – Ongoing Census). The CT Retirement Savings – Contributions FTP will export MyCTSavings deduction information from isolved. Please visit the MyCTSavings website for additional information on the plan

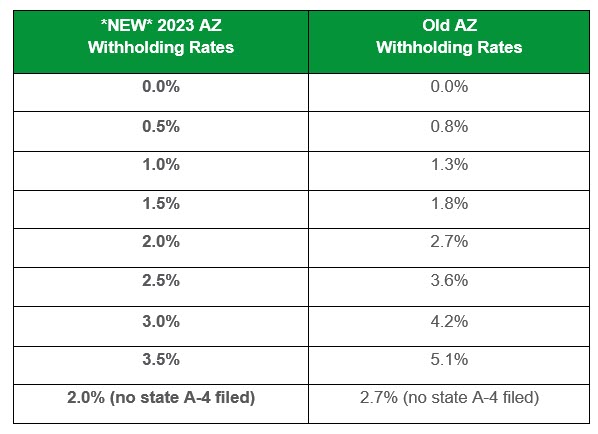

Arizona reduced withholding tax rates

Employees required to complete a new Form A-4

This release removes the old state withholding tax rates from the Quick Hire screen. The Employee Import has been enhanced to display a warning if an import contains old tax rates but will still allow old rates to be imported.

Every Arizona employer is required to make the new Form A-4 available to its Arizona employees by January 31, 2023. Tax screens may still display old rates for employees who have not yet completed a new Form A-4 and those employees’ state tax will still calculate based on the old percentage. If an employee still has an old state withholding tax rate on the first payroll in March, their state withholding will be calculated using the default rate of 2% until they complete a new Form A-4.

For more information about Arizona’s withholding tax changes, visit Arizona’s Department of Revenue website.

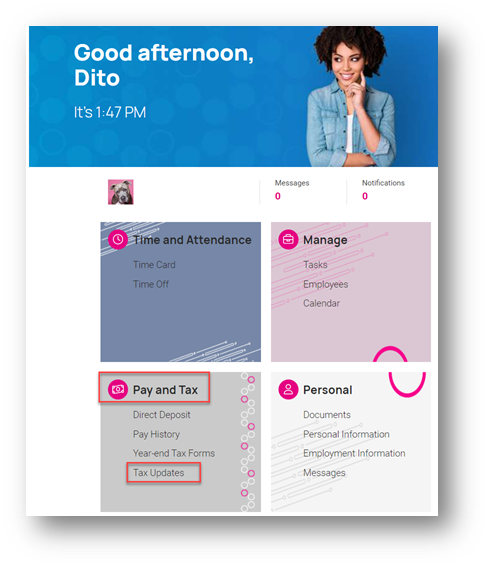

Employees can easily complete the A-4 form within isolved:

For those clients taking advantage of the modern Adaptive Employee Experience (AEX), employees can create a new A-4 by selecting the Tax Updates option.

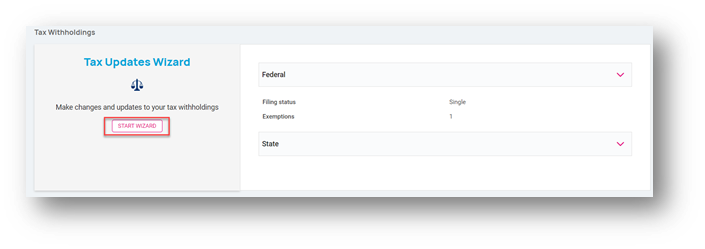

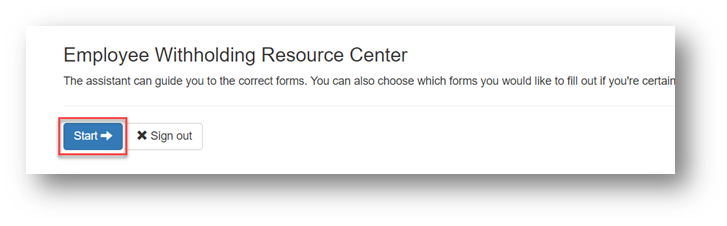

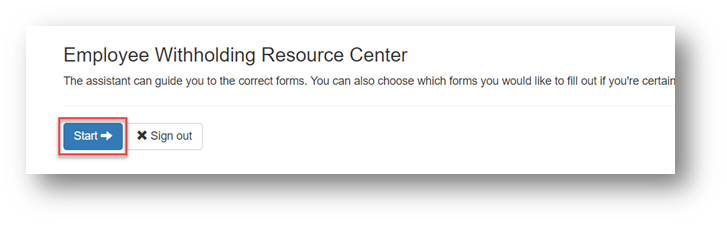

Within the Tax Updates page, the employee may access the A-4 by selecting the Start Wizard button and then clicking the blue Start button on the Employee Withholding Resource Center page that follows.

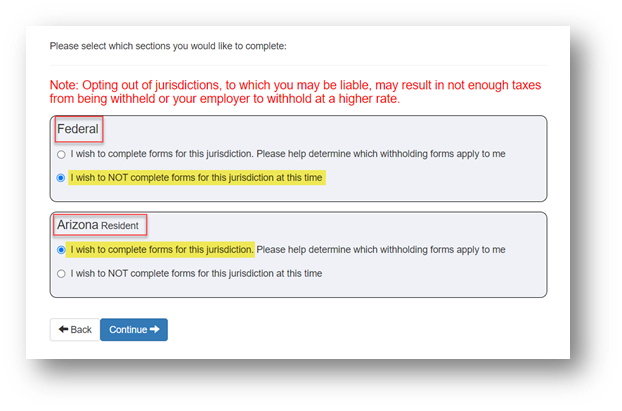

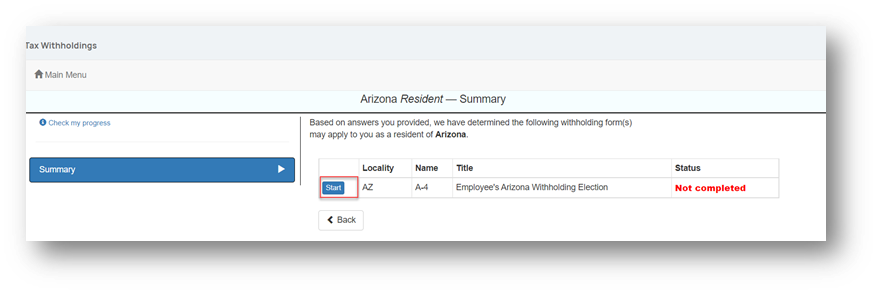

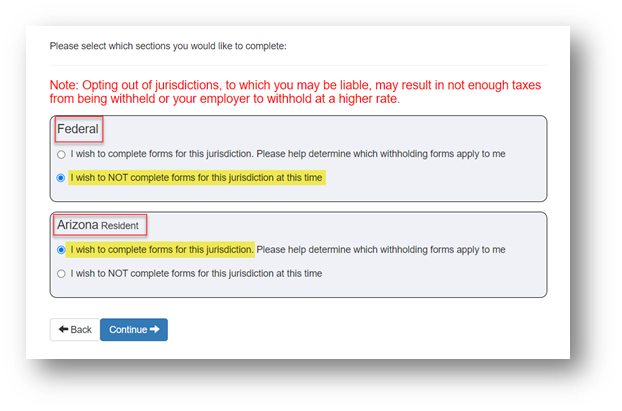

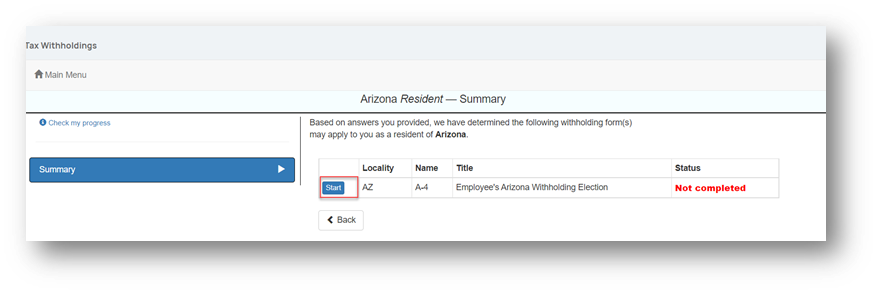

If the employee is only going to create a new Form A-4, they would select the “I wish to NOT complete forms for this jurisdiction at this time” under the Federal forms section of the screen. The “I wish to complete forms for this jurisdiction” option defaults to selected for the Arizona Resident section of the screen. Clicking on the blue Continue button will lead the employee through a series of questions to confirm the A-4 form applies to their situation and allow them to complete the A-4 form by clicking the blue Start button.

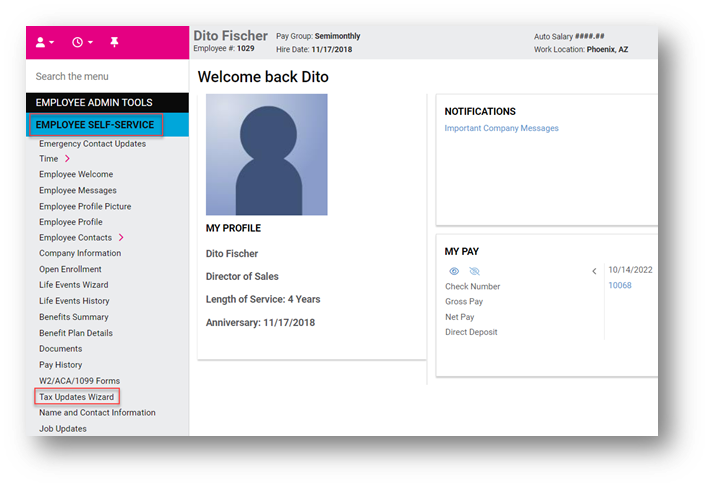

For those clients who remain on the Employee Self-Service Classic View, employees can create a new Form A-4 by selecting the Tax Updates Wizard menu option within the Employee Self-Service menu and then selecting the Start button on the Employee Withholding Resource Center page.

If the employee is only going to create a new Form A-4, they would select the “I wish to NOT complete forms for this jurisdiction at this time” under the Federal forms section of the screen. The “I wish to complete forms for this jurisdiction” option defaults to selected for the Arizona Resident section of the screen. Clicking on the blue Continue button will lead the employee through a series of questions to confirm the A-4 form applies to their situation and allow them to complete the A-4 form by clicking the blue Start button.

Time and Labor Management

Time card objections – coming soon

Allow employee objections to time cards

Those clients taking advantage of isolved’s Time and Labor Management product will be able to include employee objections to their time card verification process. Employees will have an opportunity to object to their time card and must enter comments as to why they feel the information is not accurate. Supervisors/Managers can be notified by email/AEX so they can address concerns the employee may have.

For more information about the changes in the version 9.01 release, contact your Payroll Specialist.

Download the release notes

Download the release notes: isolved Product Release v9.01